On the chart of a sharp decline, the fate of a group of whales and institutions is being tested by the market, intertwining massive floating losses and high leverage liquidation risks into a bleak winter scene for the crypto market. On November 18, the cryptocurrency market faced another round of fierce selling, with Bitcoin dropping below the $92,000 mark and Ethereum losing the psychological barrier of $3,000.

In this collective downturn affecting U.S. stocks, gold, and cryptocurrencies, a whale investor using the pseudonym "Calm Order King" opened a 20x leveraged Bitcoin long position worth up to $28.7 million in the past two days, facing the market decline with an astonishing gambler's mentality.

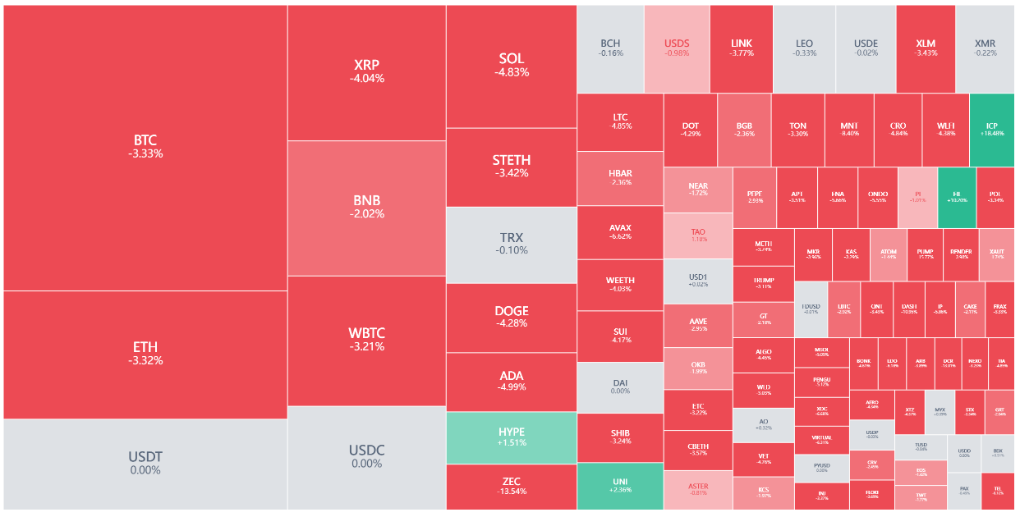

1. Comprehensive Decline of Crypto Assets

● The cryptocurrency market is undergoing a severe test. As of November 18, Bitcoin has fallen below $90,000, with a 24-hour decline of 4.48%. This price means that Bitcoin has completely retraced all gains since 2025, and market sentiment has sharply deteriorated.

● Meanwhile, Ethereum has shown even weaker performance, with its price dropping to $2,975, a cumulative decline of 24% since early October.

● This sell-off is not limited to the cryptocurrency sector; U.S. stocks and gold have also been affected. On Monday, the financial markets faced another round of fierce selling, sweeping across various assets from gold to cryptocurrencies to tech stocks.

● The S&P 500 index and the Nasdaq Composite index have both fallen below the 50-day moving average, ending the longest period since 2007 that the S&P 500 has operated above this trend line.

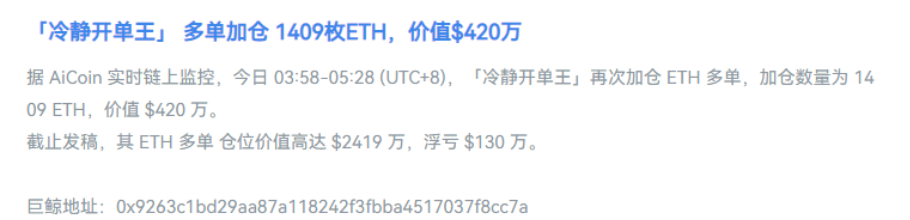

2. "Calm Order King" Takes a Contrarian Bet

Amid the bleak market, a whale investor known as "Calm Order King" (wallet address: 0x9263c1bd29aa87a118242f3fbba4517037f8cc7a) has taken a striking contrarian approach. On November 17, this whale:

● Increased his position by 1,409 ETH long contracts, valued at approximately $4.2 million. Estimated liquidation price: $2,860 - $2,891.

● Increased his position by 58 BTC long contracts, valued at $5.3 million. Estimated liquidation price: $88,800.

● Increased his position by 32,000 SOL, valued at $4.1 million. Estimated liquidation price: $125 - $127.

● This operation brought the total value of his ETH long position to approximately $24.19 million. However, as the market continued to decline, the whale's ETH position is currently facing a floating loss of $1.3 million. Including his Bitcoin long position, as of November 14, this trader's overall floating loss on long positions is about $1.22 million.

● Despite facing short-term losses, this whale's trading record shows he has rich market experience. His cumulative contract profit still stands at $20.7 million, and he achieved a record of 20 profitable trades in early November, with total profits exceeding $23 million.

3. Institutional Dilemma: Holding Firm and Increasing Positions Amid Huge Losses

MicroStrategy: Continuing to Buy at High Levels

Once a corporate software service provider, MicroStrategy (now renamed Strategy) has completely transformed into a new type of enterprise centered around Bitcoin as its core asset. Its business model has shifted from traditional corporate software services to a "software + Bitcoin reserve" dual structure, with Bitcoin becoming the absolute dominant asset.

● As one of the largest holders of Bitcoin, MicroStrategy (now renamed Strategy) continues to adhere to its Bitcoin accumulation strategy. Between November 10 and 16, the company executed $835.6 million in BTC purchases, acquiring 8,178 Bitcoins at an average price of $102,171.

● This purchase brought its total holdings to 649,870 BTC, with a total cost of approximately $48.37 billion, an average cost price of $74,433. Based on the current Bitcoin price of about $91,859, this newly purchased batch of Bitcoins has already shown significant floating losses, but its overall position still has some profit potential.

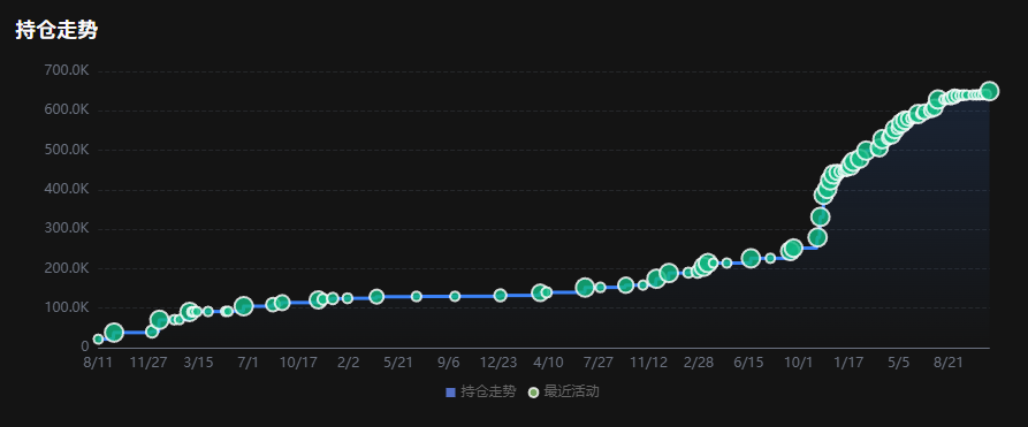

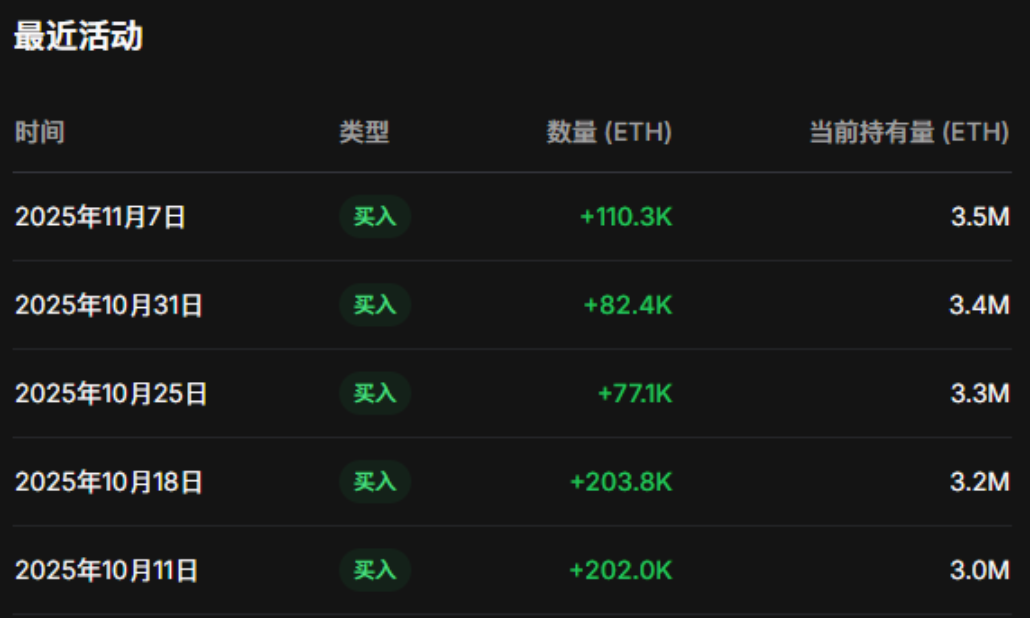

BitMine: Significant Floating Losses in Ethereum Holdings

● In terms of Ethereum, large holder BitMine is facing severe pressure. According to the holding data released by BitMine, the company currently holds approximately 3.56 million ETH, but its comprehensive cost for ETH is as high as $4,009.

● Based on the current Ethereum price, BitMine's ETH holdings are facing a floating loss of $2.98 billion, with a loss rate of 21%. This massive floating loss accounts for a significant portion of BitMine's total holding value, with the company's total cryptocurrency and "potential stock" holdings valued at $11.8 billion.

4. Market Sentiment: From Greed to Extreme Fear

● As the market continues to decline, the sentiment among cryptocurrency investors has fundamentally shifted. Participants in the cryptocurrency market are deeply entrenched in a "state of extreme fear." This emotional shift has been rapid and intense; just weeks ago, the market was still intoxicated by historical highs.

● Trading activity in the options market also reflects this pessimistic sentiment, with traders spending $740 million betting that Bitcoin will continue to decline before the end of November, with the scale of put contracts far exceeding call positions.

● The demand for downside protection in the market—especially for protection at the $90,000, $85,000, and $80,000 levels—has surged significantly.

5. Multiple Factors Influencing Market Direction

Analysts believe that multiple factors have contributed to the current predicament of the cryptocurrency market.

● Kaiko research analyst Adam McCarthy pointed out: “The Federal Reserve's policy and discussions about the AI bubble are the two main obstacles facing cryptocurrencies and various risk assets before the end of the year.” The risks in the AI sector may be exacerbating and affecting the sentiment in the cryptocurrency market.

● Traders are closely watching Nvidia's earnings report to be released on Wednesday, as the company is seen as a bellwether for the tech industry and speculative risks.

● Meanwhile, changes in expectations for a potential interest rate cut by the Federal Reserve in December are also impacting the market, with the federal funds futures market currently pricing in only a 42% probability of a rate cut in December.

● Kraken's global economist Thomas Perfumo stated: “This risk-averse sentiment has spread to the cryptocurrency market, and the current market sentiment remains very fragile—this decline reflects broader macroeconomic concerns rather than structural flaws in the industry.”

In times of extreme fear in the market, maintaining rational judgment is more precious than ever.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。