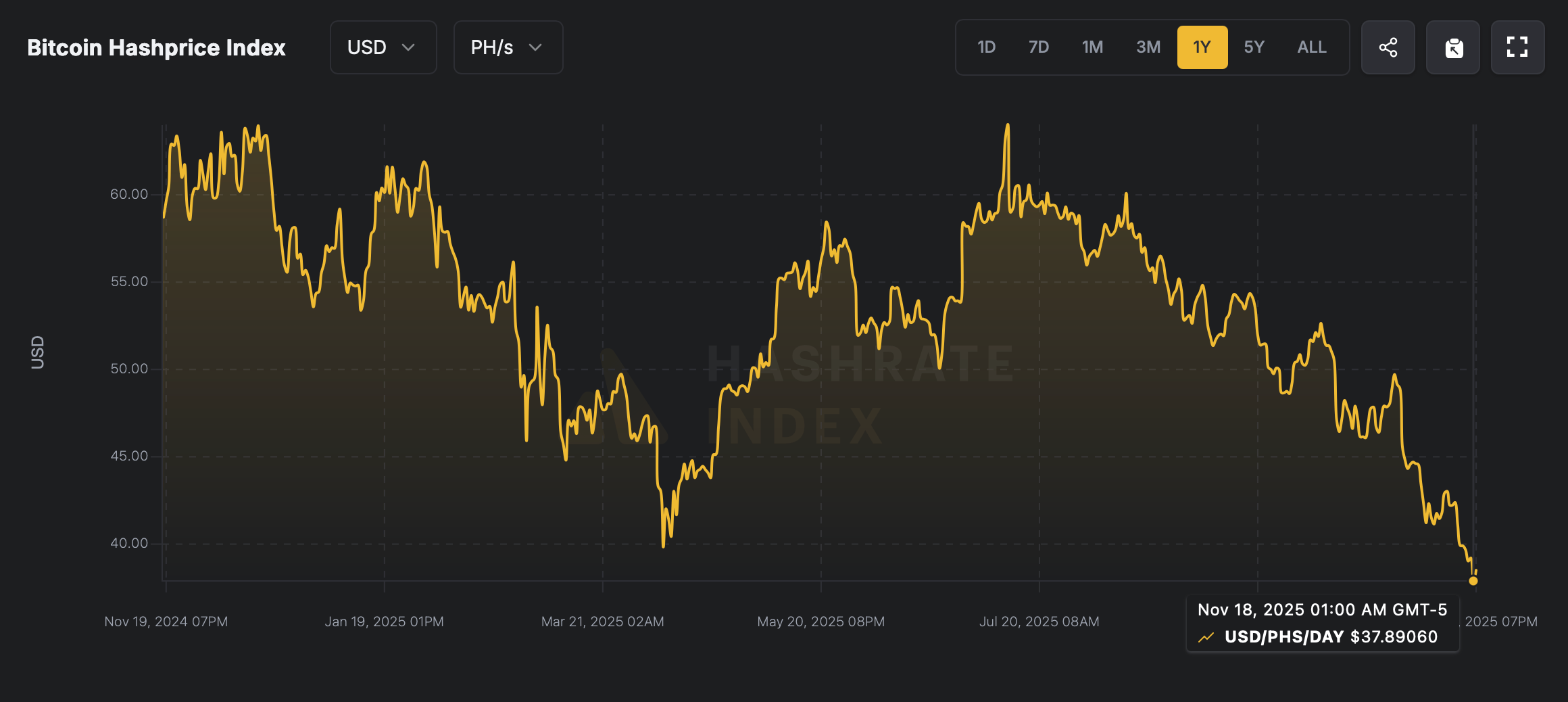

Bitcoin’s hashprice — the daily expected value of 1 petahash per second (PH/s) of hashing power — has sunk to its lowest point on record since Luxor began tracking the metric in December 2016.

Much of that revenue slide traces back to the 2020 and 2024 halvings, but onchain fees have withered dramatically in the aftermath, adding insult to injury. Right now, when a miner lands a block, only about 0.73% of their payout comes from transaction fees, with the rest tied to the 3.125 BTC subsidy.

Source: Luxor’s hashrateindex.com.

Bitcoin closed April 7, 2025, at $79,874 with a hashprice — the value of a single petahash — sitting at $39.83. Fast-forward to Nov. 19, 2025, and bitcoin is priced at $91,172, a full $11,298 higher per coin, yet the estimated value of 1 PH/s is lower at $38.14.

Yesterday’s hashprice dipped even lower to $37.48 per PH/s. At these rates, something has to break loose, or bitcoin miners will be wedged in a financial jam with no easy exit. In the end, the numbers paint a pretty blunt picture: miners can’t keep marching down this path without something giving way.

Either bitcoin’s price needs to climb enough to offset the thinning margins, or onchain activity has to heat up considerably to deliver more meaningful fees. If neither materializes, miners will be forced to rethink their operations — whether that means upgrading fleets, moving faster into artificial intelligence (AI), consolidating, or pursuing other revenue streams — because the current squeeze won’t stay tolerable for long.

- What is bitcoin’s hashprice? It’s the estimated daily value of 1 PH/s of mining power based on price, difficulty, and fees.

- Why is mining revenue falling? Hashprice has dropped to record lows as onchain fees shrink and subsidies dominate payouts.

- How are miners affected? Many face tighter margins as revenue per petahash falls despite higher bitcoin prices.

- What could change the outlook? Higher fees, a significant price lift, or operational shifts like AI integration could ease the pressure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。