Highlights of This Issue

This week's report covers the statistical period from October 24 to October 30, 2025. The RWA market continues to show steady growth, with a total on-chain market capitalization reaching $35.66 billion, an increase of 8.77% week-on-week, and the number of holders surpassing 520,000, indicating a continuous expansion of the user base. The transaction volume of stablecoins surged to $4.65 trillion, with monthly active addresses also rebounding, signaling a healthy expansion phase driven by efficiency in the market, with significant improvements in capital turnover efficiency. On the regulatory front, Canada and South Korea are accelerating the advancement of stablecoin regulatory legislation, while Europe is moving at a slower pace. The Hong Kong Monetary Authority has stated that it will establish a digital currency framework to promote the complementary coexistence of various tokenized currencies. On the project side, tokenization platforms Securitize and tZero have launched their listing plans, challenging traditional capital markets; JPMorgan has completed the tokenization of private equity funds on its self-developed blockchain and plans to launch an investment fund tokenization platform; Circle's payment public chain Arc has begun public testing, with traditional giants actively participating.

Data Insights

RWA Market Overview

According to the latest data from RWA.xyz, as of October 31, 2025, the total on-chain market capitalization of RWA reached $35.66 billion, an increase of 8.77% compared to the same period last month, with growth rate slowing down; the total number of asset holders exceeded 523,600, up 10.39% from the same period last month, indicating a continuous increase in market participation; the total number of asset issuers rose to 232.

Stablecoin Market

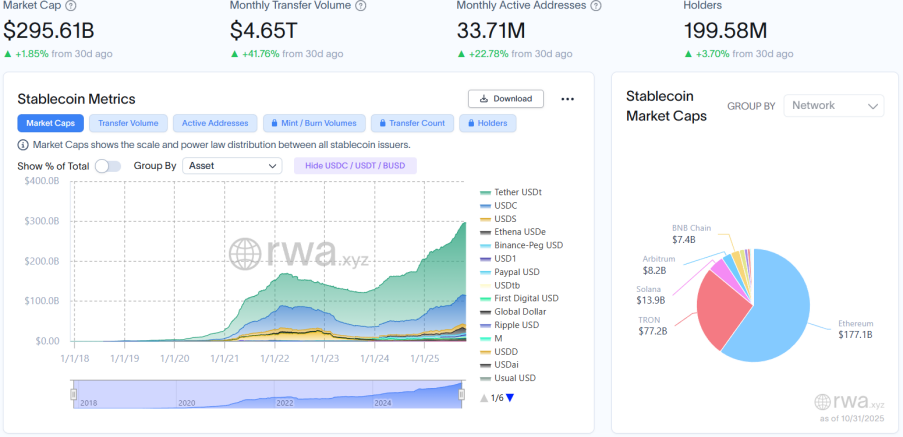

The total market capitalization of stablecoins reached $295.61 billion, a growth of 1.85% compared to the same period last month, achieving moderate growth; monthly transaction volume surged to $4.65 trillion, a significant increase of 41.76% compared to the same period last month; the total number of monthly active addresses rebounded to 33.71 million, up 22.78% from the same period last month; the total number of holders is approximately 200 million, a slight increase of 3.70% compared to the same period last month. Both metrics confirm that the market has entered a healthy expansion phase driven by "efficiency," with improvements in capital turnover efficiency and user activity creating a positive resonance. Data indicates that institutional settlement demand and retail trading inflow are working together, with explosive growth in transaction volume far exceeding market capitalization growth, highlighting the strengthening of on-chain payment and settlement functions. The leading stablecoins are USDT, USDC, and USDe, with USDT's market capitalization increasing by 3.82% compared to the same period last month; USDC's market capitalization saw a slight increase of 1.84%; while USDe's market capitalization further deteriorated, plummeting by 31.21% compared to the same period last month.

Regulatory News

Canada Accelerates Stablecoin Regulation, New Rules May Be Announced in Federal Budget

According to informed sources, Canada is in discussions regarding stablecoin regulatory rules and may announce a significant update in the federal budget to be released next week. These sources indicate that government officials have been in deep discussions with regulators and industry participants for weeks. It is reported that Canadian Finance Minister Chrystia Freeland will address this topic in the budget document to be released on November 4. In July of this year, the U.S. passed the Genius Act, authorizing financial regulators to oversee stablecoin issuers and their reserve management practices, requiring issuers to comply with anti-money laundering and sanctions evasion regulations. This new law has been welcomed by many in the crypto industry. However, in Canada, due to a lack of relevant legislation, regulators have indicated that stablecoins may constitute securities or derivatives. Some experts believe they should be regulated as payment tools with strict oversight.

According to Yonhap News Agency, South Korean National Power Party lawmaker Park Sung-hoon will lead the proposal of an amendment to the Foreign Exchange Transaction Act, aiming to formally include stablecoins as legally recognized payment methods. This move is intended to fill the regulatory gap in current laws and fundamentally eliminate illegal activities such as money laundering and tax evasion using stablecoins. The amendment explicitly adds stablecoins as one of the payment methods in the definition clause, meaning stablecoins will gain the same legal status as traditional payment tools like South Korean government banknotes, banknotes, and coins. This legislative trend echoes concerns raised by the Bank of Korea. In a recent written opinion submitted to the National Assembly, the Bank of Korea expressed concerns about the potential risks of dollar-pegged stablecoins, pointing out that they "may bypass the reporting procedures stipulated in the Foreign Exchange Transaction Act and be used for transactions in current accounts and capital accounts between countries."

Hong Kong Monetary Authority Chief Executive Eddie Yue announced in an article for "Hong Kong Economic Journal" that the next phase of the financial technology development blueprint will be released to ensure that Hong Kong remains at the forefront of financial technology. The Hong Kong Monetary Authority will explore central bank digital currency (CBDC) and build a new generation of data infrastructure, further researching tokenization to improve the financial system. Additionally, Hong Kong will establish a comprehensive digital currency framework to promote the complementary coexistence of digital HKD, tokenized deposits, and regulated stablecoins.

European Central Bank Aims to Launch Digital Euro Pilot in 2027

The European Central Bank stated on Thursday that it may launch its digital currency pilot project in 2027 if it can obtain timely approval from lawmakers. The European Central Bank considers this project crucial for the financial autonomy of the Eurozone. It views the project as a strategic alternative to U.S.-dominated private payment methods such as credit cards and stablecoins. The European Central Bank emphasized that this initiative is becoming increasingly important in an era of heightened geopolitical tensions, as financial autonomy and resilience are seen as key to maintaining European economic sovereignty. After four years of research and preparation, the European Central Bank indicated that it is currently considering conducting a pilot, which means that some digital euro transactions could occur as early as mid-2027, with a full launch two years later.

Local Developments

Hong Kong Expands Digital RMB Applications, Nearly 400 Convenience Stores Now Support e-CNY Payments

According to Caixin, Bank of China (Hong Kong) announced a partnership with convenience store chain Circle K and vending machine operator FreshUp. Starting from October 27, 2025, over 380 Circle K stores and the first 1,200 FreshUp vending machines across Hong Kong will officially support digital RMB (e-CNY) payments. Local residents and mainland visitors to Hong Kong can make e-CNY payments at these convenience stores and vending machines through the BoC Pay+ "Digital RMB Zone" or the "Digital RMB" app. Bank of China Hong Kong has upgraded the acquiring systems for Circle K and FreshUp and will automatically convert digital RMB into Hong Kong dollars to assist merchants with cross-border settlement.

Project Progress

Custodia and Vantage Bank Launch Real-Time Network for Tokenized Deposits for U.S. Banks

According to Decrypt, Custodia Bank and Vantage Bank Texas have launched a real-time network for tokenized deposits aimed at U.S. banks, expanding their previous pilot to a national network. The system supports switching between deposits and stablecoins compliant with the GENIUS Act. The platform is awaiting final regulatory approval for large-scale launch.

According to Financefeeds, Swiss cryptocurrency bank AMINA Bank has partnered with Luxembourg tokenization company Tokeny to provide a regulated digital securities issuance channel. This collaboration connects AMINA's bank-grade custody and settlement with Tokeny's ERC-3643-based issuance stack. The goal is to create a single platform that handles both primary issuance and qualified custody. The bank holds investor funds and supervises accounts under the framework regulated by the Swiss Financial Market Supervisory Authority (FINMA), while smart contracts execute qualification checks and transfer rules on-chain. Both companies stated that this could reduce the time to market for institutional issuers from months to weeks by eliminating custom integrations and reducing manual checks.

Tokenized Securities Market Platform tZero Prepares for 2026 IPO

tZero Group Inc. operates a securities market linked to digital tokens, and its CEO Alan Konevsky stated that the company plans to conduct an IPO in 2026. The company's investors include the Intercontinental Exchange (ICE). Konevsky mentioned that the company has been in discussions with bankers regarding the IPO but has not yet selected a partner. He also noted that the company is exploring pre-IPO financing simultaneously. The company, which has over 50 employees, has yet to turn a profit.

Circle Launches Public Testnet for Arc Blockchain, with Participation from Visa and BlackRock

According to CoinDesk, Circle (the issuer of USDC, CRCL) has launched a payment-oriented public test of its Arc blockchain, with over 100 institutions participating, including Visa, HSBC, BlackRock, AWS, Anthropic, Coinbase, and Kraken. Arc is positioned as a foundational layer for financial services, offering USD billing, sub-second settlement, optional privacy, and integration with Circle's payment system. Visa is testing stablecoin settlements to accelerate cross-border payments, while BlackRock is exploring stablecoin settlements and on-chain FX. Circle states that its long-term goal is decentralization, with open validators and governance.

Asset Tokenization Company Securitize to Go Public via $1.25 Billion SPAC Deal

According to The Block, Securitize has become the latest crypto-native company to announce plans to go public, with a pre-IPO equity valuation of $1.25 billion. This asset tokenization giant plans to go public in the U.S. through a special purpose acquisition company (SPAC) initiated by an affiliate of Cantor Fitzgerald. The merged company will be renamed Securitize Corp. and will trade on NASDAQ under the ticker SECZ, while the company also plans to tokenize its own equity.

The company stated that as part of the public listing process, Securitize also plans to raise a total of $469 million in proceeds to "enhance the company's balance sheet" and accelerate its business roadmap. This funding will partly come from a fully committed $225 million private equity investment in the public offering (PIPE), attracting new investors including Arche, Borderless Capital, Hanwha Investment & Securities, InterVest, and ParaFi Capital. Citigroup and Cantor will act as joint placement agents for this PIPE transaction. Securitize announced that existing shareholders, including ARK Invest, BlackRock, Blockchain Capital, Hamilton Lane, Jump Crypto, and Morgan Stanley Investment Management, will transfer 100% of their equity to the merged company.

Decentralized finance protocol Grove disclosed on its official blog that Securitize today announced the launch of the Securitize Tokenized AAA CLO Fund (STAC), which focuses on tokenized investments in AAA-rated CLO tranches. The fund is custodied by Bank of New York Mellon (BNY) and advised by its subsidiary investment firm Insight. Pending governance approval, Grove will provide $100 million in anchor investment for STAC. Fund shares will be issued in the form of Ethereum digital tokens, and eligible investors can subscribe through the Securitize platform.

Ondo Expands Its Tokenized Products to BNB Chain

According to Cointelegraph, RWA tokenization platform Ondo Global Markets has expanded its tokenized products to the BNB Chain, allowing BNB Chain users to trade over 100 Wall Street stocks and ETFs. Ondo stated in a release on Wednesday: "This integration allows BNB Chain to access over 100 tokenized U.S. stocks and ETFs, supported by ecosystem projects like PancakeSwap."

According to The Wall Street Journal, JPMorgan has completed a pilot for the tokenization of a private equity fund on its proprietary blockchain network, aimed at achieving on-chain representation and settlement of fund shares to enhance liquidity and transparency. JPMorgan plans to officially launch an "Alternative Investment Fund Tokenization Platform" in 2026, providing on-chain issuance and trading services for private equity, credit, and other non-public market assets to institutional clients.

Japanese Startup JPYC to Launch First Yen-Pegged Stablecoin

According to Reuters, the world's first stablecoin pegged to the yen will be launched in Japan on Monday. Japanese startup JPYC announced that it will begin issuing a stablecoin fully redeemable for yen, backed by domestic savings and Japanese government bonds (JGB). The JPYC stablecoin will initially not charge transaction fees to focus on expanding its usage, instead earning revenue through interest from holding Japanese government bonds.

According to CoinDesk, Japanese payment infrastructure provider TIS, with an annual transaction volume of $2 trillion, has teamed up with the Avalanche team to launch a multi-token platform based on AvaCloud, supporting the issuance and settlement of stablecoins, tokenized deposits, and future central bank digital currencies (CBDCs). The platform complies with Japan's Payment Services Act and aims to promote the transformation of financial infrastructure towards programmability and real-time settlement. TIS will collaborate with banks, enterprises, and government agencies to promote the global application of this system.

Tokenized Stock Trading Platform MSX Launches Spot and Contract Targets in Three Tracks

According to official news, MSX has completed spot and contract trading for communication and optical network provider $NOK.M and clean energy company $NEE.M. Spot trading for integrated power company $VST.M has also been newly launched.

Insights

According to The Block, Standard Chartered Bank stated that excluding stablecoins, the market capitalization of real-world asset tokenization (RWA) is expected to grow from approximately $35 billion to $2 trillion by 2028, an increase of about 5600%. The bank's head of digital asset research, Geoffrey Kendrick, noted that stablecoins lay the foundation for the large-scale on-chain representation of other assets, with "most" of these activities occurring on Ethereum due to its over 10 years of uninterrupted mainnet operation. Kendrick estimates that by 2028, tokenized money market funds and listed stocks will account for the largest share, with money market funds driven by corporate use of stablecoins accounting for $750 billion, and listed stocks expected to account for another $750 billion once U.S. regulations become clearer. Kendrick believes that lending, especially RWA, is key to DeFi disrupting traditional finance, as DeFi has initiated a growth cycle. The U.S. Genius Act accelerates the adoption of stablecoins, and the Digital Asset Market Clarity Act is expected to further legalize asset tokenization; even without this act, regulatory agencies may act under clear rules, although the lack of clarity in U.S. regulation remains a risk.

PANews summarizes: This article discusses how payment giant Mastercard is planning to acquire stablecoin infrastructure company Zerohash for up to $1.5 to $2 billion, signaling a strong commitment from traditional financial giants to embrace blockchain technology and integrate stablecoins into their core payment systems. This is not an isolated case; previously, payment company Stripe acquired a similar company, Bridge, indicating that the traditional payment industry is undergoing a "bidding war" for stablecoin and blockchain infrastructure companies. Unlike competitors focused on payment applications, Zerohash offers a broader range of technical products, including APIs to help financial institutions build cryptocurrency trading platforms and tokenize traditional assets. Therefore, Mastercard's potential acquisition is seen as a key strategic move aimed at seizing the future global payment pillar—"blockchain infrastructure"—marking a significant shift in the "payment war" towards blockchain.

U.S. Treasuries and Stocks on Chain Reshape Wall Street, RWA Institutional Turning Point Has Arrived

PANews summarizes: The core argument of this article is that traditional financial assets represented by U.S. Treasuries and stocks are being massively "tokenized" and moved onto the blockchain, marking a critical turning point where "real-world assets on-chain" transition from a conceptual experiment to acceptance by mainstream financial institutions. The development path is clear: first, on-chain representation of assets that generate stable cash flows, such as government bonds and private credit, to build a reliable "yield base"; then, based on this foundation, tokenizing equity assets like U.S. stocks and ETFs through blockchain technology, enabling nearly 24/7 uninterrupted trading accessible to global investors. The core value of this transformation lies in its combination of blockchain efficiency (such as round-the-clock trading and rapid settlement) with traditional financial compliance frameworks (such as KYC verification and asset custody). Platforms like Ondo Finance have successfully attracted institutional investor participation by designing compliant product structures and technical solutions, thereby reconstructing Wall Street's asset distribution model and creating a more efficient and transparent new infrastructure for global capital allocation.

The Realization of RWA: Ondo Finance's On-Chain Bond Experiment and Institutional Innovation

PANews summarizes: This article delves into the latest developments in "real-world assets on-chain," particularly the successful practice of companies like Ondo Finance in converting low-risk, income-generating traditional financial assets such as U.S. Treasuries into on-chain tokens. Ondo has issued tokens like OUSG and USDY by investing funds in short-term U.S. Treasuries, allowing investors (from qualified institutions to global retail users) to securely and transparently obtain stable returns on the blockchain. The success of this model lies in its clever integration of compliant legal structures, reliable technical architectures (such as cross-chain circulation and net asset value oracles), and strict risk controls (such as asset isolation and tiered redemption mechanisms), thereby earning the trust of institutional investors. This marks a transition of blockchain from a mere accounting tool to a new generation of infrastructure capable of supporting mainstream financial assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。