Bitcoin and Ether ETFs See $670 Million in Exits

Friday’s ETF trading was marked by heavy exits from bitcoin and ether ETFs, and surprising strength from alternative assets. While the majors bled, Solana and most notably, XRP ETFs showed investors aren’t afraid to explore new lanes.

Bitcoin ETFs logged a third straight day of outflows, shedding $492.11 million across four major funds. The vast majority of the redemptions came from Blackrock’s IBIT, which saw a staggering $463.10 million exit. Grayscale’s GBTC added to the downturn with another $25.09 million outflow. Smaller withdrawals hit Wisdomtree’s BTCW ($6.03 million) and Fidelity’s FBTC ($2.06 million). A modest $4.17 million inflow into Grayscale’s Bitcoin Mini Trust barely moved the needle against the sea of red.

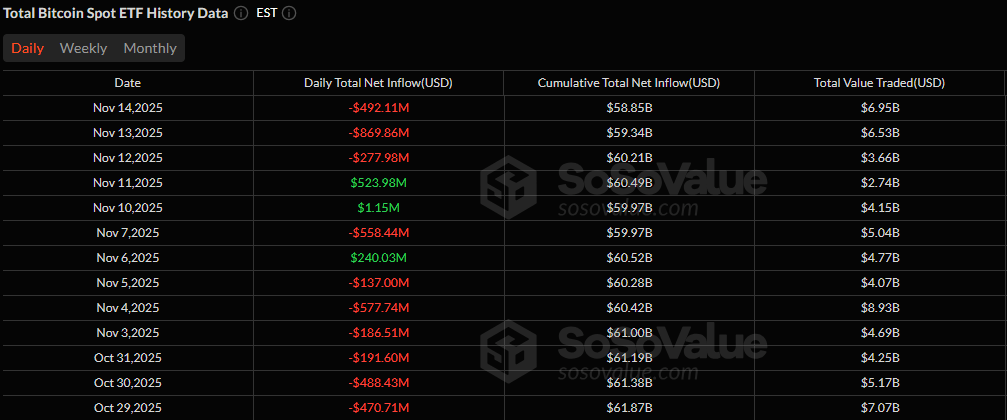

Trading activity remained heavy with $6.95 billion in volume, and net assets fell to $125.34 billion, marking a new local low driven by weeklong pressure.

Over two weeks beginning from Oct. 29, bitcoin ETFs have only seen three days of inflows as against 10 days of outflows.

Ether ETFs were no exception to the risk-off sentiment, recording a fourth consecutive day of outflows totaling $177.90 million. The selling was concentrated overwhelmingly in Blackrock’s ETHA, which lost $173.27 million. Grayscale’s ETHE added another $4.63 million to the exits. Total value traded reached $2.01 billion, and net assets settled at $20 billion as investor appetite remained muted.

Read more: Bitcoin Tracks Nasdaq Losses, Not Its Rallies

Solana ETFs, however, extended one of the most consistent inflow streaks in the crypto ETF landscape. Bitwise’s BSOL attracted $12.04 million, pushing net assets to $541.31 million on $42.40 million in trading volume.

The day’s biggest twist came from the debut of XRP ETFs. Canary’s XRPC launched with a striking $243.05 million inflow, instantly marking XRP as a new contender in digital asset ETF markets.

With capital rotating aggressively and new entrants gaining traction, the ETF market is shifting quickly, and in ways few expected.

FAQ 💸

- Why did bitcoin and ether ETFs see another major outflow day?

Investors pulled a combined $670 million from BTC and ETH ETFs as risk-off sentiment persisted. - How did solana ETFs perform despite the broader market weakness?

Solana continued its resilient streak with a $12 million inflow and rising net assets. - What was the biggest surprise in Friday’s ETF flows?

XRP ETFs made a striking debut with a massive $243 million first-day inflow. - What does this mean for the broader crypto ETF landscape?

Capital rotation is accelerating, with investors shifting from major assets toward emerging alternatives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。