Original Author: Eric, Foresight News

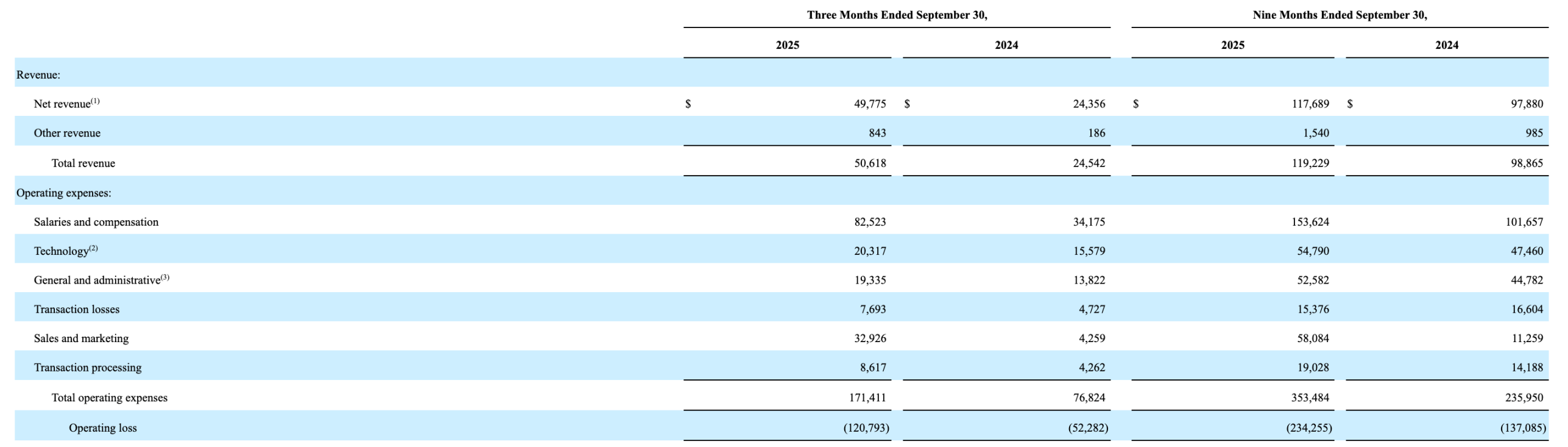

On November 10, local time in the United States, Gemini, which went public not long ago, announced its first financial report since its listing. The report showed that Gemini's net income for the third quarter was $49.775 million, a year-on-year increase of 104.4% and a quarter-on-quarter increase of 51.8%, exceeding market expectations of $46.84 million. However, despite the significant increase in revenue, the net profit remained negative, with losses increasing by 76.9% year-on-year to $159.5 million, and earnings per share at -$6.67, far exceeding the market expectation of -$0.767.

Due to investors' concerns about the expanding losses at Gemini, the stock price fell below $15 in after-hours trading, setting a new low since its listing, having dropped two-thirds from its peak price.

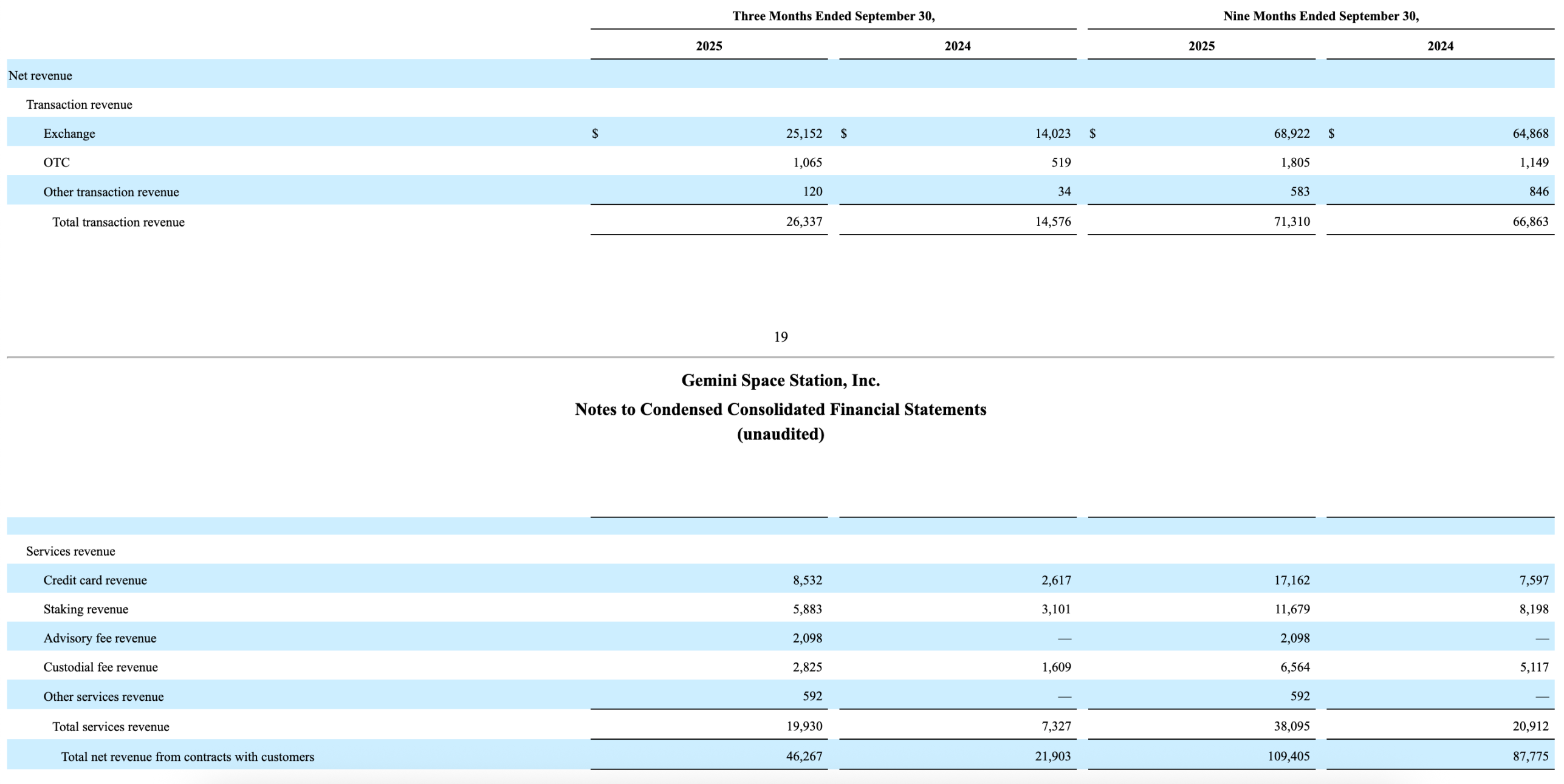

In terms of revenue, Gemini saw significant improvements in both trading income and service income. In the third quarter, Gemini's trading income was $26.337 million, with a year-on-year increase of over 80%. The total trading volume on the Gemini platform for this quarter was $16.4 billion, a year-on-year increase of 144.8% and a quarter-on-quarter increase of 45.1%. Regarding service income, efforts in credit cards, institutional staking, and custody services led to year-on-year revenue growth of 226%, 89.7%, and 75.6%, respectively.

According to data provided in the shareholder letter, the number of Gemini credit card accounts has surpassed 100,000, with spending exceeding $350 million, doubling quarter-on-quarter; at the same time, the value of staked assets on the platform reached $741 million. This quarter, service income accounted for 39% of total revenue, up from less than 30% a year ago.

While revenue increased, Gemini's operating costs also rose at a higher rate. In the third quarter, Gemini's operating expenses reached $171 million, a year-on-year increase of 123.1%, with sales and marketing expenses rising nearly sevenfold year-on-year.

The increase in operating expenses outpaced the increase in revenue, combined with the continuing losses, making Gemini's first report after going public very disappointing. To date, Gemini has not proven its ability to generate self-sustaining profits. Although part of the losses stemmed from IPO expenses, even when calculating EBITDA (earnings before interest, taxes, depreciation, and amortization), Gemini still reported a loss of $52.4 million in the third quarter, an increase of 3.4% year-on-year.

Typically, increasing revenue without increasing profit is seen as a problem with a company's operational capability. In fact, Gemini's IPO documents clearly outline a significant risk: as of June 30 of this year, Gemini's total borrowings had approached $1.4 billion, of which $1.28 billion was provided by investment companies owned by Gemini's founding brothers. Among this $1.28 billion, over $400 million in borrowings can be converted into shares at a 20% discount to the IPO price at the time of the IPO. Gemini has even explicitly stated that the purpose of the IPO financing is to pay off debts.

Under these circumstances, it is entirely expected that Gemini's stock price would continue to decline after going public. If one were to find some points of optimism, it would be that its total liabilities have decreased by 9.2% from the end of last year to $1.685 billion. Discretionary cash has also increased by 118.6% year-on-year to $1.108 billion. If Gemini can achieve a situation of "decreasing expenses and increasing revenue" after short-term investments, it may indicate an improvement in the company's operational status.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。