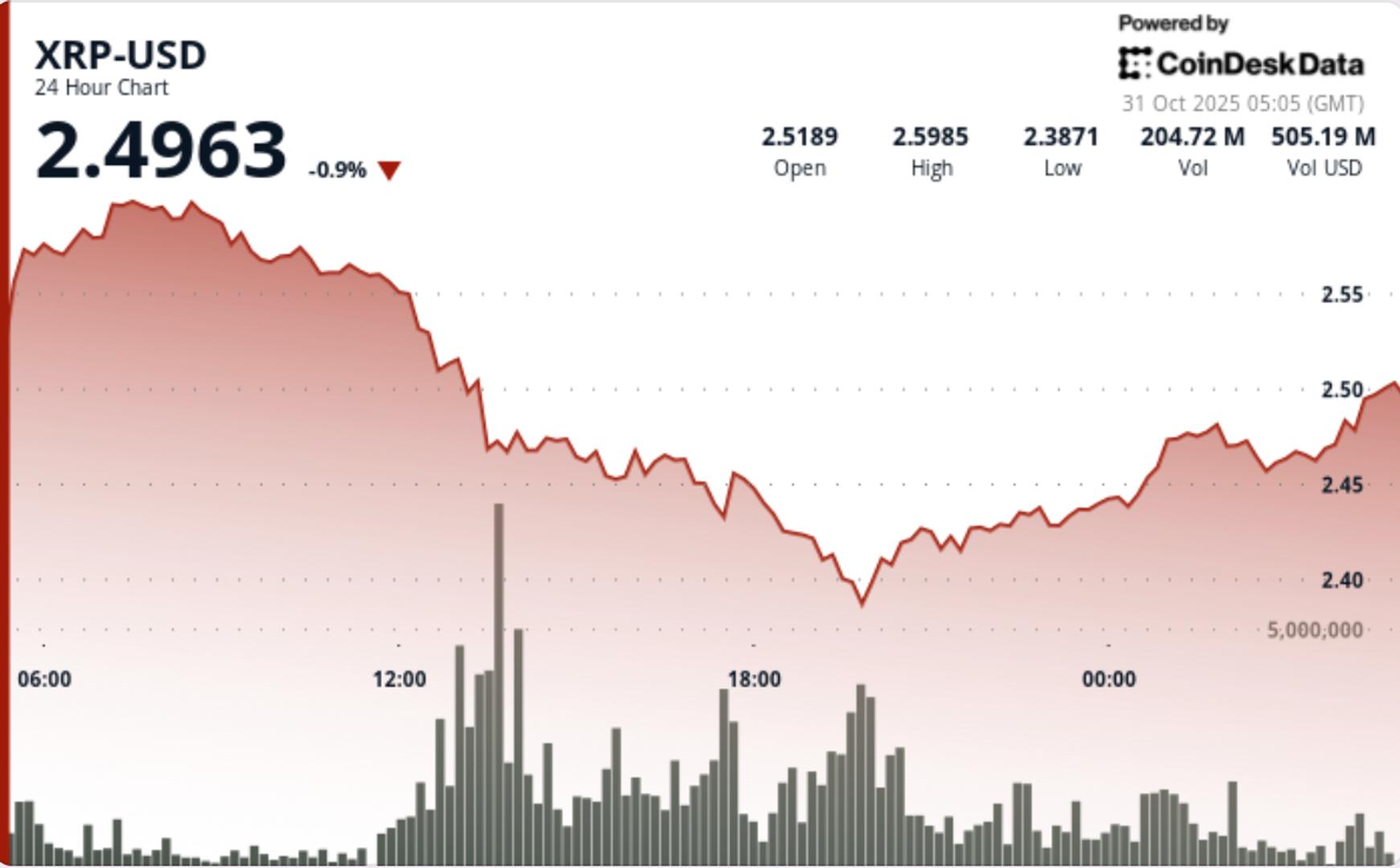

XRP broke below the $2.50 support during Tuesday’s session, sliding 5% to $2.47 as institutional selling pressure accelerated across major exchanges. The breakdown confirmed a decisive shift in structure following weeks of tight consolidation, with volume and chart patterns now aligning toward a deeper corrective phase.

News Background

- The token’s 24-hour session saw prices tumble from $2.60 to $2.47, marking one of the largest single-day declines this month.

- The breach of the $2.50 psychological level triggered a wave of algorithmic and institutional selling, propelling trading activity to 169 million tokens, up 158% versus the 24-hour average.

- XRP’s market underperformance contrasts with broader crypto strength, suggesting rotation away from altcoins as risk appetite cools amid waning speculative participation.

- The breakdown reinforced strong overhead resistance at $2.60, where repeated rejection points over recent weeks had capped upside momentum.

Price Action Summary

- The selloff unfolded in structured phases through Tuesday’s trading. The initial breakdown began at 13:00 UTC, when heavy sell volume drove price decisively through the $2.50 support, igniting a cascade that extended to intraday lows near $2.38.

- Subsequent price stabilization formed around the $2.43–$2.46 range, suggesting the early stages of a potential consolidation base.

- Short-term momentum readings indicated exhaustion as volume tapered into the close, a dynamic often preceding interim pauses in trending declines.

- On the microstructure level, 60-minute data showed two distinct distribution waves as XRP slipped from $2.472 to $2.466.

- Successive hourly volume spikes of 2.8M and 2.6M tokens—each exceeding 300% of hourly averages—confirmed continued institutional control over intraday flows.

Technical Analysis

- XRP’s breakdown marks a continuation of its lower-high, lower-low structure that began after the failed retest of the $2.60 resistance.

- The session’s 8.8% volatility range underscores aggressive liquidation and profit-taking from larger holders, aligning with recent on-chain signals of exchange inflows.

- Momentum indicators such as RSI have shifted into neutral-to-bearish territory, while MACD shows expanding downside divergence. The $2.40–$2.42 area now acts as immediate technical support, and a close below this band could open further downside toward $2.30–$2.33.

- Volume analytics remain pivotal— the 169M turnover during breakdown confirms institutional participation rather than retail panic, while declining late-session activity implies that the bulk of distribution may already be complete.

What Traders Should Watch

- Traders are closely monitoring whether $2.43–$2.46 can evolve into a stable accumulation zone or if a clean break below $2.40 accelerates capitulation.

- Reclaiming the $2.50 level would be required to neutralize short-term bearish momentum and reestablish a constructive setup targeting $2.60.

- Until then, rallies toward resistance are likely to face supply from trapped longs and short-term profit-takers.

- Broader sentiment remains cautious amid risk-off rotation, with derivatives positioning showing declining open interest and modest upticks in short exposure across perpetual futures markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。