Author | @Defi_Warhol

Compiled by | Odaily Planet Daily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

Crypto airdrops may seem like "free money," but seasoned yield farmers know that not every airdrop is worth the gas and effort. Over the past 5–7 years, I have participated in dozens of airdrops, some of which turned into six-figure profits, while others resulted in total losses.

The difference lies in whether a thorough assessment was conducted. In this report, I will attempt to provide a framework for evaluating the potential of airdrops.

I have developed a relatively objective assessment system to determine whether an airdrop opportunity is worth participating in or should be skipped altogether. I will combine real case studies (from the legendary Uniswap airdrop to the latest L2) and some quantifiable benchmarks to provide professional crypto practitioners and even VCs with references for identifying high-potential, low-risk airdrop opportunities.

Key Factors in Airdrop Evaluation

Evaluating whether an airdrop has potential is not based on guessing or chasing trends, but rather a structured process. We can approach this from several core dimensions, each pointing to key aspects of risk or reward:

- Protocol Fundamentals and Narrative

- Token Distribution and Economic Model

- Participation Conditions and Anti-Sybil Mechanisms

- Cost, Investment, and Risk-Reward Ratio

- Market Environment and Timing

- Liquidity and Exit Strategy

Next, I will delve into each dimension, including what questions to ask and why they are important.

1. Protocol Fundamentals and Narrative

Before you start testing networks or cross-chain funding, you must first assess the project itself. Airdrops are not magic; their value comes from the success of the underlying protocol.

- What is this project about? Is it solving a real problem, or is it just following trends?

A strong use case or technological innovation (e.g., new scaling solutions, unique DeFi primitives) usually indicates that the token's value is unlikely to plummet after initial hype. For example, Arbitrum was a leading L2 on Ethereum before its token launch, with real users and an ecosystem, giving participants reason to believe its airdrop would be substantial. In contrast, many unremarkable copycat projects quickly plummeted after launch due to concentrated selling by farmers.

- Does the project have an attractive narrative or trend?

The crypto market is driven by narratives. In 2023–2024, themes like modular blockchains, restaking, and ZK-rollups attracted significant funding. If a project aligns with a hot narrative (e.g., a modular data network like Celestia), its token demand may see excessive growth. However, narratives can also quickly lose relevance (which has indeed happened), so I prefer those with technical backing.

- Are users and developers genuinely active?

Checking on-chain data and community channels is crucial. An active testnet and Discord group, along with weekly development updates, are positive signals. It's even better if user behavior is not purely speculative. For instance, Blur (an NFT marketplace) achieved explosive growth and real trading volume after gamifying its airdrop, indicating that its user growth was organic rather than merely speculative.

A protocol with a solid fundamental story and strong community engagement is the foundation of everything. If the project itself lacks value, no matter how cleverly designed the airdrop is, it won't save the token price. I have personally paid a painful price for this: in 2022, I spent months on several L1 testnets, only to find that these projects failed to attract real users, and even when they launched tokens, no one was willing to buy, resulting in a price drop of over 90%.

In short: if I have no interest in the project beyond the airdrop, I will seriously reconsider whether to participate.

2. Token Distribution and Economic Model

Token design is the second key factor, including airdrop distribution ratios, release methods, valuations, and value capture mechanisms. I mainly focus on the following points:

- User allocation percentage

- Value capture mechanism

- Release and lock-up rules

- FDV assessment

- Market price before TGE and early valuation signals

- Fairness of distribution

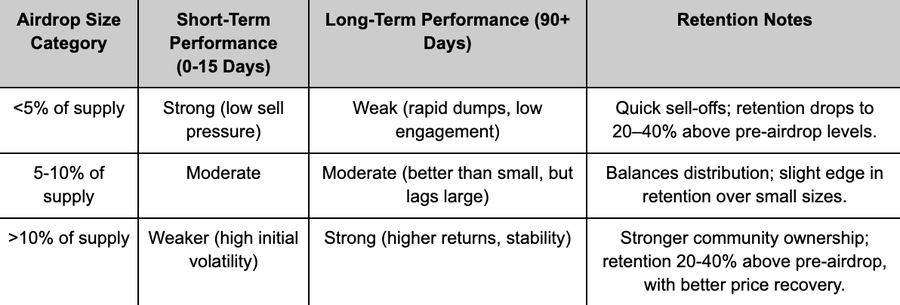

User Allocation Percentage

How much does the airdrop give to users?

Airdrops that provide users with a sufficient share usually foster a stronger community and create some price support. Experience shows that projects that allocate >10% for airdrops perform significantly better than those that allocate only 5%, as the latter often suffer from too small a circulating supply, leading to immediate sell-offs. For example, Uniswap allocated 15% of UNI for its airdrop in 2020, peaking at a value of about $6.4 billion, which directly established loyalty within its governance community.

In contrast, some projects launching in 2024 allocated very little to users, with most held by insiders, leading users to immediately sell their small allocations, and the token price never recovered. Celestia's TIA genesis airdrop allocated about 7.4%, while Arbitrum allocated about 11.6%, both of which are substantial enough to give users real "game rights." If only a tiny portion is allocated to the community, I see this as a dangerous signal for token sell-offs.

2024 crypto airdrops with low user allocation and high insider holdings

Value Capture Mechanism

- What role does the token play in the protocol ecosystem? How does it capture value?

Not all tokens can share in the growth of the protocol, which is evident in the many failed airdrops in the past.

Some tokens only serve governance functions, such as UNI or DYDX. Governance rights can build long-term value in certain cases, especially when a DAO manages real cash flows or key system parameters, as governance tokens can reflect profit distribution. However, if the protocol itself has low fees or governance is effectively non-existent in practice, the token will become a "symbol of participation," and the market will ultimately assign a very low price to such "pure governance tokens" that do not generate substantial returns.

Some projects build value capture through revenue sharing, buybacks, staking rewards, or protocol capacity binding, such as HYPE or GMX. These tokens allow airdrop participants more strategic options—either to cash out immediately after receiving the tokens or to hold them long-term for cash flow. I prefer tokens that can play a positive economic role; they are not just "certificates" for governance but can also impact transaction fees, inflation, or protocol throughput.

Lock-up and Release Mechanism

- Can airdrop tokens be immediately traded, or are they locked or restricted?

Generally speaking, "immediately sellable" is usually more favorable for yield farmers, as it allows for quick profits. If tokens cannot be transferred or are locked for a long time, it essentially means you are forced to hold them long-term—something I often joke about, as it often means "short-term yield farming has turned into forced value investing." The EIGEN airdrop in 2024 is a typical example. Users worked hard for a year to earn points, but the tokens were not transferable upon launch, leading to widespread dissatisfaction among those who farmed points.

Therefore, I usually avoid airdrop projects with mandatory long locks or complex veToken-style claiming mechanisms unless I have extremely high confidence in the project's long-term value. My airdrop strategy is essentially about pursuing "options," rather than being forced into long-term bets. Remember a very practical principle: "No protocol is absolutely safe, so no airdrop should ever require you to hold long-term."

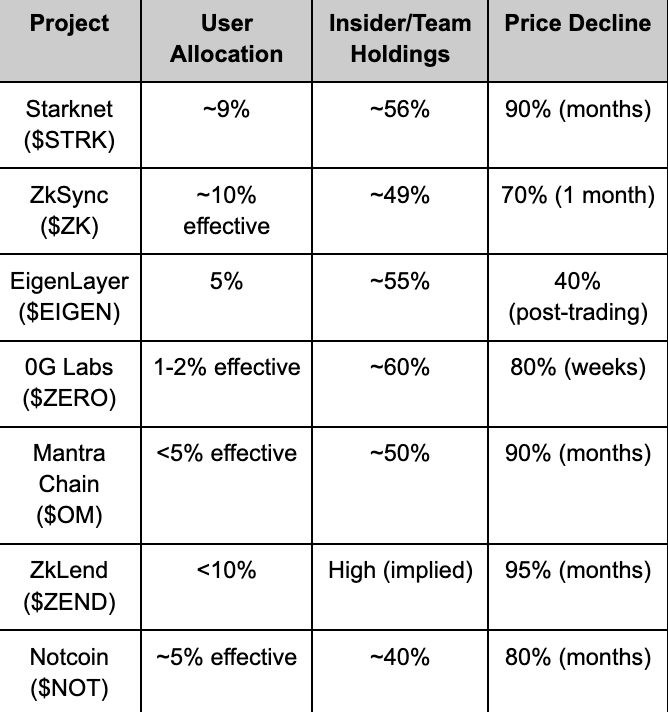

Fully Diluted Valuation

- Estimate the FDV (Fully Diluted Valuation) at the time of token issuance (total supply × expected price).

An excessively high FDV almost guarantees selling pressure, as no airdrop can "counteract valuation magic." In 2024, most airdrops launched with extremely high FDVs and generally retraced 50–80% within two weeks. A study covering 62 airdrops found that 88% of tokens experienced a decline within 15 days of launch, often due to initial pricing being far above real value.

Performance of newly launched tokens and correlation with FDV

Therefore, I prioritize looking for projects with "margin of safety." For example, if similar projects have a market cap in the $500 million range, and a new project has an expected FDV of $5 billion, caution is warranted. Conversely, if the quality is excellent but the pricing is reasonable, that is a positive signal.

Liquidity also needs to be considered: will it be listed on major exchanges? Is there enough depth on DEXs? A lack of liquidity can lead to even quality projects being quickly crushed due to an inability to absorb selling pressure. Among the few projects in 2024 that maintained value a month later, "reasonable FDV + deep liquidity" was almost a common characteristic.

Market Price Before TGE and Early Valuation Signals

A new trend is that large potential airdrop projects will engage in pre-launch trading on perpetual DEX or OTC markets before officially launching. These pre-launch markets often reflect market expectations and can sometimes lead to implied FDVs in the hundreds of millions or even billions due to speculation. For yield farmers, these signals are crucial: if the expected FDV is extremely high, it can enhance promotional efforts and incentivize greater investment; but it also means higher risk, as if the narrative fails to materialize, it can quickly backfire after launch.

I view these pre-launch prices as "sentiment indicators," rather than definitive signals. The key is to discern when the market is paying too high a premium for unrealized potential and to adjust exposure in advance to avoid valuation corrections after the official launch.

Fairness of Distribution

- Check whether the airdrop is concentrated in a few wallets or more evenly distributed.

Highly concentrated airdrops mean that a few large holders may dump significant amounts of tokens in the short term. For example, in the case of Arbitrum, despite the overall generous distribution, some top users received as many as 10,250 ARB, creating a "whale group."

Interestingly, a small number of wallets often hold a large portion of the tokens. If I find data (Dune panels or project blogs) indicating that the top 1% of addresses may claim a significant proportion of the total allocation, I will be particularly cautious.

I prefer designs that limit individual reward caps or use secondary distribution formulas to avoid "winner-takes-all" scenarios. For example, the Blast L2 points system introduced activity caps, allowing small active users to receive meaningful allocations, alleviating wealth disparity.

In summary: Higher community allocation, freely circulating tokens, and reasonable valuations indicate healthier airdrops; projects with minimal allocations, strong lock-ups, and high FDVs are more suitable for "quick in and out," but often do not warrant significant upfront investment.

3. Qualification Criteria and Anti-Sybil Mechanisms

Next, we enter another core dimension: how you qualify for airdrops and how the project identifies and excludes "Sybil behavior" (multiple addresses farming airdrops). This section addresses two key questions: How high is your probability of winning? And can you scale safely (multiple wallets or a single wallet)?

Standard Transparency

- What qualification criteria has the team disclosed?

Some airdrops are entirely "traceable" and come with surprise terms (Uniswap directly gave all historical users 400 UNI); others use task-based, point-based, or monthly activities (e.g., Optimism and Arbitrum).

The clearer the standards, the easier it is to plan your strategy. For example, Arbitrum disclosed the composition of points in advance (cross-chain, trading in different months, providing liquidity, etc.), allowing me to take targeted actions ahead of time, even maxing out my points. Conversely, if the standards are vague, you may need to participate in a "jack of all trades" manner, leading to increased costs and lower efficiency.

Single Address Earnings vs. Multi-Address Expansion

- Estimate the value that eligible wallets might receive.

Sometimes the team hints at reward tiers, or you can infer them based on past similar airdrop activities. For example, many Ethereum L2s previously averaged $500–$2000 in value per ordinary participating wallet. If I estimate that this airdrop's rewards fall within that range and the tasks are simple, then the cost-benefit ratio is good. However, if each address requires significant effort (like running nodes for months) to achieve similar rewards, it may only be worth participating with one address or simply opting out. There are exceptions, such as early dYdX traders receiving tens of thousands of DYDX.

I also consider whether using multiple wallets can significantly increase earnings, but I need to be cautious of Sybil screening. If the project explicitly expresses "strong anti-Sybil" measures, multiple addresses may not be worth the effort. For example, Optimism removed over 17,000 Sybil addresses in 2022; Hop was even more direct, reclaiming and recovering allocations from Sybil addresses after the airdrop distribution.

My rule of thumb: the higher the Sybil risk, the more I should focus on nurturing one or two "high-quality real accounts" rather than blindly diversifying.

Sybil Identification Mechanisms

In addition to direct bans, some projects enhance "real user" scores through point weighting or design preferences, such as: long-term activity weighting, on-chain reputation NFTs, KYC, etc. In 2024, LayerZero marked 800,000 Sybil addresses and reduced their rewards to 15% of normal levels.

Additionally, be aware of conditions that can easily "trap" users, such as Starknet's first airdrop requiring wallets to hold at least 0.005 ETH at the time of the snapshot, which excluded many genuine users. At the same time, some projects set early tasks on testnet NF or Galxe/Crew3 as necessary conditions, and missing them means losing eligibility, so it's essential to pay attention in advance.

Risk of Rule Changes

The worst-case scenario is: you complete all tasks, only for the project to change the rules and exclude you. While this situation is rare, it has indeed occurred.

The solution is to stay in sync with the community and pay attention to how the team defines "abnormal behavior." For example, "multiple new wallets funded simultaneously by one address" will almost certainly be viewed as Sybil behavior.

I appreciate projects with clear communication, but we always assume that the possibility of exclusion is not zero. This mindset can help avoid overconfidence. A key phrase to remember is: "If you miss the opportunity, that's your fault, plain and simple." Blockchain data does not care about excuses, so I try to engage in farming in a way that can withstand scrutiny.

In summary, understanding airdrop qualification can help us gauge the level of competition for the airdrop and how to mine effectively. Situations with high Sybil attack risks require more caution (it's best to invest time in a reliable identity), while open, freely participatory airdrops (without Sybil attack checks, entirely based on trading volume, etc.) may be more suitable for multi-wallet strategies, but these strategies are often diluted by a large number of airdrop farmers. This requires a delicate balance; my default approach is to operate at least one account like a "real super user," which helps avoid most Sybil attack screenings and earn substantial rewards.

4. Investment, Costs, and Risk-Reward

Airdrop farming ultimately requires an investment of time and money, so I must conduct a cost-benefit analysis in advance:

Time and Complexity

Some tasks require only a single interaction, while some testnet incentives may demand weeks or even months of continuous participation. I will list all tasks in advance and estimate the time costs.

If an activity can ultimately yield only $500 but requires 100 hours of investment, it is definitely not worth it. Additionally, be particularly cautious of "indefinite point-based activities," as they often devolve into endless competition with diminishing returns.

Some projects I participated in in 2022 made me realize the importance of setting a deadline. For example, "If a month later, my points are still not at the level of the top X% on the leaderboard, I will reassess; if it still doesn't work, I will stop participating."

Gas and Direct Costs

I will calculate how much gas (or transaction fees) I will consume and other costs (cross-chain bridge fees, minimum deposit requirements, etc.). For example, Arbitrum's standard encourages users to cross-chain over $10,000 and remain active over multiple months; if gas prices are high, these operations on certain networks can be expensive. All these investments must be weighed against potential returns.

A good method is to simulate a few operations first, observe the actual gas consumption, and then multiply it by the expected number of iterations or wallets. Some mining projects may seem to have a great narrative, but when calculated, the gas alone exceeds the potential rewards, which has led me to opt out (especially during the period of skyrocketing gas prices in 2021, when many small airdrops were simply not worth spending $100 on gas to claim).

Capital Risk

- Does the platform require you to lock up a large amount of capital or bear market risks?

Doing LP, lending assets, or staking tokens can expose you to impermanent loss and even smart contract risks. For example, during the DeFi "liquidity mining" boom, some platforms (like Sushi) did indeed offer airdrops, but miners faced threats from liquidity or protocol vulnerabilities.

If a new protocol (like a newly launched bridge or lending platform) requires you to deposit a large amount of capital solely for airdrop eligibility, you need to assess its audit status and consider the potential risk of being hacked. Hacking is not a theoretical event: from the Ronin $600 million bridge exploit to several small failures on testnet bridges, LPs have lost their principal while chasing airdrops due to vulnerabilities.

Worst-Case Scenario Assessment

Always ask yourself: "What if I end up with nothing?"

If the answer is: I would lose an amount of money or time that I cannot afford, then it is not worth doing. I usually assume that a portion of mining projects will fail (the project cancels the airdrop, I get filtered out, or the token is worthless). For instance, I once invested a lot of time in certain L1 testnets (I won't name them), but the projects ultimately did not launch tokens—purely sunk costs. These lessons have taught me to minimize irreversible investments.

In terms of time costs, this means regularly reassessing and not being blinded by the "sunk cost fallacy"; in terms of monetary costs, it means not spending too much on gas or keeping as flexible as possible (for example, using scripts or choosing low-peak times to reduce costs).

To determine "if it's worth it," I usually perform a simple expected value calculation: for example, airdrop probability (80% chance of issuance, 20% chance of non-issuance) * estimated token value (e.g., $1000 per wallet) minus total costs. If the expected value is clearly positive and the subjective judgment is reasonable, I will proceed; if the result is marginal or negative, I will stop or wait for clearer information.

5. Market Environment and Timing

Bull Market vs. Bear Market

In a bull market, airdrops can be highly profitable, as tokens typically launch at higher valuations, with stronger buying interest and more apparent FOMO; whereas in a bear market, even decent projects may face tepid demand upon launch. For example, major airdrops in 2022–2023 (like Optimism and Aptos) mostly occurred in a bear market, leading to rapid sell pressure and slow recovery after launch.

In contrast, bull market airdrops in 2021 often continued to rise after launch. I do not attempt to precisely gauge macro trends (airdrop mining is essentially market-neutral before token issuance), but the market conditions influence my enthusiasm for mining and exit strategies (which will be discussed in the next chapter). In a bull market, I will be more proactive in exploring opportunities and tend to hold for a longer period; in a bear market, I will only pursue the most promising projects and tend to sell immediately upon launch.

Narrative Cycle

Narrative matching depends not only on whether the category is popular but also on whether you enter at the right time.

For example, "restaking" in early 2024 is an absolute hot narrative, attracting massive attention with even a slight expectation of airdrops. If you participate while TVL is still low, it will stand out more; but by Q1 2024, the space becomes crowded, making it difficult for latecomers to stand out from the crowd.

I will assess whether a particular airdrop is in the "early" or "late" stage. If everyone on X is talking about a certain testnet, it is highly likely that the easy money has already been picked up, and the project will be stricter in preventing Sybil attacks; conversely, a low-profile project in an emerging space may be a gem. For example, in 2025, AI + DeFi hybrid protocols began to gain attention, and airdrops for such projects may not yet be completely overwhelmed by airdrop farmers, thus having a higher win rate.

Project's Own Timeline

Observe what stage the project is in. If the mainnet or token launch is approaching (e.g., within a few weeks), the time left for your mining efforts is shorter, and the standards are usually fixed. If it is a long-term testnet with no announced end date, you will need to judge for yourself how long you are willing to invest. Some projects will distribute incentives in "seasons"; if a timeline is publicly available, you can plan ahead.

Also, pay attention to the snapshot time. Many airdrops take a snapshot at a certain block height. If you find that the snapshot is approaching, it's the final sprint; if you feel you've done enough, you can reduce additional spending.

Ability to Handle Negative News

This is a subtle but important factor; observe how the project deals with negative events. Does a testnet crash scare away users? Did the team delay the token sale? If the project encounters a hack or incident, and the team's handling is professional while the community remains supportive, that resilience can actually boost my confidence, indicating that the demand is real. On the other hand, if a minor delay causes people to angrily exit, then their interest in the project isn't deep enough.

A project that can "ignore bad news in a bull market narrative" may be in a more favorable position. I've seen similar situations with Arbitrum and Optimism: despite airdrop controversies and governance FUD, the number of users continued to grow, indicating that the underlying demand is strong enough.

In summary, the situation is crucial. I am more cautious during bubble periods (when everyone is mining and competition is fierce), but I tend to be more proactive during market downturns (fewer people are willing to persist, potentially leading to greater returns). My largest airdrop gains came at the end of 2022, when almost no one was willing to continue mining; by the time these tokens launched in 2023 (like ARB), I became one of the few who could reap the rewards.

6. Liquidity and Exit Strategy

Finally, I will plan in advance how to realize the value of the airdrop. The old saying still applies: "Plan your trades and trade your plan."

Claiming Strategy

The moment the tokens are open for claiming is often the most chaotic. I remember the day ARB was open for claiming; gas prices soared, RPCs crashed, and the entire network was in disarray.

I usually prepare multiple backup RPCs and script the claiming process in advance if possible. If I have multiple wallets, I will prioritize claiming those that I plan to sell immediately to complete the process before congestion hits; the portions I intend to hold long-term do not need to be rushed.

Also, pay attention to the claiming deadline: most airdrops allow claims for several months, but some tokens may be reclaimed by the DAO after expiration.

Market Liquidity

I tend to choose airdrops that have deep liquidity upon launch. If the project has backing from large institutions or is highly popular, exchanges like Binance and Coinbase are likely to list it early; even if not, there will at least be large AMM pools.

For example, ARB was immediately traded on major platforms after launch, with daily trading volumes exceeding $1 billion, making exits very smooth. In contrast, small airdrops may only trade on a single DEX with thin liquidity, causing significant slippage or price impact when you sell.

I will research in advance whether the project has announced partnerships with market makers or exchanges, as this is usually a good sign; conversely, if it requires a native wallet or is a niche Cosmos project, I will expect greater price volatility and adjust my position accordingly (or even abandon it altogether).

Sell, Hold, or Stake

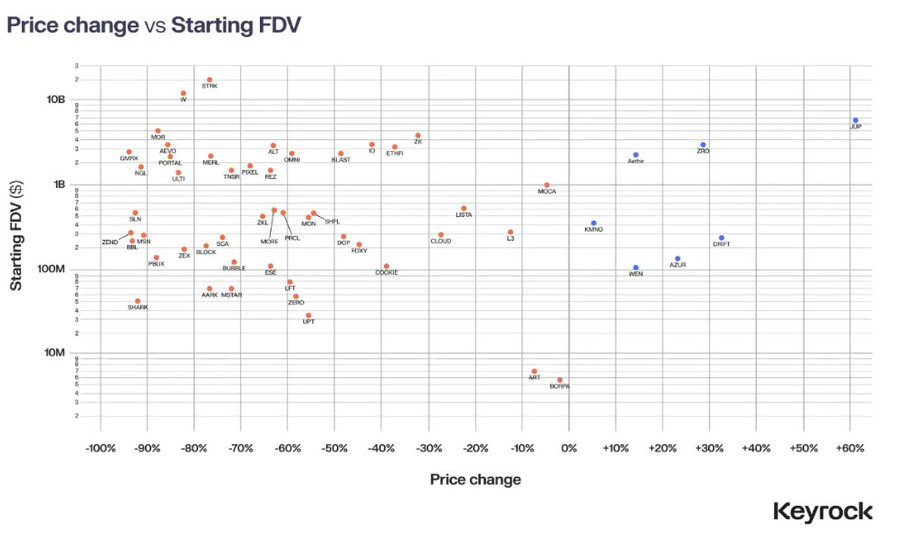

I usually decide in advance what percentage to sell immediately and what percentage to continue holding. Experience shows that most airdrop tokens peak within the first two weeks.

My strategy is often to sell about 50% on the day of claiming to lock in profits, while setting stop-loss or trend-following orders for the remaining portion.

This approach can hedge against the common risk of a sharp decline while retaining upside potential. Unless I encounter a project that I am very optimistic about or the price is significantly below my perceived reasonable range, I will not hold long-term; even if I do hold, I will assess whether to earn additional returns through staking, but if it requires a long lock-up period (like governance lock-ups), I will carefully consider the loss of flexibility.

Taxes and Compliance

Taxes cannot be overlooked either. Many jurisdictions treat airdrops as taxable income received at the time of receipt. A large airdrop can directly create a tax burden, so sometimes I choose to sell early to set aside funds for taxes.

Additionally, be aware of regional restrictions: for example, EigenLayer restricts U.S. users from claiming. If a project hints at future KYC requirements or begins geographic restrictions, I will view this as a negative factor, as it may render the airdrop worthless to me. For instance, by 2025, several airdrops began requiring simple KYC to comply with regulations.

In summary, until the tokens are liquid and successfully sold, airdrops cannot be considered real profits. I formulate an exit plan for each airdrop in advance to avoid being caught during a liquidity collapse.

Best Practices and Final Thoughts

In summary, when evaluating early airdrops, I follow these best practices:

Do Your Homework: Before participating in any "tasks," research the project's fundamentals and token plans. Read documentation, governance discussions, and look for signs of token issuance. Many failures stem from "thinking it will launch, but it actually won't" (and vice versa). Don't just listen to rumors; verify the possibilities.

Develop an Investment Strategy (and continuously validate it): Clearly determine why the airdrop might be valuable, such as "the project is a leader in a new category, with potentially low initial market cap and strong demand." Then continuously validate this with on-chain data and news. If the narrative breaks (growth stagnates, competitors overtake), be decisive in adjusting or abandoning it. Avoid getting caught in self-verification biases.

Quantitative Scoring and Comparison: I use tables to score based on dimensions like "fundamentals, token potential, cost/risk, Sybil difficulty," etc. This can reveal many issues—some projects may be hot, but with poor token distribution, resulting in a lower overall score. This helps identify low-profile but higher-value opportunities.

Control Risk, Don't Gamble: Treat airdrops as part of a portfolio, diversifying across multiple opportunities rather than going all-in. This way, even if one project fails, others can compensate. I typically mine 5–10 projects concurrently in a quarter, knowing that only about half may be profitable, with the core principle being to preserve capital to seize opportunities when significant airdrops arise.

Monitor On-Chain Metrics: Observe the number of new wallets, testnet usage, leaderboard positions, etc. If you notice your relative contribution declining, reassess whether it’s worth continuing; if overall project activity declines, it may indicate insufficient potential value, which is a bad sign for the token's ultimate value.

Plan for Entry and Exit: Know how to exit before participating. If you cannot sell smoothly after launch (due to thin liquidity, long lock-ups, etc.), then you shouldn't participate at all. Execute according to plan on launch day, without being swayed by greed or fear.

Continuous Learning and Iteration: Every airdrop (regardless of success or failure) has lessons to summarize: Did I overestimate the project? Did I overlook key qualifications? Did being too conservative lead to missing out on significant opportunities? These will continuously refine your framework. Over time, my attitude toward airdrops has become more "cautious and opportunistic": being careful with all noise, but seizing genuine opportunities without hesitation.

In conclusion, evaluating early airdrops is both an art and a science: it requires understanding the "art" of human nature, narratives, and incentive structures, as well as the "science" of analyzing data and dissecting token economics. The best airdrops often reward those who are true early users and participants in the ecosystem, rather than temporary participants.

This means that if you genuinely use and support excellent projects early on, you will typically receive the greatest rewards. My framework helps filter out these situations. By focusing on fundamentals, pragmatically assessing token designs, accurately evaluating costs and returns, and maintaining flexibility and updated knowledge, you will significantly increase the probability of identifying "worthwhile mining" airdrops.

Ultimately, airdrop hunting, like any investment, requires due diligence, risk management, and a clear strategy. By doing these, you can find signals amid the noise and have the opportunity to capture the next UNI or ARB-level opportunity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。