Bitcoin Market Outlook After Late November

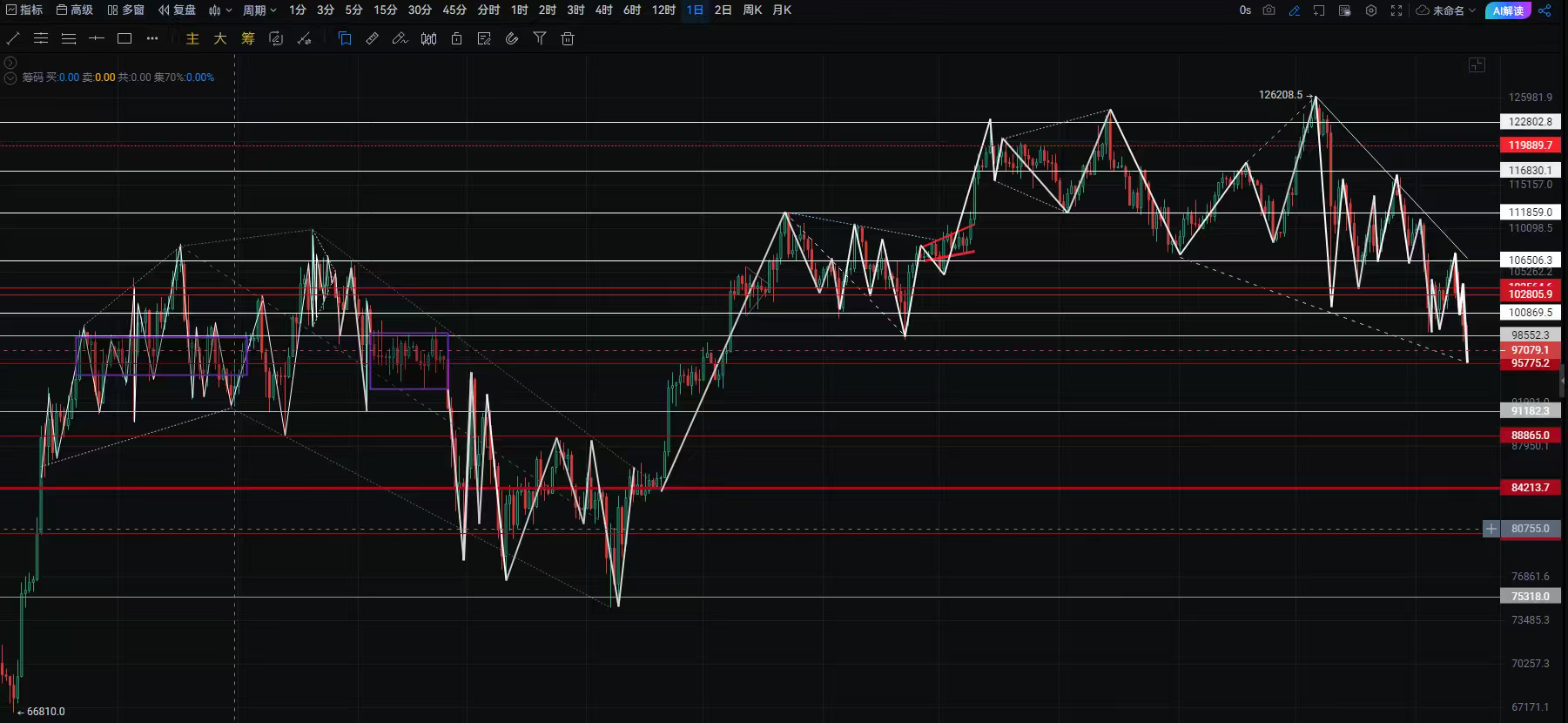

Good afternoon everyone, I believe we should first briefly review the price movement of Bitcoin. Looking at the four-hour chart, on the afternoon of November 13, Bitcoin was pressured around the ema30 at 103500, failing to rebound and test the ema120 and ema144, instead testing the 100,000 mark. Three consecutive hourly candles with increasing trading volume formed a bearish pattern, driving the price down to around 98500. There was buying support here, and at 4 AM, it rebounded to a high of 100300, but did not reach the support at 100800. The next three four-hour candles continued the bearish pattern, reaching a low of 95800 by noon. The following four-hour candle showed a slowdown in selling pressure, with the RSI in the oversold zone and the KDJ extremely low, indicating signs of stabilization.

We should focus on each important segment of the tug-of-war: the 100,000 mark, 98500, and 95800.

The pressure on Ethereum during this period seems somewhat deliberate. Since November 10, the four-hour battles have been intense, but the gaps between the high and low points in several tug-of-war segments are very narrow. This may lead many to expect the bottom to be around 3350. However, the actual movement broke below and hit 3100. Given the structural similarity to Bitcoin, we look for other details that may affect the future market.

The lowest point of Ethereum's drop on November 5 was around 3050. Notice that this week, Ethereum did not break below its previous low. In contrast, Bitcoin hit a low of around 99000 on November 5, and today it has reached a lower point. Looking back at the black swan event on October 11, Bitcoin's lowest was around 101500, while Ethereum was around 3400. Ethereum has shown clear signs of a bottom divergence.

Analyzing the three segments of the downward trend combined with the volume, Bitcoin's amplitude has gone from strong to slow and then back to strong, while Ethereum has gone from strong to slowing down, indicating that spot players have already entered the market. The downward space will only become more limited. From the daily chart of Ethereum's performance this year, the 3080 level has always been a turning point in the cycle, serving multiple times as a pressure point and a forced liquidation point. Many trapped investors are worried about a drop to around 2800. However, with such limited space below, if it drops further, the bull market rhythm will be lost. Therefore, there will be a consensus for support around 3080. Similarly, Bitcoin's 98500 is a turning point, but it is not the dividing line between bull and bear markets; the pressure here is to induce direction.

So, looking towards late this month, we can expect upward movement. Ethereum can be looked at around 3400, while Bitcoin can be looked at around 102200. Let's see if we can reach that next week; if it drops again, the rhythm of the bull market will be disrupted.

Recently, things have been okay. For short-term references, check the public account: Jiang Xin Lun Chan.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。