Original author: Nina Bambysheva, Forbes

Original translation: Luffy, Foresight News

In the words of David Bailey, the past six months have been a "Saving Private Ryan-style brutal battle." The 35-year-old CEO of Nakamoto Holdings — a digital treasury company he founded to manage corporate Bitcoin reserves — has witnessed his boldest bet yet: a merger with KindlyMD, a small publicly listed medical company in Utah, transitioning from initial victory to current trials.

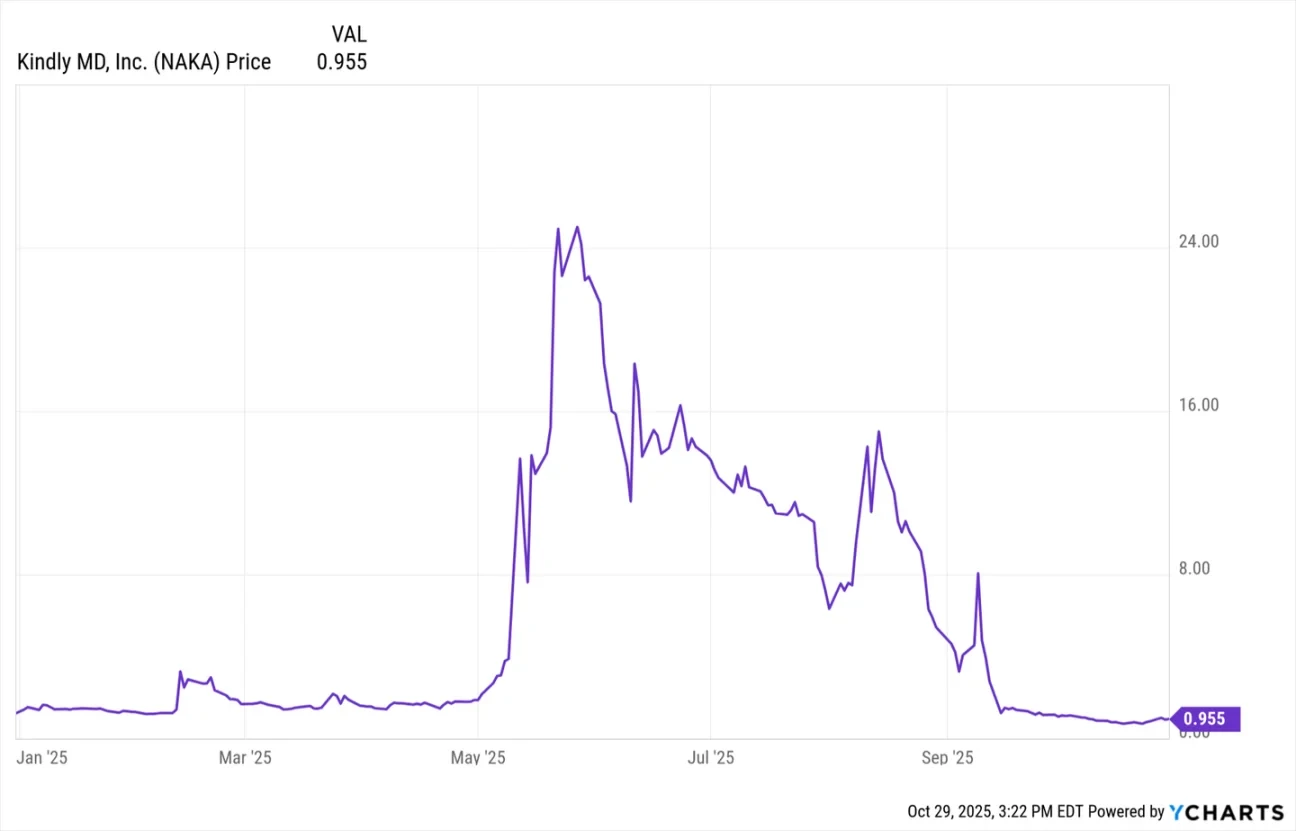

"I'm busy getting beaten up in the stock market," he said. The company's stock price has plummeted from $25 to 92 cents in six months.

Bailey is not your typical Nasdaq-listed executive. He is better known as the CEO of Bitcoin Magazine, the organizer of the world's largest Bitcoin conference, and a key figure in changing Donald Trump's stance on cryptocurrency. "Our goal," he stated, "is to become the number one Bitcoin company in the world."

In May of this year, KindlyMD — a publicly traded medical clinic operator in Utah with an annual revenue of $2.7 million, offering both traditional and alternative therapies — announced a reverse merger with Bailey's Nakamoto Holdings, aiming to transform into a Bitcoin holding company. The merged company is listed on Nasdaq under the ticker NAKA and currently holds approximately $653 million worth of Bitcoin.

Wall Street is not optimistic about Bailey's plans. After the company's stock peaked at nearly $35 in May, it spent most of October trading below $1, representing a 98% discount to the net value corresponding to the 5,765 Bitcoins held on its balance sheet.

It turns out that Nakamoto Holdings has fallen victim to its own financing strategy. To raise funds for purchasing cryptocurrency, the company completed a series of private investment in public equity (PIPE) transactions totaling about $563 million. These transactions issued hundreds of millions of new shares to private investors at steep discounts, significantly diluting the equity of existing shareholders. In September, a large volume of PIPE shares became unrestricted, prompting investors to cash out and lock in profits, leading to a stock price crash. Bailey's letter to shareholders urging short-term speculators to exit the stock only added fuel to the fire.

"Those investors who come in just for trading are actually a very costly source of capital for us," Bailey said. "I know some people disagree with this view, but what we need are long-term partners with aligned interests. This is a high-stakes gamble for us."

In fact, Bailey stated that he will soon integrate his other businesses — including Bitcoin Magazine, the Bitcoin conference, and the parent company of the consulting business BTC Inc., as well as UTXO Management, which owns hedge fund 210k Capital and venture capital firm 2140 — into KindlyMD. Forbes estimates that these entities could add up to $200 million in value to the Bitcoin treasury company while increasing Bailey's ownership stake (currently 3%).

Bailey did not comment on Forbes' data but indicated that the cash generated from these profitable businesses would help KindlyMD purchase more Bitcoin. According to insiders, the assets under management of 210k Capital alone have quietly grown from about $100 million in January to $400 million, achieving a fourfold increase.

The emerging financier's logic is simple: Michael Saylor holds over 600,000 Bitcoins and does not have, nor needs, much operational business. Other players must have differentiated strategies to prove their value.

"We need to do things that create value," Bailey said. "Operating real companies is one way to do that."

Although KindlyMD is headquartered in Salt Lake City, Utah, Bailey primarily works from his home in Guaynabo, Puerto Rico. During video calls, he often sits in front of a large painting depicting a bank engulfed in flames. This piece, created by crypto artist Cypherpunk Now, is one of Bailey's hundreds of collectibles and is titled "Burning Bank."

"Every time I meet with bankers, I make sure this painting is in the background," he said with a smile. For someone looking to build his own bank, the scene couldn't be more fitting.

Bailey grew up on a farm in Fayetteville, Tennessee, about an hour's drive south of Nashville. He developed a strong interest in money and markets at an early age. In 2009, he entered the University of Alabama to study economics, finance, and mathematics, aspiring to become an investment banker.

"I was a super fan of Warren Buffett, attending every Berkshire Hathaway shareholder meeting during college. I never imagined I would buy Bitcoin; it was completely out of character for me at the time," he recalled.

In 2012, a friend sent him an article about Bitcoin, and everything began to change. Initially, Bailey thought Bitcoin was a scam but couldn't prove it. In November of that year, when Bitcoin's price fluctuated between $10 and $12, he made his first investment.

In 2014, a year after graduating, Bailey joined Bitcoin Magazine, an early publication focused on the emerging cryptocurrency co-founded by Vitalik Buterin, who later created Ethereum. Soon after, Bailey and his college friend Tyler Evans acquired the magazine through their jointly founded BTC Inc.

To expand the brand's influence, the two launched the Bitcoin conference in 2019. This festival-like event has now become the "Coachella of crypto," making Bailey one of the most influential evangelists for Bitcoin. The conference held in Nashville last year attracted 35,000 believers, investors, and politicians, including then-presidential candidate Donald Trump.

Bailey stated that his connection with Trump began with a conversation in Puerto Rico in 2024 about how to pique the president's interest in Bitcoin. "Paul Manafort was the initial gatekeeper who helped us get into his circle," he said. Soon, Bailey's team was granted permission to pitch at Trump Tower. The core message was simple: Bitcoin voters would play a crucial role in the presidential election. Trump, who is skilled at making deals, decided to meet if Bailey and his friends could bring votes and enthusiasm for support, giving the cryptocurrency industry a chance to have a voice.

"Trump turns everything into a season of The Apprentice; you're always auditioning," he added. "‘Okay, you want to be a Bitcoin advisor? I'll find three more people to compete for that position.’" Bailey ultimately prevailed, and he and industry leaders raised over $100 million for Trump's campaign, with the Nashville conference alone raising $21 million. At that conference, Trump's famous promise — to make America the global capital of cryptocurrency — became widely known.

"He was initially very uncertain, but the cheers from the audience changed his attitude. As he left, he said, ‘These Bitcoin enthusiasts like me; they are my people,’" Bailey recalled. Today, he serves as an informal advisor to the president. In his view, Trump has simply realized that cryptocurrency is treated differently from all other asset classes (post-election, Trump has profited hundreds of millions from the cryptocurrency space). He believes the current goal is to create a fair competitive environment, with a grander vision of making the U.S. the most Bitcoin-friendly country in the world.

Bailey claims that in his 13-year career, he has invested in over 100 Bitcoin-related companies, with the best performers being Metaplanet and Smarter Web, turning millions of dollars in investments into hundredfold returns. He stated that the returns are not just financial; good ideas get replicated. "If thousands of Bitcoin companies thrive, we win."

This Buffett-inspired long-term vision is now driving the development of KindlyMD. Bailey envisions transforming it into a large holding company with profitable and independently operating subsidiaries. For him, this is not just an investment strategy but a reenactment of monetary history. What he refers to as the "Bitcoin standard" echoes the evolution of gold: from gold and silver trading houses to gold and silver banks, eventually evolving into central banks and investment banks. He believes that today's Bitcoin treasury companies are the trading houses of the digital age, moving towards a new type of banking.

KindlyMD is pushing this transformation. The company has invested in other Bitcoin holding companies, including Japan's Metaplanet and the Netherlands' Treasury B.V. "Imagine nurturing an ETF," Bailey explained, "what we are doing is exactly that — nurturing these actively managed ETFs globally in the form of corporate stocks." Of course, like other newly established crypto treasury companies, Bailey's entry into the public market has avoided scrutiny from the U.S. Securities and Exchange Commission (SEC) regarding ETFs and IPOs.

Although KindlyMD's "debut" on Wall Street ended poorly, Bailey is not too concerned. "One of the best things about Bitcoin is its tolerance; you can make mistakes in your career and then start over," Bailey said.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。