In his latest remarks, Bessent told the press that working families can expect “very good” refunds or fatter paychecks when the new tax changes kick in early next year.

The refunds, he explained, are linked to provisions in the administration’s One Big Beautiful Bill, which exempts income like tips, overtime, and even some Social Security payments from taxation.

Bessent remarked that the benefits of the Trump administration’s policies could arrive in the first quarter of 2026 — and advised Americans to adjust their tax withholding early to see more take-home pay. The comments echo the administration’s promise to deliver tangible relief to the middle class without dipping into the Treasury’s general funds.

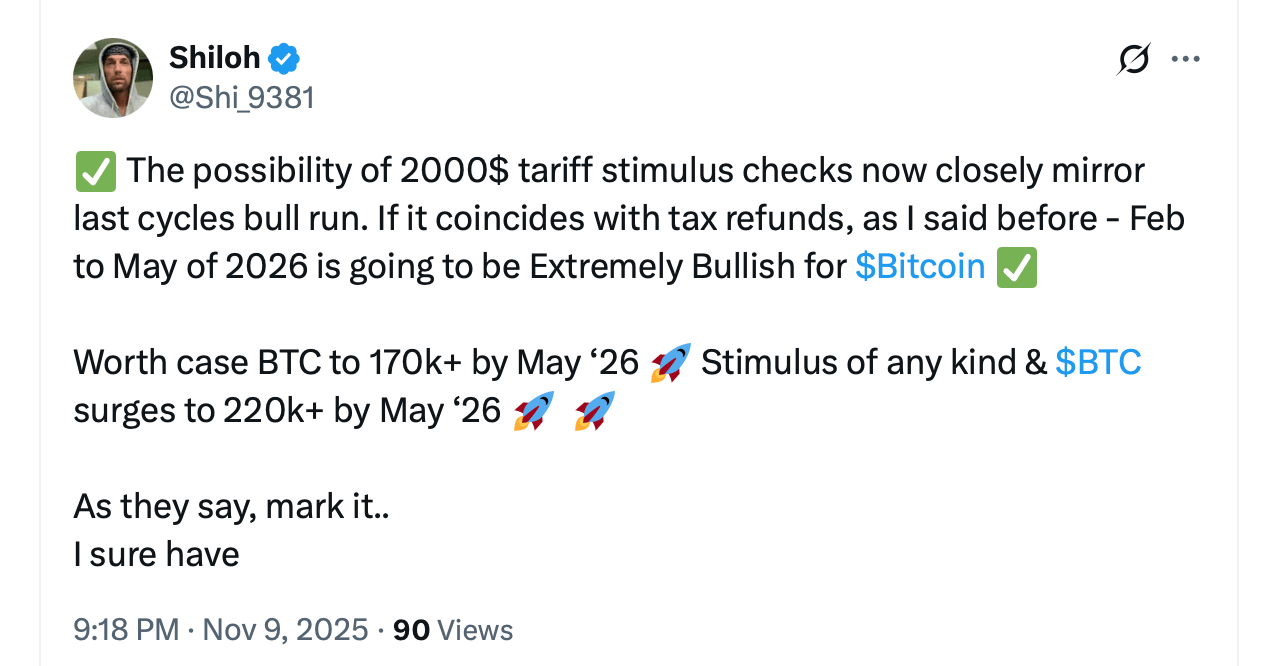

For Bitcoin supporters, that’s music to their ears and this theory has been growing since it was first disclosed. Crypto traders and analysts immediately drew comparisons to 2020, when government stimulus checks sent hundreds of billions directly to U.S. households in true helicopter money fashion.

Back then, the Covid-19 pandemic-era stimulus spurred a retail-driven frenzy. As $1,200 checks began landing in Americans’ accounts, Coinbase reported a surge in $1,200 bitcoin purchases, and the asset’s price skyrocketed from roughly $10,000 in October 2020 to more than $60,000 by April 2021. Analysts have long tied that run to the unprecedented flow of “free money” into all types of asset classes.

This time, bitcoiners think the setup looks eerily familiar. If refunds averaging $1,000 to $2,000 land in early 2026 — as some reports have suggested — it could once again inject liquidity into the crypto market. Call it what you want—a refund, a stimulus—retailers are going to do exactly what they want with it.

Read more: Trump Tariff Stimulus Could Spark a Bitcoin Liquidity‑Led Bull Run

Of course, not everyone is buying the hype. Critics point out that Bessent hasn’t detailed how large or widespread the refunds will be. The Treasury hasn’t published official IRS guidance yet, and some warn that the program may shift more income into paychecks rather than lump-sum refunds.

Even so, market sentiment has already responded to the nearing of the U.S. government shutdown. Bitcoin recently and temporarily traded above $107,000, buoyed in part by talk of the shutdown ending, “tariff dividends,” and tax refunds acting as fiscal fuel. While the plan still lacks congressional sign-off, the narrative alone has been enough to energize the crypto community.

Economists note that if these refunds arrive alongside tariff-funded rebates proposed by President Donald Trump, the combined impact could mimic a targeted stimulus — adding spending power without a new deficit-financed package. Whether that proves inflationary or simply bullish for digital assets remains to be seen.

For now, Bessent’s words are serving as both economic reassurance and speculative spark. If history rhymes, early 2026 could look a lot like early 2021 — and some bitcoiners are already positioning for it.

- When are the refunds expected? Bessent said Americans could see substantial refunds or bigger paychecks in the first quarter of 2026.

- Why are bitcoiners excited? They believe refunds could mimic 2020’s stimulus effect, when free cash helped drive Bitcoin’s massive rally.

- How big could the refunds be? Reports suggest $1,000 to $2,000 per person, though official figures haven’t been confirmed.

- Will it really impact Bitcoin’s price? History suggests extra liquidity boosts speculative assets — but the scale and timing will determine the effect.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。