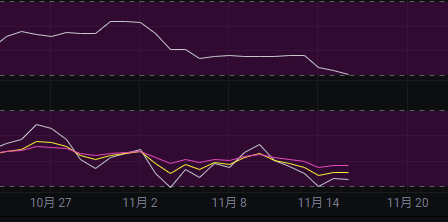

Yesterday, when the market was rising, we mentioned that this was a rebound market. Today, we see that it has dropped again, which aligns with our judgment from yesterday. Currently, the fluctuations over the past two days are not significant and can be understood as a consolidation phase after a continuous decline, which is building momentum for the market's development next week.

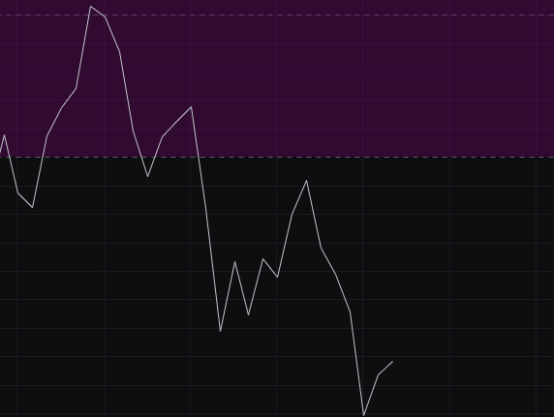

From the MACD perspective, the energy bars continue to move downwards, but the magnitude is relatively small, indicating a consolidation. The fast line and slow line are also under pressure, which from a technical standpoint is more favorable for the bears. Until the pattern changes, we will maintain a bearish outlook.

Looking at the CCI, today's CCI movement is quite strange; while the price is closing down, the CCI is showing an upward trend. We will see how it ultimately closes tomorrow.

From the OBV perspective, the OBV continues to flow out, and the slow line is also under pressure. The pattern cannot change in the short term, so we also maintain a bearish mindset regarding the OBV.

Looking at the KDJ, it has now fallen below 20, indicating that the market is very weak. Therefore, the market is unlikely to improve much in the coming days, and we will continue to maintain a bearish outlook.

From the MFI and RSI perspectives, both indicators are in the weak zone, indicating that market sentiment is still leaning towards the bears, so we are also bearish here.

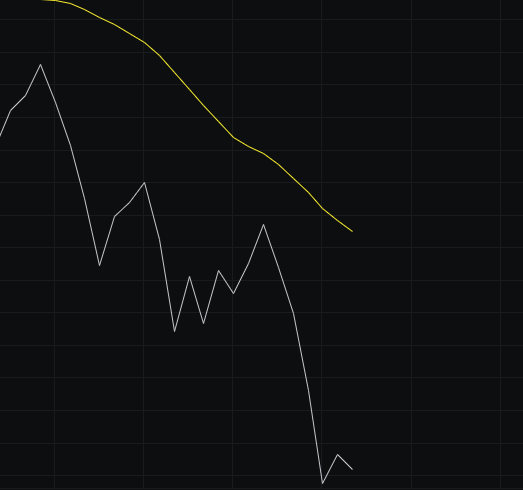

Looking at the moving averages, several moving averages are under pressure, and the BBI has also fallen below the 100,000 mark. The moving averages also indicate a bearish trend, so we continue to maintain a bearish mindset.

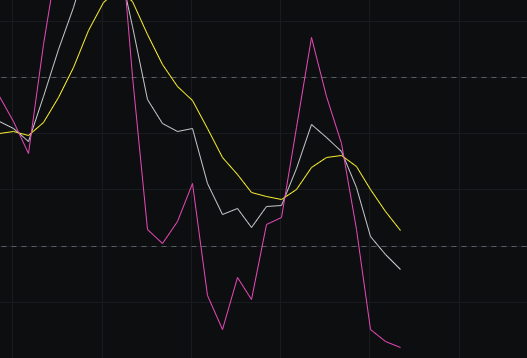

From the Bollinger Bands perspective, both the upper and lower bands are under pressure, indicating a downward channel. We will continue to be bearish, but for the pattern to hold, it would be best to close with a bearish candle today. We will see if that happens tomorrow morning.

In summary: Most market indicators still lean towards the bears, so we will maintain our bearish mindset. At the same time, we hope that today can close with a bearish candle to solidify the downward channel. Today's resistance is seen at 96,500-98,000, and support is at 94,500-92,500.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。