Family, what is the crux of BTC's inability to rise this time? The main players are clearly taking action but are slow to push the market up. Today, we will uncover the underlying reasons, and after reading, you'll understand how to respond to this market situation!

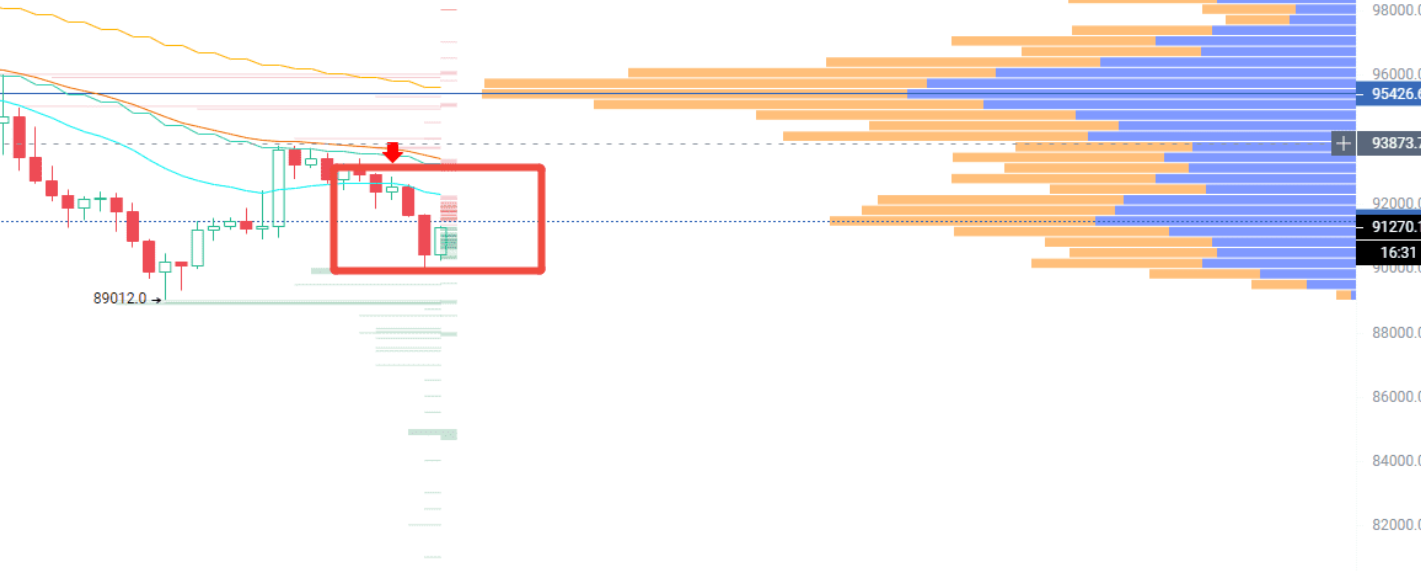

First, let's look at BTC's real-time movements: in the 90-minute cycle, it is clearly being suppressed by ema52 and is unable to move. The MACD is still in the negative zone forming a death cross, indicating that this rebound doesn't seem to have much strength.

Near the current price, there are quite a few small concentrated orders, but what's more interesting is that today there have been frequent large orders testing the waters, worth over 180 million dollars—this main player is simply a "drama queen," sometimes placing huge sell orders to scare off retail investors, and then placing buy orders to test the support, only to withdraw the orders after stirring things up. It's clear they are probing the market's depth.

Short-term support is focused on the 90000 and 89000 levels, while resistance is at 93410 and 95460. If it can't break through the resistance, the market is likely to remain volatile.

Now, looking at the long-term logic: the current price is in a zone of scarce chips, with strong support below at 84290~85530. This is a key area backed by both chip distribution and Fibonacci retracement, and holding this level is crucial for any potential rebound.

ETH's situation is almost identical to BTC's, they are truly "brothers in difficulty," with movements that are nearly a copy-paste.

Short-term key support is at 2985~3000, while resistance is at 3115 and 3190;

From a long-term perspective, 2810~2750 is an important defense line, and the lower level of 2500 is the "lifeline"—this price is right near the densest trading area in the past two years. If it breaks below this, the consequences could be dire.

Additionally, it must be emphasized that the MACD signal on the monthly chart for Bitcoin is very accurate, and everyone should pay close attention to it. By the way, I want to mention that AiCoin's PRO features exceed 30, including AI-written indicators, main player transaction tracking, and liquidation statistics—all practical functions that can save a lot of effort in market analysis.

Back to the main point, the core reasons why the main players are slow to push the market up are these five:

The first core reason is the macro environment is too weak! The U.S. government and the Federal Reserve are like "market siphons." The liquidity issues we discussed in previous live streams are still fermenting. The previously anticipated interest rate cut in December now has a probability of dropping below 50%, which is like pouring cold water on the market; more critically, the Federal Reserve is busy with balance sheet reduction, which is a real "siphoning operation." Recently, the dollar has been very strong, with funds flocking to the dollar and bond markets—who would want to take risks in the highly volatile crypto market? Additionally, the impact of the U.S. government shutdown has not fully recovered; while the interest rate cut is uncertain, the balance sheet reduction is ongoing, leading to less money in the market, and the main players naturally lack the confidence to push the market up.

Even stocks of tech giants like Nvidia, Microsoft, and Meta are falling. Just look at the Nasdaq index, which has been showing a lot of red recently. It's hard to say whether it will crash, but the downward trend is indeed obvious. These tech stocks started to pull back at the end of October, which is not much related to earnings reports; the essence is still the liquidity crunch.

The second reason is the main players are cleaning up leverage. Many retail investors in the market are holding onto leverage with a sense of luck, and the main players are taking advantage of the macro weakness to repeatedly shake out those uncertain leveraged positions, so that there will be less resistance when they push the market up later.

The third reason is false breakouts repeatedly harvesting profits. The main players occasionally create small breakouts to attract retail investors to chase highs, and once everyone is on board, they sell off, repeatedly harvesting funds that chase highs and kill lows, which can lower their own costs for pushing the market up while also making a profit from the price difference.

The fourth reason is institutions are still accumulating at low costs. On-chain data shows that large fund holders have not moved much and are clearly still slowly accumulating. Institutions are waiting for lower costs, so they naturally won't spend big money to push the market up now; after all, everyone wants to make more profit.

The fifth and most critical reason is—the crypto market lacks a "super narrative"! When DeFi and NFTs were hot, new funds flooded in like a tide, but now? There are no new eye-catching plays or hotspots, and incremental funds are simply unwilling to enter the market. Without new money coming in, even if the main players want to push the market up, there is no one to take over; they can't just hold all the chips themselves, right?

Finally, a reminder that there will be significant non-farm payroll data tomorrow night at 9:30, which is a key event affecting market liquidity, so everyone should pay close attention. Currently, the price is falling + volume is rising + LSUR is rising, which is a relatively healthy decline. There is no need to panic excessively, but also don't blindly try to catch the bottom; it's more prudent to patiently wait for the main players to give clear signals.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。