Coinbase's "Everything Exchange" Accelerates Formation.

Written by: KarenZ, Foresight News

On the last day of October, Coinbase released its Q3 2025 financial report, showcasing strong operational resilience and growth potential. It achieved double-digit quarter-over-quarter growth in both revenue and profit, and made key progress in advancing its "Everything Exchange" strategy, stablecoin and payment services, derivatives business breakthroughs, and expansion of custody services.

Core Financial Highlights

Revenue Structure: Q3 Total Revenue of $1.869 Billion, Trading Revenue Accounts for 56%

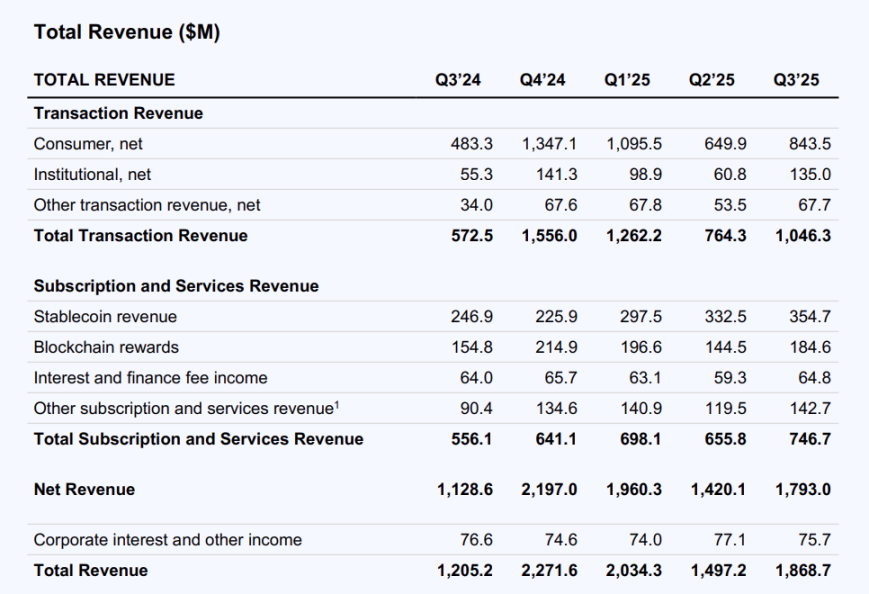

Total revenue for Q3 reached $1.869 billion, a quarter-over-quarter increase of 25%, driven primarily by the recovery in trading business and steady growth in subscription services.

Among this, trading revenue grew 82.7% year-over-year to $1.046 billion, with a quarter-over-quarter increase of 37%. Of this, retail trading revenue from individual users reached $844 million, accounting for over 80% of total trading revenue; institutional trading revenue was $135 million, with a staggering quarter-over-quarter growth of 122%, mainly due to business synergies following the acquisition of Deribit.

Subscription and service revenue reached $747 million, a quarter-over-quarter increase of 14%, with diverse revenue sources continuing to thrive, including stablecoin-related income ($355 million), blockchain rewards ($185 million), and interest and financial service fees ($64.8 million).

How to Reduce Costs and Increase Efficiency?

Operating costs decreased by 9% quarter-over-quarter to $1.388 billion; however, core investments in technology R&D and marketing increased (including the acquisition of Deribit).

Net profit was $433 million, adjusted net profit was $421 million, and adjusted EBITDA reached a remarkable $801 million.

Cryptocurrency Accumulation

Coinbase increased its holdings by 2,772 BTC and 11,933 ETH in Q3, bringing total Bitcoin holdings to 14,458 and total Ethereum holdings to 148,715.

Core Platform Data

Platform Assets: Coinbase holds or manages assets worth $516 billion on behalf of clients, with custody assets surpassing $300 billion for the first time, setting a new historical high, partly due to Coinbase being the primary custodian for the majority of cryptocurrency ETFs.

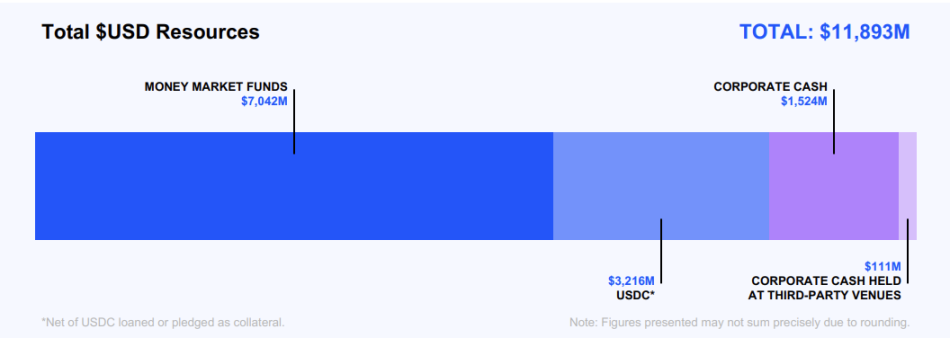

Liquidity Reserves: As of the end of Q3, Coinbase had $11.9 billion in USD assets (including $7.042 billion in money market funds, $1.524 billion in corporate cash, and $3.216 billion in USDC), a quarter-over-quarter increase of 28%, mainly driven by the issuance of $3 billion in convertible bonds and revenue growth. Including $2.6 billion in crypto assets for investment and $1 billion in crypto collateral assets, total available resources reached $15.5 billion.

Trading Volume: In Q3, Coinbase's global cryptocurrency spot trading volume increased by 38% quarter-over-quarter, while US cryptocurrency spot trading volume grew by 29%, totaling $295 billion. Among this, retail spot trading volume increased by 37% quarter-over-quarter to $59 billion, showing significant improvement in activity.

USDC Related Scale: The market capitalization of USDC reached a historical peak of $74 billion in Q3, with an average USDC balance on the Coinbase platform of $15 billion, a quarter-over-quarter increase of 9%.

Customer Scale: The number of active clients in institutional financing business achieved double-digit quarterly growth, with an average loan balance of $1.2 billion, setting a new historical high.

Employee Count: The number of full-time employees increased by 12% quarter-over-quarter to 4,795.

Strategic Implementation: "Everything Exchange" Blueprint Accelerates Formation

Coinbase continued to advance its "Everything Exchange" strategy in Q3, accelerating the construction of a comprehensive financial services platform through asset coverage, business extension, and ecosystem improvement.

Dual Breakthrough in Asset Coverage and Derivatives Business

Spot asset coverage continues to expand, meeting users' diverse investment needs through access to DEX on Base.

The derivatives business achieved milestone growth, completing the acquisition of Deribit and launching US-compliant perpetual futures and 24-hour continuous trading services.

The financial report shows that institutional trading revenue for Coinbase reached $135 million in Q3, a significant quarter-over-quarter increase of 22%, with Deribit contributing $52 million in revenue, accounting for nearly 39% of institutional trading income, primarily driven by the continued growth of its options trading business. Following the acquisition, Deribit significantly boosted Coinbase's nominal trading volume in the global crypto options market, with a combined nominal trading volume of over $840 billion in Q3.

At the same time, Deribit's inclusion directly propelled Coinbase's market share in the core derivatives market. Overall, Q3 performance indicates that Deribit has initially transitioned from an "acquisition target" to a "strategic asset": in the short term, it brought dual growth in revenue and market share to Coinbase; in the medium term, it improved the business ecosystem through product and customer synergy; and in the long term, it built a barrier for competition in the compliant derivatives market. As institutional demand for crypto options continues to grow, Deribit is expected to become one of Coinbase's core growth engines in the next 1-2 years.

Stablecoin and Payment Scenarios Accelerate Penetration

In Q3, Coinbase users held an average of $15 billion worth of USDC.

Payment scenarios continue to expand: Coinbase launched payment APIs and B2B payment UI/APIs, allowing businesses to embed stablecoin checkout and 24-hour payment features using USDC via the Base chain.

Coinbase One Card integrates cryptocurrency rewards into fiat payments, with total spending exceeding $100 million.

Promoting the x402 Protocol: This protocol allows stablecoin payments to be attached to any network request and has attracted partners like CloudFlare, Vercel, and Google; Coinbase also released the open-source toolkit Agent Kit, supporting AI agents to integrate stablecoin wallets, seizing new opportunities in internet payments and AI agent payments.

Base Upgrade and Ecosystem Expansion

After launching on the Flashblocks mainnet, Base further reduced block confirmation time to 200 milliseconds, enhancing transaction efficiency.

The Base testnet introduced cross-chain capabilities between Base and Solana, allowing users and developers to transfer assets more easily between the two networks, with mainnet support set to launch in Q4.

The Base App entered the testing phase in Q3, integrating various functions such as trading, social, and payment, while the embedded wallet lowers the entry barrier for users.

Capital Formation: Acquisition of Echo to Expand Business

In late October, Coinbase announced the completion of its acquisition of Echo for approximately $375 million (composed of cash and stock).

Coinbase co-founder and CEO Brian Armstrong emphasized during the Q3 earnings call that crypto technology will revolutionize the financial system, and capital formation is an important part of this. The acquisition of Echo can help Coinbase secure a position in the capital formation space.

Brian Armstrong continued to state that Echo enables anyone to raise funds more easily, and with over $500 billion in assets on the Coinbase platform, along with a large number of retail institutional clients or accredited investors looking to invest in unique assets, the combination will create a powerful bilateral market, making capital formation more efficient and allowing more people to participate.

Coinbase President and COO Emilie Choi also pointed out that Echo's management team can accurately assess which companies and tokens have growth potential. If Echo successfully launches these outstanding companies and tokens, it will help Coinbase expand its upstream business, as this involves the issuance phase of tokens before they enter exchanges, representing a strong vertical integration that is very beneficial to Coinbase's entire product ecosystem.

Summary

Coinbase's Q3 performance conveys several important signals: first, the growth of stablecoins, institutional financing, and custody services indicates that institutional-level demand is continuing to expand. Additionally, Coinbase's diversification strategy is proving effective. Although trading revenue still accounts for a high proportion, the growth rate of subscription and service revenue indicates that Coinbase is building a more stable revenue foundation.

According to Coinbase's financial report, Coinbase will continue to deepen its layout in "spot, derivatives, stocks, prediction markets, and commodities" across all categories of trading, and leverage Echo's advantages to strengthen its position in capital formation. It will also enhance the ecosystem aggregation capabilities of the Base chain and expand its global market share by developing compliant businesses in emerging markets such as Brazil and India.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。