Good evening everyone, I am Jiang Xin. Let's briefly review.

There was interference in Bitcoin's one-hour chart. We look at the fifteen-minute chart. On the evening of the 16th, after Bitcoin broke below the 95,800 level, it began to decline. At 11:30 PM, it started to test the market, facing resistance from bulls around the 94,000 level, and rebounded to around 95,500, failing to reach the 95,800 divergence point. Subsequently, three fifteen-minute selling pressures brought it back to around 93,800. This rebound can be seen as the exit of short profit-taking.

At 4:30 AM, the selling pressure and continuous testing showed that the bears had no interest in pursuing further downwards. There were only repeated edge tests without a response from the bullish main force, making it difficult to continue. However, after several attempts, the bears also lost patience. In the morning, despite not being optimistic about buying, there was a continuous rebound, and during the day, it returned to around 95,800. It couldn't hold this level and started to sell off again, returning to the 93,800 starting point. After touching this level again, it spiked back to 95,800 along with the US stock market.

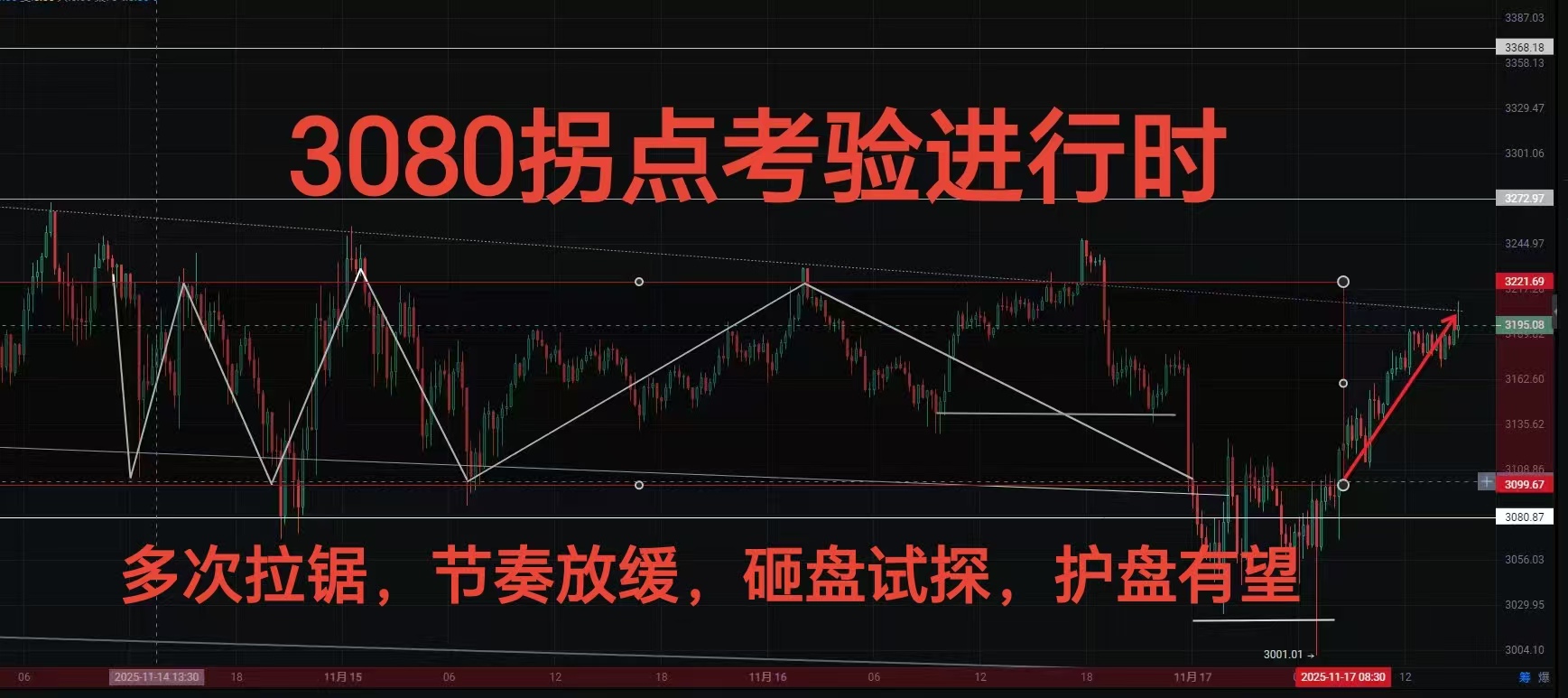

As for Ethereum, after dropping to 3,000 in the morning, it saw a volume contraction and oscillated back to 3,200. Before the US stock market opened, it fell back to the day’s starting point, but after hours, it rose back to around 3,200 with the market sentiment. After facing pressure again, it started to rebound, oscillating between 3,100 and 3,200 throughout the day. Recently, Ethereum has been very volatile, with sharp drops followed by sharp rebounds, completely reflecting a high-leverage situation in both directions. This is very helpful for the continuation of the bull market.

Below are the records confirming the daytime trading:

The important levels for Bitcoin are 92,800, 94,200, and 95,800. We can focus on the upward range based on these levels. Breaking above 95,800 could liquidate high-leverage short positions around 93,800, and we could look towards 97,200 and 98,500 in the future.

Recently, Ethereum's trend has been quite clear, and we can handle it in waves. The central construction of the bottom is forming, and we can trade within the range of 3,000 to 3,220, with important divergence points at 3,150 and 3,050. Handle it in waves, focusing on the long side. A breakout above 3,220 could lead us to 3,350, and at that time, the range will shift upwards.

We have achieved some results in both daytime and evening trading. Recently, the market has been supported by long positions, and the results are naturally good.

As always, stand on the shoulders of giants. Official account: Jiang Xin on Chan.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。