With the passage of the U.S. GENIUS Act and the accelerated formation of a global regulatory framework, stablecoins are moving from the gray area to a controllable market order, but new challenges with both risks and opportunities are just beginning.

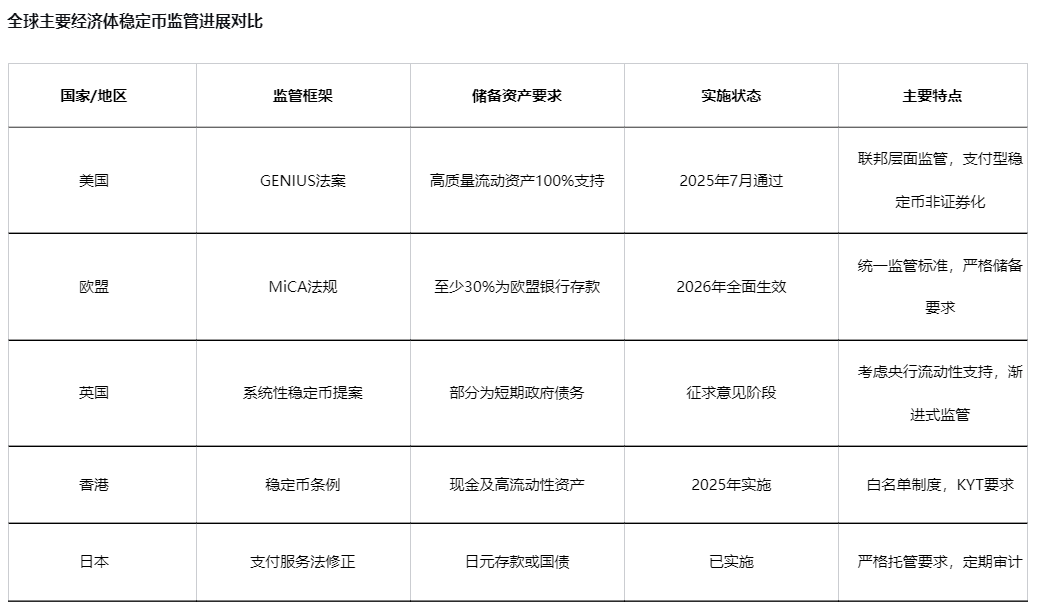

In 2025, stablecoin regulation will reach a significant turning point. In July, the U.S. Congress passed the GENIUS Act, establishing the country's first federal regulatory framework for stablecoins, marking the integration of this rapidly growing digital asset into the mainstream financial regulatory system. Meanwhile, major economies such as the UK, EU, and Canada are also launching or accelerating the implementation of cryptocurrency regulatory laws, pushing global crypto regulation from "whether to regulate" to "how to systematically regulate."

Against this backdrop, the risk characteristics and response strategies brought about by the deep integration of stablecoins with the traditional financial system have become the focus of attention for regulators and market participants.

I. Formation of a Global Regulatory Framework

Major economies are accelerating the layout of stablecoin regulation, making 2025 a breakthrough year for crypto asset legislation.

● The U.S. GENIUS Act provides a federal regulatory path for stablecoin issuance, requiring issuers to maintain safe asset backing and ensure price stability and redeemability. The act also removes payment stablecoins from the definition of securities, providing regulatory clarity for market participants.

● The EU's Markets in Crypto-Assets Regulation (MiCA) sets unified regulatory standards for crypto asset service providers and stablecoin issuers, expected to come into wide effect by 2026. However, industry insiders point out that MiCA requires at least 30% of reserve assets to be EU bank deposits, which may put euro stablecoins at a disadvantage in international competition.

● The Bank of England released a regulatory proposal for systemic pound stablecoins in November 2025, aimed at ensuring public trust in new forms of currency. The proposal allows systemic stablecoin issuers to hold part of their reserve assets in short-term UK government debt and considers establishing central bank liquidity arrangements as backup support.

II. Diverse Risk Landscape of Stablecoins

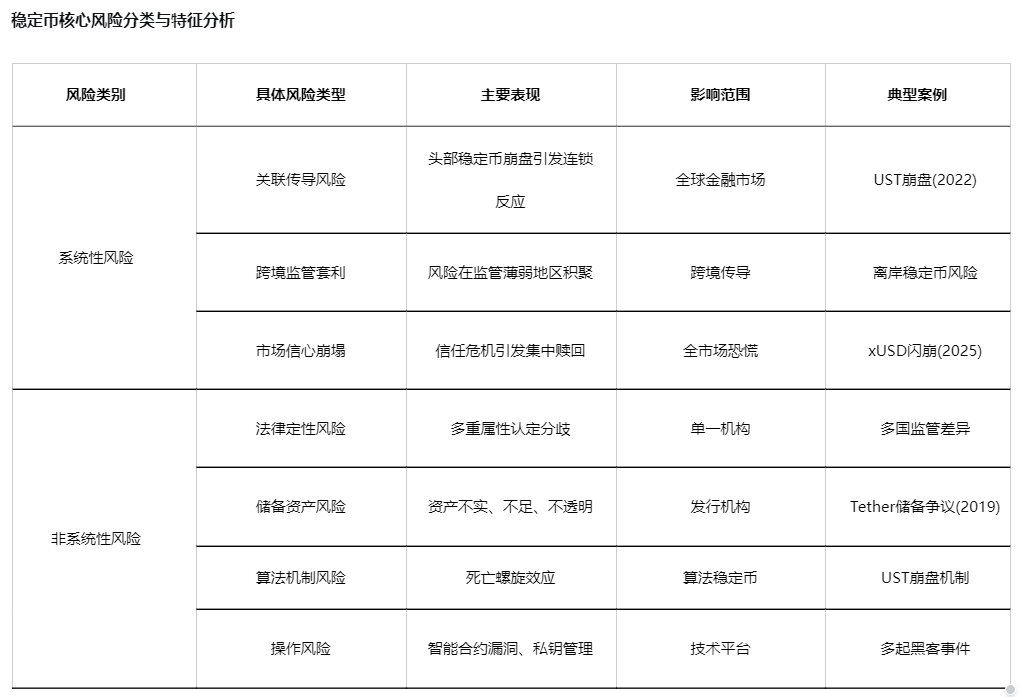

Systemic Risks

● Federal Reserve officials have pointed out that stablecoins may increase demand for U.S. Treasury securities and other dollar-denominated liquid assets, thereby affecting the monetary policy transmission mechanism. "Stablecoins could become a multi-trillion-dollar elephant that central bankers need to face." Federal Reserve Governor Stephen Milan stated in a recent speech.

● An analysis report from BPI emphasizes that if stablecoins become more deeply integrated into the traditional financial system without adequate safeguards, shocks in the crypto market could potentially infect the broader economy for the first time.

● DeFi lending platforms exhibit risks similar to highly leveraged banks but lack key protective measures such as deposit insurance, capital requirements, liquidity buffers, or regular inspections.

Non-Systemic Risks

● In early November 2025, the stablecoin xUSD experienced a flash crash, dropping from $1 to $0.12, evaporating 88% of its market value in a single day, triggering over $1 billion to flee from high-yield stablecoins. This incident revealed issues of insufficient transparency and excessive leverage in certain stablecoin projects.

● Analysis found that xUSD raised $530 million in loans using only $170 million in real assets, with actual leverage exceeding four times.

III. Risk Cases and Regulatory Challenges in Practice

Lessons from the xUSD Collapse

● Stream Finance packaged its high-risk strategy as the stablecoin xUSD, claiming to use a "delta-neutral strategy" to hedge against market volatility risks. However, when the crypto market crashed on October 11, 2025, its trading strategy failed, resulting in a loss of $93 million, leading to a suspension of all withdrawals and deposits a month later, ultimately causing xUSD to decouple.

● This case reflects the "packaging-expansion-collapse" model, sharing similar roots with the 2008 global financial crisis and the 2022 LUNA collapse—transforming high-risk assets into low-risk products.

Regulatory Boundaries and Coordination Challenges

Significant differences in regulatory standards across different jurisdictions remain, and global consistency has yet to be formed, posing obstacles to cross-border crypto asset services.

● Hong Kong has innovatively proposed a "whitelist system" for stablecoin regulation, requiring stablecoin users to complete "Know Your Wallet Holder" identity verification when opening accounts, clarifying user identity and regional information from the source.

● This contrasts with the traditional "blacklist system" of retrospective tracing, providing a compliant entry point for large enterprises, government agencies, and others who previously refrained from using stablecoins due to risk concerns.

IV. Future Trends in Regulation and Risk Prevention

Coordinated Development of Digital Currencies

● Chen Yulu, President of Nankai University, pointed out that the global development of digital currencies should adhere to three fundamental principles: value authenticity, systemic robustness, and inclusive accessibility. He called for promoting the coordinated development of central bank digital currencies and compliant stablecoins to build a multilateral digital currency liquidity mutual assistance network.

● Similarly, a BCG report noted that CBDCs and stablecoins are complementary rather than substitutive, reflecting the digital continuation of the traditional dual currency system of central bank money and commercial bank money.

Balancing Regulation and Innovation

Excessively strict regulation may stifle innovation—if regulatory costs are too high or restrictions too many, small innovative projects may be unable to bear the burden.

● The Bank of England's approach is to design a stablecoin regulatory regime that adapts to the future, focusing on its potential applications in real-world payments and settlements rather than its current use for buying and selling crypto assets.

● South Korea is considering a dual-track approach: allowing non-bank stablecoin experiments within a regulatory sandbox while promoting institution-led stablecoins by commercial banks.

Stablecoin regulation is shifting from reactive responses to proactive framework design. The Bank of England's vision of a "multi-currency" system, where stablecoins coexist with commercial bank money (including tokenized bank deposits), is all based on the central bank's ongoing role in the financial system.

As the global regulatory framework gradually improves, stablecoins are expected to transition from "fringe games" to "mainstream financial tools," truly becoming an important force in serving the real economy and enhancing financial efficiency based on value authenticity, systemic robustness, and inclusive accessibility.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。