James Chanos, founder of Kynikos Associates and one of Wall Street’s most recognizable skeptics, has long criticized Strategy for what he calls an overreliance on bitcoin as its core business model.

Under CEO Michael Saylor, the company has accumulated more than 641,000 BTC through debt-fueled purchases and equity issuance, turning its stock into a leveraged proxy for bitcoin.

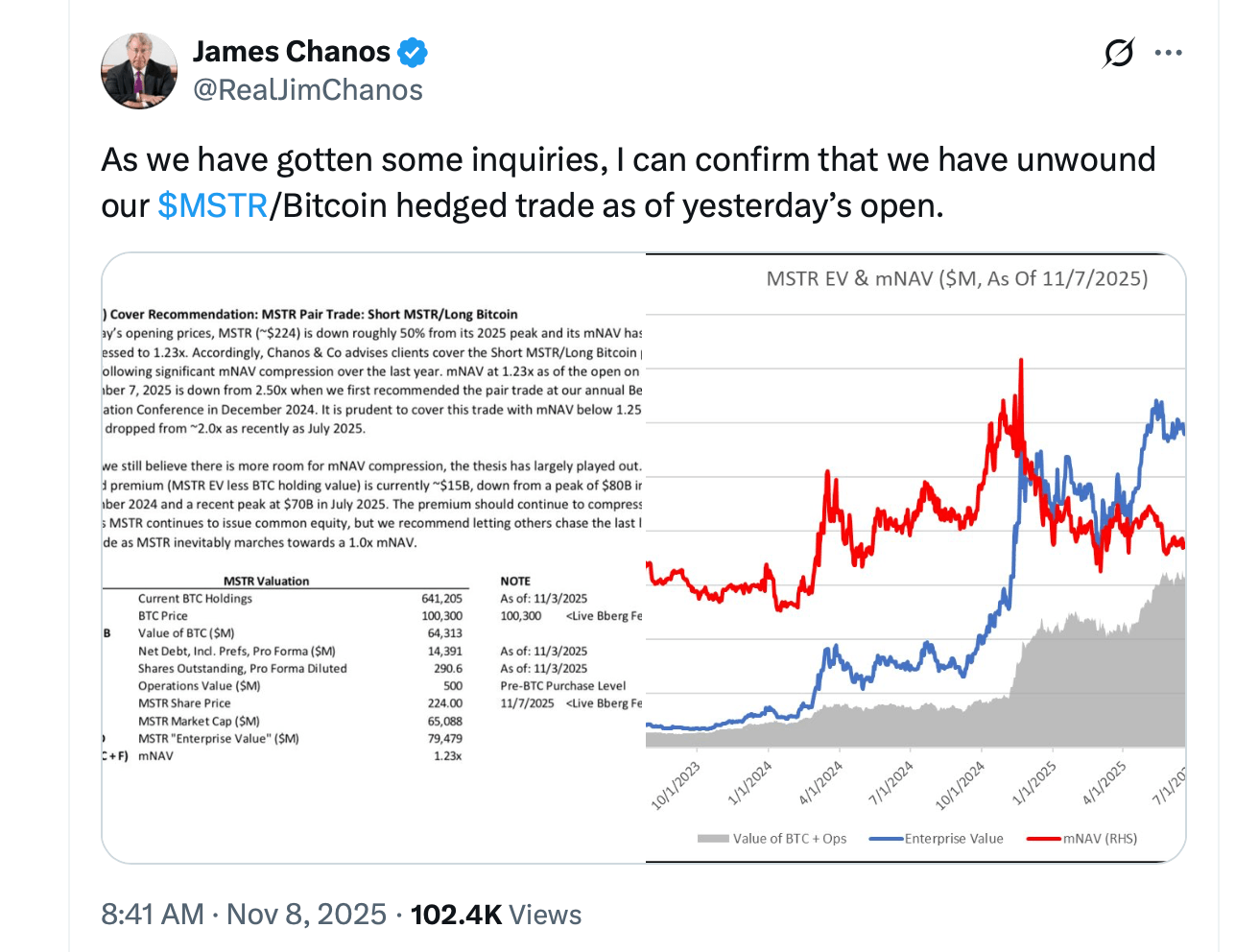

In May 2025, Chanos made his move—shorting Strategy while going long bitcoin. The approach was a classic arbitrage bet that Strategy’s share price, then trading at roughly 2.5 times its modified net asset value (mNAV), would eventually fall closer to parity with its bitcoin reserves.

By Nov. 7, 2025, Chanos had closed the trade. Strategy’s mNAV multiple had compressed to about 1.23x, down from its lofty highs earlier in the year. Bitcoin’s spot price hovered near $63,405, while Strategy’s stock price had plunged roughly 50% from its 2025 peak. The premium on its bitcoin holdings—once hovering around $80 billion—had shrunk to just $15 billion, effectively confirming Chanos’ call.

The trade essentially achieved what it set out to do as Strategy’s premium drifted toward parity. His exit likely locked in gains from the narrowing spread, sidestepping any rebound risk if bitcoin’s price recovers or investor enthusiasm reignites around Strategy.

Chanos’ latest victory echoes his long-standing reputation for spotting bubbles before they pop. From Enron to Strategy, his playbook remains consistent: identify overvaluation, bet on gravity, and bow out before the crowd catches on.

Whether Strategy’s model represents a visionary form of bitcoin leverage or an overextended debt play remains up for debate—but for Chanos, at least for the short term, the math has already spoken. On the same day, Saylor took to X and said:

“₿uy Now”

- What did James Chanos short?

He shorted Strategy stock while taking a long position on bitcoin. - Why did Chanos target Strategy?

He viewed Strategy’s stock as overvalued due to its premium over bitcoin’s market value. - When did Chanos close his Strategy short?

He exited the position on Nov. 7, 2025, after the premium compressed to near parity. - What’s Strategy’s bitcoin exposure?

The company holds more than 641,000 BTC, acquired through debt and equity offerings.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。