Author: Zuo Ye

The direct triggers of the events on October 11 and November 3 were not yield-bearing stablecoins, but they dramatically struck USDe and xUSD in succession. Aave's hard-coded USDe pegging to USDT hindered the on-chain spread of the Binance crisis, and Ethena's own minting/redemption mechanism was also unaffected.

However, the same hard coding caused xUSD to be unable to die directly, falling into a long period of garbage time, with the issuer Stream's bad debts unable to be cleared in a timely manner, and the related party Elixir and its yield-bearing stablecoin product deUSD also faced scrutiny.

In addition, multiple Curators on Euler and Morpho accepted xUSD assets, leading to user assets randomly exploding in various Vaults, lacking the Federal Reserve's emergency response role seen in SVB, and the next step could be a potential liquidity crisis.

This single-point crisis magnified into industry turbulence when xUSD crossed the sinking Curators and declared eternal war.

Curators + Leverage, Source of the Crisis?

The crisis was not caused by leverage; rather, the private dealings between protocols led to a lack of transparency, lowering users' psychological defense thresholds.

At the outbreak of the crisis, the following two points of understanding formed the basis for the division of responsibility:

- Stream and Elixir's insufficient issuance of xUSD from leveraged cycles makes their management teams the main culprits;

- Lending platforms like Euler/Morpho accepting "toxic assets" xUSD means that the platforms and Curators should bear joint responsibility;

Let's reserve our opinions for now and take a look at the operational mechanism of YBS. Compared to the operational logic of USDT/USDC, where dollars (including US Treasury bonds) are deposited in banks, and Tether/Circle mint equivalent stablecoins, earning interest on deposits or government bonds, the usage of stablecoins inversely supports Tether/Circle's profit margins.

YBS's operational logic is slightly different; it theoretically employs an over-collateralization mechanism, issuing 1 dollar of stablecoin for collateral exceeding 1 dollar, and then investing it in DeFi protocols to earn returns for holders, with the remainder being its own profit, which is the essence of its yield.

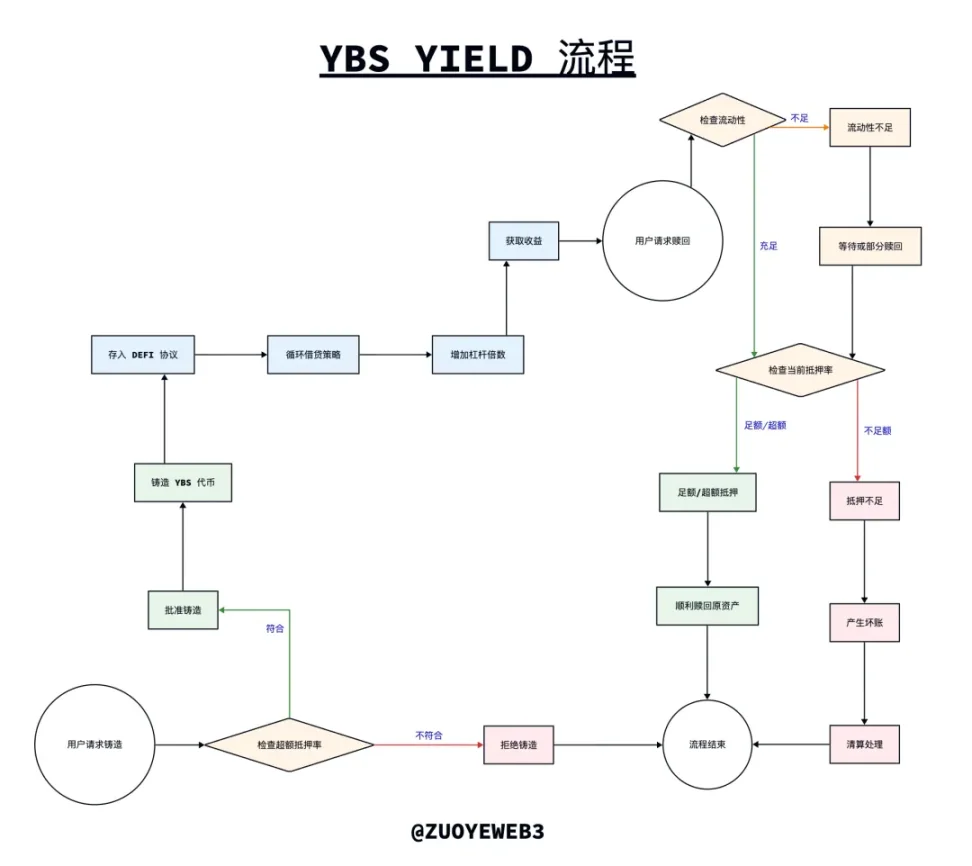

Image description: YBS minting, yield, and redemption process, image source: @zuoyeweb3

Theory is not reality. Under high-interest pressure, the YBS project developed three "cheating" methods to enhance its profitability:

- Transforming the over-collateralization mechanism into insufficient collateralization is foolish as it directly lowers the value of collateral and is unlikely to be effective, but corresponding strategies are evolving:

- Mixing "expensive" and "cheap" assets for support; cash in dollars (including US Treasury bonds) is the safest, BTC/ETH are also relatively safe, but TRX supporting USDD has to be discounted;

- Mixing on-chain and off-chain assets for support; this is not a bug but a form of time arbitrage, ensuring that assets are in the corresponding positions during audits. Most YBS will adopt such mechanisms, so no separate examples are provided.

- Enhancing leverage capacity; once YBS is minted, it will be invested in DeFi protocols, mainly various lending platforms, preferably mixed with mainstream assets like USDC/ETH:

- Maximizing leverage, using 1 dollar as if it were 100 dollars, potentially increasing profits; for example, the circular loan formed by Ethena and Aave/Pendle can achieve approximately 4.6x Supply leverage and 3.6x Borrow leverage with the most conservative cycle of 5 times.

- Using less capital to leverage, for instance, Curve's Yield Basis once planned to directly issue crvUSD, effectively reducing the capital required to utilize leverage.

Thus, xUSD executed a series of combined strategies, leveraging upfront and issuing in cycles, which is essentially the mechanism of xUSD. Observing the above image, YBS enters the yield "strategy" after minting, which is essentially a process of increasing leverage. However, xUSD and deUSD work together to migrate this to the issuance process, allowing users to see both the over-collateralization rate and the yield strategy, but this is entirely a smokescreen by Stream, which acts as both referee and athlete, making xUSD an insufficient YBS.

xUSD uses the leverage from the second step to issue in the first step, relying on Elixir's deUSD to leverage about 4 times, which is not significant. The problem lies in the 60% of the issuance controlled by Stream itself; when profits are made, they will also be retained, and when a crisis occurs, the bad debts are also theirs, failing to achieve the crucial socialization of losses in the liquidation mechanism.

The question is, why do Stream and Elixir do this?

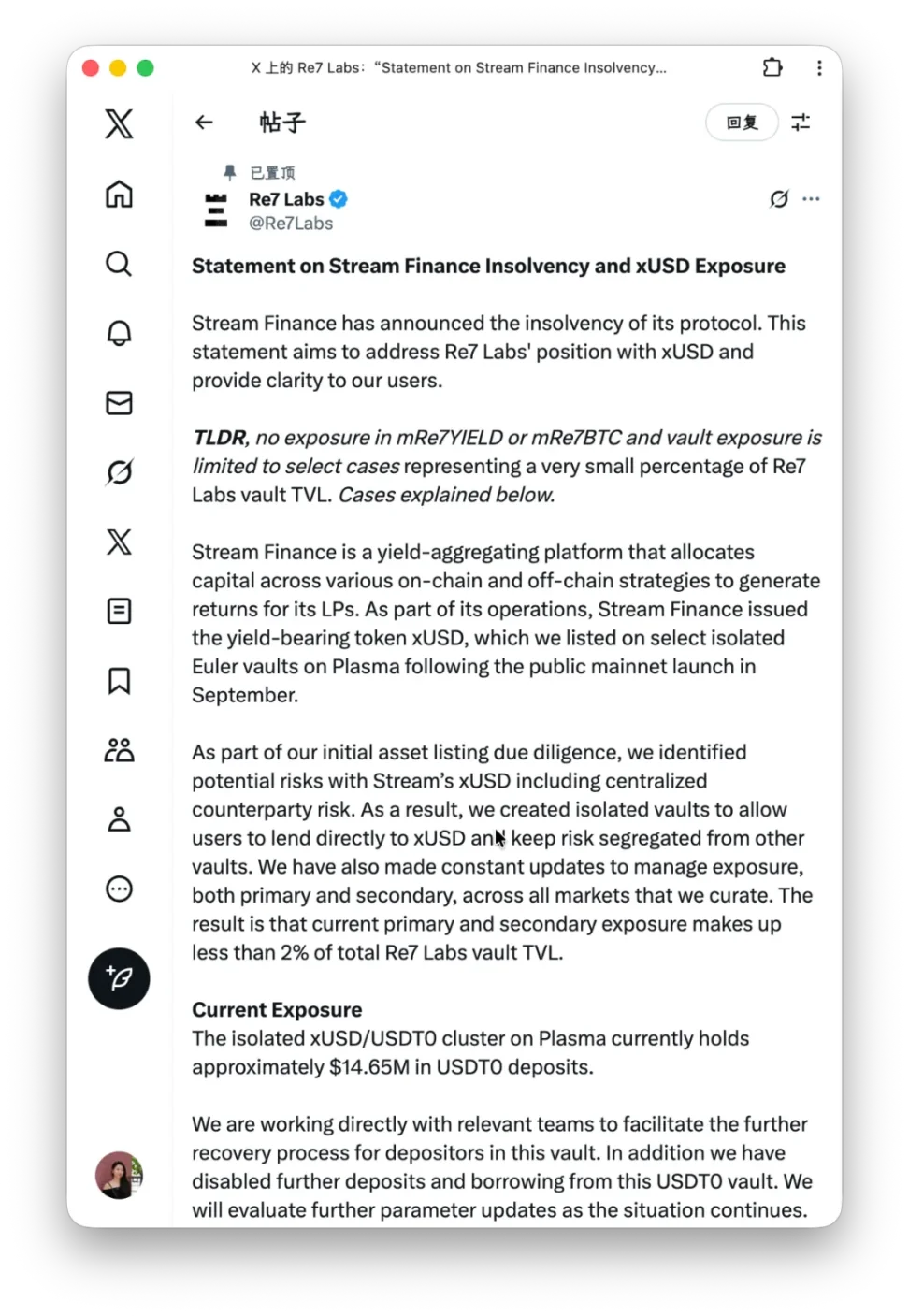

In fact, direct collusion between protocols is no longer news. When Ethena introduced CEX capital, it gained partial exemption rights during ADL liquidation. Returning to xUSD, among the responses from many vault Curators, Re7's was the most interesting: "We recognized the risks, but under strong user requests, we still listed it."

Image description: Re7's response, image source: @Re7Labs

In fact, the vault Curators on platforms like Euler/Morpho can absolutely identify the issues with YBS, but under the pressure of APY and profit demands, some will accept it actively or passively. Stream does not need to persuade all Curators; it only needs to avoid being rejected by everyone.

Those Curators accepting xUSD certainly bear responsibility, but this is a process of survival of the fittest. Aave was not built in a day; it grew continuously through crises. Would relying solely on Aave make the market safer?

Not necessarily. If there were only one lending platform like Aave in the market, Aave would become the sole source of systemic crisis.

Platforms like Euler/Morpho represent a decentralized market or "new third board" mechanism, with more flexible allocation strategies and lower entry barriers, which is significant for the popularization of DeFi.

However, the problem remains one of transparency. The Curators of Euler/Morpho essentially allow third-party sellers to exist, while Aave/Fluid is entirely self-operated, so interacting with Aave means Aave is responsible for security. However, some vaults on Euler are managed by Curators, and the platform intentionally or unintentionally blurs this point.

In other words, platforms like Euler/Morpho lower users' defense and due diligence expectations. If the platform adopted a friendly fork like Aave or a liquidity backend aggregation like HL, while maintaining absolute separation in the front end and branding, the criticisms would be significantly reduced.

How Should Retail Investors Protect Themselves?

The endpoint of every DeFi dream is to ring the doorbell of retail investors.

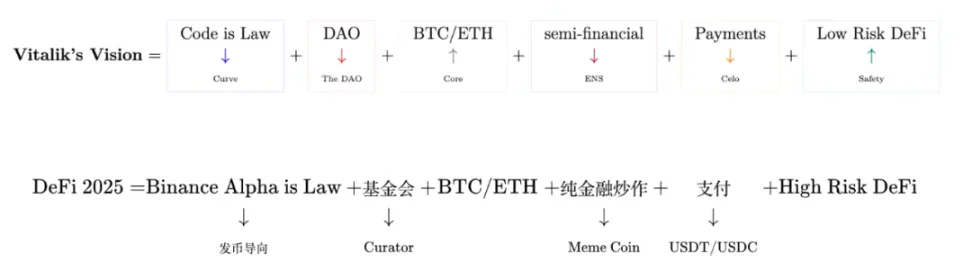

As the main public chain carrying DeFi, Vitalik is not particularly fond of DeFi and has long called for non-financial innovations to occur on Ethereum. However, he genuinely cares for retail investors. Since DeFi cannot be eliminated, he has begun to advocate for Low Risk DeFi, empowering the world's poor.

Image description: Vitalik's view of DeFi and the real world, image source: @zuoyeweb3

Unfortunately, what he envisions has never been a reality, and people have long believed that DeFi is a high-risk, high-reward product. Indeed, during the DeFi Summer of 2020, yields often exceeded 100%, but now even 10% is suspected of being a Ponzi scheme.

The bad news is that there are no high yields; the good news is that there are no high risks.

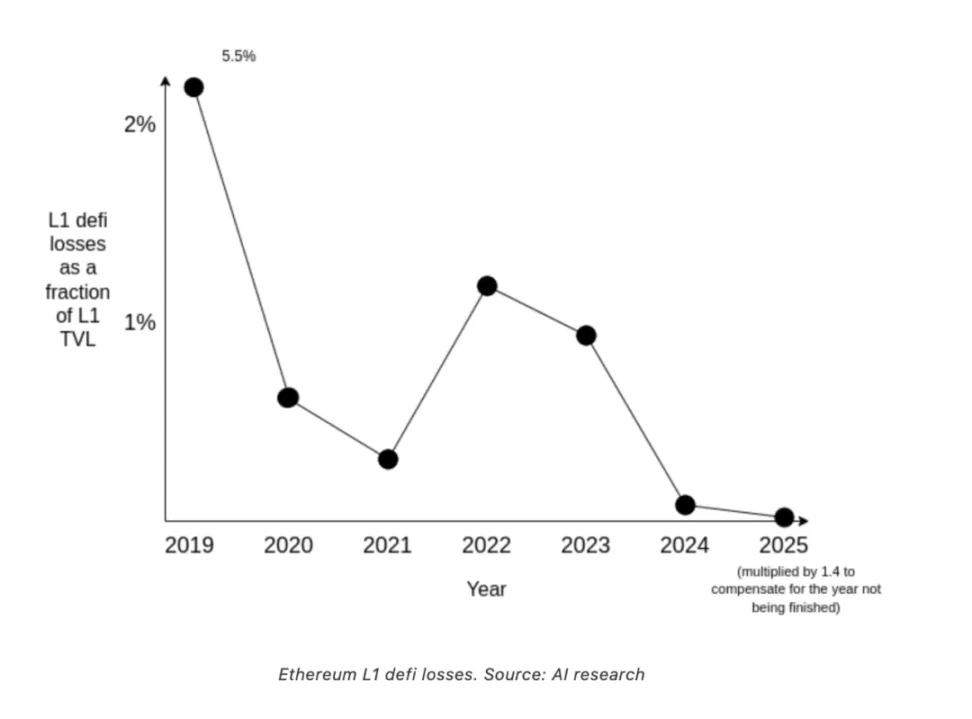

Image description: Ethereum loss rate, image source: @VitalikButerin

Whether from the data provided by Vitalik or from more professional research institutions, the safety level of DeFi is indeed increasing. Compared to the liquidation data from Binance on October 11 and the massive theft from Bybit, the explosions and losses in DeFi, especially in YBS, are negligible.

However! I must say, this does not mean we should feel safe rushing into DeFi. The transparency of CEX is increasing, but the transparency of DeFi is decreasing.

The era of regulatory arbitrage for CEX has ended, but the era of regulatory leniency for DeFi has returned. This certainly has its benefits, but what is called DeFi is, in fact, increasingly centralized, with too many unknown terms hidden between protocols and Curators.

What we think of as on-chain cooperation is code; in reality, it is the TG commission ratio. This time, many Curators of xUSD released TG screenshots, and their decisions will directly impact the future of retail investors.

Demanding regulation from them is of little significance; the core is to start from on-chain to combine usable modules. Don't forget that over-collateralization, PSM, x*y=k, and Health Factor are sufficient to support macro activities in DeFi.

By 2025, the entire yield supported by YBS will consist of the following: YBS assets, leveraged yield strategies, and lending protocols, which are not numerous enough to be uncountable. For example, Aave/Morpho/Euler/Fluid and Pendle can meet 80% of interaction needs.

Lack of transparent management leads to ineffective strategies; Curators do not demonstrate superior strategy-setting capabilities, and the elimination process must occur after each issue.

Beyond that, what retail investors can do is to penetrate everything, but frankly, this is not easy. Theoretically, both xUSD and deUSD are over-collateralized, but the mixing of the two causes the leverage process, which should occur after minting, to be brought forward to the minting stage, resulting in xUSD not being over-collateralized in reality.

When YBS is minted based on another YBS, the iterated collateralization rate becomes difficult to discern.

Before products capable of penetrating everything are launched, retail investors can only protect themselves with the following beliefs:

- A systemic crisis is not a crisis (socialized); participating in mainstream DeFi products assumes safety, and the moments of insecurity are unpredictable and unavoidable. If Aave encounters issues, it can signal the decline or restart of DeFi.

- Do not rely on KOLs/media; participating in projects is a subjective choice (all judgments are our own thoughts). Information merely reminds us "there is this product." Regardless of KOL alerts, warnings, calls, or DYOR disclaimers, ultimately, one must make their own judgments. Professional traders should not even look at news but rely solely on data for decision-making.

- Pursuing high yields is not riskier than low-yield products; this is a counterintuitive judgment that can be viewed through Bayesian thinking. P(high yield | no crash, high risk) = very small, P(low yield | no crash, low risk) = very large, but we cannot quantify the ratio of the two, thus deriving the odds. More simply, the two are independent events.

Use external data to correct our beliefs; do not seek data support for beliefs.

Additionally, there is no need to overly worry about the market's self-repairing ability. It is not retail investors who pursue volatile returns, but rather capital that seeks liquidity. When all capital retreats to Bitcoin or USDT/USDC, the market will automatically induce them to pursue volatility, meaning stability creates new volatility, and volatility crises trigger a pursuit of stability.

One can look at the history of negative interest rates; liquidity is the eternal hum of finance, and volatility and stability are two sides of the same coin.

Conclusion

In the upcoming YBS market, retail investors need to:

- Seek data—penetrating data that goes through leverage ratios and reserves. Transparent data does not lie; do not rely on opinions to assess facts.

- Embrace strategies—leveraging and deleveraging in a continuous cycle. Simply reducing leverage does not ensure safety; always ensure your strategy includes exit costs.

- Control losses—you cannot control the loss ratio, but you can set your psychological position based on points 1 and 2, and then take responsibility for your own understanding.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。