Crypto asset manager Grayscale Investments projected a bullish expansion in the digital asset market as new U.S. regulatory clarity paves the way for a surge in altcoin exchange-traded products (ETPs). The company’s latest analysis suggests that broader access to regulated crypto exposure could accelerate institutional adoption and fuel diversification beyond bitcoin and ethereum.

The Grayscale Research Team published Market Byte: Here Come the Altcoins on Oct. 31, stating:

In the coming weeks, investors can anticipate a significant increase in the number of exchange-traded products (ETPs) offering exposure to ‘altcoins’ — crypto assets with a lower market cap than bitcoin — due to new guidance from U.S. regulators.

The outlook follows the U.S. Securities and Exchange Commission’s (SEC) Sept. 17 approval of generic listing standards for crypto asset ETPs, allowing exchanges to list qualifying tokens without case-by-case SEC review. Solana’s SOL token is already trading under the new framework, signaling early implementation of the streamlined process and setting precedent for other large-cap altcoins such as XRP, cardano, and chainlink.

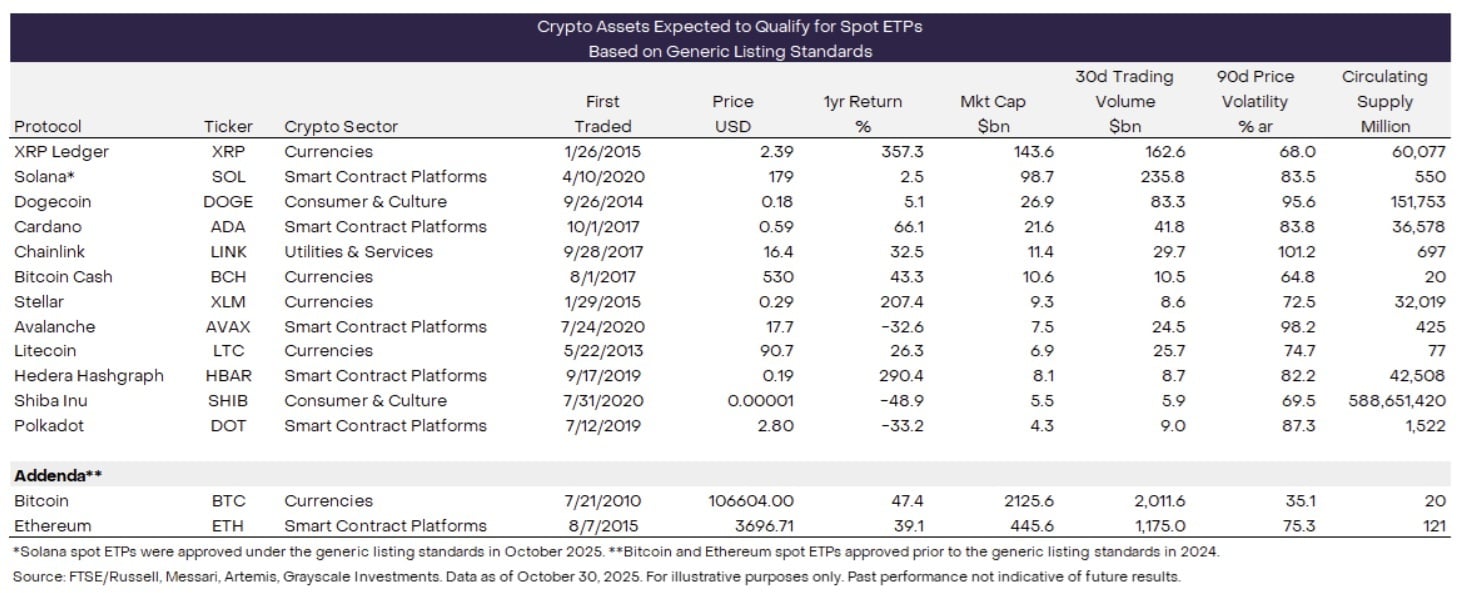

Grayscale’s list of crypto assets that may soon be available as U.S. ETPs. Source: Grayscale Investments

Grayscale added:

In addition to solana, Grayscale expects that 11 distinct crypto assets will qualify for ETPs based on the generic listing standards … Over time, the number of crypto assets that qualify under the new criteria will likely increase further.

The 11 crypto assets are XRP, dogecoin (DOGE), cardano ( ADA), chainlink (LINK), bitcoin cash ( BCH), stellar ( XLM), avalanche (AVAX), litecoin ( LTC), hedera (HBAR), shiba inu ( SHIB), and polkadot (DOT). This week, ETFs for LTC and HBAR already launched alongside a SOL ETF, reinforcing investor confidence that additional listings will follow.

According to its Crypto Sectors framework, developed with index provider FTSE/Russell, the eligible assets—together with bitcoin and ethereum—could represent nearly 90% of total crypto sector market capitalization. Market strategists interpret the move as a bullish signal that regulated ETPs will enhance liquidity, expand access, and accelerate long-term adoption across the altcoin sector.

- What impact will new U.S. regulations have on the altcoin market?

New U.S. regulatory clarity is expected to trigger a surge in altcoin ETPs, boosting liquidity and institutional participation. - How many crypto assets are expected to qualify for ETPs under the new framework?

Grayscale projects that at least 11 altcoins, alongside bitcoin and ethereum, will initially qualify for regulated ETPs. - Why is institutional adoption expected to rise after this development?

Regulated ETPs offer safer, transparent exposure, which could draw more institutional investors into diverse crypto assets. - What share of the crypto market could these assets represent?

Grayscale’s analysis suggests these qualified assets could account for nearly 90% of total crypto market capitalization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。