The first full week of XRP’s ETF era did not unfold the way the community expected because, instead of a continuation of the long inflow streak that began right after XRP was ruled not a security in 2023, the market delivered the exact opposite — a $15.5 million outflow from XRP-tied investment products, the largest single-week reversal since the asset reentered institutional rotation last year.

XRPC’s debut on Nov. 13 produced no net creations on day one, but the next session pulled in $243 million through cash and in-kind flows, and trading volume hit $58 million, the highest opening print of any ETF launched this year out of more than 900 products. It even edged past the spot Solana ETF launch, which landed at $57 million.

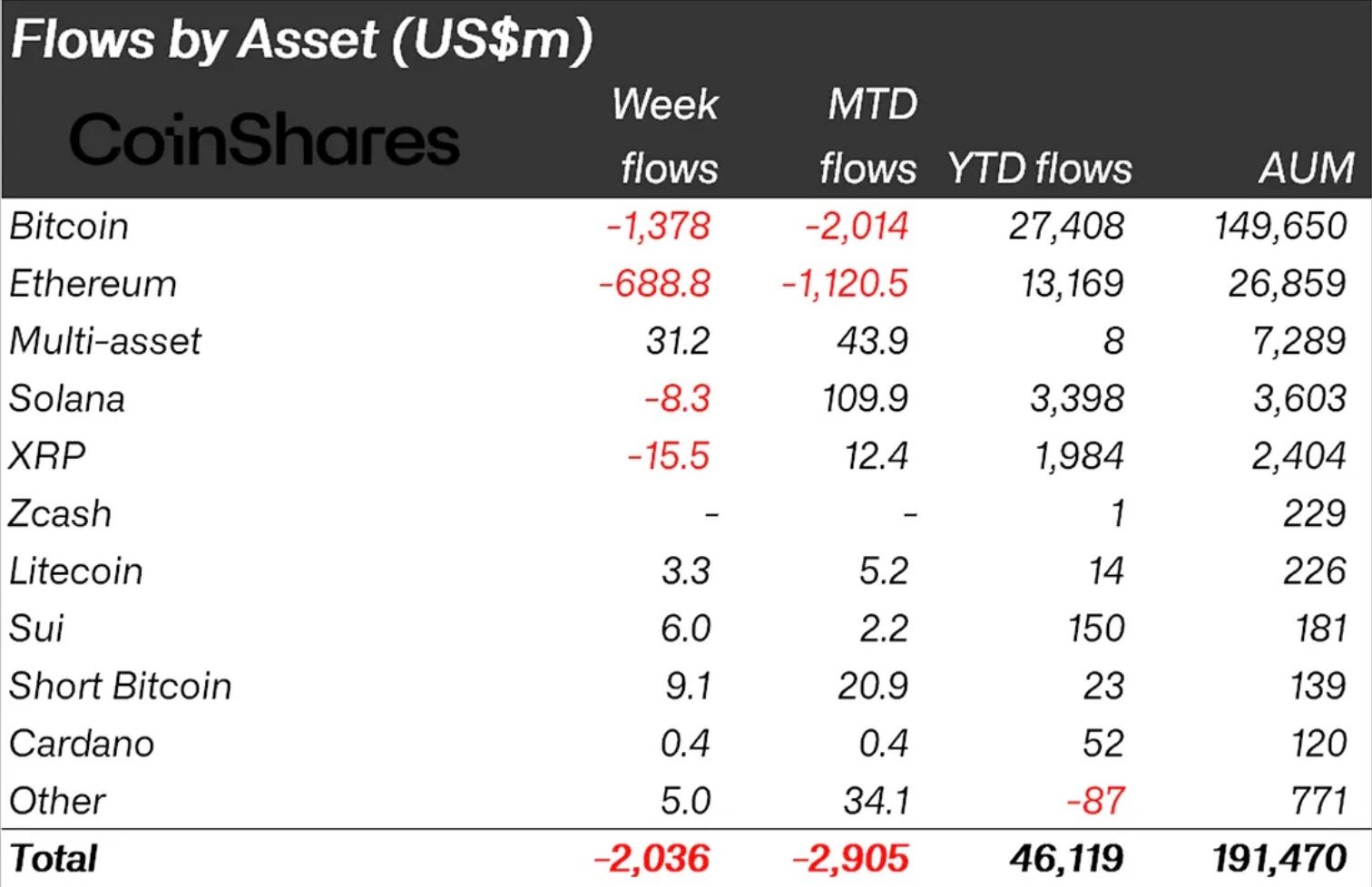

Source: CoinShares

Historically, inflows tended to follow these kinds of liquidity bursts. Across the last 12 months, XRP ETPs added roughly $2 billion in net allocations, while the price climbed from $0.50 to $3.50 — a 700% surge.

HOT Stories Bitcoin (BTC) Hits Death Cross, XRP Spot Activity Jumps 2,490%, 207 Billion Shiba Inu (SHIB) Leaving Exchanges — Crypto News DigestFirst Dogecoin ETF Predicted to Launch This November BREAKING: Saylor Stuns Market with Enormous Bitcoin PurchaseMorning Crypto Report: XRP May Rocket 25% in 2025: Bollinger Bands, Bitcoin Breaks €80,000, Cardano (ADA) Wallet Awakens With 88% Loss

Sell-the-news for XRP ETF

But the CoinShares data shows the first break in that pattern arriving immediately after the ETF went live, at the same moment the entire ETP market logged $2 billion in outflows driven by monetary-policy uncertainty and large crypto-native sellers. Bitcoin lost $1.38 billion, Ethereum shed $689 million and XRP’s $15.5 million outflow sits inside the same liquidation wave.

You Might Also Like

Mon, 11/17/2025 - 13:22 XRP Is Fundamentally Stronger Than Ever: Network Metrics Break DownByArman Shirinyan

The structure implies that investors treated XRPC’s launch as a sell-the-news pivot rather than an entry point, and the assumption that inflows will arrive simply because the ETF now exists has no support in this environment.

Now the main scenario is that If crypto ETP outflows continue in general in the same direction, XRP’s post-launch bleed can extend further.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。