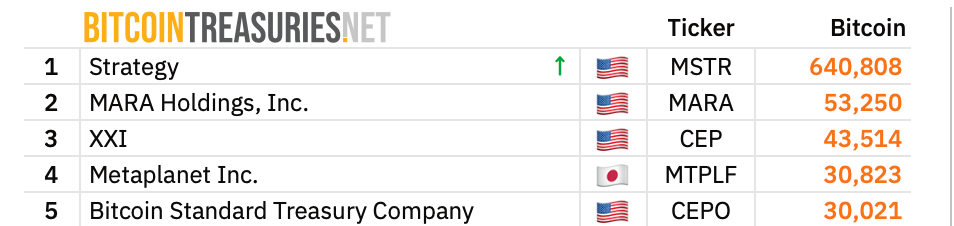

Corporate coin chests start with the obvious heavyweight: Strategy (MSTR) towers over the bitcoin field with 640,808 BTC, a lead so wide it reads like a different league. Bitcointreasuries.net data shows the chase pack is no slouch.

MARA Holdings (MARA) lists 53,250 BTC, XXI (CEP or 21 Capital) holds 43,514 BTC, Metaplanet (MTPLF) shows 30,823 BTC, and Bitcoin Standard Treasury Company (CEPO) reports 30,021 BTC—enough to make CFOs everywhere double-check their cold storage.

The top five bitcoin treasury firms on Nov. 1, 2025, according to bitcointreasuries.net.

Just behind them, the publicly-traded bitcoin exchange Bullish (BLSH) carries 24,300 BTC, the mining entity Riot Platforms (RIOT) fields 19,287 BTC, Trump Media & Technology Group (DJT) claims 15,000 BTC, and the trading platform and custodian Coinbase (COIN) keeps 14,548 BTC, and bitcoin miner Cleanspark (CLSK) lists 13,011 BTC.

The rest of the bitcoin top 20 shows how broad this treasury thesis has become: Tesla (TSLA) 11,509 BTC; Hut 8 (HUT) 10,667 BTC; Block (XYZ) 8,692 BTC; GD Culture (GDC) 7,500 BTC; Galaxy Digital (GLXY) 6,894 BTC; Cango (CANG) 6,394 BTC; Strive (ASST) 5,958 BTC; Next Technology Holding (NXTT) 5,833 BTC; KindlyMD (NAKA) 5,765 BTC; and Semler Scientific (SMLR) 5,048 BTC.

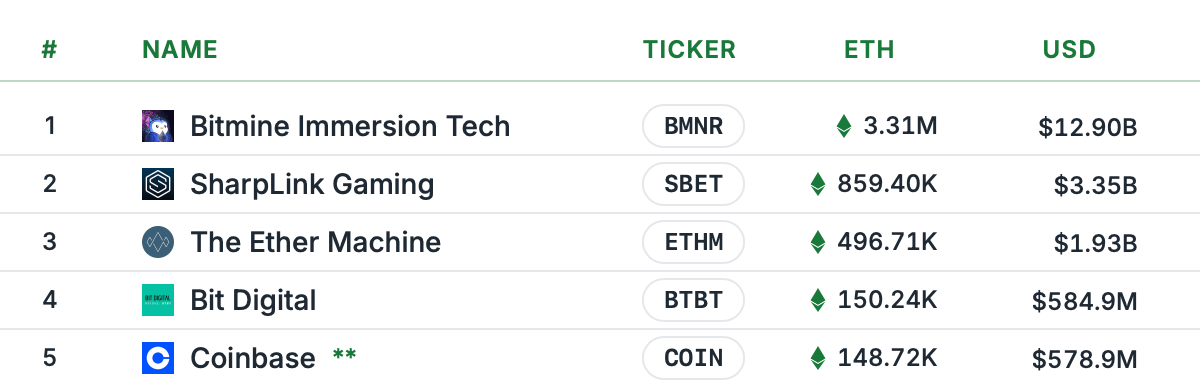

Ether tells a different tale—more distributed, more sector-hopping, and every bit as ambitious. At the top of the list collected from strategicethreserve.xyz‘s dashboard, Bitmine Immersion Tech (BMNR) holds 3.31 million ETH (about $12.90 billion).

Sharplink Gaming (SBET) follows with 859,400 ETH (~$3.35 billion), and The Ether Machine (ETHM) lists 496,710 ETH (~$1.93 billion). If you thought miners had all the fun, meet the gamers and infra builders.

The top five ether treasury firms on Nov. 1, 2025, according to strategicethreserve.xyz.

The middle ranks are tight. Bit Digital (BTBT) shows 150,240 ETH (~$584.9 million) and Coinbase (COIN) clocks 148,720 ETH (~$578.9 million). ETHzilla (ETHZ) posts 93,790 ETH (~$365.1 million) while BTCS (BTCS) holds 70,030 ETH (~$272.6 million). Market observers are watching ETHZ as the firm recently sold some of its ETH.

Rounding out the ether 20 treasury list from publicly traded firms: FG Nexus (FGNX) 50,770 ETH; Gamesquare (GAME) 15,630 ETH; Yunfeng Financial (0376.HK) 10,000 ETH; Intchains (ICG) 8,820 ETH; KR1 (KROEF) 5,530 ETH; IVD Medical (1931.HK) 5,190 ETH; Quantum Solutions (2338.T) 4,370 ETH; Ethero (ALENT) 3,120 ETH; Exodus (EXOD) 2,550 ETH; BTC Digital (BTCT) 2,140 ETH; Vault Ventures (VULT) 771.3 ETH; and Centaurus Energy (CTARF) with 137 ETH.

What jumps out? Exchanges appear on both lists, miners still matter, and media plus fintech names keep things spicy. Treasuries aren’t just hedges—they’re still calling cards in late 2025.

There’s a quiet geography here, too. U.S. tickers dominate, but Japan shows up with Metaplanet near the top of bitcoin and Yunfeng in ether, signaling Asian boardrooms are very much in the game.

If 2024 was about dabbling, 2025 reads like conviction: balance sheets turned billboards, and strategies written directly in sats and gwei.

- What sources back these figures? Bitcointreasuries.net for bitcoin and Strategicethreserve.xyz for ethereum. Statistics from this report were recorded on Nov. 1, 2025.

- Why do some firms appear on both lists? Exchanges and miners manage multi-asset operations and treasury strategies.

- Do these numbers change often? Yes—holdings can move with corporate actions and disclosures.

- Which regions lead today? Primarily U.S. issuers with notable entries from Japan and Hong Kong.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。