Original Title: "Unveiling the KOL Cycle: A Wealth Experiment Wrapped in Traffic"

Original Authors: Viee, Biteye

Once upon a time, the rules of the primary market were relatively clear: VCs provided funding, KOLs made their voices heard, and retail investors provided liquidity.

But today, this set of rules seems to be breaking down.

VC endorsements are no longer omnipotent; project teams are starting to redesign the game rules around "influence." KOLs are no longer just simple traffic roles. They hold the chips, sit at the table, and can even determine the life and death of a project.

To some extent, the KOL cycle is a token distribution method that emerged after VCs exited and retail investors fell silent, under the narrative of "influence supremacy." In the past 7 days, XHunt statistics show that there were as many as 3,860 tweets mentioning "KOL" in the crypto circle, while "VC" had 3,078, marking the quiet beginning of a shadow war over influence.

This article does not discuss grand theories but tells the real story behind the KOL cycle—where it came from, who is laughing, who is crying, who is counting money behind the scenes, and who is losing sleep at night.

01 How Did the KOL Cycle Step into the Spotlight?

Let's turn back time to the end of 2022.

The winter of crypto VCs has arrived. Primary market valuations are inflated, exit cycles are prolonged, and the secondary market cannot absorb the supply. Large institutions are hesitant to act, and small projects struggle to raise funds.

On the other hand, retail investors have quietly returned. Blast, ZKsync, Friend.tech… each liquidity explosion signals the return of retail investors.

What influences these people the most is not institutional research reports but those KOLs who seem to "know the industry" while actually "selling products."

Project teams have also realized: VCs may not be able to help me break out, but KOLs can. Instead of spending money on advertising, it’s better to hand low-priced chips to KOLs, let them tweet, and create momentum.

Thus, a new play emerged:

- Project teams give KOLs quotas, sometimes at prices even lower than VCs;

- KOLs hype the project before TGE, creating FOMO;

- At the moment of unlocking, traffic explodes, and KOLs cash out and leave.

The KOL cycle has arrived. You can think of it as a "private placement with tasks." Low prices, quick unlocks, and even "minimum guarantee clauses."

Project teams calculate clearly: give tokens to those with fans and influence, and after going live, they will naturally bring people to drive up the price.

KOLs also feel it’s a win: acquiring tokens at a low price, bringing some traffic, and selling a portion upon unlocking sounds like a guaranteed profit.

But is reality really like this?

02 The Truth Behind the KOL Cycle: Some Get Rich, Some Go to Zero

2.1 The Profit and Loss of the KOL Cycle

The profit and loss performance of the KOL cycle varies greatly depending on the project and market environment.

In a bull market, the KOL cycle is often seen as a "triple win": projects get funding, KOLs position themselves at low prices, and retail investors can profit by following along. But in a bear market, the script changes completely.

As liquidity decreases, price drops upon launch become the norm. KOLs, unable to sell in time due to lock-up, can suffer heavy losses. KOL @realChainDoctor admitted that he invested in more than ten KOL cycles last year, none of which were profitable, and some didn’t even receive tokens. In the view of the prominent figure @kiki520_eth, the KOL cycle has certain systemic traps, where tokens may not be received, or rules may even change after a price increase.

Top KOL @jason_chen998 stated that his most profitable investments were Aster and Mira, where he obtained lower valuations when the market was quiet and the project teams were reliable, coinciding with a bull market during TGE. Therefore, the key to making money in the KOL cycle is to ambush in a bear market and rely on connections to secure projects. However, he also admitted that most KOL cycles are just high-yield financial products; with good luck, there might be some returns, but with bad luck, one ends up working for free, facing pressure from project teams for content, having tokens withheld, and not unlocking them, ultimately leading to an unhappy ending.

We reviewed some recent KOL cycle cases, and some projects indeed brought high returns, such as:

- Aster: When the token price broke $1.79, the KOL cycle had a maximum floating profit of over 70 times. If only considering the 30% that was unlocked at launch, it yielded 21 times, equivalent to a profit of 1.05 million U from an initial investment of 50,000 U.

Holoworld AI: Lookonchain detected that the on-chain address 0x3723, suspected to be a KOL investor, received about 10.24 million HOLO in September at a cost of only $0.088. Subsequently, they gradually cashed out at an average price of around $0.6, totaling over 4.71 million U, with a single round return rate of over 444%, netting more than 4 million U.

WalletConnect: After unlocking, ICO and KOL cycle investors only achieved about 1.5 times returns.

However, there have also been many KOL cycle projects that experienced price crashes after launch or faced issues with the project teams.

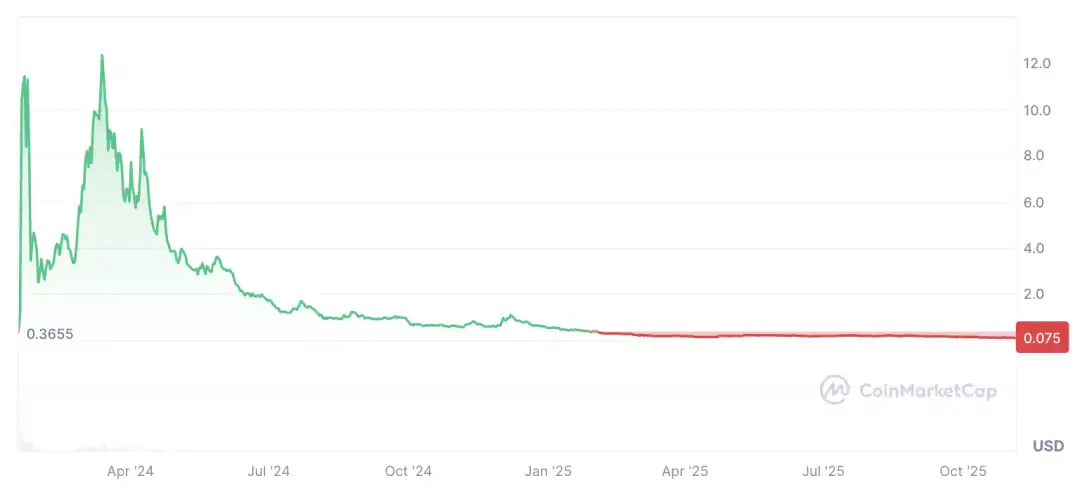

A typical case is SatoshiVM at the beginning of 2024, where the project token $SAVM was preheated with a large number of KOLs, briefly soaring above $11, but soon news of KOLs cashing out at high prices emerged, leading to a trust crisis, and the project gradually cooled down. Those KOLs and retail investors who did not sell are likely to find it hard to profit; currently, $SAVM has dropped to about $0.075.

Another example is ZKasino, where KOLs participated in financing and promotion, but the project team unilaterally changed the rules after users completed the lock-up, absconding with the assets. In this incident, KOLs who participated in financing and promotion were condemned by fans as accomplices, suffering not only financial losses but also immense public pressure.

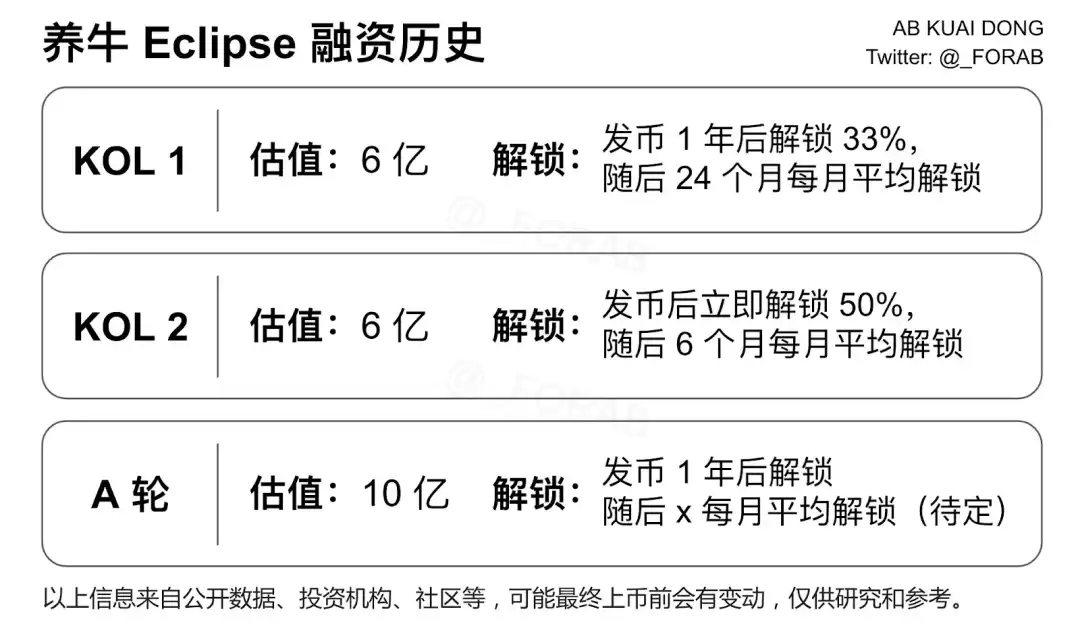

Just a few months ago, Eclipse launched its token with a KOL cycle valuation of up to $600 million and a Series A valuation of $1 billion, but after launch, the actual circulating market value was only about $380 million, far below the rumored $600 million valuation. Research KOL @_FORAB stated that some KOL cycle quotas were also distributed to media and communities, and in the end, it didn’t even get listed on Binance contracts.

In response, well-known KOL @yuyue_chris tweeted that the real problem with the KOL cycle is not losing money, but that project teams and intermediaries use the KOL cycle under the guise of promotion to pull people in, making KOLs use their fans to redeem their principal. This kind of scheme to exploit acquaintances is the most irresponsible.

2.2 Behind the Profits: The Triangular Game of Projects, KOLs, and Retail Investors

As mentioned earlier, the KOL cycle reflects the changing power structure of the entire primary market.

In the past, project teams relied on VCs for funding, and VCs filtered projects based on their influence. Now, project teams have discovered that KOLs are cheaper, faster, and more capable of generating momentum.

VCs are unhappy: after investing millions of dollars, the project teams allow a group of low-cost tweeters to come in, whose influence may even surpass their own… Thus, some VCs choose to "exit."

Retail investors are even more displeased: they buy tokens that KOLs have dumped after unlocking in the secondary market, only to see KOLs shouting orders on launch day, which actually means they are offloading.

Project teams are not necessarily happy either: because KOLs' hype is often short-lived, the volume, liquidity, and high opening on launch day do not represent the project's long-term trajectory.

Thus, a tense triangular relationship has formed on the stage of the KOL cycle.

KOLs are calculating: how can they safely exit with their invested money and reputation?

Project teams are wondering: can the quotas given translate into the expected volume and price increase?

Retail investors are asking: is this follow-up an opportunity or a trap?

The interests of these three parties are like forces pulling in different directions. Unless the project itself is strong enough to magnetically attract all three forces, any party exerting too much force could cause this triangle to collapse completely.

03 The "Intermediary" You Cannot Ignore—Agency

In the KOL cycle, project teams often do not connect directly with KOLs but instead distribute and manage through third-party agencies.

They are the "resource allocators" in this game. They help project teams design KOL cycle terms (prices, quotas, unlocks); select and invite suitable KOLs; supervise progress, and ensure content delivery. Some reliable agencies also design mechanisms such as guaranteed returns, promotional rewards, or principal refunds to help KOLs reduce risks.

They are the "intermediaries" in the entire KOL cycle system, controlling both traffic and resources. So if you are a newly emerging KOL looking to participate in the KOL cycle, the first thing to do is not to find a project but to find the right agency.

You may have heard of the names of these agencies:

LFG Labs (@dubailfg): Founded by @snow949494 (XHunt Chinese Ranking 134), focusing on China, Japan, South Korea, and the Middle East, mainly connecting top projects, skilled in integrating KOL resources, content dissemination, and KOL cycle financing linkage.

JE Labs (@JELabs2024): Founded by @0xEvieYang (XHunt Chinese Ranking 244) in 2024, mainly building brands and communities for early high-potential projects, connecting with Chinese audiences, helping projects grow from 0 to N.

BlockFocus (@BlockFocus11): Founded by "Er Gou" @CryptoErgou (XHunt Chinese Ranking 469), one of the earliest agencies in the Chinese market, emphasizing project value accumulation and medium to long-term operations.

Shard (@ShardDXB): Founded by @ciaobelindazhou (XHunt Chinese Ranking 784), a marketing agency incubated by a crypto investment fund, focusing on providing strategic narratives and global growth services for Web3 infrastructure projects, covering key markets in multiple languages including Chinese, English, Korean, Japanese, and Russian.

XDO: Led by seasoned primary investor @mscryptojiayi (XHunt Chinese Ranking 213) with years of market experience, preferring to work on "few but refined" projects, handling everything from mechanism design, strategic consulting, to market narrative shaping and execution.

Mango Labs (@MangoLabs): Founded by @dovwo (XHunt Chinese Ranking 112), focusing on marketing and KOL placement in Chinese regions, providing a complete set of services from narrative creation to community operation for projects.

Cipher Dance (@Cipher_Dance): Founded by @Jeffmindfulness (XHunt Chinese Ranking 2178), specializing in content marketing during the Pre-TGE phase, skilled in amplifying project narratives through creative formats and multilingual KOL placements.

4XLabs: "Strategic Advisor + KOL Matrix," helping global projects achieve growth from 0 to 1 in the Chinese market. Team members include @jasonchen998 (XHunt Chinese Ranking 34); @Bitwux (XHunt Chinese Ranking 24); @PhyrexNi (XHunt Chinese Ranking 8); @KuiGas (XHunt Chinese Ranking 31).

04 How to Get the Attention of Project Teams/Agencies?

Typically, project teams or agencies allocate quotas based on KOL influence metrics (such as follower count, past tweet engagement, etc.) and clarify content production and unlocking requirements.

To gain opportunities in the KOL cycle, the core is to enhance "content + data" and establish a trustworthy personal brand:

Continuously produce professional content: Consistently publish market analysis, on-chain data insights, or project evaluations.

Actively engage on Twitter: Interact with project teams and other KOLs, participate in AMAs, live streams, and tweet discussions to increase activity within the industry.

Use tools to optimize data: Utilize analytical tools to enhance account visibility, such as using @xhunt_ai to check your account's influence ranking, capability model, engagement, etc., and adjust content production accordingly. XHunt has also launched scoring systems like the "Soul Index," which has become an important reference for many project teams and agencies in evaluating KOLs.

Establish connections through multiple channels: In addition to online promotion, attending offline industry events or hackathons can help meet project teams.

05 How Do KOLs Select Projects?

The KOL cycle is not charity; every participant faces pressure to recoup their investments. Choosing the wrong project not only leads to losses but also damages reputation and affects ordinary users' interests. Therefore, it is best to conduct systematic screening before collaboration, similar to investing in private placements, focusing on the following key dimensions:

Valuation and FDV: Is the overall valuation of the project reasonable, and is the KOL cycle price relatively discounted?

Unlock Design: Is the TGE unlock ratio and linear cycle healthy, and is there a risk of concentrated selling pressure?

Capital Background: Check if there are leading VC investments and whether the institutional lineup has endorsement effects.

Participation Lineup: Which top KOLs have participated, and is there a signal of joint participation from institutions and individuals?

Agency Source: Understand whether the agency responsible for matchmaking is professional, their past performance, and whether they have participated in quality projects.

Team Reputation: Does the founding team have past project experience or industry reputation, and is there a history of controversy?

Terms Requirements: Does the promotional content need to be reviewed in advance, and are there special arrangements such as minimum guarantees or token refund clauses?

Additionally, tools like XHunt can be used to analyze the reliability of projects, using plugins to view financing information, team information, follower counts of Chinese and English KOLs, community sentiment, and project influence rankings.

06 Conclusion: The KOL Cycle is a Narrow Door Left for Ordinary People in the Primary Market

From a higher-dimensional perspective, the KOL cycle is a financing tool that has naturally evolved in the crypto industry under the backdrop of traffic prioritization, narrative leadership, and community-driven dynamics.

It lowers the funding threshold, accelerates dissemination, and indeed helps some small projects stand out without VC support.

Of course, the KOL cycle sometimes lacks standards and has ambiguous responsibilities. But from another angle, this may also be one of the few opportunities for retail investors to "squeeze into the primary market." Compared to traditional private placements dominated by elite VCs with high information barriers, the KOL cycle at least possesses a certain level of liquidity and openness. Any ordinary person, as long as they can continuously produce content and have influence, has the potential to secure a quota and truly participate in the primary pricing game.

This is not a perfect mechanism, but it is a "grassroots method" in the current crypto-native capital market. In a stage where rules are not yet formed and trust mechanisms are still being built, the KOL cycle, as a new market solution, still holds significance.

Because in this era, influence itself is a new form of capital.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。