The latest fallout has rippled through decentralized finance (DeFi) markets, exposing the fragility of complex collateral systems underpinning yield-bearing tokens. The week’s losses were punctuated by cascading total value locked (TVL) declines across dozens of protocols.

Stablewatch.io data shows the biggest seven-day TVL drawdowns came from yUSD (-82.2%), mTBill (-59.5%), yUTY (-53.6%), and srUSD (-81.2%). Several smaller assets such as syUSD (-63.3%), sdUSD (-61.0%), and sUSDx (-88.2%) nearly evaporated.

Other major yield-bearing coins also posted steep declines — syrupUSDC (-10.6%), sDAI (-33.6%), and syrupUSDT (-8.8%) — pointing to how quickly confidence drained from the sector.

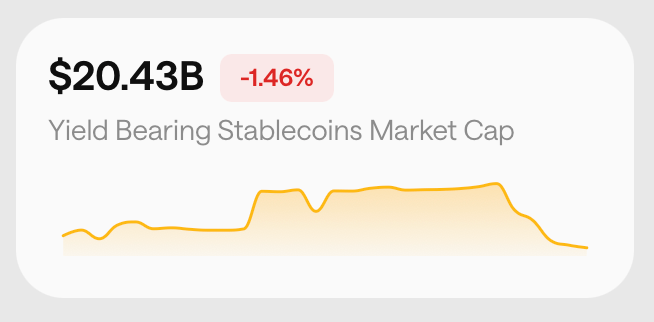

Image source: Stablewatch.io

While a sea of yield-bearing stablecoins watched their liquidity trickle out, most managed to keep their stable composure — except for the trio of troublemakers: deUSD, XUSD, and USDX. Moreover, despite the red ink, a handful of assets managed to buck the trend. USCC (Superstate) and sGHO (Aave) both rose over 16% in TVL over the week, while gtUSDa (Gauntlet) skyrocketed 114.4%, marking one of the few bright spots amid the rout.

The crisis began when Elixir’s deUSD, a synthetic stablecoin designed to generate yield through DeFi collateral, depegged from the U.S. dollar on Nov. 6, 2025. The collapse followed Stream Finance’s disclosure of a $93 million loss that crippled deUSD’s collateral reserves. Reports note that by the time Elixir processed redemptions for 80% of holders, the token’s price had plunged to roughly $0.015.

Stream Finance, which held 90% of deUSD’s remaining supply, reportedly did not close positions or repay exposure. That move was said to have forced Elixir to halt withdrawals and coordinate with partner protocols to mitigate losses. The depeg left thousands of users underwater and prompted renewed calls for stricter onchain transparency in DeFi collateral management.

Just hours after the deUSD collapse, XUSD — another synthetic stablecoin issued by Stream Finance — also lost its dollar peg, crashing to $0.20. Reports link the depeg to a $128 million exploit of the Balancer protocol, which drained key liquidity pools and triggered a chain reaction of liquidations.

The same exploit also destabilized USDX, the yield-bearing coin from Stables Labs, which plummeted to the $0.30–$0.38 range during panic-driven sell-offs. The liquidity crisis slashed USDX’s market cap by roughly 65% in one day and caused severe stress across integrated protocols such as Lista DAO and Pancakeswap.

Stables Labs has since announced a recovery initiative, including claim registration windows for affected holders based on onchain snapshots. But despite minor rebounds, USDX remains far below its $1 target, highlighting the systemic risk tied to algorithmic collateral design.

Across the yield-bearing stablecoin category, the week’s drawdowns totaled hundreds of millions in lost TVL. sUSDe (Ethena) fell 7% to $4.66 billion, while syrupUSDC (Maple) sank 10.6% to $1.18 billion. The ripple effect extended to secondary assets such as sDAI (Sky) and vyUSD (YieldFi), both down over 30% and 46%, respectively.

Average seven-day annual percentage yields (APYs) fluctuated sharply. For instance, yUSD’s APY dropped 4.7% to 8.73%, while coreUSDC (Upshift) spiked 8.2% to 11.99%. Meanwhile, mBASIS (Midas) saw an eye-catching 10.1% APY increase to 14.26%, indicating opportunistic risk-on behavior despite widespread losses.

The string of depegs reignited long-standing skepticism toward algorithmic stablecoins. DeFi analysts note that while yield-bearing stablecoins attract liquidity with high APYs, their reliance on synthetic collateral and automated balancing systems exposes them to outsized tail risks.

To many observers, it could be the same systemic weaknesses that took down Terra’s UST, only in smaller doses. The parallels are hard to ignore: cascading liquidations, redemptions halted, and governance turmoil as protocols scrambled to patch holes in real time.

Despite the turmoil, a few protocols saw modest inflows. Superstate’s USCC gained 16.3% in TVL and Aave’s sGHO climbed 16%, which may be reflecting renewed investor appetite for projects with institutional backing or clearer collateral transparency.

Still, with overall market capitalization dipping 1.46% to $20.43 billion over the past 30 days, this past week proved that even yield-bearing stablecoins — long marketed as safer DeFi plays — are not immune to systemic risk.

Analysts expect ongoing volatility as DeFi teams behind these types of tokens work to restore confidence. Stablewatch.io’s dashboards continue to track inflows and APY adjustments, with several tokens now showing unusually high yield rates as they attempt to lure back liquidity providers.

For now, the narrative remains clear: the chase for yield in DeFi stablecoins carries risks that even a 20% APY can’t mask.

- What caused the deUSD, XUSD, and USDX stablecoins to depeg?

Each depeg stemmed from collateral losses and liquidity crises tied to Stream Finance’s $93 million exposure and the Balancer DeFi hack. - How much did the yield-bearing stablecoin market lose overall this past month?

Stablewatch.io data shows the category fell 1.46% to a total market cap of $20.43 billion over the last 30 days. - Which stablecoins saw the worst TVL drops?

yUSD, mTBill, srUSD, and sUSDx suffered the steepest 7-day outflows, each losing over 50% of their total value locked (TVL). - Are any yield-bearing stablecoins gaining traction?

Yes, USCC and sGHO both rose more than 16% in TVL, signaling selective inflows toward different projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。