Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

On October 22, top venture capital firm a16z released the “2025 Annual Report on the Crypto Industry”, vividly annotating the current market maturity. The report paints a picture of ecological prosperity: the cryptocurrency market continues to expand, traditional financial institutions are systematically embracing this new asset class, and stablecoins have evolved into an important force in the global macroeconomic system. Meanwhile, the improvement of blockchain infrastructure and its deep integration with cutting-edge technologies like AI are opening new golden cycles for the crypto industry.

Behind these grand trends is the participation and choice of countless real individuals. The shared “underlying consensus” among them can be traced back to the 9-page “Bitcoin White Paper” written by Satoshi Nakamoto 17 years ago. The peer-to-peer electronic cash system, proof-of-work mechanism, and distributed ledger structure proposed in that document form the initial trust foundation of today’s crypto ecosystem. The white paper is not just a technical proposal but a social experiment—an idea about decentralization, transparency, and self-sovereignty. Today, the technological ideals have long transformed into market realities, becoming the starting point for the behavior patterns of tens of thousands of traders.

On the 17th anniversary of the white paper's release, rather than simply revisiting that technological revolution, we hope to explore: How have these ideals gradually shaped today’s market behavior? And who is continuing its rhythm?

To this end, Odaily, in collaboration with Bitget, conducted a survey from October 24 to October 30, targeting traders covering various assets such as mainstream coins, altcoins, and meme coins through a combination of community push and targeted invitations. The aim was to capture an answer to a question from a micro perspective—how do real traders think, make decisions, and adapt to volatility in a crypto world woven together by grand narratives and market desires?

No Philosophy in Trading: Humanity and Volatility in a Questionnaire

This is a group of sufficiently vivid real traders. They cannot outline the entirety of the crypto market, but they serve as windows into individual worlds. Through the returned questionnaires from this survey, we see not cold numbers, but a collage of vibrant trader faces, each narrating their experiences, collectively piecing together the investment landscape of this era.

The tone of this collective portrait is very clear: primarily young individuals under 35, with contract trading experience concentrated in 1-3 years, most having a background in cross-asset investment (such as stocks and gold), trading frequently, but with a win rate generally hovering around “fifty-fifty.”

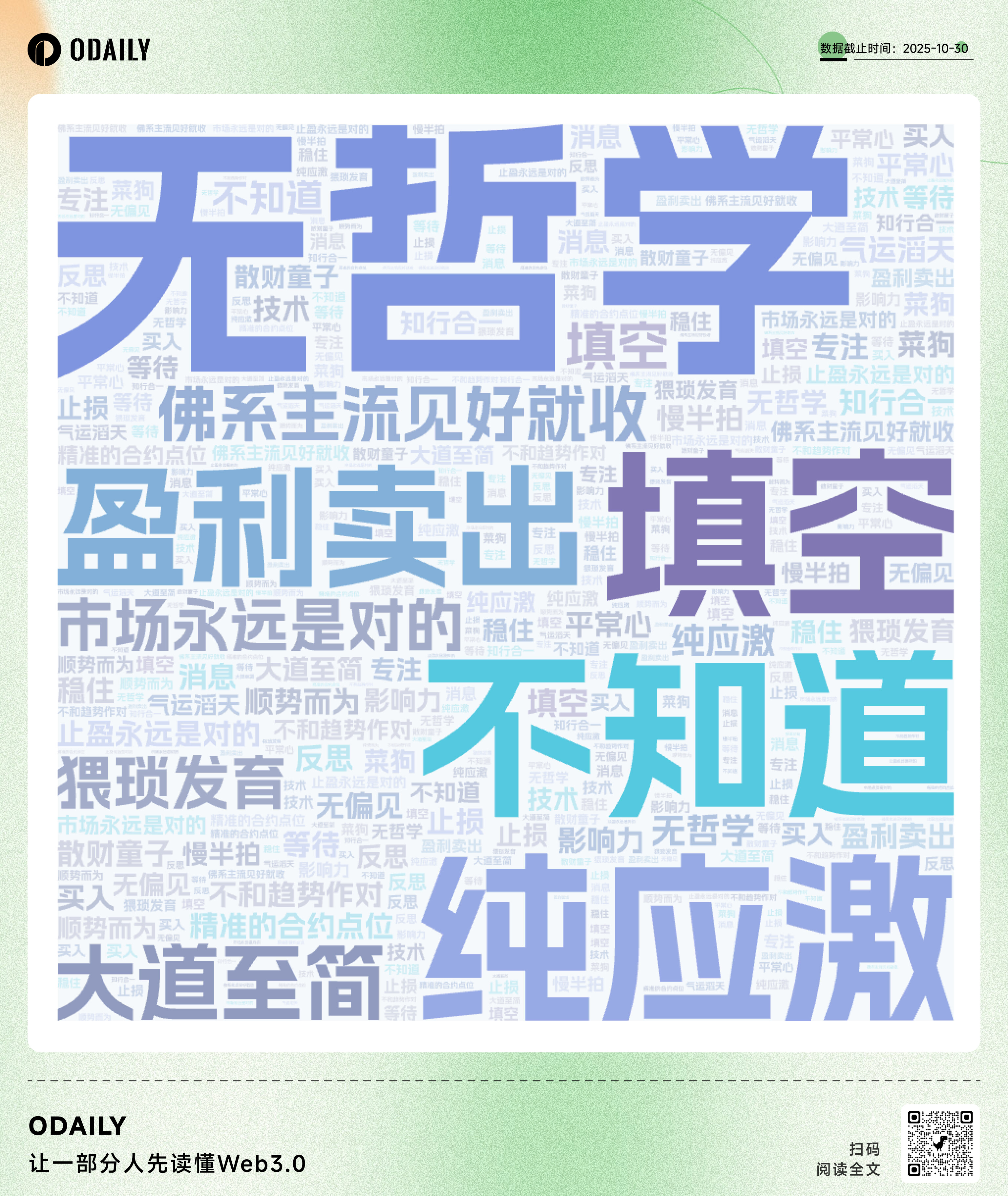

Overview of keywords in trading philosophy

However, one prominent feature runs throughout—a widespread state of “no philosophy.” When asked about their trading philosophy, as many as 80% of respondents unanimously chose “no philosophy, purely reactive.” This somewhat self-deprecating summary accurately reflects the true ecology of most: their decisions heavily rely on “market sentiment/news,” and their actions resemble instinctive reactions to market fluctuations rather than systematic judgments.

In this commonality, the differences between individuals become particularly vivid. The persona of Jack Wang (pseudonym) precisely captures the core characteristics of a “reactive” trader. Despite coming from a background that values logic and rigor in the technology or internet industry and having one to three years of contract experience, Jack’s trading behavior presents a stark contrast: he heavily relies on market sentiment and news for high-frequency operations (trading more than once a day), with a very short decision chain. This model has led his trading career to resemble a high-speed roller coaster—at his brightest moment, he “all-in on Bitcoin and made 10,000 U,” while his most painful experience was having all leveraged positions liquidated during the “10.11 crash.” He summarizes his win rate as “half sea water, half flame,” while his overall investment return is a disheartening “all lost.”

In the face of the extreme volatility on 10.11, his first reaction was “wait and see/confused,” which reveals the true dilemma of most emotion-driven traders: even though he has allocated to gold and stocks outside of cryptocurrencies and possesses a certain awareness of diversification, in the face of the high volatility of contracts, the systematic risk control framework often succumbs to instinctive reactions.

Outside of trading, he strives to maintain a “normal person’s routine” and uses “foot baths and massages” as a way to relieve stress. This oscillation between high tension and attempts to relax makes him a clear and real footnote in the crypto world—an ordinary person constantly seeking balance between a rational professional background and a nonlinear market.

In contrast, Melody Li’s profile reveals a more complex psychological layer. Like Jack, she comes from the technology or internet sector and brings analytical skills into her trading decisions: focusing on altcoins, she bases her operations on fundamental analysis, maintaining a trading frequency of several trades per week. This rational framework once brought her shining moments—she started building positions in ORDI when it was only 5 to 8 dollars, witnessing it rise to 96 dollars.

However, the starting point of success also became a source of regret. She ultimately lamented that she “didn’t run when the market moved,” failing to lock in profits in time. The “roller coaster” style of regret became a more tormenting experience than simple losses. Even during the 10.11 crash, her reaction was filled with contradictions: on one hand, “wait and see/confused,” while on the other hand, she also entertained thoughts of “adding positions to bottom fish,” showcasing the common hesitation and greed of traders.

More concerning is the deep erosion of trading into her life. Melody focuses solely on cryptocurrencies and has no other investment preferences; this full immersion gradually alters her life trajectory: her routine is turned upside down, and she has “no hobbies outside of trading.” This candid confession reveals the invisible pressure that new traders endure while adapting to the high-intensity market rhythm—not only the fluctuations of funds but also the invasion of life rhythms and personal space.

Thus, Melody’s image transcends a simple narrative of gains and losses, revealing the real dilemmas faced by many traders transitioning from the tech field to the crypto world: even with a rational analytical framework, it is difficult to completely avoid emotional disturbances, and in the pursuit of Alpha, they constantly confront the blurring boundaries between life and trading.

Of course, the collective portrait also includes more glamorous figures. For instance, Ricardo Ge, who enjoys poker, is a seasoned trader focusing on meme coins for over three years. These Alpha information seekers typically prefer the primary market information paths provided by Bitget, project tracking tools for initial offerings, and GetAgent for decision support. With a keen sense of market sentiment, he achieved a tenfold return on a single coin on AIOS, earning 200,000 U. The story of this successful player paints a picture of a seasoned individual profiting in a high-risk field through experience and courage.

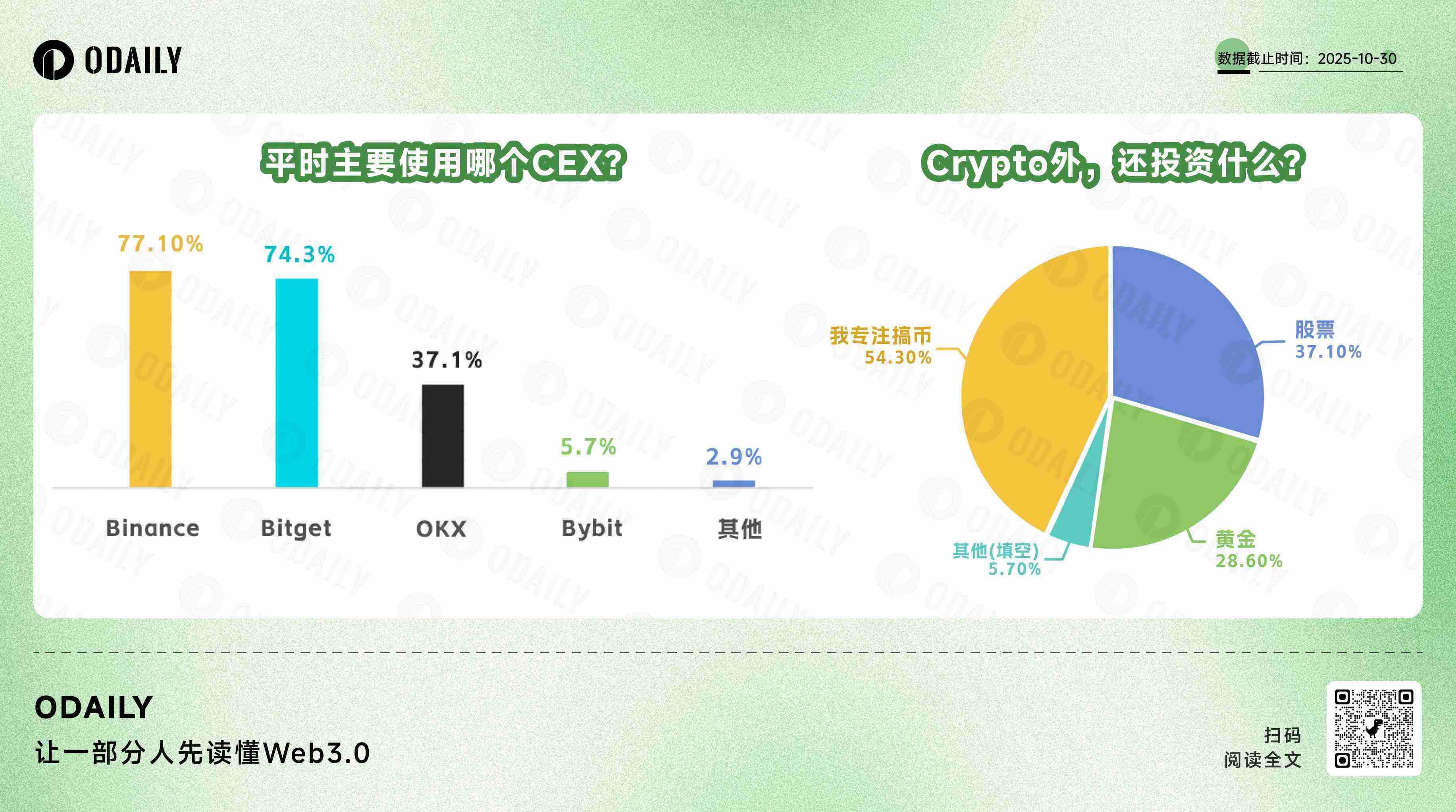

CEX choices and external investment targets (the first question allows multiple selections)

Participant Mark (pseudonym) represents another direction; he is a seasoned “old bull” in the circle, trading for over three years, primarily focusing on mainstream coins. His experience is quite representative: from making small profits during the “mining machine mining” era to “always losing” after contracts, and he has personally experienced multiple black swan events like “9.4.” He condenses his trading philosophy into “the great way is extremely simple, knowing and acting as one,” embodying an explorer who persists in introspection amidst market fluctuations, attempting to elevate complex experiences into simple rules.

Looking at these faces, from the confused “pure reactives” to the reflective ones under pressure, to the periodically winning profit-takers and the seekers of balance, the internal tension of the crypto trading ecosystem is clearly visible. This world amplifies human weaknesses while testing extreme rationality. The deep paradox it reveals is that a group of participants with cognitive abilities and focus often make highly emotional decisions in a market that heavily relies on discipline.

This fracture between rational cognition and reactive behavior may be the most authentic and cautionary backdrop in the field of crypto trading.

Market Ukiyo-e: Strategies, Philosophies, and Lives of Five Traders

No one can teach you how to survive in the crypto world; every trader must explore their own script. In this chaotic theater, we have gathered five low-profile yet stylistically diverse practical players, attempting to depict a “market ukiyo-e”—their strategies, philosophies, and lives collectively form a manual beyond the white paper.

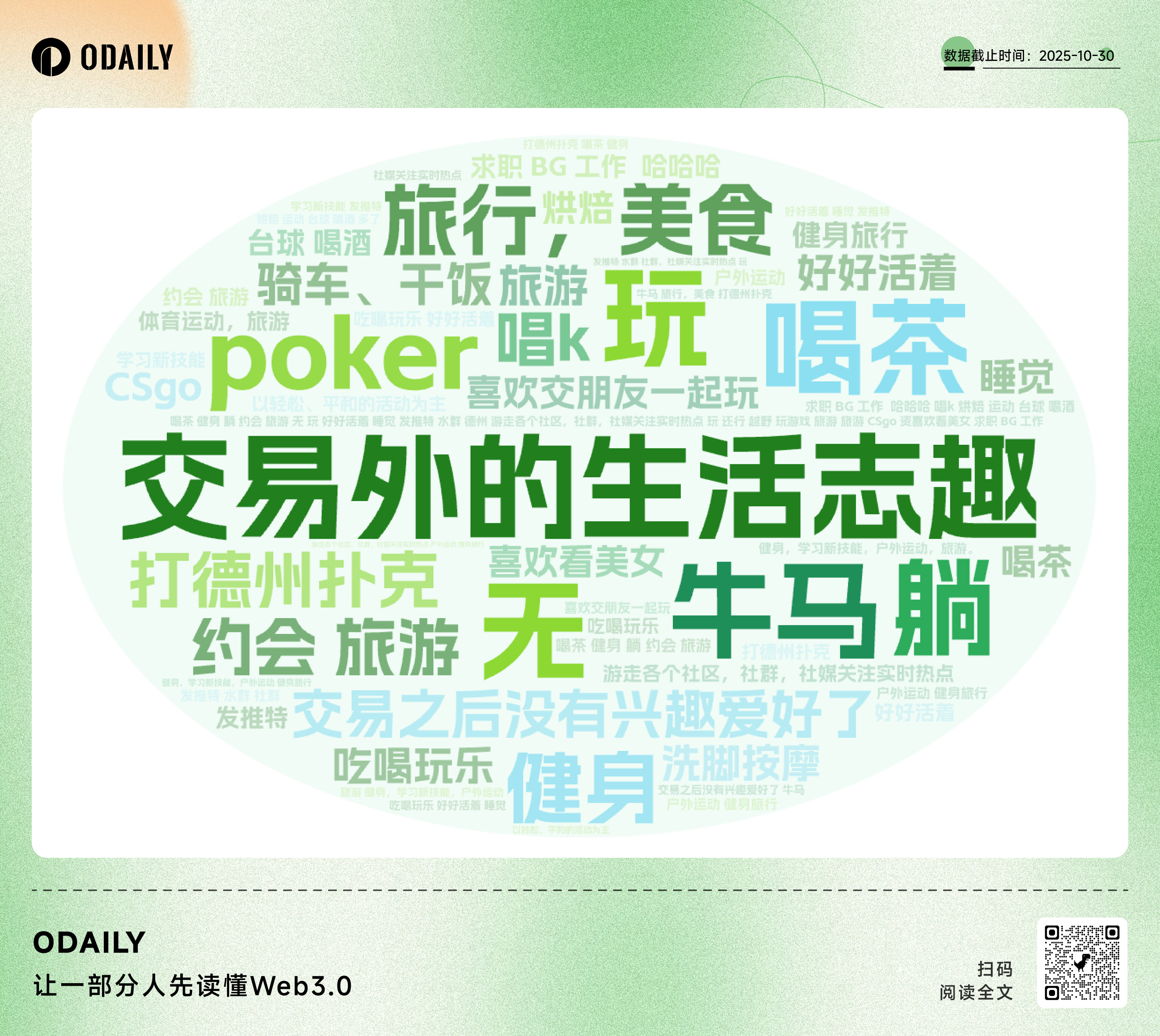

Overview of traders' interests and lives outside of trading in the survey

Respondent One: One cannot only focus on the market; one must occasionally look at the sky

Full-time research and trading trader Araki in the crypto world (@HM010169), primarily focusing on altcoins, has over three years of contract experience. His world consists of two dimensions—system and enlightenment. In the system, he is an extremely calm architect; in the moment of enlightenment, he resembles an observer awakened by life.

When evaluating early projects, he has developed a “four-dimensional scale”: team (35%), track (25%), economic model (25%), community (15%). The team is the top priority; he only trusts those with solid resumes, strong execution, and founders backed by YZi Labs or a16z; he prefers explosive sectors, especially emerging tracks with essential logic like AI Infra, RWA, and DePIN; the economic model is like a math problem—team ≤20%, private placement ≤25%, ecosystem ≥40%, bound to actual use, and preferably set with linear release and buyback mechanisms; even though community weight is the lowest, the requirements are not vague: it must be organically grown, multilingual penetration, and high interaction frequency.

When acquiring information, he executes an almost rigorous “Alpha Hunting Three-Step Method”: First, only trust the source, not intermediaries; the sources of information are limited to project parties, VC wallets, and Builder movements. Second, cross-verify using on-chain data, official statements, and community enthusiasm; at least two must align before considering action. Third, test the natural fermentation level of the information in multilingual communities; the bottom line is—“real news grows on its own, fake news relies on shouting.”

In terms of VC project trading strategies, he prefers a calculated layout. On the day of TGE, he first locks in 30-40% profit as a stop-loss buffer, then assesses positions based on the unlocking rhythm, market depth, and narrative enthusiasm, usually deciding to increase or exit positions on the 7th day. For example, $VULT: low FDV, high circulation, launched on Kraken, strong enthusiasm, and the narrative hits all points—this type of coin can bet 60-70% on the mid-term, but the premise is that the VC hasn’t dumped, tweets are ongoing, and the ecosystem is active; otherwise, he will clear positions with one click.

This entire process is precise and calm, almost machine-like. But the real him, outside the system, has a past where he was once held hostage by market conditions. He once self-deprecatingly said, “I can’t do anything but watch the market,” until one morning, when sunlight fell on his coffee cup and the aroma rose, he suddenly realized: the market can drain a person, but life can also heal slowly. Since then, he has set a few life disciplines for himself: brewing coffee in the morning, not to energize, but to spend a few minutes away from the market; running two kilometers in the afternoon to reset his brain; watching the market when it moves, but no longer emotionally—“if I get liquidated, I close the computer, light a cigarette, and if I can’t earn, so be it.”

He said, “The crypto world teaches me about volatility, life teaches me to let go.” His ultimate realization is not in charts or models, but in that moment after countless hours of staring at the market when he suddenly looks up—“One cannot only focus on the market; one must occasionally look at the sky.”

Respondent Two: The Mainstream Coin Hunter with Discipline as a Blade

With ample real trading experience, Mandy (@mandywangETH) is the type of contract player who only trusts rules and does not rely on luck. She primarily focuses on mainstream coins, with a calm and decisive style, summarizing her core logic in one sentence: the market cannot be predicted, reactions must be precise.

Her operational system almost eliminates all “feelings”—she only focuses on price action, using data as supporting evidence, while emotions are kept outside the system. What constitutes an exit signal? It is not a vague “it seems to have reversed,” but rather a complete breakdown of major support + weak rebound confirmation; once established, she exits without hesitation. She says, “The market is always right; my task is not to question but to obey.”

In a bull market, she holds firm at key points, riding the entire wave of the trend; in a bear market, she hides in the grass, waiting for hunting signals. “The cycle dominates strategy, and discipline ensures execution.” She does not chase news, does not trust KOLs, does not tell stories, but relies on structure to build trading order.

She has no illusions about the future market trends—she does not believe in predictions; the only things she can control are her own rules and reaction speed.

Her lifestyle is also extremely simple; outside of trading, she enjoys “eating, drinking, and having fun,” but with clear boundaries and never indulging. Once a crypto bull, she used to have erratic hours, trade emotionally, and face continuous liquidations; now she survives with a clear system, no longer fantasizing about getting rich, nor dancing chaotically with the market.

She won’t tell you the best entry point, but she certainly knows when to exit. Because she is not someone who guesses the future, but a hunter who obeys reality. In her world, emotion is a trap, certainty is a weapon.

Respondent Three: The Cautious and Keen “Stealth Development Faction”

While traveling, the “artist” (@CryptoPainter_X) occasionally opens Bitget to monitor the market; he is a typical “cook based on the ingredients” type of practical trader, not superstitious about a unified logic but flexibly adjusting strategies based on the attributes of different coins. Mainstream coins with profitability and strong fundamentals tend to be held long-term; emotionally driven targets are primarily for short-term speculation.

Behind this flexible combination is a profound understanding of market structure and risk management. The stablecoin supply ratio and the futures-to-spot price difference are the two most frequently referenced indicators— the former measures the willingness of off-market funds to enter, while the latter reflects emotional intensity and directional momentum. In his view, data is not a decorative “proof,” but a fundamental constraint of the trading system, used to calibrate emotions and intuition. His overall style is calm and pragmatic: supported by indicators, with a feedback loop.

He refers to his trading philosophy as “stealth development,” which is not self-deprecating but a proactive choice after cognitive maturity. High win-rate strategies are not reliant on explosive gambling but on controlling uncertainty. He does not chase high positions, does not gamble on low positions; when the trend is unclear, he reduces positions, observes, and waits, trading space for time, reserving room for the next attack.

When judging trend reversals, he rejects “knee-jerk” decisions, relying on structural signals—whether high and low points are alternating downwards. This logic was validated during the “10.11 crash”: increasing positions in strong coins and stopping losses in weak coins, executing both directions. That is not courage, but a rational execution based on structure.

Coming from a technology and internet background, he retains a programmer-like rationality in trading. Now, he resembles a data-driven market veteran—he doesn’t shout “All in,” doesn’t trust KOLs, but relies on his self-built system and strict discipline. That system has allowed him to achieve 52 times returns on his capital, embodying the truth of the saying, “The real enemy is not volatility, but arrogance and impulsiveness.”

In a market that frequently touts “opportunity windows,” calm individuals like him, who do not rely on winning once but ensure they do not lose too badly each time, form the most overlooked yet stable force in the crypto market.

Respondent Four: Using Quantitative Methods to Engage in a Game of Freedom

Coming from traditional finance, with experience in the stock market, gold, and crypto assets, UNICORN (@UnicornBitcoin), who has over three years of contract experience and has achieved returns of over 100 times his capital, is a quant player who is not loud but whose data is exceptionally hardcore.

His trading system is built like a continuously operating “factor machine”: centered on cyclical regression, continuously iterating effective factors, eliminating noise and ineffective variables. It is not a model that lasts forever, but an endless “probability experiment”—which factors are still alive, which must be eliminated, all determined by backtesting.

When facing market crashes, he does not rely on mysticism or sheer boldness. His operational structure is clear: large funds use zero leverage, prioritizing survival; small funds use high leverage, but with precise stop-loss and take-profit settings. During the sudden drop on October 11, the moment the model signaled, he directly increased positions to bottom fish—without hesitation, without ambiguity.

UNICORN is one of the few traders who has seriously read the Bitcoin white paper and has a rare conviction about “the super-sovereign currency of freedom.” He does not treat this understanding as a slogan but writes it into the strategy’s foundation, treating crypto as a parallel narrative to traditional rules.

This system is calm, clean, and replicable, allowing him to summarize his trading philosophy in two words: game life, game trading. He enjoys competitive gaming and raising small animals, leaving himself breathing space outside the risk curve.

When asked if he believes “this market is different,” he simply replied: “In the face of cycles, there is no such thing as different this time.”

No emotional highs, no philosophical footnotes, only a continuously self-calibrating system, writing footnotes in every round of volatility.

Respondent Five: Finding Coins Through Connections and Winning with Luck

xiaoyufu (@Cryptostartup11) is a typical “luck-based” trader. He does not stick to technical models, nor does he blindly trust data-driven approaches; instead, he connects information sources, relationship networks, and market intuition to build a highly personalized trading system.

In early project evaluations, his judgment framework is straightforward yet essential: the team’s background carries the highest weight, followed by the economic model and narrative of the track. He expresses it simply, but the logic behind it is clear—what truly determines a project’s height is always the people. He values people, circles, and information sources; Alpha is not found in charts but is filtered from “friends’ trading styles” and “private channels worth paying attention to.” For instance, during a dinner, he might hear a VC friend mention a Testnet address, which days later becomes a launchpad for a new hot coin—he refers to this as a signal triggered by “trust and fate.”

This method may not be standardized, but it is extremely real. He does not pursue certainty but captures vague signals in the crypto market using intuition and experience. As he puts it: “The crypto world is a realm that unfolds in the two dimensions of data and the three dimensions of dreams.” He acknowledges that effort and research are foundational, but what truly elevates a person is “immense luck.”

His trading philosophy is encapsulated in these four words: immense luck. This is not blind faith in fate but a coping mechanism for an extremely uncertain market—in the crevices of black swans, bull markets, and community speculation, rationality and mysticism sometimes have blurred boundaries.

Outside of trading, he enjoys fitness, travel, and learning skills, seemingly unrelated to the crypto market, but he understands clearly: emotional management and physical and mental state are the basis for maintaining “signal reception.” And the “signal” itself may be hidden in a dinner conversation, a group chat, or an Alpha tweet that no one has liked.

Not everyone can replicate his path. But in a market where information is highly skewed and emotions dominate prices, he relies on trust and fate, incorporating both connections and luck into his system. This system is not written in the white paper but truly exists in the “gray areas” of the crypto world.

Summary:

From the disciplined “structural faction” to the fate-driven “luck faction,” the five traders exhibit five distinctly different survival strategies. However, in stark contrast to their rich strategies is a general detachment from the understanding of the Bitcoin original text: among the five, only one has deeply studied the white paper, three have only skimmed it, and one has not even opened it.

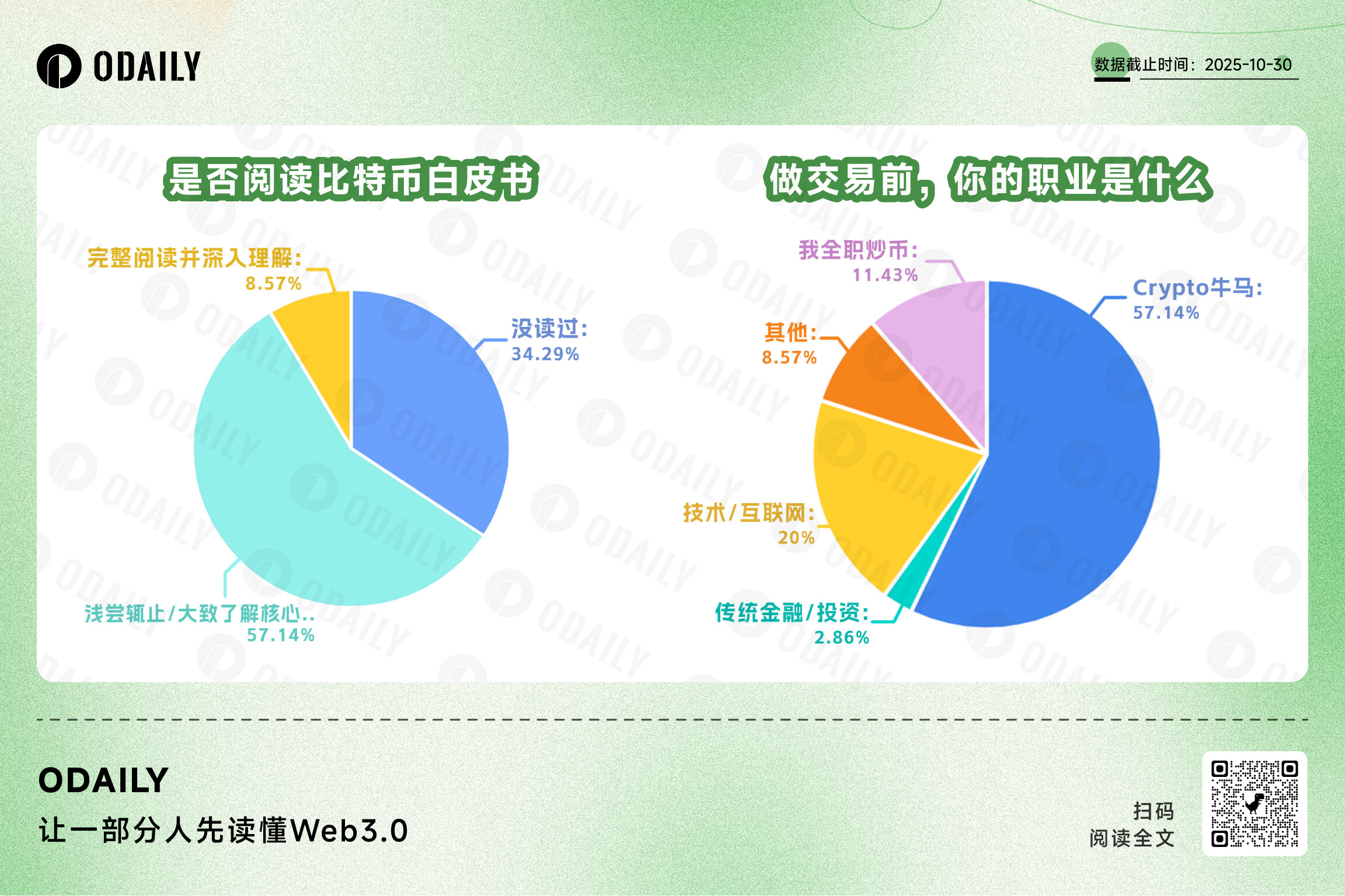

Pie chart of Bitcoin white paper reading and pre-trading professional background

In the entire survey of trader profiles, over half of the respondents have only skimmed the Bitcoin white paper. This precisely indicates that what drives this market is far from a consensus on the original theory. They all use real money, emotions, and trial and error to add living footnotes to that nine-page white paper. If Satoshi Nakamoto’s blueprint is an idealistic script, then each of their openings and closings is a reality performance filled with entanglements and improvisation.

They may not all be able to interpret the white paper, but each is rewriting its real version in their own way.

17 years have passed, and the story of Bitcoin continues to be rewritten by countless people following Satoshi Nakamoto.

In the autumn of 2008, Satoshi Nakamoto released a PDF white paper in the cypherpunk mailing list. It depicted a “peer-to-peer electronic cash system” in calm and concise language, but it did not predict how this protocol would reshape the wealth logic, daily rhythms, and worldviews of a group of people.

Seventeen years have passed, and Bitcoin has long ceased to be merely a technical protocol or an investment target. It has gradually become an anchor, a foundation of consensus: some use it to build models, some learn to cut losses from it; some achieve leaps through it, while others seek order in its zeroing out. Some view it as a symbol of free will, while others see it as an unavoidable “job.”

In this “Trader Habits Survey,” a questionnaire collected in just one week has gathered a group of the most genuine participants in the crypto market. They are scattered across different countries and platforms, with assets spanning mainstream coins and meme coins, strategies ranging from high-frequency to long-term, and trading experience from six months to ten years. Some are reviewing trades in high-rise buildings in Dubai, some are watching the market in tea houses in Chongqing, and others are long-term hidden deep within Discord channels.

We cannot restore their full picture based solely on a form, but we hope to leave an unfiltered, authentic footnote for the market through these fragments. Perhaps many of them have never read the Bitcoin white paper, are unfamiliar with “zero-knowledge proofs” or “elliptic curve cryptography,” and may even be unable to recite the workings of a “peer-to-peer system.” But there is no doubt—they are the most genuine and indispensable active users within this system.

Every opening of a position, every profit-taking, every liquidation, and every review, every emotional fluctuation and strategic choice, is a rewriting of this system. They are collectively writing a “user manual” beyond the white paper—it is not publicly published on GitHub, nor does it have a unified format; it exists only in the practice of each individual.

This manual is sometimes chaotic, sometimes radical, filled with the warmth and noise of humanity, but its writing has never ceased. This, perhaps, is the deeper meaning of Bitcoin 17 years later: it is no longer just a protocol about “what it is,” but a long race about “how we coexist with it.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。