Original | Odaily Planet Daily (@OdailyChina)

This year, the crypto market has seen many narratives such as Meme, DAT, AI, and stablecoin wealth management come and go, but they only shine brightly for a "three minutes" before being pushed off the stage. Looking back, only the prediction market continues to stand in the spotlight.

The product-market fit of prediction markets is gaining recognition from more and more people. In November, Google announced it would directly integrate Polymarket and Kalshi prediction market data into Google Finance. Trump's social platform, Truth Social, also announced it would soon launch a new service called "Truth Predict," allowing users to bet on the outcomes of specific events using cryptocurrency, covering areas such as sports competitions, political campaigns, and economic changes.

At the same time, Polymarket, the leading prediction market that has completed over $2 billion in financing and is valued at $9 billion, confirmed that there will be a token airdrop in the future. Therefore, with the narrative gradually heating up and the airdrop confirmed, Polymarket has undoubtedly become the next key project for users to capitalize on, and many users who usually do not engage in prediction markets are looking forward to obtaining future "big gains" with minimal losses.

However, the prediction market also follows the 80/20 rule: most users will incur losses.

In this context, many KOLs have begun to recommend "tail-end strategies" to retail investors, which only bet on events whose outcomes are close to being determined, with probabilities of 95% or even over 99%, aiming to capture the last few points of certain profits. Some have even treated the "tail-end strategy" as a new type of wealth management tool, stating, "If there is a 1% profit daily, then the annual compound interest can reach 365%."

The ideal is appealing, but reality can be harsh. The so-called "tail-end strategy" is not as safe as KOLs promote; you may have a high win rate, but you will still ultimately incur losses.

"Tail-end strategy" has a 95% win rate, but still incurs losses

Not long ago, I firmly believed in the magic of the "tail-end strategy" on Polymarket. This stemmed from my basic assertion about prediction markets like Polymarket, which is that people will make responsible predictions due to their vested interests, and the probability of bets will align with the actual outcomes of events under rational analysis. Under such premises, the probability of incurring losses at the tail end is extremely low.

At the same time, I not only executed the "tail-end strategy" manually but also handed over the execution to an AI agent to search for events in the market with probabilities greater than 95% and place bets (Related reading: Using AI agents to execute tail-end strategies, can one qualify for Polymarket airdrops?). At that time, I thought I was quite clever; on one hand, I could automate interactions to obtain potential airdrop qualifications, and on the other hand, it was a stable wealth management method. In hindsight, this was a very foolish decision.

Out of caution, I only wanted to use $100 for the strategy, but after testing for 9 days, I decided to stop running this AI agent.

During its operation, this AI agent made a total of 146 bets, averaging 16 bets per day. Anyone who has truly engaged in prediction markets knows that this frequency is already far higher than that of an average person. According to Polymarket Analytics data, the AI agent had a win rate of 95.1%, but only earned $3 while incurring losses of $16, resulting in a total loss of $12 by the time I stopped its operation.

You might think that a loss of $12 or an overall -12% return doesn't seem severe; how could I not afford to lose even this little? That's because I realized the problem with the "tail-end strategy" before it became serious (-80% return).

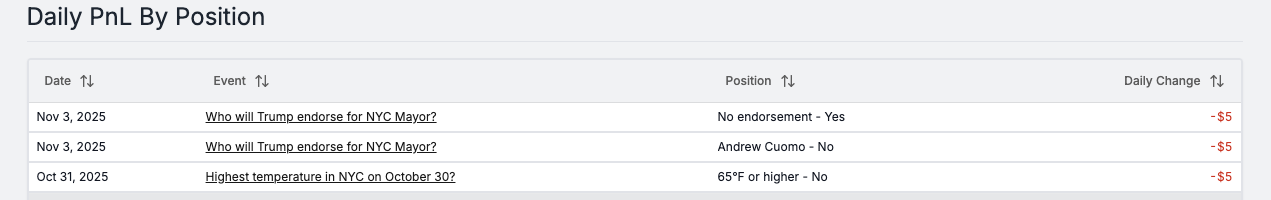

In over 100 bets, my AI agent only incurred losses on two events, namely "the highest temperature in New York City on October 30" and "who Trump will support for New York City mayor." Ironically, before Trump expressed support for Andrew Cuomo's campaign, the probabilities for "not supporting Andrew Cuomo" and "no one will support" on Polymarket were both above 95%, so the AI generously bought both outcomes, ultimately losing on both.

Before using AI to execute the tail-end strategy, I was aware of the "black swan" risk of the tail-end strategy, and the AI agent was designed to mitigate this risk by only betting 5% of the total capital (betting only $5 each time from a $100 principal).

However, I overlooked the frequency of trades by the AI agent; with daily bets reaching over a dozen, the probability of a "black swan" event occurring increases. The more bets placed, the more likely errors will occur. A human might not encounter a tail-end "black swan" even once in a month, but the AI encountered it three times in just nine days.

I realized that the speed of cumulative losses can exceed the speed of cumulative gains, which is the main reason I stopped using this AI agent strategy. Even if the AI only bets 5% of the capital each time, it may earn a 1% profit most of the time, but once it incurs a loss, the AI would need to win 103 consecutive bets to recover the original 5% loss. In reality, due to frequency issues, it is impossible for the AI not to encounter another "black swan" in those 103 bets. Therefore, my AI agent might never be able to recover its losses and would only continue to accumulate them.

This is a simple mathematical problem. With the help of ChatGPT, I understood the risks hidden behind the high odds of the tail-end strategy in just five minutes: this is a foolish strategy that only allows for winning and betting big to gain small.

On UnifAI, there are still 379 wallets using AI agents to implement the tail-end strategy, with total funds reaching $59,000. However, the ROI of this strategy to date is -44.93%. I hope users who see this article think twice about whether their expectations for airdrops outweigh the accumulated losses.

Betting big to gain small will ultimately lead to being wiped out

What about manual operation and reducing frequency? Wouldn't that avoid making the same mistakes as AI?

Such thinking is also naive. No matter how clever, cautious, or skilled I am at managing luck, in a strategy of betting big to gain small, I will ultimately be wiped out.

On November 9, a trader ranked in the top 0.7% of Polymarket profits was wiped out in one wave, going from a profit of $3,500 to an eventual account loss of $15,000 overnight (Related reading: A Polymarket top 0.7% winner recounts: how I lost $19,000 in one minute). Perhaps no one understands the tail-end strategy better than him, as he earned $3,500 through this strategy over the past month, with a total trading volume of $200,000.

This trader placed bets of thousands or even tens of thousands of dollars each time, only to earn 1% or even less in "certain profits." The result was that on the evening of November 9, he was wiped out by a game with a reversal. If he continued to insist on using the tail-end strategy to turn things around, his performance would not be much better than my AI agent.

Essentially, prediction markets like Polymarket are gambling platforms, and the correct approach is always to bet small to gain big, pursuing Alpha returns, rather than executing beta return strategies on them. Players who truly excel in prediction markets do not advocate for the tail-end strategy. As the blogger Lone Wolf Capital (@AnselFang), who earned $2.93 million in 25 days on Polymarket, stated, guaranteeing that something has a very high certainty, only to incur losses on the principal for the sake of that tiny tail-end profit, is always a losing proposition.

Related Reading

Odaily Selection: Tools that can double trading win rates in prediction markets

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。