Key positions unexpectedly change, pressure from the White House continues to mount, and internal decision-making differences become public. The independence of the Federal Reserve is facing multiple tests.

Atlanta Fed President Bostic suddenly announced his retirement at the end of February 2026, more than five years before the Federal Reserve's mandatory retirement age. The departure of the first African American regional Fed president in the history of the Federal Reserve not only means the loss of a staunch hawkish voice within the Fed but also occurs at a sensitive moment when the Trump administration seeks to expand its influence over the Federal Reserve.

Meanwhile, Fed Governor Milan emphasized, "The only way we maintain our independence is by not engaging in matters outside of monetary policy." This statement reflects the deep concerns of the Fed's senior leadership regarding its current independence.

1. Key Personnel Changes: Bostic's Unexpected Early Retirement

Bostic's decision to retire came suddenly and is significant. The 59-year-old Fed official was eligible to continue serving as regional Fed president for six more years until the mandatory retirement age of 65 but chose to leave early.

● On the day he announced his retirement, Bostic reiterated his hawkish stance. He clearly stated his preference to keep interest rates unchanged until he sees "clear evidence" that inflation is consistently returning to the Fed's 2% target.

● Bostic's position on monetary policy leans "hawkish," advocating for measures to prevent rising inflation and urging colleagues to be cautious about lowering interest rates.

● Bostic's career has been pioneering; he is not only the first Black president of the Atlanta Fed but also the first openly gay regional Fed leader. His career blends academia and public policy, holding a Ph.D. in economics from Harvard University and having worked at the Department of Housing and Urban Development.

However, his tenure has also been scrutinized due to financial issues. Some insiders at the Fed believe these financial problems have made his reappointment difficult.

2. Data Dilemma: Government Shutdown Triggers Statistical Crisis

● Amid the partial shutdown of the U.S. federal government, which has disrupted the release of key economic data, Fed officials have recently voiced intense debates over whether to continue lowering interest rates in December. The government shutdown has thrown the release of economic data into chaos, creating an unprecedented information vacuum for Fed decision-making.

● Chicago Fed President Goolsbee pointed out that, in the context of the federal government shutdown leading to missing key inflation data, he is cautious about further rate cuts. Despite consistently supporting gradual rate cuts, Goolsbee emphasized that the current lack of the latest price reports poses a significant policy challenge, especially as overall inflation shows signs of rising recently.

● This information asymmetry increases the risk of "premature" rate cuts—i.e., mistakenly assuming that the recent inflation rebound is only temporary. He specifically mentioned that core inflation had an annualized growth rate of 3.6% for three consecutive months before the shutdown, which is concerning.

3. White House Pressure: Trump's Federal Reserve Restructuring Plan

Bostic's retirement is not an isolated event but rather the latest development in the broader context of the Trump administration's attempt to comprehensively reshape the Federal Reserve.

● Unlike the Federal Reserve Board, the presidents of the 12 regional Fed banks must be reappointed every five years. Under the current system, the U.S. president does not directly nominate candidates for the 12 regional Fed presidents, but such appointments require approval from the Federal Reserve Board.

● As Trump attempts to remove Governor Lisa Cook and will decide on the successor to Fed Chair Powell next spring, the White House is seeking to reshape the Fed's decision-making body.

● All 12 regional Fed presidents must be reappointed at the end of their five-year terms, a process that is usually low-key and routine. However, if the Trump administration seeks to exert greater influence over personnel, this traditional process may be disrupted.

● In August of this year, Trump attempted to dismiss Fed Governor Cook from the Federal Reserve Board. After Fed Chair Powell's term ends in May, Trump will have the authority to select his successor.

● Bostic's early retirement coincides with the Federal Reserve Board evaluating the reappointment of the 12 regional Fed presidents, while President Trump seeks to exert greater influence within the central banking system. Bostic's departure will create opportunities for Trump to appoint loyalists, complicating this year's personnel adjustments at the regional Fed level.

4. Banking Sector Voices: Strong Support for Fed Independence

In this debate about the independence of the Federal Reserve, the banking sector has expressed clear support.

● According to a recent survey released by IntraFi, 95% of the bank executives surveyed stated that maintaining the Fed's independence in implementing monetary policy is very important, with 75% expressing strong support. Similarly, 92% of respondents believe that the Fed's independence in bank regulation is important.

● IntraFi co-founder and CEO Mark Jacobson stated, "Bank leaders are sending a clear message: the independence of the Federal Reserve is crucial for the stability and integrity of our financial system."

● The survey also showed that 88% of bank executives believe that the president should only be able to dismiss a Fed governor if there is evidence of misconduct, with only 4% of respondents supporting the idea that the president should have unrestricted power to fire Fed governors.

These survey results come as the U.S. Supreme Court plans to hold hearings in January regarding the president's power to dismiss Fed governors.

5. Internal Divisions: Public Divergence in Policy Paths

The internal divisions within the Federal Reserve regarding interest rate policy are intensifying, with several voting and non-voting regional Fed presidents and governors sending out starkly different policy signals in public statements. This divergence is particularly pronounced against the backdrop of data shortages caused by the government shutdown.

● Fed Governor Stephen Milan continues to call for a faster pace of easing. He reiterated on Wednesday that the current monetary policy is "too tight" and should further lower interest rates to mitigate economic downturn risks. Milan advocates for a single rate cut of 50 basis points, with a minimum of 25 basis points.

● In sharp contrast, St. Louis Fed President Alberto Musalem stated that he expects the U.S. economy to rebound significantly in the first quarter of 2026. He noted that the current monetary policy is nearing a level that no longer suppresses inflation, emphasizing that there is limited room for further rate cuts and caution is needed to prevent overly loose policies.

● Boston Fed President Susan Collins, who has voting rights on the Federal Open Market Committee this year, clearly stated on Wednesday that, given inflation is still above the 2% target and the government shutdown has led to missing key data, the threshold for further rate cuts in the short term is "relatively high."

6. Future Implications: Potential Consequences of Damaged Independence

The Trump administration's ongoing pressure on the Federal Reserve has raised deep concerns in the market about the central bank's independence.

● Fed Governor Milan's statement—"The only way we maintain our independence is by not engaging in matters outside of monetary policy"—reflects the Fed leadership's vigilance against political interference. Analysts point out that Bostic's departure will create opportunities for Trump to appoint loyalists, complicating this year's personnel adjustments at the regional Fed level.

● Bostic's announcement of retirement marks a key personnel change at the Federal Reserve, and his steady stance on inflation risks and rate-cutting strategies will be absent in the short term. Combined with current political pressures and other personnel changes, the uncertainty surrounding the Fed's monetary policy will increase.

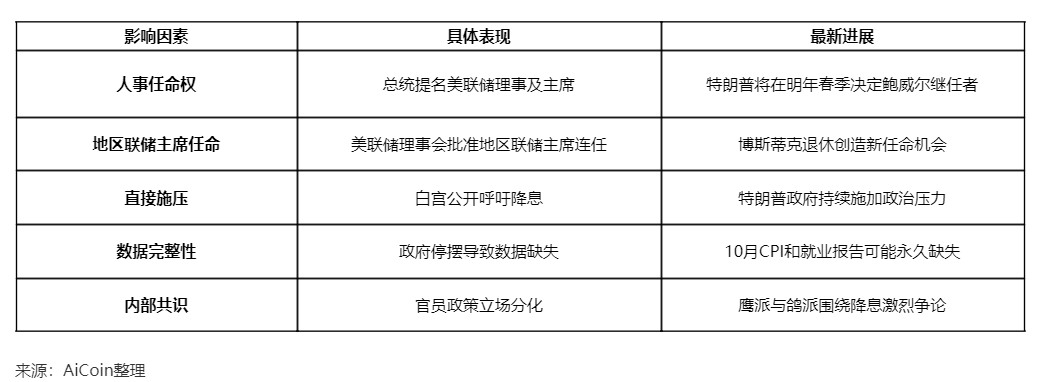

The table below summarizes the key factors affecting the independence of the Federal Reserve and related developments:

Bostic's departure occurs during a time of other key personnel changes at the Federal Reserve, while facing political pressure from President Trump to lower interest rates. Analysts indicate that this will add uncertainty to the Fed's monetary policy decisions, especially regarding the future path of rate cuts and interest rate strategies.

The Federal Reserve stands at a critical historical crossroads. The strong support from bank executives shows a consensus in the financial sector on maintaining the Fed's independence, but political pressure continues to mount, and internal divisions are difficult to bridge.

Bostic's departure is not just the retirement of one individual but may become a key battle in the defense of the Federal Reserve's independence.

Join our community to discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=7JmRjnl3w

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。