Another onchain mishap unfolded this week when a Cardano blockchain user set out to grab some stablecoins and ended up parting with a hefty sum in the process. Onchain analyst ZachXBT broke the story, pointing out that the trader lost $6.05 million “due to low liquidity causing the price to sharply spike temporarily.”

Essentially, a long-dormant cardano ( ADA) wallet from 2020 jolted back to life and swapped 14.4 million ADA — roughly $6.9 million — for a mere 847,000 USDA on the Minswap dex.

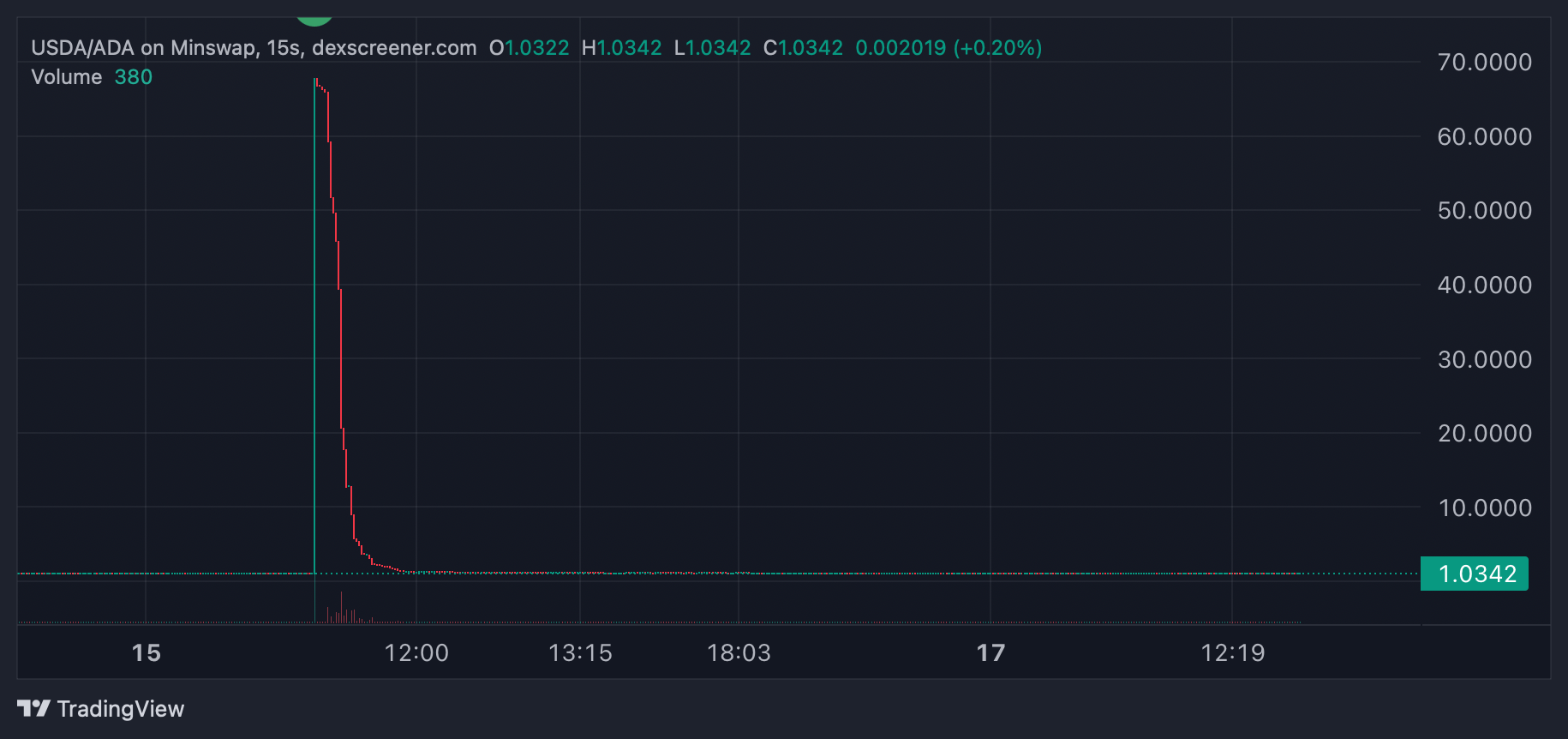

With the ADA-USDA pool holding only $1.5 million in liquidity, the trade nosedived into brutal slippage and sent the USDA stablecoin briefly careening to an eye-popping $60 to $70 per coin. Well above the intended $1 peg.

Dexscreener.com snapshot.

Arbitrage traders wasted no time pouncing on the chaos, scooping up millions in ADA as the price snapped back within the hour.

Also read: Bitcoin User Accidentally Hands Over $105,000 Fee on $10 Transaction

Some market trackers like Coingecko captured only a modest pop, showing USDA topping out at $4.85, while others — including Dexscreener and onchain sleuths like Lookonchain — recorded the token blasting past the $60 mark. Based on Dexscreener’s 15-second interval chart, the wild price jump lasted roughly 20 minutes, give or take, before cooling off.

In the end, this episode is a blunt reminder that even blockchain architecture can’t outsmart everyday human slipups. Smart contracts, immutable ledgers, and decentralized rails may keep the gears turning, but they can’t shield users from costly misclicks, overpaid onchain fees, or overlooked liquidity pools. Cardano’s DeFi stack will evolve, but no upgrade can fully patch the oldest bug in the system — human error.

- What caused the Cardano trader’s $6.9 million loss? Low liquidity in the ADA-USDA pool triggered extreme slippage during the swap.

- Why did USDA briefly trade above $60? A massive imbalance pushed the stablecoin far off its peg until arbitrage traders corrected it.

- How long did the USDA price spike last? Dexscreener’s 15-second chart shows the jump lasted roughly 20 minutes.

- What does this incident highlight for Cardano’s defi sector? It exposed persistent liquidity weaknesses and renewed calls for stronger stablecoin infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。