The myth of digital gold is fading in the storm of reality, and the cryptocurrency market is undergoing a brutal deleveraging baptism.

Before the clock strikes midnight, the cryptocurrency market is already in disarray. Bitcoin has fallen below the $103,000 mark, Ethereum has dropped below $3,410, and the total liquidation amount across the network has accumulated like an avalanche—this is not a normal market adjustment, but a perfect storm triggered by multiple factors.

1. Market Performance

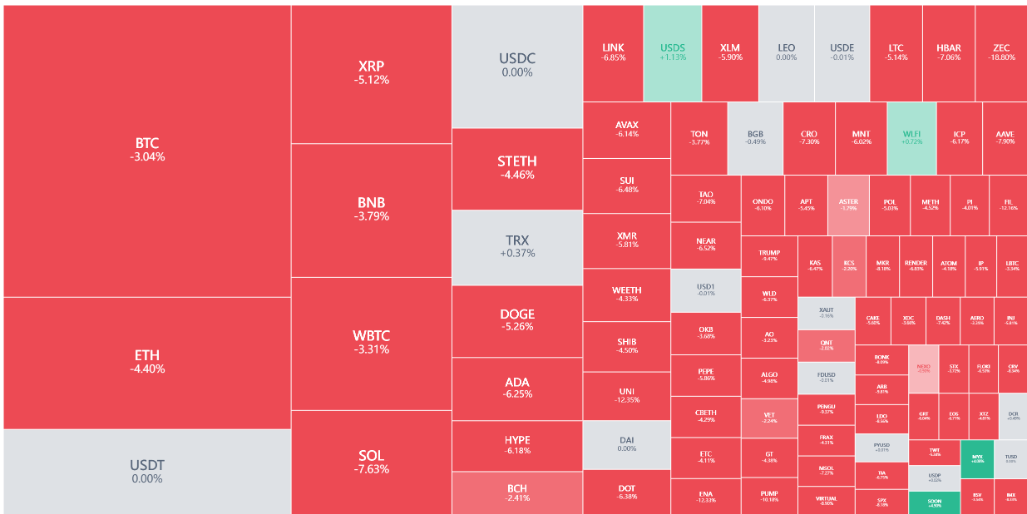

Major Cryptocurrencies in Bloodshed

The cryptocurrency market is once again experiencing a "roller coaster" trend, with no major cryptocurrencies spared.

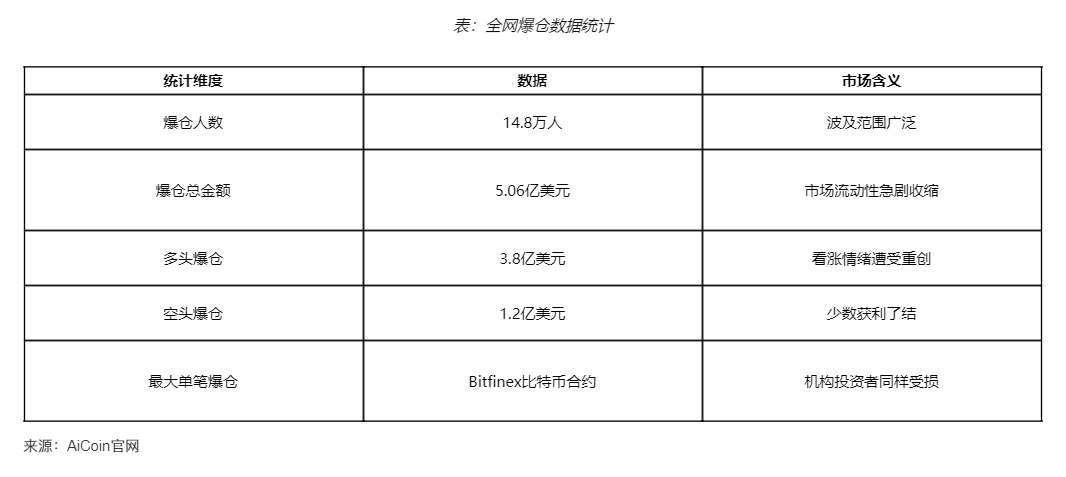

● The severity of this crash can be seen from the liquidation data. In the past 24 hours, nearly 150,000 investors in the cryptocurrency market have been wiped out.

2. Unveiling the Truth Behind the Crash

Tech Stock Chill

● The divergence in the U.S. stock market overnight set the stage for the decline in cryptocurrencies. NVIDIA plummeted nearly 3%, losing $143.1 billion in market value overnight, a figure that exceeds the total market value of most cryptocurrencies. The trigger behind this was SoftBank Group's liquidation of all its NVIDIA shares.

● More concerning is that the stock price of CoreWeave, a cloud computing company invested in by NVIDIA, plummeted over 16%, as the company lowered its full-year revenue forecast. This news further amplified the selling pressure on AI concept stocks, which, like cryptocurrencies, are high-risk assets, making the transmission of sentiment almost inevitable.

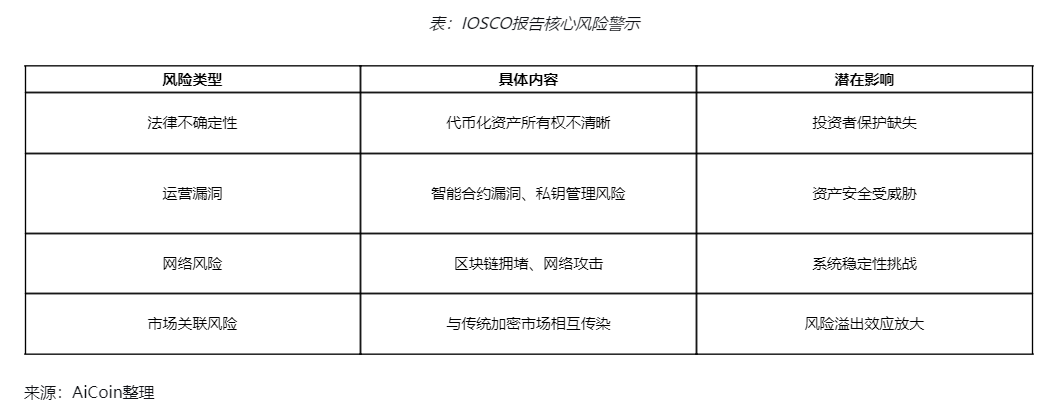

Regulatory Clouds

● On November 11, the International Organization of Securities Commissions (IOSCO) released its final report on the tokenization of financial assets, dropping a bombshell on the market. This report appears to target the tokenization of traditional financial assets but actually issues a stern warning to the entire cryptocurrency ecosystem.

IOSCO specifically emphasized that tokenized assets may encounter potential spillover effects due to their interconnection with the cryptocurrency market. This warning was perfectly validated on the day of the crash—regulatory concerns from the traditional financial world quickly transformed into selling pressure in the crypto market.

Internal Collapse

The internal structural issues of the market are also a significant driving force behind this crash. The fragility of this internal structure makes the market vulnerable to external shocks.

● Market sentiment is weak. A clear sign is that after the U.S. Congress passed a bill ending a 40-day government shutdown, the cryptocurrency market did not see a significant rebound. This indicates a lack of internal momentum in the crypto market, with investors' confidence still not restored after last month's crash.

● “Such massive and sustained losses indicate forced selling or panic exits, usually caused by the liquidation of leveraged positions or loss aversion among latecomers.” said a CryptoQuant analyst.

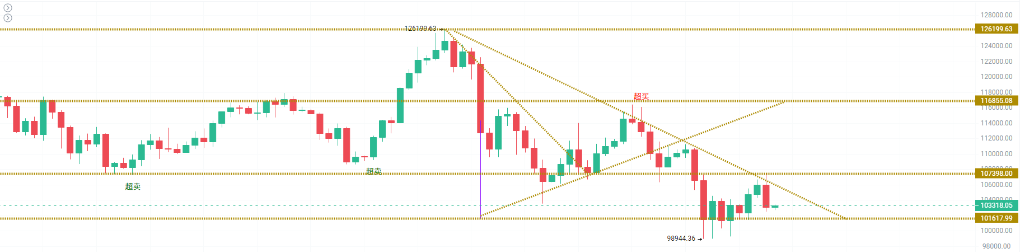

● In recent weeks, Bitcoin's price has fallen and consolidated below $110,000, putting significant pressure on short-term holders with large amounts of Bitcoin. Since the price failed to maintain above the average cost of $110,000, these investors increased their selling efforts, leading to substantial losses.

3. Chain Reaction

Loss of Investor Confidence

The crash is not only reflected in prices but also profoundly affects the psychology of market participants.

● Glassnode analysis points out: “Bitcoin seems to be at a critical turning point. Market conditions remain cautious but positive, momentum is improving, capital flows are stabilizing, and there are signs that a local bottom may form around $100,000.”

● However, this relatively optimistic view is not shared by all analysts. The blockchain data analysis platform Glassnode simultaneously warns that Bitcoin's upside potential is “limited,” as the downward trend in profitability continues to suppress market sentiment and weaken confidence in price increases.

Divergence in Institutional Attitudes

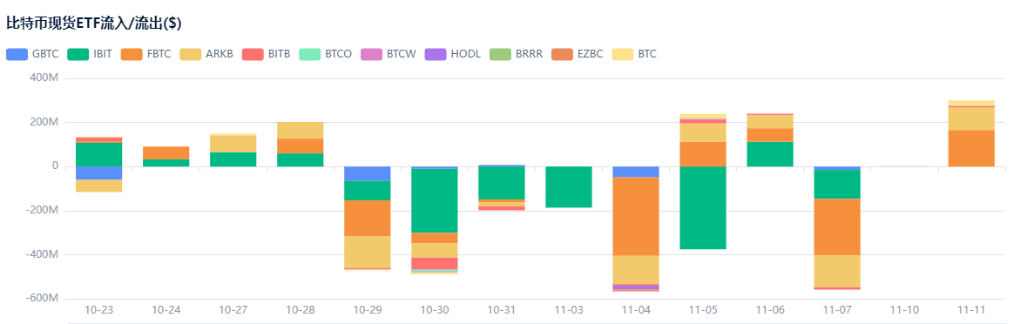

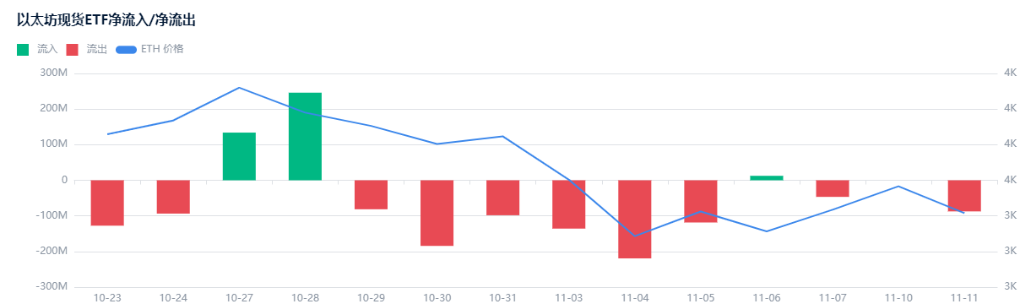

● In this crash, the attitudes of institutional investors have shown subtle changes. Ethereum ETFs have seen net outflows, indicating that some institutional funds may be withdrawing;

● “The rapid decline of Bitcoin in November was driven by profit-taking, macroeconomic uncertainty, and institutional rebalancing, rather than a fundamental collapse.” said a seasoned market observer.

4. Where to Go: The Cryptocurrency Market in the Fog

Short-term Volatility is Inevitable

● Technical analysis shows that the range between $100,000 and $108,000 may constitute a mid-term support level for Bitcoin. However, whether this support can hold depends on the interplay of multiple factors.

● Some analysts believe that despite the bearish technical indicators and ETF fund outflows being concerning, a structural bull market is still supported by ETF fund inflows, infrastructure investments, and clearer regulatory policies.

● The key question is whether the market can quickly digest the current negative factors and reassemble bullish momentum.

Evolution of Long-term Trends

From a longer-term perspective, this crash may just be an episode in the maturation process of the cryptocurrency market.

● In the tech stock sector, AMD CEO Lisa Su remains optimistic about the prospects for AI development, predicting that the market size for data center chips and systems will grow to $1 trillion by 2030. If this expectation is realized, it will provide long-term support for risk assets like cryptocurrencies.

● At the same time, on the regulatory front, IOSCO's tokenization report may just be the beginning of regulators paying closer attention to the cryptocurrency market, with more regulatory measures likely to be introduced in the future. While this regulatory tightening may create pressure in the short term, it will benefit the healthy development of the market in the long run.

Building a New Balance

● The cryptocurrency market is undergoing growing pains from wild growth to regulated development. As the tokenization of traditional financial assets accelerates, the connection between the cryptocurrency market and traditional financial markets will become tighter, which also means that the interlinkage effects between the two markets will become more pronounced.

● In the coming months, the interplay of macroeconomic data, institutional capital flows, and regulatory policy outcomes will determine whether this is a cyclical correction or the beginning of a structural shift.

This perfect storm in the cryptocurrency market is jointly caused by the chill in tech stocks, regulatory warnings, and the internal structural fragility of the market. After the storm, market participants must confront a core question: as digital gold becomes increasingly connected to the real economy, any tremor in the traditional world will inevitably stir waves in this emerging market.

The road ahead is full of challenges but also nurtures new opportunities—a more mature and robust cryptocurrency market may quietly emerge from the baptism of this storm.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。