The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome everyone's attention and likes, and I refuse any market smoke screens!

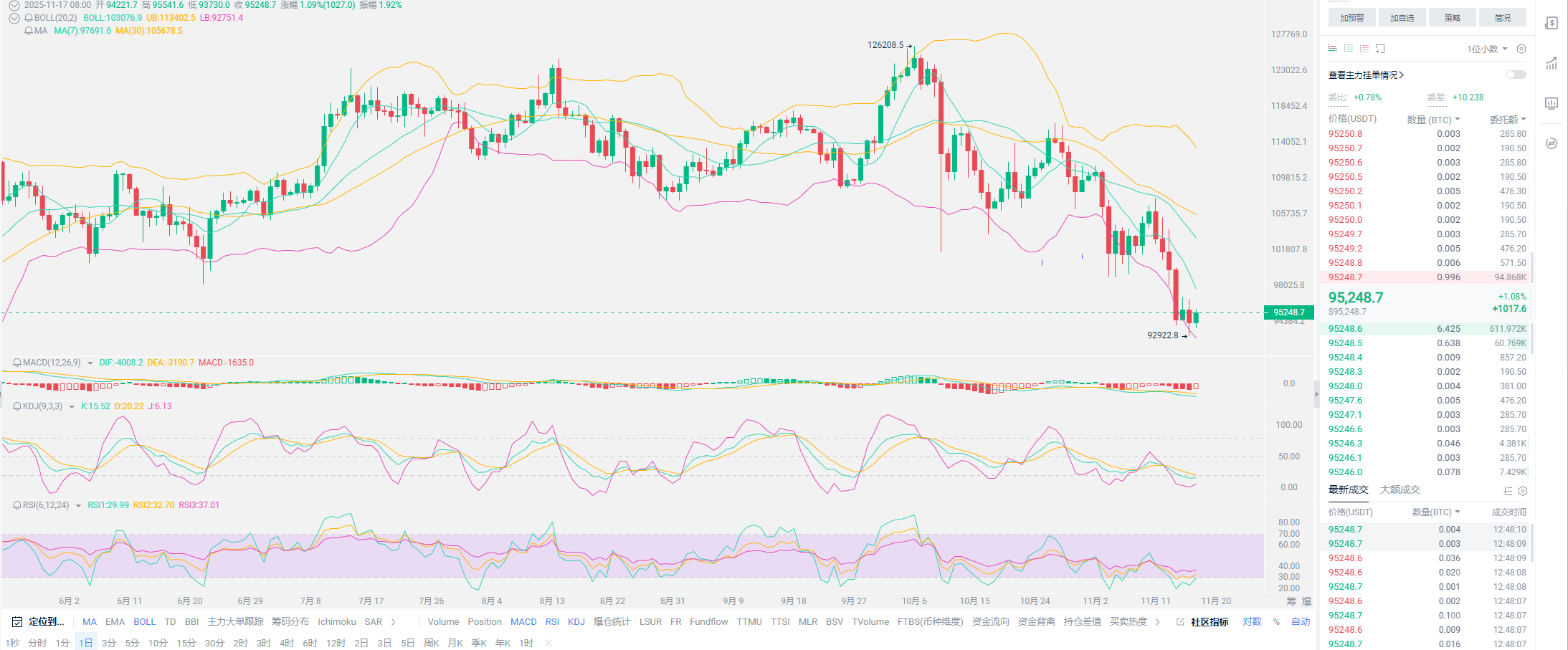

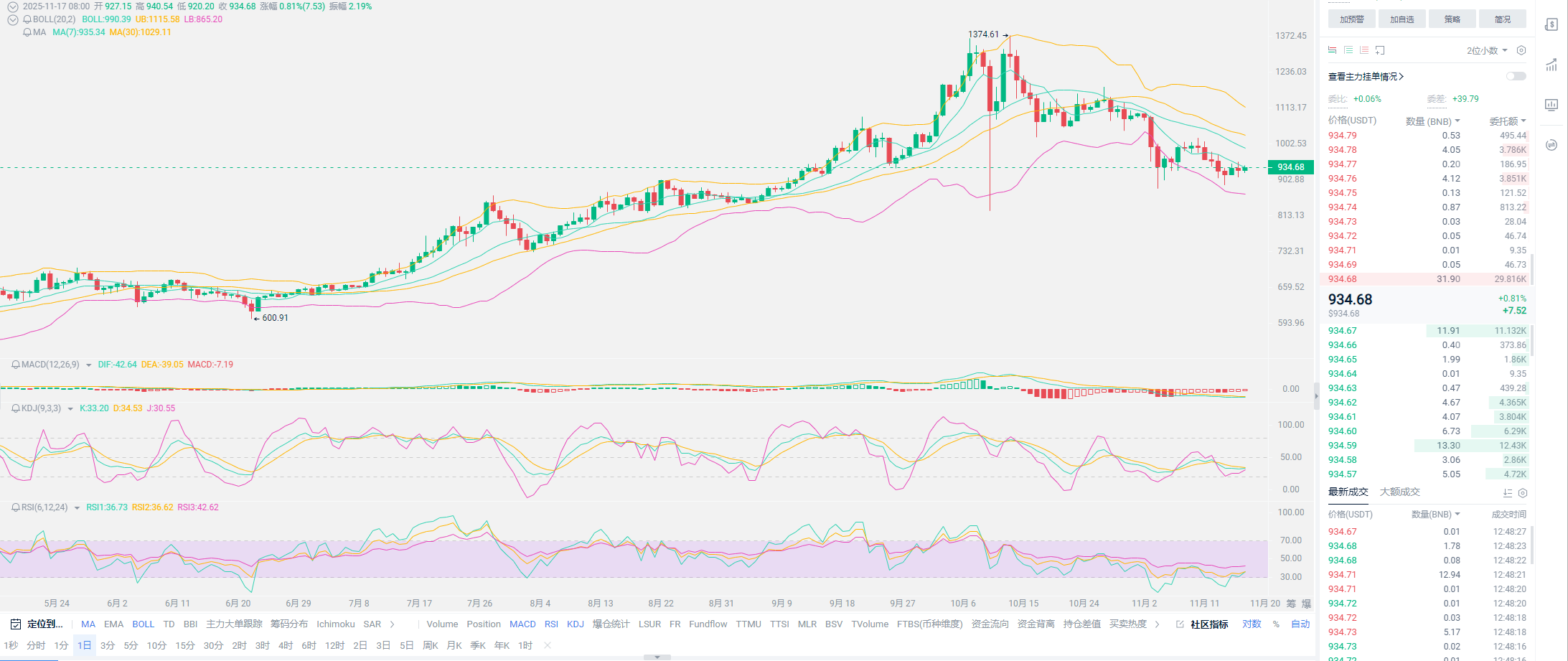

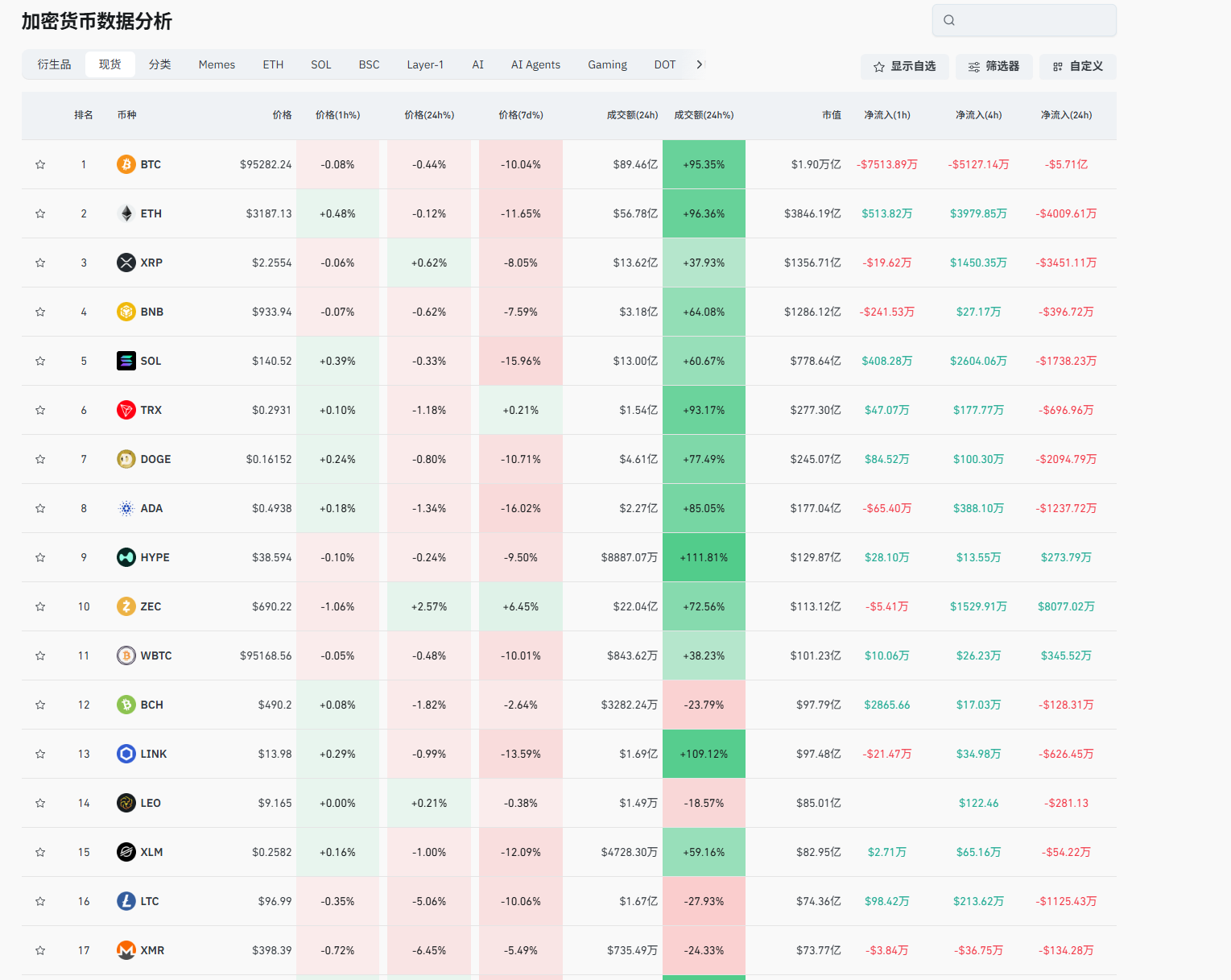

Today's article will predict the market trend for next week. I will need to go on a business trip tomorrow and the day after, so if you have any questions, please ask today, as responses later may be delayed. On the 14th, Bitcoin hit a new low of 939,550, and the market trend is gradually rising, showing signs of recovery. As of today, we have reached mid-November, and there is an opportunity to halt the bearish trend and push towards a bullish direction. Especially since the Fear and Greed Index has dropped to 15, which is lower than the lowest point of Bitcoin at 70 this year. Everyone should also develop a habit of comparison; during the downward trend in the first half of the year, there were eye-catching coins like Trump Coin and SOL that temporarily upheld the reputation of the crypto market. This time, during the downward trend, there was also support from BNB, but the uniqueness of BNB does not solely belong to the crypto market's reputation; it can be said that this downward trend is almost a universal decline.

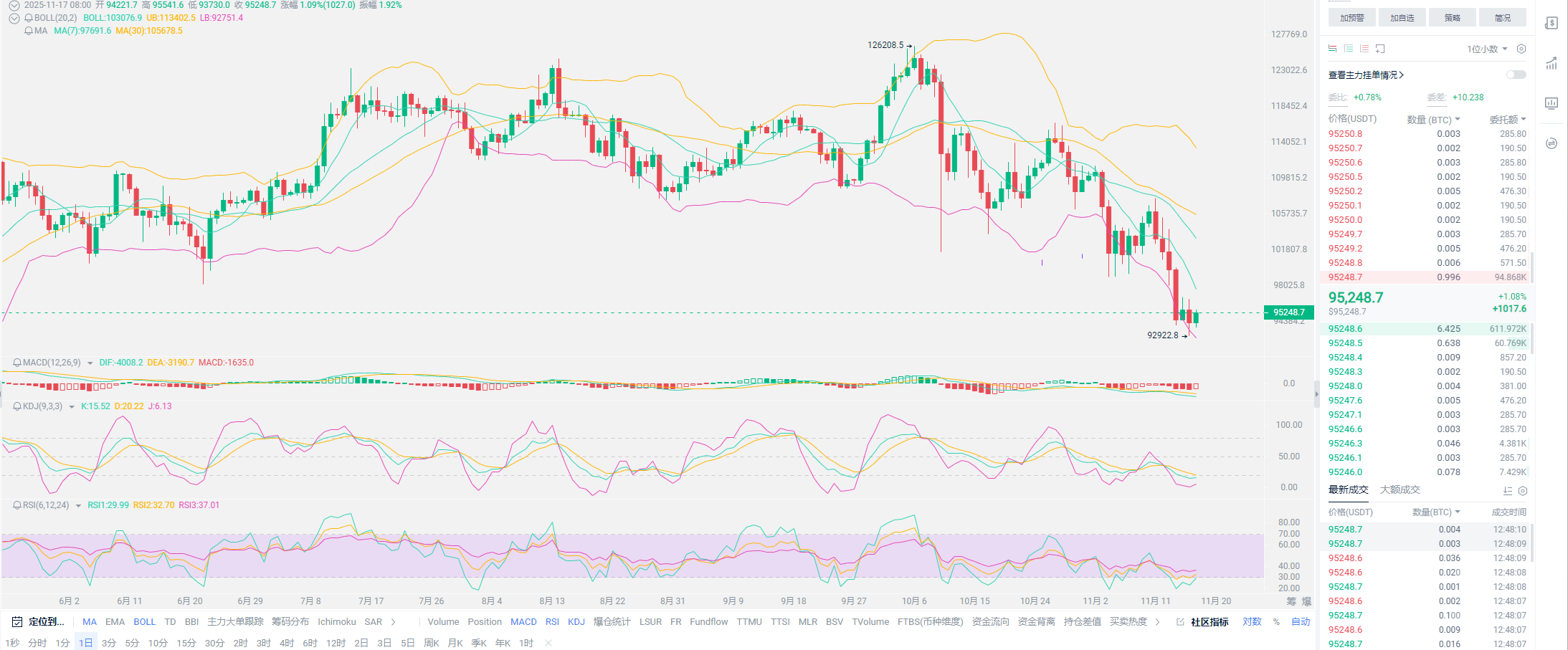

In this strong bearish atmosphere, those who can still insist on going long indeed show extreme trust in Lao Cui. Therefore, today I will provide a detailed interpretation of the future layout. Although the short-term trend is indeed continuously hitting new lows, as long as the layout is appropriate, the daytime should be in a profitable state. Using user examples in hand, I will demonstrate the approach. The basic entry point for the first order is around 96,000. Yes, according to everyone's view, this type of order should currently be in a loss state. However, the vast majority of users are now in a profitable position of about 80%. The method of entering is extremely simple. When entering at 96,000, I built positions four times, with 96,000 as the first order, occupying about 10% of the funds. Then, I placed orders at 95,000, 94,000, and 93,000, each occupying another 10%.

Currently, three entry opportunities have been triggered, with the average price just at the 95,000 point. Today's high was 95,541, which means a profit of 541 points. The biggest advantage of this layout is that the lower the point, the larger the position. When the market reaches 94,001, the loss is actually only two Bitcoin positions, but at 95,000, there are three Bitcoin positions, keeping the profit at 1,500 U. The most important point to confirm with this approach is the safety of the position and the confirmation of the low point. So far, this layout is also the best response to the short-term market, and it is the best choice for those with insufficient positions. The current long position means being prepared for the possibility of breaking below the support level. As long as there is a responsive position, there is an opportunity for profit. For example, if you have a position of 1WU, if you are buying with five Bitcoin, you must now divide it into five equal parts for purchase.

The downward movement during the US trading hours is an opportunity for you to buy, while the upward movement during the Asian trading hours is your profit time point. You can also choose to short; for those going short, short-term profits may come easier than going long, but also be prepared to cut the last order calmly when the market reverses. Don't think this is something that can be easily overcome; making a decision to take a loss requires strong psychological endurance. According to my estimation, the time for a reversal from the new low is getting closer. Each wave of new low testing has become about 1,000 points deep for Bitcoin, and there is likely one more wave of decline before this short-term bear market ends, leading to a bullish counterattack. Especially for Bitcoin, this special player has a strong ability to reach new highs. A wave of bullish counterattack is not as difficult as you think; at most, it will take half a month to complete a main upward wave phase.

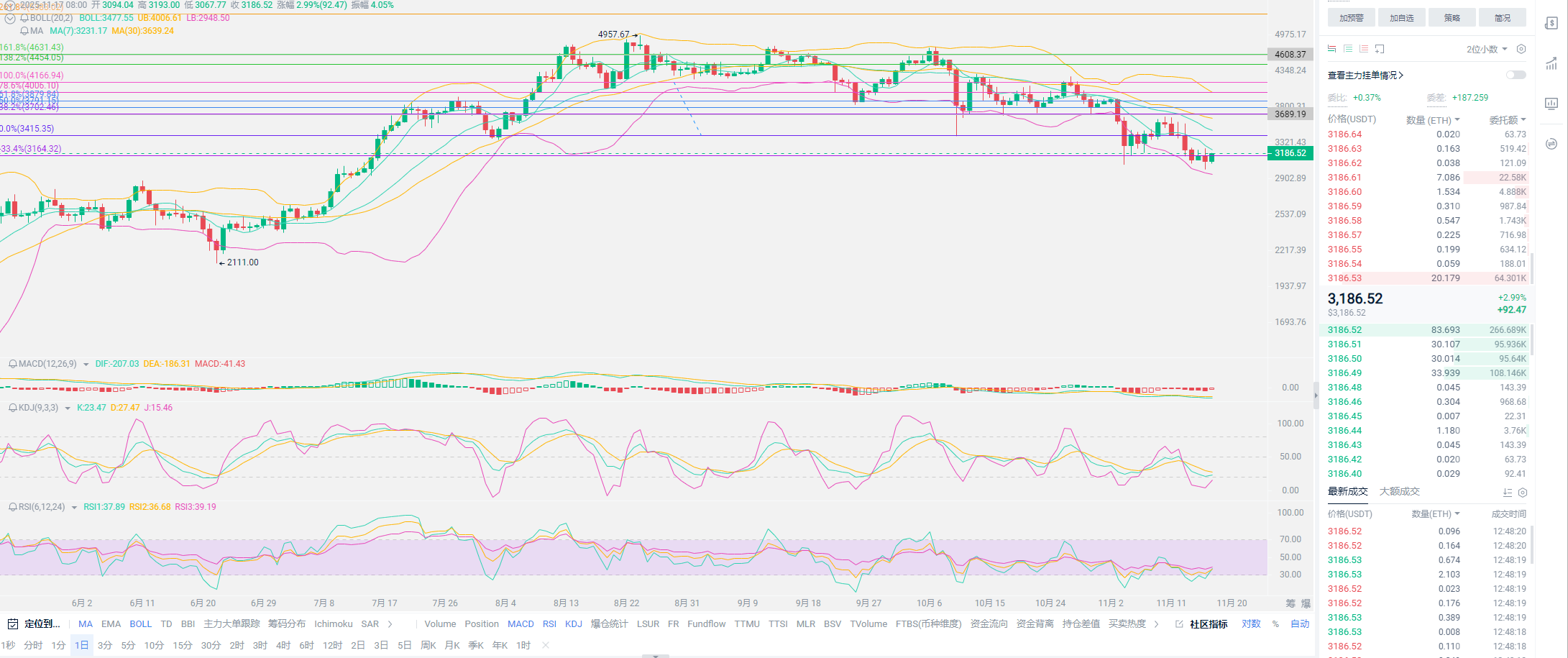

It all depends on how you choose. Convincing yourself to go long during a downward phase is a very difficult thing. However, the returns from going long are definitely higher than the short options. If you are considering short-term profits, going short is also an option, but the profits from shorting should not be too large. Overcoming greed and withdrawing in time is the key; follow a principle: securing profits is safe. When looking at the long term, also consider the positions of the giants. The giants you can see are basically holding positions; whether it is Grayscale holding SOL ETFs or BlackRock and major platforms investing in Bitcoin, including figures like Trump, they are all adopting a strategy of buying on the way down, which represents an investment measured in years, and the returns will definitely come. Lao Cui still remembers Trump from the same period last year, which boosted Lao Cui's positions. At one point, Lao Cui also complained about his choice, as it dropped from 4,300 to 3,400, but his purchases also gave Lao Cui confidence.

Buying Ethereum with half a position at 3,400, it quickly rose to 1,400. Lao Cui still chose to trust and increased the position to 2,400; it took a full nine months to see feedback. Although it was spot trading, it was enough to make Lao Cui question it. The process was difficult, but the outcome was good. The doubts you have now are merely because you haven't seen the returns. Let the bullets fly for a while to verify your assumptions. In the crypto world, there are no other options for the future. Especially with Trump's blueprint, the current crypto market is far from sufficient; growth is the only option. Do not doubt your vision; hold boldly, and the results will not disappoint you. Lao Cui also cannot see the rebound from the lowest position; let me strongly emphasize that Lao Cui does not have the ability to predict the future. What I can provide is to reduce losses and expand profits. The final conclusion is that users with spot positions should short to reduce their burden, while users without spot positions should follow Lao Cui's method to gain profits. Today, I won't say much; I need to set off. If you have questions, please ask in time. At the end of the article, Lao Cui will temporarily not accept platforms or group chats. For those looking for investment, please do not contact Lao Cui anymore. Thank you all for your understanding. If there is a need, Lao Cui will seek you out!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one square, aiming for the final victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。