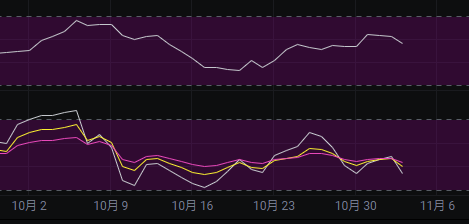

Yesterday we mentioned that a trend reversal is expected this week. Today is the first day of the week, and the market has already dropped by more than two points, which aligns with our prediction from last week about a potential trend reversal this week. Since the market has chosen to reverse, there is a possibility of a continuous decline, so we need to be cautious about the emergence of a sustained downward trend. Meanwhile, several short positions we have set up are already in profit.

Weekly Level

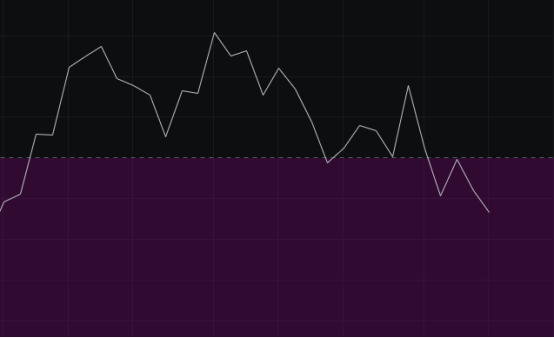

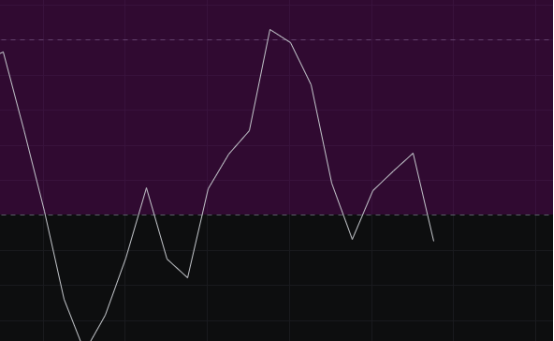

From the MACD perspective, the energy bars continue to move downward, and the fast and slow lines are still some distance from the zero axis, indicating that there is still an expectation for further declines.

From the CCI perspective, the 100 level has provided support for the market several times. The last rebound failed to hold above 100, and subsequently, the CCI began to decline. Therefore, it is difficult for the CCI to rise above 100 in the short term.

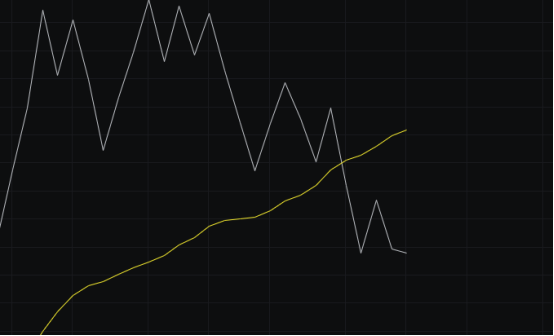

From the OBV perspective, the volume has been continuously flowing out, but there hasn't been a large-scale outflow yet. For a significant outflow to occur, several more cycles of brewing are needed, along with the slow line flattening out before it can turn downward.

From the KDJ perspective, after the previous death cross, the KDJ has been moving downward, and it has just started to decline, so it is unlikely to stop falling in the short term. The KDJ will continue to maintain a downward trend.

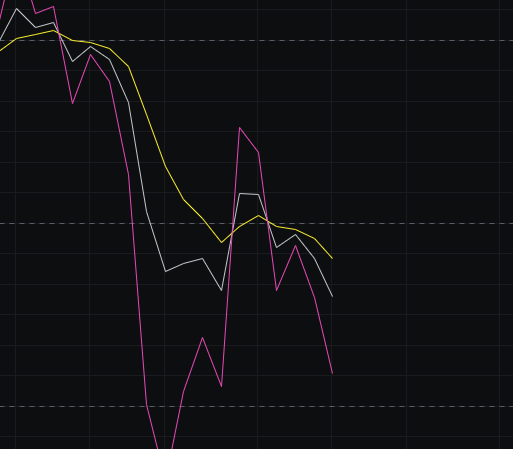

From the MFI and RSI perspectives, both indicators are in the neutral zone, with MFI moving upward and RSI moving downward. The inconsistent directions of the two indicators suggest that it will take several cycles for them to align.

From the moving averages perspective, the 30-period line has provided support for four cycles, but it appears to have broken below 30. Whether the 30 can provide support for a fifth cycle is highly questionable.

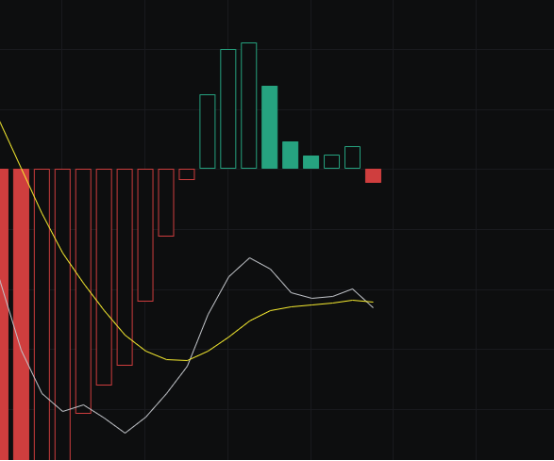

From the Bollinger Bands perspective, the market continues to narrow this week and is currently extremely tight. The next step is a trend reversal. Today we saw the market drop by more than two points at the start of the week. For a trend reversal to occur, the Bollinger Bands need to expand, which requires the price to reach near the lower or upper band. Currently, a downward move seems more likely, so if the narrowing can end this week, the price should approach around 105,000.

Daily Level

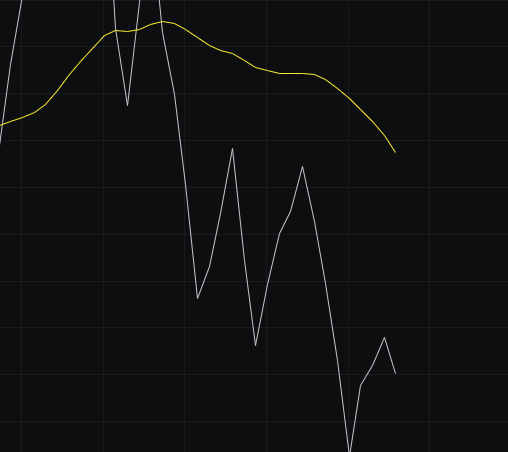

From the MACD perspective, after several days of sideways movement, the MACD is also in a sideways state. Although it dropped by more than two points today, the decline in the energy bars is relatively small. To maintain a downward trend, we need to see two consecutive bearish candles in the next two days.

From the CCI perspective, the rise on Sunday did not lead to a rapid increase in the CCI, indicating a weak market. Today's decline has caused the CCI to drop below -100, suggesting a bearish outlook.

From the OBV perspective, the three days of upward movement on Sunday brought in some volume, but today's decline did not see much volume flowing out. To continue the downward trend, we need to see two more days of bearish candles to maintain the outflow of volume.

From the KDJ perspective, after the death cross a few days ago, the KDJ continues to diverge downward, and there are currently no signs of a stop in the decline, so we maintain a bearish view on the KDJ.

From the MFI and RSI perspectives, both indicators are in the neutral zone and show a downward trend, indicating a bearish outlook. However, to maintain this pattern, we need to see two more days of bearish candles.

From the moving averages perspective, the 30-period line continues to press down, but the 120-period line is still flat. For a sustained decline, we need to see the 120-period line move downward, which requires the subsequent price action to produce bearish candles.

From the Bollinger Bands perspective, the lower band has started to move downward while the upper band is also moving down. This can still be seen as a narrow range. To end this narrow range, the best scenario would be consecutive bearish candles to expand the Bollinger Bands.

In summary: The market has followed our prediction from last week for this week, and we now believe there is a possibility of a sustained decline. Additionally, the market has reached an extremely narrow state, and with the market dropping more than two points at the start of the week, the likelihood of continued decline is greater. Today's resistance is seen at 109,000-110,000, with support at 107,500-106,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。