The native token of oracle network Chainlink bounced 3.6% on Friday, reversing some of Thursday's losses as traders stepped in around key support level.

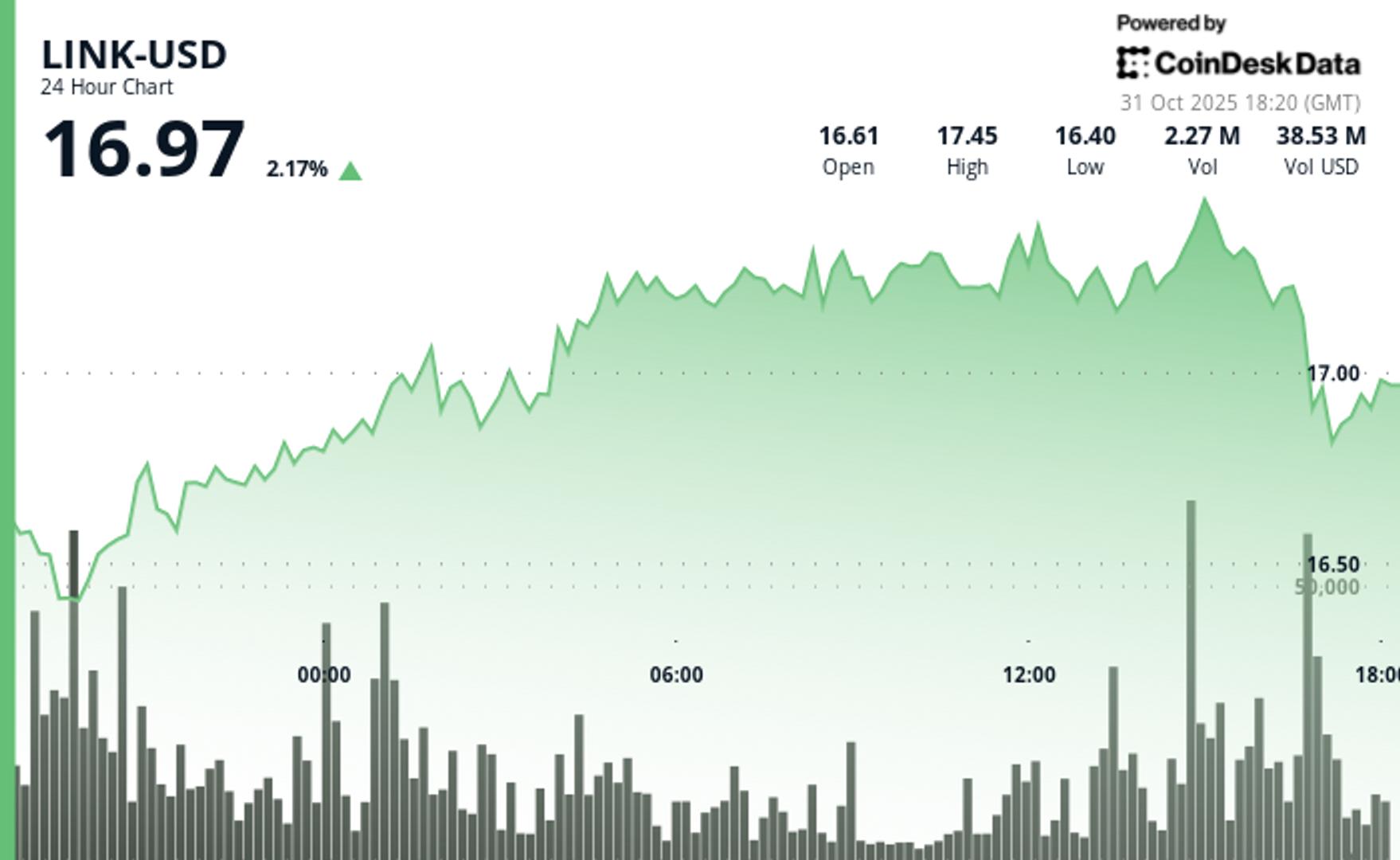

LINK briefly cleared the $17 level with a surge in trading volume — some 3 million tokens changed hands during a morning breakout up —, pointing to renewed accumulation, CoinDesk Research's market insight tool suggested. However, weakness during the U.S. trading hours drove LINK back below $17. Recently, the token traded at $16.96.

On the news front, payments-focused Stellar (XLM) announced to integrate Chainlink’s Cross-Chain Interoperability Protocol (CCIP), Data Feeds, and Data Streams. The move enables developers and institutions building on Stellar to access real-time data and trusted cross-chain infrastructure for tokenized assets.

With over $5.4 billion in quarterly RWA volume and a fast-growing DeFi footprint, Stellar’s adoption of Chainlink tooling signals expanding demand for secure, interoperable financial infrastructure.

Key technical levels to watch:

LINK now holds near-term support at $16.37 with upside targets at $17.46 and $18.00. Whether the token can build on Friday’s rebound may depend on broader market flows and follow-through from dip-buying.

- Support/Resistance: Solid support holds at $16.37 after multiple successful tests, while $17.46 resistance shows repeated rejection patterns.

- Volume Analysis: 78% volume surge during breakout attempt confirms institutional interest, explosive selling volume indicates position rebalancing.

- Chart Patterns: Late-session flush-out pattern creates classic oversold setup for accumulation strategies.

- Targets & Risk/Reward: Holding above $16.89 targets $17.46 retest with upside to $18.00, downside risk limited to $16.37 support.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。