Variational: The Counterparty for the Entire Contract Market

Variational does not produce liquidity; it is merely a transporter of liquidity.

After an extensive introduction to the past of Hyperliquid, the capital operations surrounding its $USDH and DAT/ETF related to $HYPE will be completed later.

Binance's crisis management is becoming increasingly adept, while OK has taken the lead in internal clean-up. Hyperliquid continues to rise, and even though 1011 may gradually expose a few market makers or YBS project parties, it is still difficult to harm these mainstream platforms. Even second and third-tier CEX/DEX like Lighter or MEXC are showing resilience far beyond previous crisis moments.

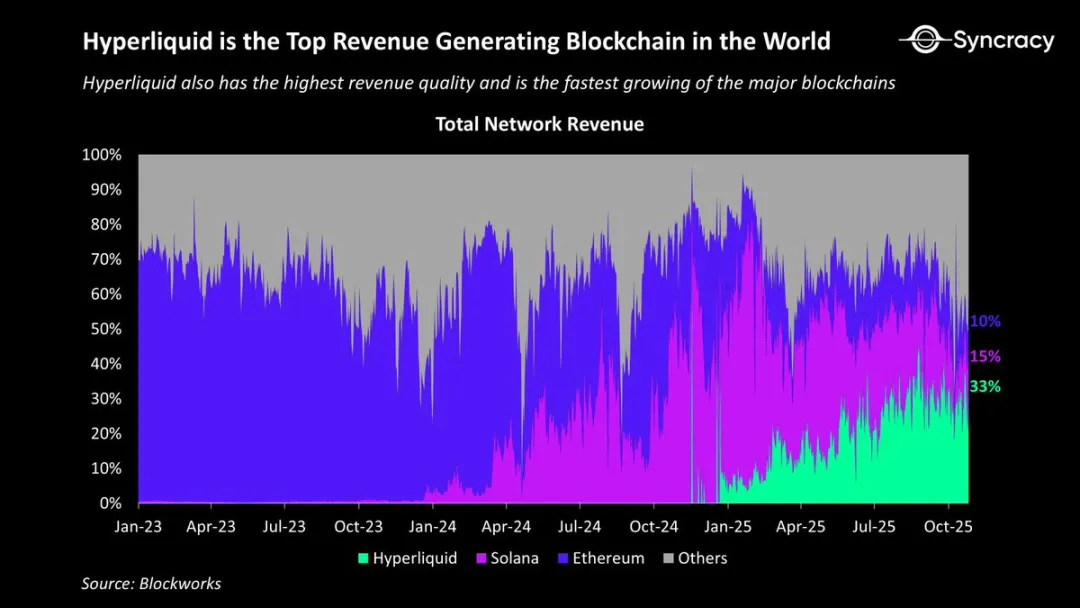

Image Caption: HL Revenue Share

Image Source: @RyanWatkins_

The rise of HL has become unstoppable after Aster and 1011, unless it self-collapses or is shut down by regulators. It is difficult for Binance to take down HL like it did with FTX.

The trading landscape of cryptocurrencies has solidified; what should the latecomer Perp DEX do?

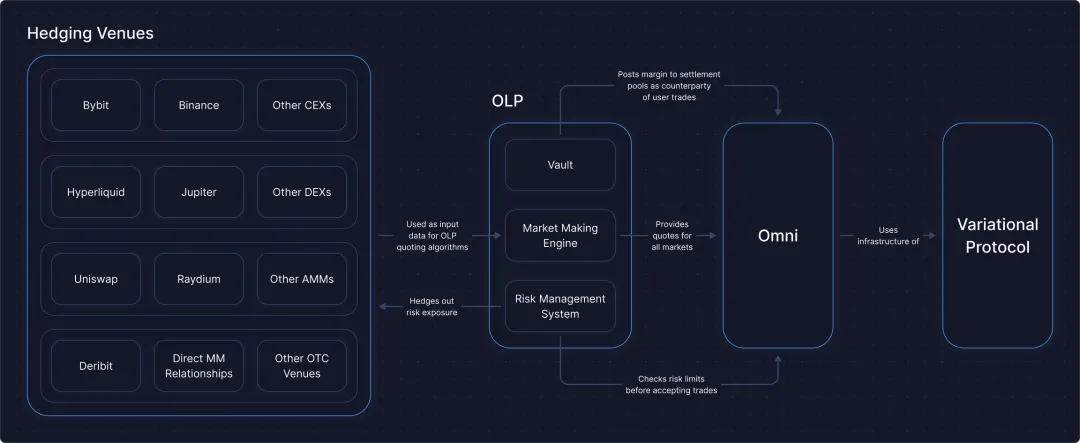

Market-Level Market Maker: OLP Covers Everything

Variational's idea is to link all liquidity. Variational predicts that the future will not be dominated by a single entity; even if one does dominate, there will still be third-party market makers present.

As mentioned earlier, both Binance and HL claim to have an open attitude towards market makers, and even HL's HLP claims to account for only 1% of trading volume.

This principle is not complicated; just as Qualcomm had to sell its telecom business to be accepted by the entire industry, Visa/Mastercard will not start their own banks, and Stripe's Tempo is unlikely to issue stablecoins.

Only with sufficient neutrality will all market participants actively accept it.

If Hyperliquid's Builder Codes are the front end of liquidity, then Variational's OLP is the counterparty for all market makers.

Strictly speaking, Variational is not a traditional Perp DEX. On one hand, it has a high degree of centralization; under the RFQ structure, users actively request quotes, and the only market maker, OLP, provides the quotes, with order details pre-fabricated by Variational, and the final matching price determined by OLP.

Note:

CLOB solves the slippage problem in AMM, reappearing in Variational under the RFQ mechanism, but limit orders can be set to compensate for this flaw.

However, the benefits follow; every order from users must have a counterparty to take it, ensuring absolute balance between longs and shorts in the market, and every order is insured by the OLP contract, with profits and losses originating from the same source, unrelated to others.

Moreover, OLP is the only market maker on Variational, meaning there are no third-party market makers; any user must trade with OLP, ensuring the smallest granularity balance in the market.

The advantage of this approach is that during extreme liquidations, your profits are only responsible for the losses of the counterparty to your order, not for the losses of other orders, maximizing control over the liquidation volume on Variational.

However, this does not prevent the spread of liquidation in the overall market. This is not contradictory to the above; please note that OLP is the only counterparty for users on Variational, but OLP does not only operate as a market maker on Variational.

Image Source: @variational_io

In addition to the common user deposits where OLP earns profits and is responsible for liquidations, the biggest difference between OLP and HLP is that OLP will hedge in the market's DEX/CEX.

For example, if Alice opens a long position with OLP and cannot find a corresponding short position to match, OLP will directly open a corresponding short position in BN/HL to achieve its own balance.

Thus, Variational does not resemble a Perp DEX but rather a market-level market maker like WinterMute, where the openness is not about liquidity but about access permissions for market makers.

For HLP, user deposits need to earn market-making profits, but HLP cannot excessively capture market traffic; otherwise, ordinary users and market makers will flee.

However, OLP is the only market maker; users either deposit with OLP or become its counterparties, naturally excluding the participation of other market makers.

In 1011, market makers coupled positions between Binance and on-chain, and when the crisis hit, multiple market makers would create a cascading effect, causing the market crisis to spread infinitely. OLP, on the other hand, will close and liquidate positions according to predetermined conditions.

For Binance and HL, OLP will be a higher-quality market maker choice, at least reducing the likelihood of "running away" during a crisis. OLP is unique on Variational, but for other exchanges, it is a major client.

Keep in mind that OLP's positions are in an absolutely balanced P2P model, and each user's position is only responsible to their counterparty.

Loss Rebates as Customer Acquisition Costs

As Perp DEXs engage in intense competition, how to participate and stabilize profits?

Variational targets BN/HL, which allows the existence of third-party market makers, and retail investors are powerless against market makers and super platforms. OLP transforms into an open market maker; if users want to earn passive income from Perp DEX, they can participate in OLP without trading.

But! Is it really that simple?

Image Source: @TurboFlow_xyz

Lighter's loss rebate has not yet stopped, and a new AMM mechanism trading platform, TurboFlow Perp, has introduced zero trading fees/no slippage, where the exchange only shares profits when users make a profit.

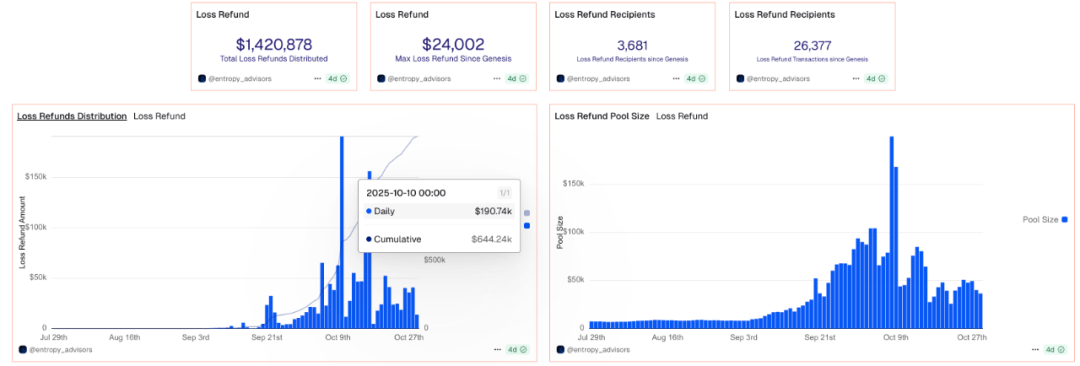

The loss rebate in 1011 is a very mechanistic approach, but Variational's loss subsidies have become normalized, which is a direct incentive for market attention after the major liquidation.

In a sense, Lighter's loss subsidies, Binance's $200 million compensation, and the same boat plan, along with potential Hyperliquid S3 trading points, are all customer acquisition strategies.

However, loss subsidies indicate that the cost of this customer acquisition channel is reaching the edge of marginal benefits. If the project party is not profitable but still needs to acquire customers, it signifies danger.

Variational is normalizing this danger as its daily customer acquisition strategy.

OLP is not only the only market maker but also a counterparty that does not charge fees. OLP's profit comes from the market-making spread, meaning "BN/HL is too powerful and will prioritize liquidating user positions, but OLP uses a black box to ensure retail rights."

Yes, OLP's market-making mechanism remains a black box, and OLP is still controlled by the project party. Retail investors do not need to believe that OLP will intentionally cause them to incur losses because OLP will subsidize losses.

OLP will satisfy the interests of OLP depositors while maintaining a neutral market-making strategy.

Additionally, OLP is the counterparty for all traders and can, to some extent, control the disturbance of whales in the market. Situations like hijacking HLP arbitrage are less likely to occur because OLP's degree of openness is lower, and in extreme cases, it can directly close whale positions.

Image Caption: Variational Loss Subsidies Peaked at 1011

Image Source: @variational_io

However, it should be noted that the current trading volume of Variational is still very small compared to HL/BN, and whether it can ensure subsidy capabilities as its market-making volume increases needs market validation.

Conclusion

The End of the Decentralized Era.

Before Variational, liquidity in the market was underground and decentralized, but Variational has brought retail power into the fold to counter market makers and large trading platforms.

• From the user's perspective: OLP controls the intensity of liquidations, but essentially cannot resist overall market changes, at most providing some peace of mind.

• From the project party's perspective: Absorb user deposits to hedge positions in BN/HL, relying on free services and APR to increase its own trading volume.

• From the perspective of BN/HL: Increase institutional-level market makers and serve as a bridging channel to utilize overall market liquidity.

However, Variational's degree of opacity is too high, and retail investors remain powerless to resist, which may be the helplessness of retail investors in this era. Institutions represented by Coinbase have already taken the lead in institutionalization, following the footsteps of the US stock market.

The on-chain and Asian markets are the last remaining retail markets; it is uncertain whether they will give rise to a Frankenstein or a new cyberpunk ideology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。