0. Introduction

Recently, the industry's excitement has shifted due to the rise of the X402 payment track, the panic of Black Monday through Friday, and the rotation of the privacy sector in the bull market legend.

This world is truly fascinating and also very noisy.

Whether it's a bear market or not, it's important to remember that a common mistake made by smart people is to strive to optimize something that shouldn't exist in the first place~ (from Musk). Now, let's calm down and review the brilliance of past successful products, examine which players in the competition are engaging in ineffective operations, and identify which are the pigs on the wind, as only when the wind stops can we truly see the long-term value of the future.

If you ask what the representative track trend is this year?

My first choice is Dex. It has been four years since the summer of DeFi, and there are indeed multiple typical products in 2025 that occupy a significant voice in the market. The most magical aspect of this track is that just when you think everything that can be done has been done, and the pattern should have settled, you suddenly see certain projects emerging as dark horses from the details. Hyperliquid in perps is one such example, and fomo in meme bots is another.

Aside from the challenges posed by new platforms, the evergreen Uniswap in DeFi continues to innovate. This article will deeply analyze two major moves made by Uniswap this week.

1. Development History of Uniswap

For those interested in the development history, you can refer to previous analyses:

Calmly Viewing the Grounding Challenges Intended to be Centered on UniSwapX and AA

2. Current Market Situation of Uniswap

As of today, Uniswap has processed approximately $4 trillion in trading volume, making it the undisputed leading Dex platform.

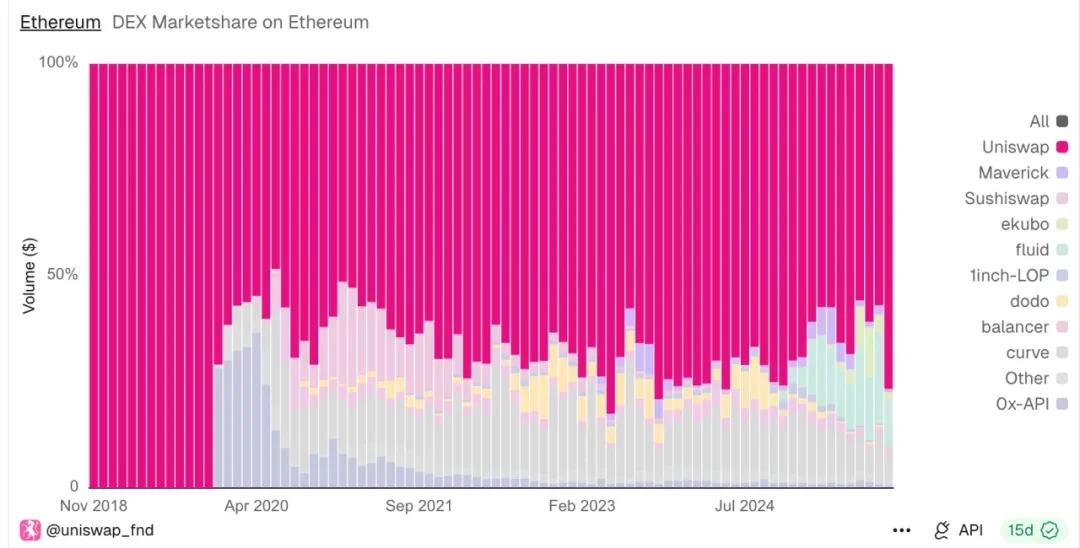

As seen in the chart below, even with new challengers emerging in 2025, it still occupies 70-80% of the market share on the Ethereum mainnet.

In October 2025, it had a trading volume of about $138 billion. Excluding monthly fluctuations, it averages a trading volume of 60-100 billion.

Market share of various Dex on Ethereum

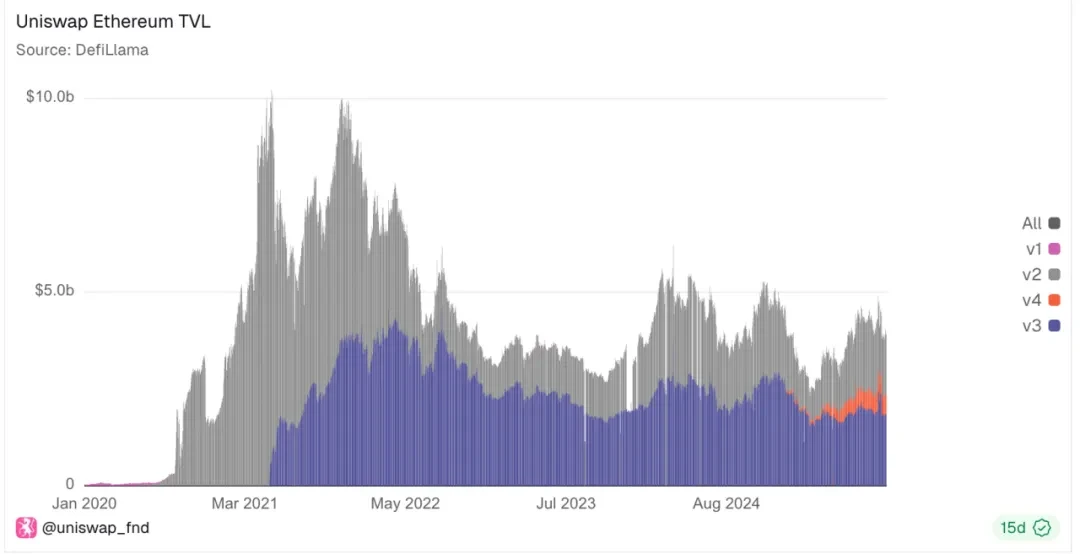

However, beneath the surface, there are indeed numerous challengers, as Uniswap's TVL continues to decline, indicating that the market has better staking options. Moreover, despite the continuous launches of v3 and v4 with more performance, gas, and LP optimizations, it is still competing for a shrinking market.

Market share of various versions of Uniswap on Ethereum

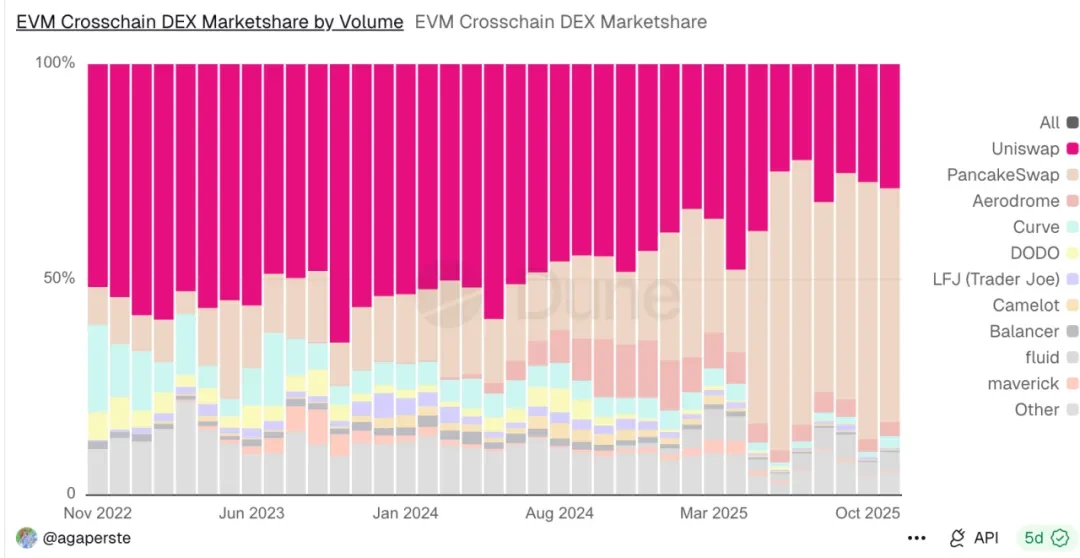

Furthermore, Uniswap is not the only player in the entire Dex market.

In the cross-chain swap market, the actual performance of UniswapX is far inferior to the experience optimizations of its competitor PancakeSwap. Since 2024, its market share has been continuously eroded. Now it holds only about 20-30% of the market.

Nevertheless, this market's potential should not be underestimated, as Uniswap still has a monthly cross-chain swap trading volume of around $200 billion.

EVM-based cross-chain Dex trading volume

Clearly, there are a host of issues. The most criticized is the poor performance of the UNI token itself. The current situation is dismal compared to its peak in 2021.

Can UNIfication help turn the tide?

3. UNIfication New Unification Proposal

UNIfication, a proposal jointly put forward by Uniswap Labs and the Uniswap Foundation, aims to fundamentally reform the operation of Uniswap—from fee distribution to governance structure to token economic model.

Key actions include:

• Enabling protocol fees and UNI burn: Activating a built-in "fee switch" that allocates a portion of each transaction fee to the protocol (instead of all going to liquidity providers). The fees collected by the protocol will be used to burn UNI tokens, thereby permanently reducing the supply of UNI. Thus, the future usage of Uniswap will be directly linked to the scarcity of the token.

• Unichain Sequencer fees will be used for burning: Uniswap now has its own Layer-2 network called Unichain. The fees earned by the Unichain Sequencer (currently generating an annual income of about $7.5 million) will also be used for the UNI token burn mechanism. Therefore, every layer of Uniswap (the main exchange and its L2 chain) participates in the same burn mechanism, increasing the scarcity of UNI tokens as usage grows.

• Protocol Fee Discount Auction (PFDA): A new mechanism that internalizes maximum extractable value (MEV) and enhances liquidity provider (LP) returns. In short, traders can bid for temporary fee discounts (i.e., trade without paying protocol fees for a short time). The highest bid (paid in UNI) will be used to burn contracts. This way, MEV that would originally flow to bots or validators will be captured by Uniswap and used to burn UNI.

• Burning 100 million UNI tokens (retroactive burn): To compensate UNI holders for the fees they "missed" during the fee conversion closure, they propose to burn 100 million UNI tokens from the treasury in one go. This amounts to about 16% of the circulating supply of UNI!

• No longer charging interface/wallet fees: Uniswap Labs will stop charging fees for its products (Uniswap official web app, mobile wallet, and API).

• Introducing a growth budget of 20 million UNI per year for Uniswap Labs (allocated quarterly).

How to Understand?

Well, there is indeed a lot of information, so let's think about it from the perspectives of different stakeholders.

3.1. For LPs

Clearly, the costs will be borne by the liquidity providers. For example, in the Uniswap v2 version, the trading fee will be adjusted from 0.30% (all going to liquidity providers) to 0.25% for liquidity providers and 0.05% for the protocol. Therefore, after the protocol fee is enabled, LPs will see their earnings per transaction decrease by 1/6.

Although this proposal also includes the PFDA scheme, which aims to expand the overall pie by internalizing some market execution value (MEV), guiding external liquidity, and charging certain fees, as well as generally increasing trading volume.

Some market analyses estimate that this mechanism will increase LP earnings by about $0.06 to $0.26 per $10,000 in trading volume. Considering that LP profits are usually very low, this is significant.

However, I am not so optimistic, as the feedback from MEV extraction to LPs and users has always been a major challenge. Additionally, LPs still bear the risk of impermanent loss, as referenced in: Understanding Impermanent Loss in Dex: Principles, Mechanisms, and Formula Derivation.

3.2. For Ordinary Users

First, user fees will be directly reduced. On one hand, high-end users can obtain fee discount coupons through the PFDA mechanism combined with auctions. On the other hand, the fees for using the Uniswap app page will be eliminated.

However, UNI will finally benefit from Uniswap's success, which is significant because previously, UNI was merely a governance token that did not share in Uniswap's trading fees (which were all given to LPs).

Moreover, UNI itself will form a deflationary asset closely related to cash flow, rather than being a passive governance token.

This clearly references the governance model of Hyperliquid, where, from a certain perspective, burning and repurchasing are analogous. For more, see: In-depth Discussion on the Success and Concerns of Hyperliquid.

3.3. For Lab Operations

Secondly, previously, extra fees from app usage were used to pay employees, but now it will be through a budget of 20,000 UNI. Based on the current market price, this amounts to a research and development budget of $140 million, which is quite high.

Sometimes I wonder if this is all just for the 20,000 UNI, as this scale is clearly much larger than previous fee revenues.

Additionally, Uniswap Labs and the foundation will merge: the Labs responsible for protocol development and the foundation responsible for grants/governance plan to combine. Most team members from the foundation will join Labs to form a united team focused on the development of Uniswap. This suggests a new atmosphere of diligence and hard work.

3.4. Is this mechanism worth a long-term view?

Perhaps due to the recent black swan events, the valuation increase brought by the burn has quickly receded.

Setting aside external factors, I believe that the short-term fluctuations are due to the initial release where everyone quickly understood that it would involve token burns, leading to growth. However, burning is not a source of long-term value.

Uniswap hopes that increased trading volume, MEV sharing, and other incentives will offset the impact of reduced earnings over time. How can it stabilize LP earnings?

In the initial charts, we have already seen that long-term Uniswap LPs are gradually migrating away.

Similarly, competitors (all doing LP) will have to hold a large amount of conventional tokens, which often incur the largest losses during black swan events, amplifying LP's impermanent loss. What about mainstream platform tokens? Ethereum staking itself offers a clear annualized yield of 4%, while Solana's staking, coupled with market conditions and Jito's MEV capture, can yield 8% or even higher, without worrying about the volatility of altcoins.

For more details, see: Ten Thousand Word Research Report: The Evolution of MEV on Solana and Its Pros and Cons

Therefore, the departure of LPs will ultimately affect trading depth, increase slippage, and eventually harm the user experience.

Thus, while UNIfication represents the biggest transformation for Uniswap since the launch of the UNI token, it addresses the long-standing issue of the lack of direct correlation between the value of the UNI token and Uniswap's actual performance.

In the long run, competition among decentralized exchanges (DEX) in 2025 is exceptionally fierce, and Uniswap's scale means its liquidity can withstand fluctuations for a while. The timing of this move is reasonable, but it will inevitably bring about turbulence.

4. CCA (Continuous Clearing Auction)

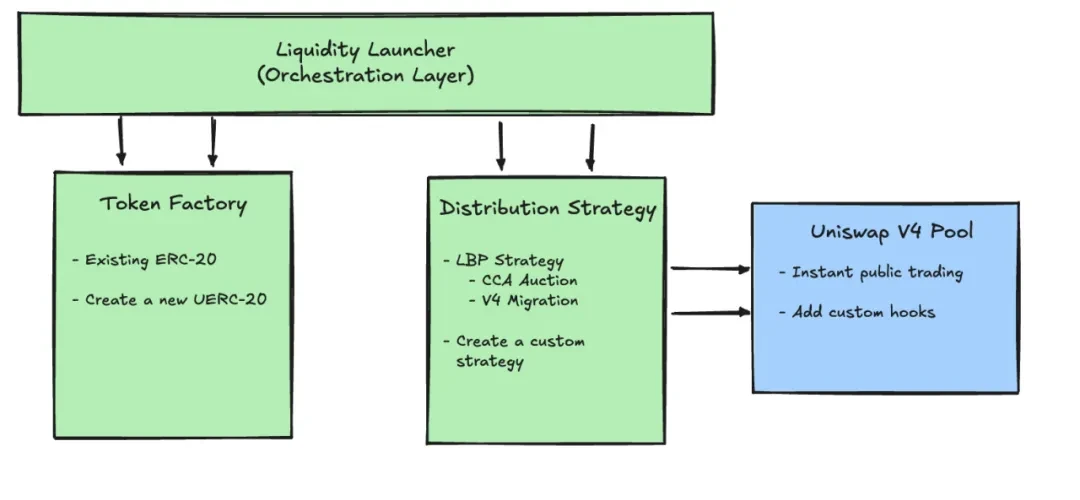

This is the new protocol CCA recently launched by Uniswap and Aztec, specifically designed for price discovery and liquidity initiation for new assets.

After this auction process concludes, project teams can directly inject the raised funds and tokens into Uniswap v4, connecting to secondary market trading.

4.1. Evolution of Asset Pricing Schemes

In fact, how to price assets has always been a grand issue. In my previous interpretations of UniswapX and Uniswap V2 mechanisms, I mentioned that objectively speaking, Uniswap's rise was due to seizing the demand for new asset pricing at that time.

After all, the on-chain AMM formula of two tokens, x*y=k, is the easiest way to quickly return to a reasonable price within the performance-limited EVM architecture.

However, this mechanism is not perfect; slippage, MEV attacks, and LP's impermanent loss are all key factors affecting it.

Therefore, fair price discovery and equitable initial token distribution have always been significant topics for DEX platforms. Yet today, most versions still feel like behind-the-scenes transactions disguised as "community activities." Insiders gain certainty, while others receive leftovers.

Subsequently, various platforms have made many attempts at pricing new assets, such as team airdrops, Dutch auctions, fixed-price sales, LBP, Bonding Curve, Fee mint, fair launches, etc.

Moreover, the above schemes still have flaws, such as:

- Fixed-price sales can lead to mispricing and priority disputes, resulting in insufficient or unstable liquidity.

- Dutch auctions create time-based games, giving professionals an advantage over actual participants.

- One-time auctions can reduce demand and often lead to last-minute buying frenzies.

- Various Curve models have path dependency and are susceptible to manipulation.

4.2. Design Philosophy of CCA

Essentially, CCA is a protocol independent of Uniswap v4, serving as a complete framework for issuance and pricing. However, it will leverage Uniswap v4's hooks mechanism to connect with the AMM core. In the entire issuance workflow, it is represented by the CCA Auction module in the diagram below.

It is a configurable auction framework, all conducted on-chain (which is an improvement over UniswapX). The five stages are:

It is a configurable auction framework, all conducted on-chain (which is an improvement over UniswapX). The five stages are:

Configuration Stage -> Bidding Stage -> Allocation Stage -> Clearing Stage -> Injection Stage

- Configuration Stage: The auction initiator first sets the rules on-chain, such as start and end times, how many "rounds" or time periods the auction will be divided into, the proportion of tokens released in each time period, the minimum price (floor price), and additional configurations like whether a whitelist/verification is needed, and how to inject liquidity into Uniswap v4 after the auction ends, etc.

- Bidding Stage: During the auction, participants can bid at any time, with each bid containing two parameters: how much capital to invest and the maximum acceptable unit price.

- Allocation Stage: The system will automatically allocate a bid across the remaining "release periods." Therefore, the earlier the bid, the more time periods the participant can engage in, allowing for participation in more rounds of clearing.

- Clearing Stage: In each round, the system accumulates all valid bids and uses a unified rule to find a price that can sell all the tokens to be released in that round, serving as the final transaction price for that round.

- Injection Stage: After the auction concludes, participants can claim their acquired tokens and any unspent funds; the protocol will inject the raised assets and the other side of the assets prepared by the project team into Uniswap v4, officially launching the liquidity pool for the secondary market.

4.3. How to Understand

In summary, it essentially divides a one-time auction into multiple rounds, dispersing the game dynamics across these rounds to address the previous issue where one-time auctions often culminated in a flurry of transactions at the last second (just before the block is mined), turning the auction into a black box.

But is this enough?

Clearly, the complexity may deter many new tokens from launching on this platform. Additionally, efficiency has decreased. Objectively speaking, since the X version, Uniswap's auction logic has not been very successful, and many DeFi protocols have left complexity for users to handle.

I believe this is difficult to replicate as the success of Uniswap V1, which rewrote the history of new token issuance and pricing with just 200 lines of code. Moreover, its reliance on V4 indicates that, as shown in the data above, there is a fivefold gap compared to mainstream V2 and V3.

5. On Asset Growth and Value Discovery

Regarding asset growth, the previous discussion focused on initial pricing platforms. I would like to add some insights on the pricing logic during the mid-to-large development stages.

Although trading financial derivatives, especially perpetual platforms, is the most profitable across all trading links.

Many people have been drawn to this initially, but the true intrinsic value of Perps lies in its ability to assist in the pricing of mid-sized assets.

Particularly small assets can be listed on Uniswap or meme platforms, and as they grow into mid-sized assets, they can be listed on BN's Alpha platform or other mid-sized CEX platforms. However, objectively speaking, before 2025, there was a lack of decentralized pricing platforms for large assets in the market.

Thus, during this interim period, market misjudgments can easily occur, leading to rapid exits by investors once assets are listed on exchanges.

This is primarily because Perps are futures; to price an asset in the market, you must place it on the platform, locking its liquidity there, which is actually detrimental to the asset.

If the asset is too small, borrowing tokens to provide liquidity to market makers can also be easy, but often small tokens disappear because they fail to coordinate well with market makers, leading to price manipulation where both parties inflate prices, either when the official sells or when they buy.

Thus, many of these market makers' influences prevent small tokens from gaining traction. As they transition to mid-sized tokens, liquidity must be placed on the platform to create sufficient depth, which increases costs for the project team and makes LP returns unstable and less apparent, as large fluctuations in tokens discourage long-term holding.

From this perspective, perpetual platforms, being futures, do not require delivery of anything; you only need to believe in the price, making them excellent pricing platforms for mid-sized assets.

Recently, facing a bull-bear transition, I have also experienced two cycles. Objectively speaking, in the ever-changing bull and bear markets, platforms that can survive long enough will certainly capture long-term demand.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。