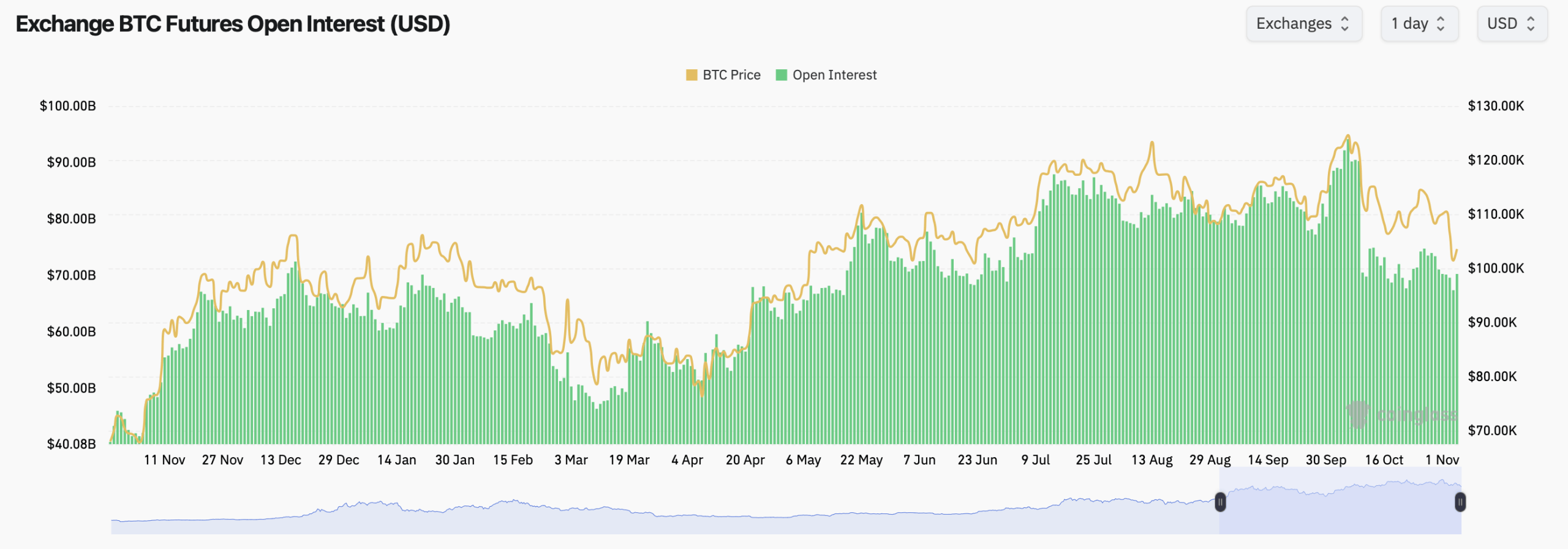

According to data from Coinglass, total bitcoin futures open interest (OI) stands at 677,750 BTC, worth about $70.24 billion, up 3.47% in 24 hours. CME continues to command the lead with $14.35 billion in OI, followed closely by Binance at $12.45 billion.

CME’s dominance accounts for 20.42% of all futures exposure, while Binance holds 17.72%. Meanwhile, OKX saw the sharpest 24-hour jump at 4.12%, signaling renewed inflows. Bybit, Gate, and Kucoin showed mixed results — Bybit’s OI fell 2.03%, Gate slipped 0.42%, and Kucoin dipped 2.97%.

Bitcoin futures open interest as of Nov. 5, 2025, according to coinglass.com

MEXC, however, grabbed attention with an explosive 17.45% OI rise over the last day, while BingX logged a 9.32% gain. These shifts suggest smaller venues are attracting short-term leveraged plays as traders reposition after bitcoin’s weekly 7% spot market drawdown.

On the options front, Deribit continues to dominate, accounting for the majority of bitcoin’s options open interest. The total BTC options OI hovers just over $50 billion, with calls representing 61% and puts 39%. Over the past day, figures show calls made up 60.73% of volume, which points to a cautiously bullish bias despite recent volatility.

The hottest bets on Deribit are clustered around December’s big expiration, with traders piling into call options targeting $140,000 per coin, alongside hefty put positions near $85,000 and moonshot calls at $200,000. In plain English: traders are covering all the bases — hedging against a drop while keeping tickets for a potential rocket ride before year’s end.

The max pain level on Deribit sits around $105,000, while Binance’s max pain curve currently points to $110,000, suggesting options writers may want bitcoin to linger near those zones to inflict maximum discomfort on speculators.

In short, bitcoin’s derivatives markets are still buzzing quite ferociously — CME and Binance dominate futures, Deribit runs the options table, and max pain levels hint at tightening volatility into mid-November. With leverage rebuilding and open interest climbing, traders are clearly gearing up for bitcoin’s next major swing. Question is: Which way will it go?

- What is bitcoin’s current futures open interest?

Bitcoin futures OI totals $70.24 billion across exchanges, led by CME and Binance. - What is the call-to-put ratio for BTC options?

Calls account for 61% of options OI, showing a mildly bullish tilt. - What are the key BTC options strikes on Deribit?

The most active strikes are $140,000, $120,000, and $85,000. - What’s bitcoin’s current max pain level?

Around $105,000 on Deribit and roughly $110,000 on Binance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。