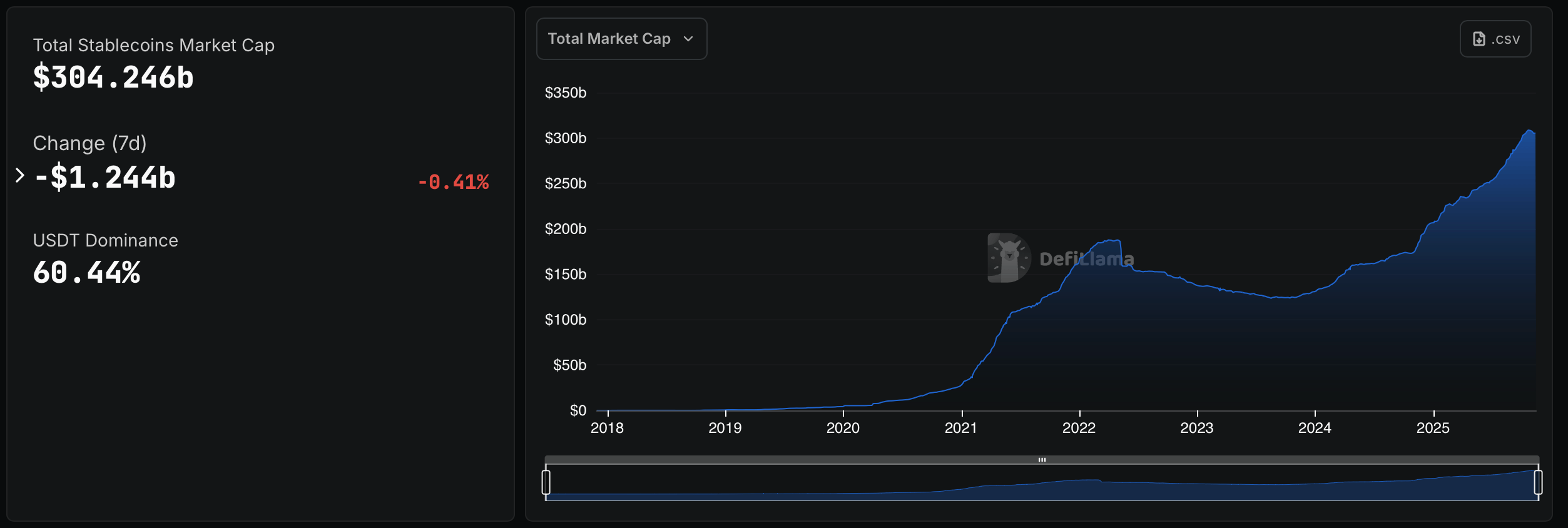

This weekend, stablecoin data from defillama.com pegs the fiat-pegged economy at $304.246 billion following the week’s 0.41% reduction. Over the past seven days, the stablecoin sector delivered a full spectrum of mood swings. Tether’s USDT, still standing tall as the heavyweight at $183.896 billion, squeezed out a modest 0.16% lift — the kind of move that barely gets a nod.

USDT’s valuation accounts for 60.44% of the entire $304.246 billion fiat-pegged token sector. Circle’s USDC at $74.498 billion slid 1.20%, the stablecoin equivalent of sighing loudly. Ethena’s USDe, holding $8.094 billion, face-planted with a much higher 6.10% drop, easily one of the week’s biggest sulks. USDe took a significant hit last week as well.

Sky’s USDS at $5.747 billion dipped 0.65%, a polite little stumble. While the same project’s older stablecoin, DAI, carrying $4.851 billion, slipped 0.46%, like it stepped on a Lego. Paypal’s PYUSD stablecoin at $3.417 billion strutted through with a loud 22.20% jump, basically the only one that showed up caffeinated.

During the same timeframe, the Trump-backed World Liberty Financial and its stablecoin USD1 at $2.846 billion fell 1.04%, trying not to make a scene but still did. Blackrock’s BUIDL, worth $2.28 billion, tanked -11.62%, a full dramatic exit worthy of a slow-clap. Like USDT, Falcon Finance’s USDf at $2.003 billion squeaked out a 0.12% lift, the bare minimum of effort.

On another side of Ethena’s spectrum, the stablecoin USDtb at $1.533 billion plunged 16.30% lower, winning the most dramatic award by miles. Ripple’s RLUSD stablecoin at $1.089 billion glowed with a clean 3.66% increase, while Circle’s USYC at $1.077 billion topped off the chaos with a confident 9.54% rise, reminding everyone that sometimes the new kid really does have main-character energy.

Also read: Bitcoin Options Traders Shrug off the Dip With Calls Leading Puts Across Markets

Ethena USDtb (USDTB) at $1.533 billion plunged -16.30%, winning the “most dramatic” award by miles. Ripple USD (RLUSD) at $1.089 billion glowed with a clean +3.66%, while Circle‘s USYC at $1.077 billion topped off the chaos with a confident +9.54%, reminding everyone that sometimes the new kid really does have main-character energy.

In all, the week wrapped with the stablecoin sector looking like a cast of characters each committed to their own brand of theatrics — some tiptoeing lower, others flopping dramatically, and a few strutting with unearned confidence. Whether this capital exit cooldown becomes a trend or just a quick mood swing, the sector’s mixed signals suggest traders are still figuring out where they want their dry powder to sit next.

- What caused the stablecoin sector’s second weekly dip?

Capital flowed out of major stablecoins, leading to a combined $1.2B decline across the market. - Which stablecoins saw the biggest moves this week?

Tokens like USDe and USDtb posted the steepest drops, while PYUSD and USYC showed notable gains. - How large is the stablecoin market after the latest drawdown?

Metrics from defillama.com place the sector at $304.246 billion following the $1.2B reduction. - What does a shrinking stablecoin market suggest for traders?

A contracting sector often signals funds shifting from crypto into fiat or other assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。