Original Author: Stacy Muur, DeFi

Translation by: CryptoLeo (@LeoAndCrypto)

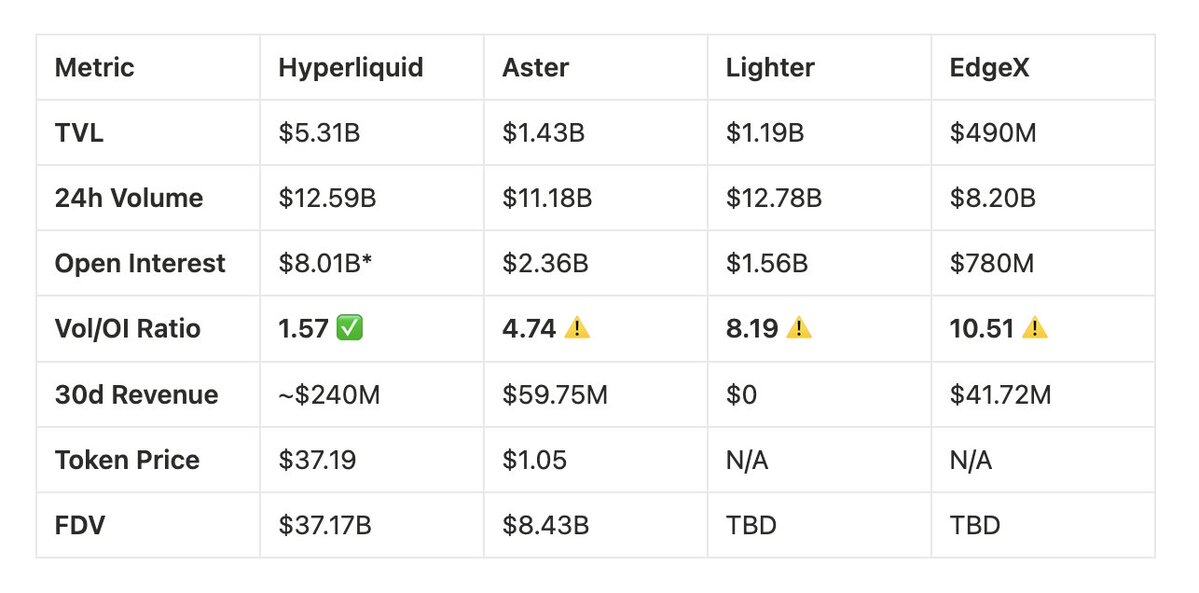

The battle of Perp DEXs continues, with four major Perp DEXs currently leading the market: Hyperliquid, Aster, Lighter, and EdgeX. Crypto analyst Stacy Muur analyzes the current status, advantages, and future of these four on-chain contract applications based on trading volume, open interest, trading activity, and background. The article is compiled as follows by Odaily Planet Daily:

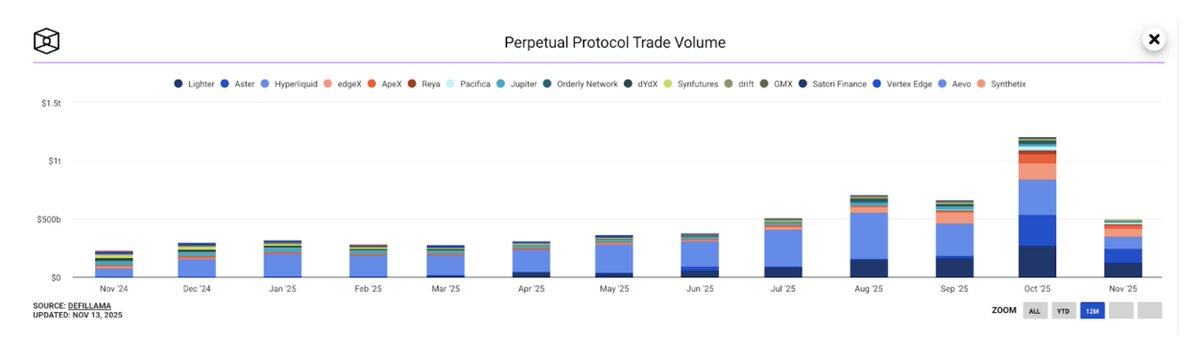

In 2025, the Perp DEX market experienced significant growth. By October 2025, the monthly trading volume of Perp DEXs surpassed $1.2 trillion for the first time, attracting the attention of retail investors, institutional investors, and venture capitalists.

For most of the past year, Hyperliquid held a dominant position, with its trading volume accounting for 71% of all on-chain perpetual contract trading in May. Fast forward to November, with new Perp DEX challengers entering the fray, its market share plummeted to just 20%. The remaining three giants are:

Lighter: 27.7%

Aster: 19.3%

EdgeX: 14.6%

In the rapidly developing ecosystem of Perp DEXs, the four dominant projects are competing for control:

Hyperliquid: The veteran of on-chain contracts;

Aster: A platform with massive trading volume;

Lighter: A zero-fee, native ZK disruptor;

EdgeX: The dark horse backed by institutions.

This in-depth investigation distinguishes hype from reality, analyzing the technology, metrics, controversies, and long-term viability of each platform.

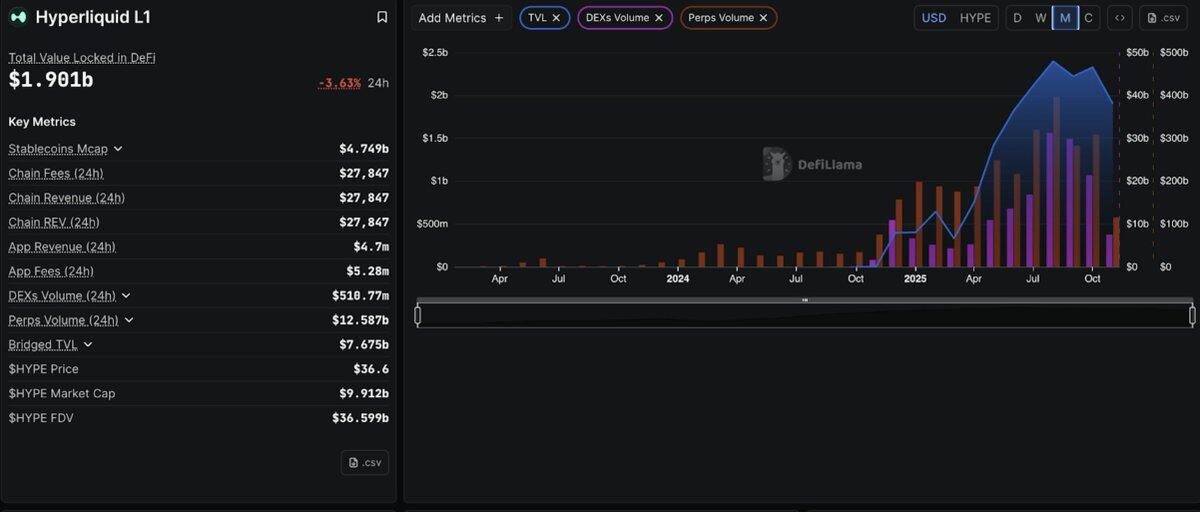

Part 1: Hyperliquid—The Undisputed King

Hyperliquid has become the leading on-chain contract exchange, with its market share peaking above 71%. Although its competitors have temporarily captured the spotlight with rapidly growing trading volumes, Hyperliquid remains the backbone of the Perp DEX ecosystem.

Technical Foundation

Hyperliquid's dominance stems from a revolutionary architectural decision: to build a customized Layer 1 blockchain specifically designed for derivatives trading. The platform's HyperBFT consensus mechanism enables sub-second order finality and a performance of 200,000 transactions per second, rivaling or even surpassing centralized exchanges.

Open Interest Reality Check

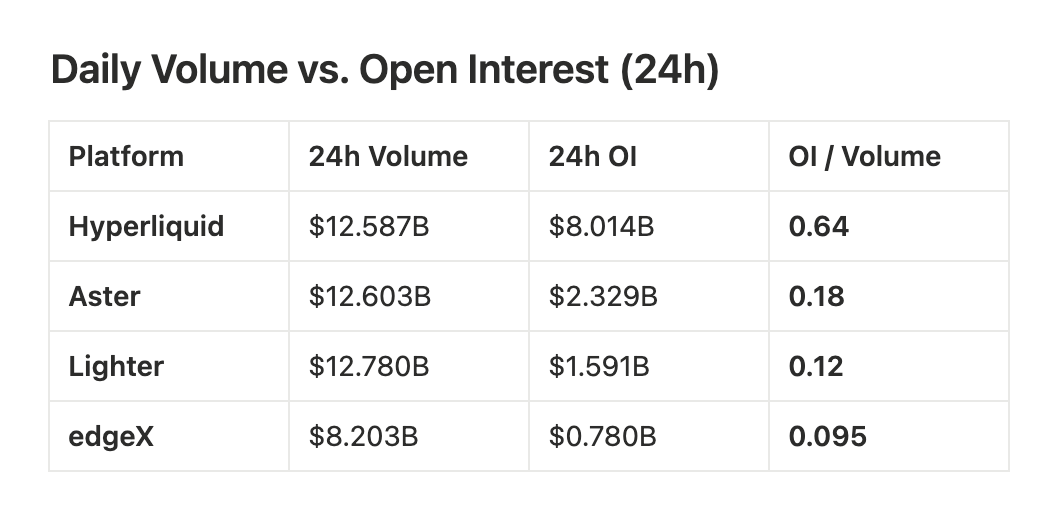

While competitors often announce high 24-hour trading volume figures, the metric that truly reveals the real capital deployment situation is open interest (OI), which is the total value of outstanding perpetual contracts. Volume indicates activity, while open interest shows users' willingness to hold positions on the platform.

According to data from 21Shares, during September 2025:

Aster accounted for about 70% of the total;

Hyperliquid temporarily fell to about 10%.

However, this dominance is only reflected in trading volume, which is the easiest metric to distort through incentives, rebates, market maker changes, or wash trading.

Latest 24-hour open interest data:

Hyperliquid: $8.014 billion;

Aster: $2.329 billion;

Lighter: $1.591 billion;

EdgeX: $780.41 million.

Total OI (Top Four): $12.714 billion, with Hyperliquid holding a share of about 63%.

This means that among the major Perp DEXs, Hyperliquid holds nearly two-thirds of the outstanding contracts, exceeding the combined total of Aster, Lighter, and EdgeX.

Open Interest Market Share (24-hour benchmark)

Hyperliquid: 63.0%

Aster: 18.3%

Lighter: 12.5%

EdgeX: 6.1%

This metric reflects the situation where traders leave funds overnight, rather than simply earning incentives or trading frequently.

Hyperliquid: A higher OI/volume ratio (about 0.64) indicates that a significant portion of the trading volume translates into active, sustained positions;

Aster & Lighter: Lower ratios (about 0.18 and about 0.12) indicate high turnover rates but relatively little remaining capital, which is typically characteristic of incentive-driven activities rather than a reflection of lasting liquidity.

Global Overview:

- 24-hour trading volume reflects short-term trading activity;

- Contract positions (24 hours) show funds still at risk;

- OI/volume (24 hours) shows the ratio of real trading volume to incentive-driven trading volume.

Based on all OI-based metrics, Hyperliquid is structurally ahead:

- Highest open interest;

- Largest share of contract margin;

- Best OI/volume ratio;

- OI exceeds the total of the other three platforms combined.

Trading volume rankings fluctuate, but open interest represents the true market leader.

October 11 Stress Test

During the liquidation event on October 11, 2025, $19 billion in positions were liquidated, and Hyperliquid maintained perfect uptime while handling the surge in trading volume.

Institutional Recognition

21Shares has submitted Hyperliquid (HYPE) products to the SEC and has listed a regulated HYPE ETP on the Swiss Stock Exchange. These developments have been reported by channels such as CoinMarketCap and other market tracking agencies, indicating an increasing level of institutional investor participation in HYPE. The HyperEVM ecosystem is also continuously expanding, although public data cannot verify the exact claims of "over 180 projects" or "$4.1 billion TVL."

Based on the current filing status, exchange listings, and ecosystem growth reported by CoinMarketCap and similar tracking agencies, Hyperliquid demonstrates strong development momentum and increasing institutional recognition, solidifying its position as a leading DeFi derivatives platform.

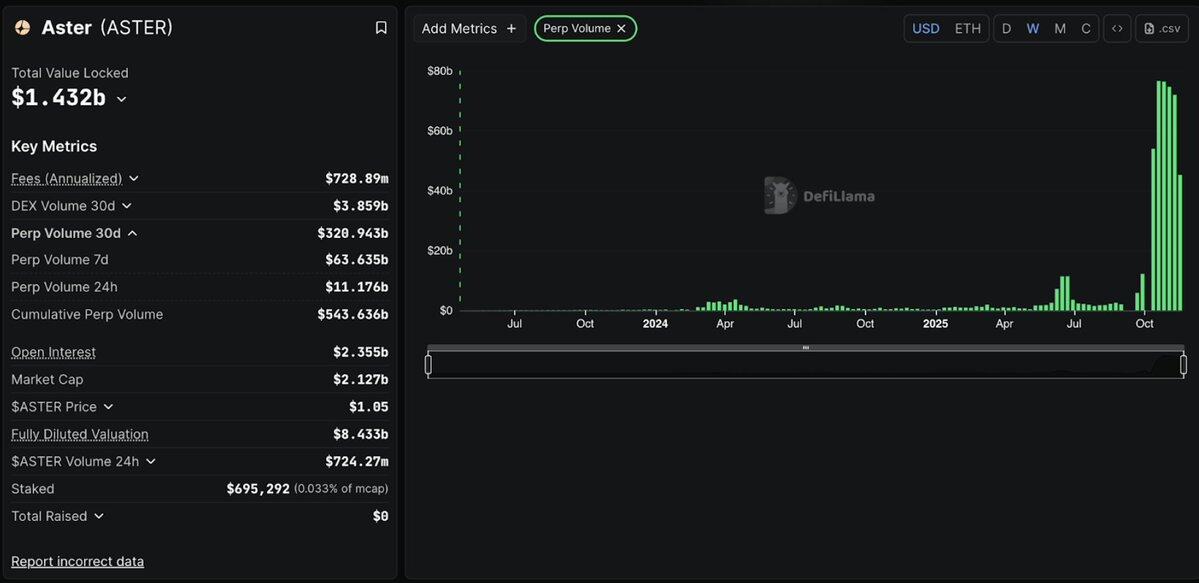

Part 2: Aster—The Explosive Growth Newcomer

Aster is a multi-chain perpetual contract exchange launched in early 2025, with a clear goal: to provide high-speed, high-leverage derivatives trading for users on the BNB chain, Arbitrum, Ethereum, and Solana without requiring them to bridge assets. The project did not start from scratch; it originated from the merger of Asterus and APX Finance at the end of 2024, combining APX's working perp engine with Asterus's liquidity technology.

Explosive Growth

ASTER launched on September 17, 2025, with an initial price of $0.08, skyrocketing to $2.42 within a week, an increase of 2800%. Daily trading volume surged to over $70 billion at its peak, dominating the Perp DEX market at that time.

YZi Labs invested in Aster, and CZ's tweet boosted the token's price. In the first 30 days, Aster's trading volume exceeded $320 billion, at one point capturing over 50% of the DEX market share.

DefiLlama Delisting

On October 5, 2025, DefiLlama discovered that the trading volume on the Aster platform closely matched Binance's trading volume (showing a 1:1 correlation) and removed Aster's current backbone data. The real exchange rate would naturally fluctuate, and a complete positive correlation with Binance's trading volume raises data credibility concerns.

Data:

Trading volume patterns are identical to Binance (XRP, ETH, all trading pairs);

Only 6 wallets control 96% of ASTER tokens;

Volume/OI ratio exceeds 58 (normal value = below 3).

Subsequently, the price of ASTER plummeted from $2.42 to around $1.05.

Aster's Defense

Aster CEO Leonard claimed that this correlation was merely "arbitrage hunters" hedging on Binance. Weeks later, Aster re-launched the platform, but DefiLlama warned: "Unable to verify Aster platform data."

Actual Features Offered

Aster possesses genuine features: 1001x leverage, hidden orders, multi-chain support (BNB, ETH, Solana), and yield-generating collateral. Aster is building the Aster chain with zero-knowledge proofs to protect privacy.

Evaluation

Aster gained immense value through CZ's hype and manufactured trading volume but failed to establish a true infrastructure. With Binance's support, it may survive, but its credibility has been damaged.

For traders: High risk, as this is a bet on the narrative of CZ rather than actual growth.

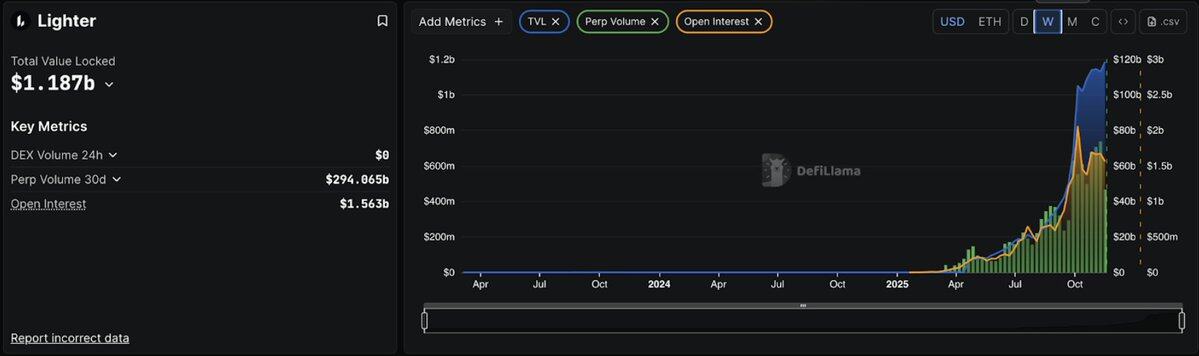

Part 3: Lighter—Promising Technology, Questionable Metrics

Lighter was founded by former Citadel engineers and supported by Peter Thiel, a16z, and Lightspeed (raising $68 million at a $1.5 billion valuation). Lighter uses zero-knowledge proofs to encrypt and verify every transaction.

As an Ethereum L2, Lighter inherits Ethereum's security through an "escape hatch" (understood as a safety valve)—if the platform fails, users can recover their funds via smart contracts, a safety guarantee not available on other L1 application chains.

Launched on October 2, 2025, its TVL reached $1.1 billion within weeks, with daily trading volumes of $7-8 billion and over 56,000 users.

Zero Fees = Aggressive Strategy

Lighter charges 0% fees for both makers and takers, making all fee-sensitive traders view other competing platforms as outdated.

The strategy is simple: capture market share through an unsustainable economic model, build loyalty, and then turn a profit.

October 11 Stress Test

Just ten days after the mainnet launch, the cryptocurrency faced the largest liquidation event, with $19 billion being liquidated.

Advantages: The system successfully handled five hours of chaos, providing liquidity while competitors withdrew.

Issues: A database crash after five hours caused the platform to go offline for four hours.

Disadvantage: LLP incurred losses, while Hyperliquid's HLP and EdgeX's eLP made profits.

Founder Vlad Novakovski: A database upgrade was scheduled for Sunday, but Friday's volatility destroyed the old system first.

Trading Volume Issues

These numbers indicate wash trading behavior:

24-hour trading volume: $12.78 billion

Open interest: $1.591 billion

Volume/OI ratio: 8.03

Below 3 is healthy, above 5 is suspicious, and 8.03 is an extreme case.

Background information:

Hyperliquid: 1.57 (standard natural)

EdgeX: 2.7 (moderate)

Aster: 5.4 (high)

Lighter: 8.03 (wash trading)

Traders generate $8 in revenue for every $1 of trading volume deployed—quickly building positions to earn points rather than holding real positions.

30-day data shows: trading volume of $294 billion, OI of $47 billion, ratio of 6.25, which is still very high.

Airdrop Issues

Lighter's points program is quite attractive, with points converting to LITER tokens at TGE (Q4 2025/Q1 2026), and the OTC market price range is $5-100+, considering the potential airdrop value of tens of thousands of dollars, such massive trading volume is not surprising.

Key question: What will happen after TGE? Will users stay or leave, causing trading volume to plummet?

Evaluation

Advantages:

Top-notch technology (ZK verification);

Zero fees, a true competitive advantage;

Inheritance of Ethereum's security;

First-class team and support.

Concerns:

An 8.03 volume/OI indicates heavy wash trading;

LLP incurred losses during the stress test;

4-hour service interruption raised doubts;

Post-airdrop retention rates cannot be verified.

The main difference from Aster is that the high ratio reflects aggressive but temporary incentives rather than systemic fraud.

Summary: Lighter has world-class technology, but the data is not good. Can it convert farmers into real users? Technically, it is possible, but historically, it seems unrealistic.

For farmers: A good opportunity before TGE.

For investors: Wait 2-3 months after TGE to see if trading volume can be sustained.

Probability analysis: 40% chance of becoming a top three platform, 60% chance of becoming another technically strong wash trading haven.

Part 4: EdgeX — Serving Institutional Professionals

Amber Group Institutional Advantage

EdgeX's operational model is entirely different, originating from the Amber Group incubator (managing $5 billion in assets), bringing together professionals from Morgan Stanley, Barclays, Goldman Sachs, and Bybit. Its team is not made up of cryptocurrency novices but rather TradFi professionals bringing institutional expertise into DeFi.

Amber's market-making gene is directly reflected in EdgeX: deep liquidity, low spreads, and execution quality comparable to centralized exchanges. The platform launched in September 2024 with a single goal: to achieve centralized exchange-level performance without sacrificing self-custody.

EdgeX is built on StarkEx (StarkWare's ZK engine), processing 200,000 orders per second with latency under 10 milliseconds, comparable to Binance's speed.

Lower Fees than Hyperliquid

EdgeX outperforms Hyperliquid in all fee categories:

Fees:

EdgeX taker: 0.038% vs Hyperliquid: 0.045%

EdgeX maker: 0.012% vs Hyperliquid: 0.015%

For traders with a monthly trading volume of $10 million, this translates to annual savings of $7,000 to $10,000 compared to Hyperliquid.

Additionally, at the retail scale (order amount of $6 million), liquidity is better, with smaller spreads and lower slippage compared to competitors.

Real Revenue, Healthy Metrics

Unlike Lighter's zero-fee model or Aster's inflated data, EdgeX can generate real and sustainable revenue:

Current metrics:

TVL: $489.7 million

24-hour trading volume: $8.2 billion

Open interest: $780 million

30-day revenue: $41.72 million (up 147% from Q2)

Annual revenue: $509 million (second only to Hyperliquid)

Volume/OI ratio: 10.51 (concerning)

10.51 seems bad. But context is important: EdgeX launched an aggressive points program to guide liquidity, and this ratio has been steadily improving as the platform matures. More importantly, EdgeX has consistently maintained healthy revenue, proving that its platform has real traders, not just those chasing airdrops.

October 11 Stress Test

During the October 11 crash (with $19 billion liquidated), EdgeX performed excellently:

No interruptions (Lighter was down for 4 hours)

eLP treasury remained profitable (while Lighter's LLP incurred losses)

LP annualized yield of 57% (the highest in the industry)

At a critical moment, eLP demonstrated excellent risk management, profiting during extreme volatility while competitors struggled.

EdgeX's Uniqueness

Multi-chain flexibility: supports Ethereum, Arbitrum, BNB chain;

Uses USDT and USDC as collateral;

Cross-chain deposits and withdrawals (Hyperliquid only supports Arbitrum).

Best mobile experience: official iOS and Android apps (Hyperliquid lacks this feature). A streamlined user experience makes it easy to manage positions;

Focus on the Asian market: strategically entering Korea and the Asian market through localized support and events like Korea Blockchain Week. While competing for the same users as competitors, it occupies underserved areas.

Points program:

60% of trading volume;

20% referral rate;

10% TVL/treasury;

10% liquidation/OI.

Clear statement: "We do not reward wash trading."

Data also supports this, with the volume/OI ratio improving rather than the data typical of wash trading projects.

Challenges

Market share: Only 5.5% of all DEX open interest, further growth requires attractive incentives or establishing significant partnerships.

No killer features: EdgeX performs well in many areas but lacks standout features. It is a "business-grade" product, performing steadily across the board but lacking revolutionary innovation.

Unable to compete on fees: Lighter's zero fees make EdgeX's "lower than Hyperliquid" advantage less convincing.

Late TGE timing: Expected in Q4 2025, later than competitors, missing the opportunity for initial airdrop hype.

Evaluation

EdgeX is the choice for professionals, not for retail speculation.

Advantages:

- Institutional support (Amber Group liquidity)

- Real revenue (annual revenue of $509 million)

- Best treasury yield (APY 57%, profitable even during market crashes)

- Lower fees than Hyperliquid

- Clean metrics (no wash trading scandals)

- Multi-chain flexibility + best mobile app

Concerns:

- Small market share (5.5% of the total)

- Volume/OI of 10.51 (improved but still high)

- No unique differentiating advantage

- Unable to compete with zero-fee platforms

EdgeX's target audience:

- Asian traders seeking localized support;

- Institutional users optimistic about Amber Group liquidity;

- Conservative traders prioritizing proven risk management methods;

- Mobile-first traders;

- LP investors seeking stable returns.

Summary: EdgeX has the potential to capture 10-15% of the market share by serving the Asian market, institutions, and conservative traders. While it may not threaten Hyperliquid's dominance, it doesn't need to, as EdgeX is building a sustainable and profitable niche.

Think of it as the "Kraken of DEXs": not the largest or the flashiest, but solid, professional, and trusted by seasoned users who value execution quality over hype.

For farmers: Moderate opportunity, with market saturation lower than competitors.

For investors: small positions to achieve diversified investments. Lower risk, lower returns.

Comparative Analysis: The Perp DEX Battle

Based on existing data estimates

Volume/OI Ratio Analysis

Industry standard: Healthy ratio ≤ 3

Hyperliquid: 1.57, indicating a strong natural trading pattern

Aster: 4.74, a high value reflecting frequent incentive activities

Lighter: 8.19, a high ratio indicating trading driven by points

EdgeX: 10.51, the impact of the points program is visible but improving

Market Share: Open Interest Distribution

Total market: Open interest approximately $13 billion

Hyperliquid: 62% - Market leader

Aster: 18%, performing strongly

Lighter: 12%, steadily increasing market share

EdgeX: 6%, focusing on specific niche markets

Platform Information

Hyperliquid—Industry Leader

62% market share, stable metrics;

Annual revenue of $2.9 billion, with an active buyback plan;

Community ownership model with a good performance record;

Advantages: Market dominance, sustainable economic benefits. Grade: A+

Aster—High Growth

Integrated into the BNB ecosystem, supported by CZ;

DefiLlama data issues;

Multi-chain model driving adoption;

Advantages: Ecosystem support, broad retail coverage.

Considerations: Need to monitor data transparency issues. Grade: C+

Lighter—Tech Innovator

Zero-fee model, advanced ZK verification technology;

Elite support (Thiel, a16z, Lightspeed);

Pre-TGE (Q1 2026), limited performance data;

Advantages: Technological innovation, Ethereum L2 security.

Considerations: Sustainability of the business model, post-airdrop retention rates. Grade: Unknown (awaiting TGE performance)

EdgeX—Institutional Endorsement

Supported by Amber Group, professional-level execution capability;

Annual revenue of $509 million, stable treasury performance;

Asian market strategy, mobile-first approach;

Advantages: Institutional credibility, steady growth. Considerations: Small market share, limited competitive positioning. Grade: B

Investment Considerations

Trading Platform Selection:

Hyperliquid—deepest liquidity, proven reliability;

Lighter—zero fees, beneficial for high-frequency traders;

EdgeX—lower fees than Hyperliquid, excellent mobile experience;

Aster—multi-chain flexibility, integrated into the BNB ecosystem.

Token Investment Timeline:

HYPE—currently at $37.19;

ASTER—currently at $1.05;

LITER—TGE in Q1 2026, assess metrics post-token launch;

EGX—TGE in Q4 2025, assess initial performance.

Industry Perspective

Market maturity: The DEX space shows clear differentiation, with Hyperliquid establishing dominance through sustainable metrics and community cohesion.

Growth strategy: Each platform targets different user groups—Hyperliquid (professionals), Aster (retail/Asia), Lighter (tech enthusiasts), EdgeX (institutions).

Metric focus: Volume/OI ratio and revenue provide clearer performance indicators.

Future outlook: The performance of Lighter and EdgeX post-TGE is crucial for determining their long-term competitive positions. Aster's future path depends on its ability to address data transparency issues and maintain ecosystem support.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。