Strategy’s Stretch security, listed as STRC, is marketed as the lowest-risk option among the company’s preferred perpetual products, with comparisons made to short-duration U.S. Treasurys despite its connection to the firm’s ongoing bitcoin accumulation.

According to the report dubbed “Bit of a Stretch,” Bitmex researchers detail that STRC’s structure centers on a variable dividend that can rise when the debt trades below its $100 target price or fall when it trades above that level, creating a system intended to keep the instrument stable. The debt has recently traded near par value, signaling early traction among investors.

Bitmex Research notes that STRC’s mechanism is highly unusual because no other known debt product adjusts its coupon strictly to keep its trading price anchored. Traditional variable-rate debt follows benchmark interest rates, while STRC responds directly to its own market valuation.

Since capital raised through STRC issuance is used to purchase bitcoin rather than fund corporate operations, researchers describe the instrument as a new iteration of Strategy’s unconventional methods for expanding its bitcoin treasury.

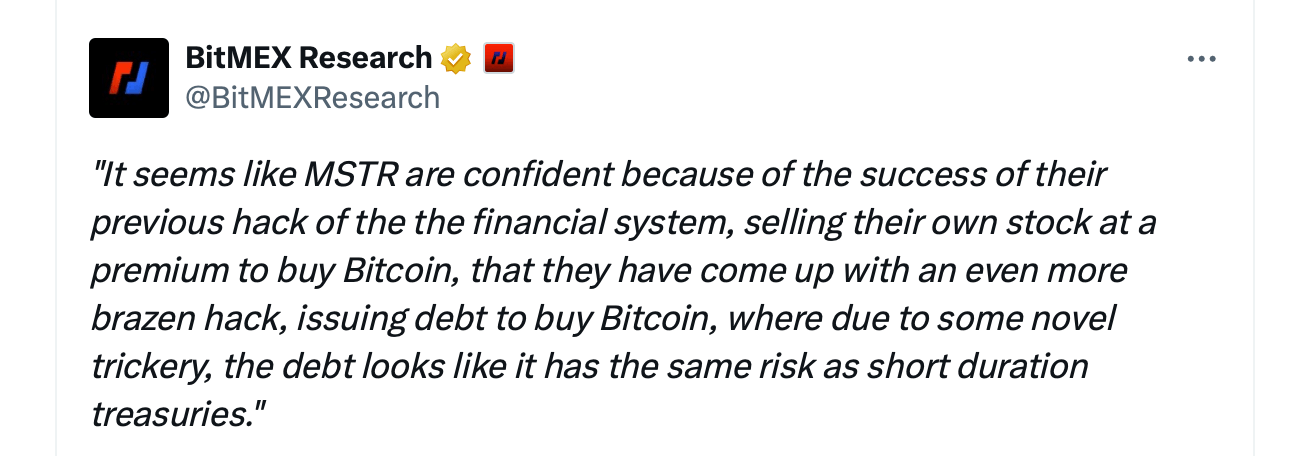

“A key difference to treasuries being that the money raised by issuing STRC is used to buy Bitcoin,” Bitmex states. “This is another attempted hack of the financial system, to buy more Bitcoin.” The research department of Bitmex adds:

“As far as we can tell, STRC is a novel product. There are no other debt instruments like it. Debt instruments typically have a fixed coupon or a variable coupon, where the interest varies depending on other interest rates in the economy such as the Fed funds rate.”

The report flags what it considers the most significant risk for holders: Strategy can reduce the dividend rate by up to 25 basis points each month at its discretion, regardless of STRC’s market performance. In some cases, reductions may occur even faster when broader benchmark rates decline. At the maximum monthly reduction, a 10% dividend could fall to zero in just over three years, substantially reducing investor returns.

The report states:

“Our understanding of the above is that MSTR can, at its absolute discretion, lower the dividend rate by up to 25 bps a month, no matter what else is happening. It doesn’t matter what is happening to the STRC price or on the wider market, the dividend rate can be reduced by 25 bps a month.”

Bitmex Research also highlights how missed payments accrue over time, potentially limiting Strategy’s ability to pay dividends on other stock classes until outstanding STRC balances are covered. However, the report emphasizes that STRC holders have no security claims and the company does not owe dividend payments if it chooses not to make them, even if arrears build up.

On the question of whether STRC shares characteristics with a Ponzi scheme, Bitmex Research concludes it does not meet the definition, though it notes similarities: Strategy cannot afford current dividend levels without new capital or bitcoin sales. But the flexibility to gradually lower dividends gives the company a long runway, making the structure highly favorable for Strategy while placing more risk on investors. The report argues that STRC carries considerably more risk than short-duration Treasurys, even though it is marketed as comparable.

In closing, the Bitmex report says that if conditions weaken, Strategy could simply reduce monthly dividends, making payments easier for the company while likely causing STRC’s price to fall. Researchers describe the design as structurally advantageous for Strategy, suggesting investors may face the steepest consequences if dividend reductions accelerate.

- What is Stretch (STRC)?

Stretch is Strategy’s variable-rate preferred security designed to maintain a $100 trading price by adjusting its monthly dividend. - How does STRC differ from traditional debt?

Its dividend rate shifts based on its own market price instead of tracking benchmark interest rates. - Why did Bitmex Research evaluate STRC?

The review analyzes STRC’s stability mechanics, dividend rules, and investor risk considerations. - What risks does the report highlight?

Bitmex Research warns that Strategy can steadily reduce dividends, which may significantly impact STRC’s value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。