Author: J.A.E

The DeFi market has surpassed $150 billion, but the over-collateralization model still limits its penetration into broader credit fields. Unsecured lending has always been one of the actively explored directions in the DeFi market, but various protocols have met their demise along the way.

Recently, the new player in unsecured lending, 3Jane, announced that it is expected to launch on the mainnet in early November. Supported by leading crypto VC Paradigm, 3Jane is another move in the lending space, attracting widespread attention in the market.

A Turning Point for DeFi Collateralized Lending Models

3Jane positions itself as a "credit-based peer-to-pool money market," aiming to provide algorithm-driven real-time unsecured USDC credit lines for groups that cannot meet over-collateralization requirements. 3Jane has a clear customer profile, which includes not only ordinary crypto investors but also liquidity miners, traders, arbitrageurs, enterprises, and AI Agents. The target demographic that 3Jane aims for indicates that it has positioned itself in the institutional-level credit market with high turnover and high capital efficiency from the very beginning.

The essence of unsecured lending is that lenders must bear the credit risk of borrowers. In traditional finance, such businesses typically require borrowers to undergo strict KYC (Know Your Customer)/AML (Anti-Money Laundering)/CDD (Customer Due Diligence) and credit assessments. However, the permissionless and anonymous nature that DeFi advocates is contrary to KYC/AML requirements. Therefore, if DeFi unsecured credit wants to achieve large-scale commercialization, especially in attracting institutional funds at the $50 million level, it must balance the contradiction between the spirit of decentralization and regulatory compliance requirements.

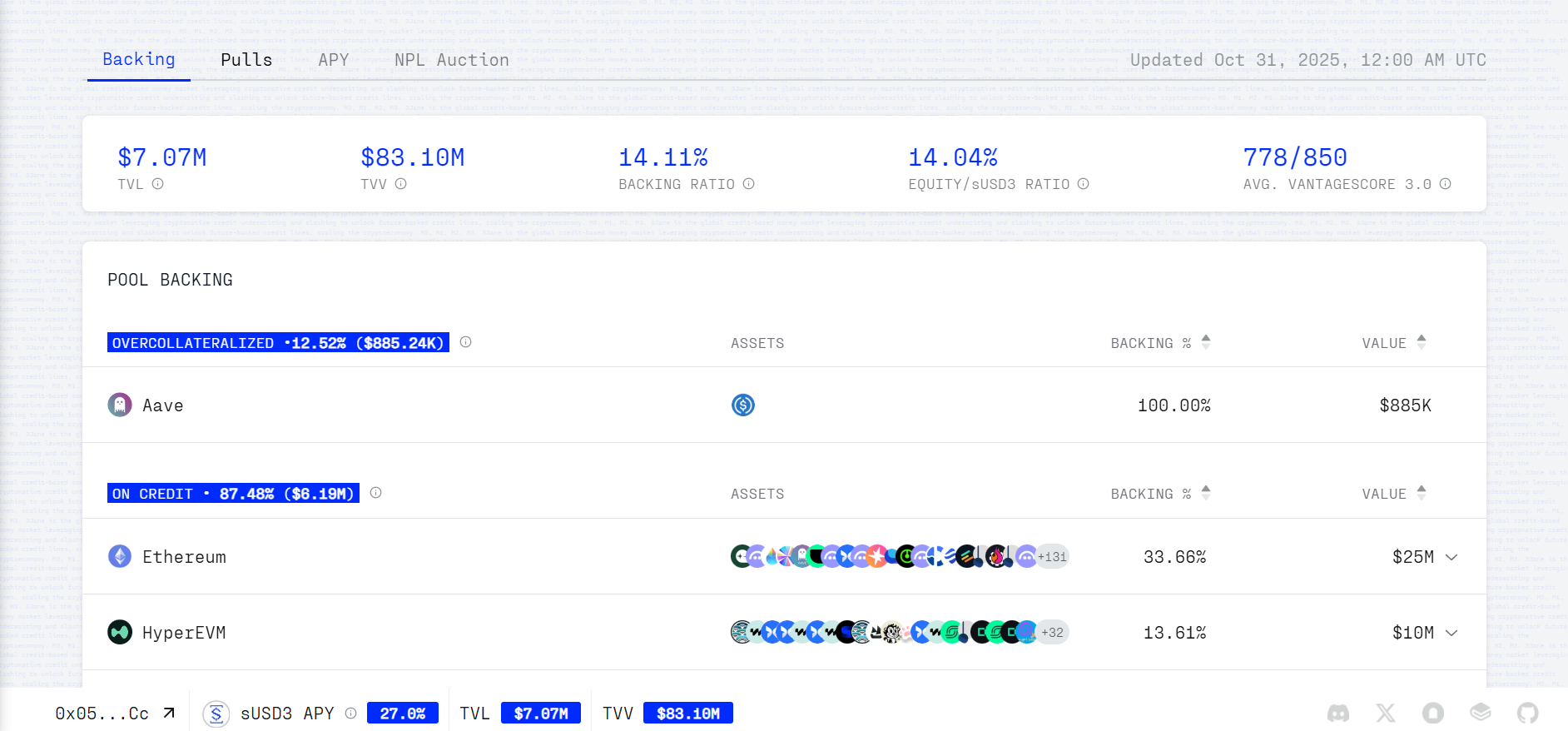

In the early stages, lenders can mint USD3 by depositing USDC on 3Jane or stake USDC/USD3 into the protocol to mint sUSD3, earning up to 27% APY. So far, over $7 million in credit lines on 3Jane is supported by approximately $83.1 million in verified assets.

For borrowers, 3Jane limits its scope to U.S. residents with total asset values exceeding $150,000, with an initial lending cap of about $50 million. This limitation is mainly due to the protocol's need for asset verification to determine credit lines while screening qualified borrowers to reduce risk. The requirement for borrowers to be U.S. residents also facilitates future debt collection.

The protocol's access mechanism directly addresses the SEC's (U.S. Securities and Exchange Commission) regulatory requirements for "qualified investors." Although the definition of qualified investors typically requires a net worth of over $1 million, the access threshold set by 3Jane and its requirements regarding user nationality demonstrate the protocol's emphasis on compliance, limiting users to those who meet specific KYC and asset thresholds from the product design stage, thereby minimizing regulatory risks.

For 3Jane, the closed-loop of its business model no longer solely depends on how precise its technical risk control model is, but rather on its ability to meet the strict regulatory requirements of institutional funds. This means that 3Jane needs to prove that it is a protocol with verifiable compliance layers to attract its target demographic into the DeFi market.

3Jane Builds User Credit Graphs, Creating a "Privacy Compliance Stack"

3Jane founder Jacob Chudnovsky admitted that previous unsecured lending protocols in the crypto market ended in failure due to a lack of sound credit underwriting mechanisms and legal recourse, with many transactions occurring off-chain. To address the challenges of unsecured lending in risk control and compliance, the protocol has created a new technological architecture by combining the 3Jane Credit Risk Algorithm (3CA) with the zkTLS protocol.

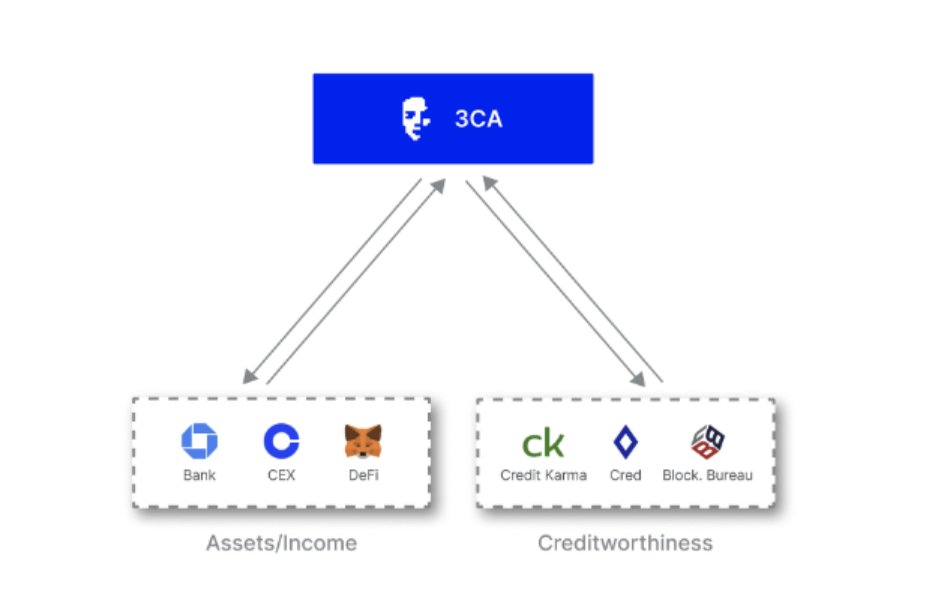

3CA is used to capture user interaction data between DeFi, CEX (Centralized Exchanges), and traditional banks, incorporating it into credit assessments. 3CA underwrites credit lines based on users' Jane Scores and asset types. The Jane Score is a credit rating for users on the 3Jane protocol, composed of their on-chain and off-chain creditworthiness. The on-chain credit score is fed by the Cred Score and Blockchain Bureau Score, both of which establish credit assessment frameworks based on users' on-chain behavior; the off-chain score integrates VantageScore 3.0 from TransUnion and Equifax (two of the three major credit agencies in the U.S.) as data sources. On the other hand, the Jane Score also includes a default penalty mechanism, deterring bad actors by restricting access and increasing interest rates.

In short, the Jane Score will comprehensively assess users' credit risk from both on-chain and off-chain dimensions. If a user attempts to inflate their asset value through external borrowing or transfers to secure a loan from the protocol, such behavior will be collected and scored by the Jane Score. For new users, if they have limited past borrowing behavior on-chain or off-chain, their initial credit score will not be high, and the credit line issued by the protocol will be controlled within an affordable range to prevent severe bad debts from lending large amounts of assets.

Additionally, 3Jane places a high emphasis on compliance, and the protocol may later feedback the credit data of defaulting users to off-chain credit agencies to constrain user behavior.

The cross-domain data input of 3CA helps the protocol build a "credit graph" that transcends a single on-chain dimension. Through the Jane Score, 3Jane shifts the credit risk assessment of lending behavior from reliance on over-collateralization (asset value) to an unsecured (user credit) model, which is the foundation for the protocol to extend credit to complex entities such as enterprises and AI Agents.

The premise of 3CA assessing user credit is obtaining user behavior data from both Web2 and Web3, but this creates a contradiction with the need to protect user privacy. 3Jane thus introduces the zkTLS (Zero-Knowledge TLS) protocol to tackle this "privacy compliance paradox."

zkTLS acts like an encrypted bridge built using zero-knowledge proof technology, allowing borrowers to connect financial data from the Web2 world, such as bank accounts or CEX accounts connected through Plaid, and privately generate proofs to verify users' repayment capabilities or asset ownership without disclosing sensitive data to 3Jane or any third party.

The value proposition of zkTLS lies in its provision of compliance proof in the form of "zero-knowledge proofs." For regulated financial institutions, the core requirements of KYC/AML are customer identification, identity verification, and due diligence on transaction authenticity. zkTLS can complete these due diligence steps while ensuring user privacy, taking on the responsibilities required under regulatory requirements. This technological innovation significantly enhances 3Jane's attractiveness to compliant institutional funds.

Paradigm Bets on "Compliant" DeFi

On June 4, 3Jane secured $5.2 million in seed funding led by top venture capital firm Paradigm. This investment is not only financial support but also a strong endorsement from Paradigm for building a "scalable compliant crypto-native credit infrastructure."

In fact, Paradigm's investment in 3Jane is a bet on a DeFi model that aligns with regulatory trends and possesses institutional-level access capabilities. The success of 3Jane's institutional strategy heavily relies on its funding partner Paradigm's frequent communication with the SEC for "regulatory navigation."

Paradigm's regulatory lobbying efforts aim to address the major compliance obstacles currently faced by the crypto market, particularly in the integration of traditional finance and DeFi. Their lobbying work is also an important strategic guarantee for 3Jane to attract institutional funds on the compliance front.

Custody is one of the biggest bottlenecks for institutional funds entering DeFi. SAB 121 (SEC Staff Accounting Bulletin No. 121) requires financial institutions to list the crypto assets of their clients under custody as liabilities on their balance sheets.

This requirement forces custodians to incur unnecessary expenses, causing traditional financial institutions like banks and trust companies to shy away, significantly limiting the number of qualified custodians. Paradigm believes that SAB 121 is essentially stifling industry growth and has called for the SEC to rescind SAB 121.

After industry lobbying, SAB 121 was rescinded by the SEC in January 2025, significantly lowering the custody threshold for institutions. For 3Jane, the rescission of SAB 121 is a "liquidity entry" paved by Paradigm. Enterprises are one of 3Jane's target demographics, and these institutional users require qualified custodial services. Now that SAB 121 has been rescinded, institutions can deposit larger amounts of funds into the protocol through compliant pathways to meet the $50 million credit demand, ensuring that 3Jane can obtain a stable and compliant source of funding.

Paradigm's regulatory lobbying efforts have created more reliable conditions for institutional entry into 3Jane, making 3Jane's technical compliance advantages more commercially viable. In the context of traditional financial institutions seeking to meet both KYC/AML and on-chain efficiency, 3Jane may provide a feasible and institution-friendly compliant DeFi model.

The strategic synergy between 3Jane and Paradigm also indicates that DeFi is shifting from serving crypto-native users to a broader traditional credit market, especially the trillion-dollar corporate credit and trade credit sectors. Once the most challenging credit assessment and compliance issues in unsecured lending are effectively resolved by 3CA and zkTLS, DeFi may carry the complete product line of traditional finance, breaking free from the constraints of over-collateralization.

At that time, DeFi will not only retain the high efficiency of decentralization but also achieve accountability under regulatory requirements. The mainnet launch in early November will test whether 3Jane can leverage traditional finance's massive credit liquidity amid the compliance wave.

However, investors should still focus on the credit risks associated with 3Jane. Although the current default probability is low, if an economic recession occurs, expanding the target demographic to enterprises and AI Agents may amplify risks. If not managed properly, unsecured lending could repeat the pitfalls of traditional finance, so investors should also pay attention to the effectiveness of the protocol's recourse mechanisms, such as collections and legal auctions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。