There are days when the crypto market feels like a steady tide. Then there are days like Thursday, Nov. 13. One of the largest ETF outflow events in digital asset history hit the market, draining more than a billion dollars from bitcoin and ether funds combined. Yet, amid the significant outflows from the two major ETFs, solana quietly remained in the green, continuing a streak that has now become a characteristic trait.

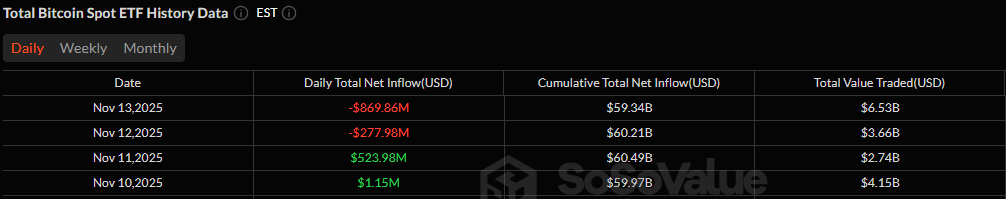

Bitcoin ETFs endured a brutal session with $869.86 million in outflows, the second-largest daily exit ever recorded for the product class. Ten different funds saw redemptions, illustrating the breadth of the retreat.

The heaviest pressure landed on Grayscale’s Bitcoin Mini Trust, which bled $318.20 million, and Blackrock’s IBIT, which saw $256.64 million leave the door, together contributing well over half the day’s losses. Fidelity’s FBTC followed as the third-largest contributor with a $119.93 million outflow.

The remaining exits rippled through the ecosystem: Grayscale’s GBTC lost $64.50 million, Bitwise’s BITB dropped $47.03 million, and Invesco’s BTCO shed $30.80 million. Smaller but still notable redemptions hit ARKB ($15.68 million), HODL ($8.34 million), EZBC ($5.69 million), and BRRR ($3.05 million). Trading was intense with $6.52 billion in volume, and net assets fell sharply to $130.54 billion, reflecting the weight of the sell-off.

Turbulent week for bitcoin ETFs with two days of outflows worth over $1 billion

Ether ETFs were pulled into the same downdraft with a sizable $259.72 million outflow across four major funds. Blackrock’s ETHA led the withdrawals at $137.31 million, while Grayscale’s ETHE followed at $67.91 million. Grayscale’s Ether Mini Trust saw another $35.82 million exit, and Fidelity’s FETH added $14.52 million to the red tally. The segment processed $2.54 billion in trades, with net assets slipping to $20.30 billion.

Read More: Solana Delivers Again as Bitcoin and Ether ETFs See Heavy Outflows

In contrast, solana ETFs managed to stay green yet again, a small but meaningful victory. Bitwise’s BSOL brought in $1.49 million, extending a streak of inflows that continues to stand out in an otherwise risk-off environment. Trading volume reached $52.62 million, and net assets held at $533.43 million.

Thursday’s flows reinforced a clear narrative: capital is rotating aggressively out of bitcoin and ether ETF products, but solana continues to attract steady interest, even on one of the roughest days of the year.

FAQ💸

- Why did Bitcoin ETFs see such massive outflows?

Bitcoin ETFs faced $870 million in redemptions as investors aggressively rotated out of major crypto products. - What happened with Ether ETFs?

Ether ETFs followed the same trend, posting $260 million in outflows during the risk-off session. - Why is Solana still seeing inflows?

Solana ETFs remained resilient, adding fresh capital despite the broad sell-off in BTC and ETH funds. - What do these flows signal for the market?

The sharp exits highlight growing caution in major assets while interest shifts toward alternative Layer-1 exposure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。