The week ended on a cautious note for crypto ETFs. After Thursday’s brief rebound, Friday brought fresh redemptions that wiped away the momentum, with both bitcoin and ether funds turning negative once again. Solana, however, refused to join the selloff, marking yet another day of inflows.

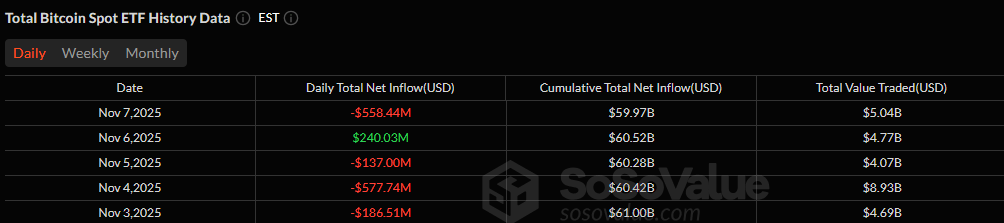

Bitcoin ETFs faced a heavy $558.44 million outflow, marking one of the largest single-day redemptions in recent weeks. Fidelity’s FBTC led the retreat with a massive $256.66 million exit, followed by Ark & 21Shares’ ARKB with $144.24 million and Blackrock’s IBIT with $131.43 million.

Additional redemptions came from Grayscale’s GBTC at $15.44 million and Bitwise’s BITB with $10.68 million, sealing the day firmly in the red. Trading volume was robust at $5.04 billion, while net assets held steady at $138.08 billion despite the pullback.

Bitcoin ETFs saw only one day of inflows in a torrid week. Source: Sosovalue

For ether ETFs, the picture wasn’t much brighter. Outflows totaled $46.62 million, dominated by Fidelity’s FETH, which saw a $72.23 million withdrawal. Grayscale’s Ether Mini Trust also lost $11.42 million, offset only partially by Blackrock’s ETHA with a $34.43 million inflow and Invesco’s CBOE with $2.59 million. Trading activity came in at $1.78 billion, with net assets finishing at $22.66 billion.

Meanwhile, solana ETFs extended their flawless streak of inflows. Bitwise’s BSOL brought in $11.74 million, while Grayscale’s GSOL added $959,000, bringing total inflows to $12.69 million. The group recorded $46.04 million in trading volume, pushing net assets to $575.93 million.

After a week of volatility, bitcoin and ether ETFs ended on the defensive, but solana’s momentum remained the quiet success story, hinting at growing investor confidence in the blockchain’s rising appeal.

- Why did Bitcoin ETFs end the week in the red?

Bitcoin ETFs saw $558 million in outflows, led by heavy redemptions from Fidelity, Ark, and BlackRock. - How did Ether ETFs perform?

Ether ETFs lost $47 million, with Fidelity’s fund driving most of the week’s withdrawals. - Did Solana ETFs maintain their momentum?

Yes, solana ETFs added $13 million in inflows, extending their unbeaten streak. - What does this mean for crypto investors?

The data shows shifting confidence, as investors increasingly look beyond bitcoin and ether toward solana.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。