Written by: Olga Kharif

Translated by: Saoirse, Foresight News

On June 5, Circle CEO Jeremy Allaire (center) attended the company's IPO ceremony at the New York Stock Exchange. Photographer: Michael Nagle / Bloomberg

Key Points:

- Although Circle is one of the most mature companies in the stablecoin sector, and CEO Jeremy Allaire has joined the ranks of billionaires, he still has an unfinished path of proof.

- Circle is facing multiple challenges: intense market competition, a core revenue source at risk due to declining interest rates, and its main competitor Tether is returning to the U.S. market.

- Allaire firmly believes that his strategy and Circle will ultimately prevail, and the company will release its financial report on Wednesday, which will be a new opportunity for him to prove the effectiveness of his strategy.

Jeremy Allaire still has an unfinished path of proof.

As the CEO of Circle Internet Financial, the company he leads is one of the top players in the latest craze in the cryptocurrency field—the stablecoin sector. The business model he has promoted for years has been formally incorporated into the legal framework through legislation signed by President Trump; thanks to Circle's IPO launched in June, which has sparked a wave of listings in the cryptocurrency industry in 2025, Allaire has now become a billionaire.

However, the 54-year-old CEO still struggles to gain widespread recognition in the industry, and Circle is facing multiple challenges. The market competition is exceptionally fierce, and the core revenue source is at risk of shrinking due to declining interest rates; meanwhile, the main competitor—Tether, which has far superior profitability and valuation compared to Circle—is returning to the U.S. market, which is undoubtedly a dangerous signal for Circle's domestic position.

Traditional bankers view Allaire as a threat, fearing that stablecoins will siphon off bank deposits; meanwhile, his peers in the cryptocurrency field also keep their distance from him. At industry conferences filled with hooded sweatshirts, he is always the "outlier" in a suit. More critically, he not only insists on compliant operations but also actively promotes the establishment of industry rules by legislative bodies.

In an industry that prides itself on anonymity, unique personalities, and disrupting traditional financial systems, such ideas clearly do not win Allaire the "popularity contest."

"Jeremy Allaire's strategic path has always been contrary to the Bitcoin ecosystem," said Cory Klippsten, head of the Bitcoin investment platform Swan Bitcoin. "The goal of Bitcoin is to separate money from the state, while his core work is to integrate crypto technology into the existing fiat currency system."

Despite the ongoing skepticism, Allaire remains confident that his strategy and Circle will ultimately prevail. The company will release its financial report on Wednesday, which will be a new opportunity for him to prove the effectiveness of his strategy.

"To persevere, you must have a firm belief in the importance of what you are doing and a strong moral foundation," Allaire said in an interview. "You will face setbacks, and everyone will tell you 'you are wrong' and 'you will fail.' But for me, this is not just a business plan—I'm doing this because I truly believe it can improve the world."

Allaire's career at Circle has been full of ups and downs; the company was founded in 2013.

Circle initially started as a payment platform based on the Bitcoin network, and after several strategic adjustments, it faced near bankruptcy and financial difficulties due to the collapse of Silicon Valley Bank. To maintain the operational structure of its core stablecoin USDC, Allaire ultimately had to sell assets and lay off hundreds of employees to keep the company afloat.

"At Circle's crisis moment, no one believed I could pull through," Allaire recalled, "but I gave it my all."

Challenges in Performance Growth

Now, Allaire's challenge has shifted from "survival" to "proving growth capability."

Stablecoin issuers like Circle primarily generate revenue by investing reserves in short-term cash-like assets such as U.S. Treasury bonds. As interest rates decline, even if Circle's revenue grows, the unit investment returns are almost certain to decrease.

Additionally, the revenue-sharing agreement Allaire reached with Coinbase Global Inc. has significantly squeezed Circle's profit margins. In the second quarter of 2025, the distribution fees payable to Coinbase were more than three times Circle's adjusted profit of $126 million. In contrast, Tether, which does not have to comply with the same rules and audit requirements, reported a profit of $4.9 billion during the same period.

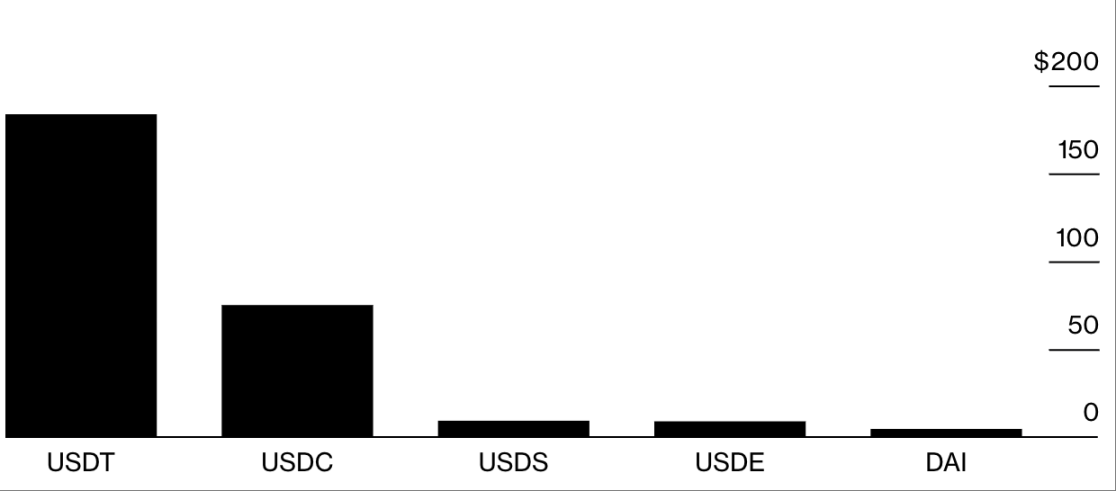

Top 5 Stablecoins by Market Capitalization

Unit: Billion USD

Data Source: CoinGecko

Tether's USDT was launched years before Circle's USDC and has a much larger scale—USDT has a market capitalization of $183 billion, while USDC is only $76 billion—therefore, it has stronger revenue-generating capabilities. Additionally, Tether has ties to Cantor Fitzgerald, where U.S. Secretary of Commerce Howard Lutnick previously worked.

Another new stablecoin competitor, World Liberty Financial Inc., has connections to the Trump family. As the usage of stablecoins surges, hundreds of companies, including Tether and World Liberty, are competing for Circle's market share. Allaire admitted in a recent earnings call that this field is a "winner-takes-all market."

Currently, Allaire is trying to open new revenue sources for Circle through other businesses, but Wall Street analysts are generally skeptical about the effectiveness of this initiative. His recent attempts include launching blockchain, payment networks, and tokenized money market funds.

Nevertheless, Mizuho Securities analyst Dan Dolev bluntly stated, "USDC is just another stablecoin, nothing special. Circle's stock is overvalued; it's that simple." Among the analysts tracking Circle, four have given "sell" ratings, eleven have given "buy" ratings, and ten have given "hold" ratings.

Currently, Circle's stock price is about $104, which is far above the IPO issue price of $31 but less than half of the peak after listing. Its market capitalization of $24 billion pales in comparison to Tether's current fundraising activities, which suggest a valuation of $500 billion.

Background as a Tech Entrepreneur

Although Allaire has previously led two companies to go public—software company Allaire Corp. and video platform Brightcove Inc.—Circle is almost certain to become the core legacy of his career.

Allaire's interest in technology began in childhood: at the age of 11, when his family moved to the small town of Winona, Minnesota, he and his brother JJ were seen as "a bit nerdy" by others—they would take machine language printouts and input them into computers to write games. "If you misspelled even one letter, the program wouldn't run, so you had to be extremely focused," he recalled.

As an adult, Allaire fully immersed himself in the internet field. He even assisted political activist Noam Chomsky in digitizing his works. He subsequently founded several startups. Shortly after leaving Brightcove, he co-founded Circle with his friend Sean Neville.

"I used to hang out at his house a lot," Neville recalled, "our ultimate goal was to create a whole new financial system."

On July 18, 2025, President Trump held a signing ceremony for the "GENIUS Act" at the White House, and Circle CEO Jeremy Allaire (top right) attended the ceremony. Photographer: Francis Chung / Politico / Bloomberg

According to the Bloomberg Billionaires Index, Allaire's current personal wealth is $2.1 billion, primarily from his stake in Circle. This figure, while far below Tether CEO Paolo Ardoino's $5.6 billion, is comparable to well-known figures in the U.S. business world, such as Apple CEO Tim Cook and BlackRock CEO Larry Fink.

Allaire stated that he grew up in a family with "progressive values"—both parents worked in social services and activism—but he speaks highly of his experience attending the signing ceremony for the "GENIUS Act" at the White House and shaking hands with Trump. The act established a federal regulatory framework for stablecoins.

"I feel incredibly honored and excited to be part of it," Allaire said, "the pen fell to paper, the act took effect, and I was able to play an important role in this process—this is one of the most meaningful moments of my life."

Public records show that Allaire has long primarily supported the Democratic Party, but Circle donated $1 million to Trump's inaugural committee.

Fitness Lifestyle

A few years ago, Allaire started a fitness regimen: he quit alcohol, began focusing on healthy eating, and according to health app data, he now averages seven hours of sleep each night.

On June 5, Jeremy Allaire attended Circle's IPO ceremony at the New York Stock Exchange. Photographer: Michael Nagle / Bloomberg

Current and former employees describe Allaire as a "gentle but strict" boss—he does not yell or pound the table, does not work late in the office, but is almost always quick to respond to messages. Some recall having strategic meetings with him while walking in the woods.

Now, Allaire is planning the next steps.

"Building a currency layer on the internet is the goal of phase 1.0," Allaire said, "we have achieved this step, and now we are advancing the planning for phases 2.0 and 3.0."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。