To understand the market amidst the Federal Reserve's "hawkish tone," it particularly tests one's technical skills. I personally recommend three core indicators: large orders from the main players + open interest + LSUR (long-short position ratio).

Looking at trading volume and OBV-type volume indicators is also possible, but this combination of three indicators can help us see the true behavior of the main players and capture the emotional changes of retail investors, making it more practical. The three indicators I recommend are large orders from the main players + open interest + LSUR.

For the specific usage of these three indicators, especially the combination techniques of open interest and LSUR, you can refer to my previous live stream reviews; I won't elaborate on them this time. Let's get straight to the point — using a review method, let's see what operations the market was doing before the Federal Reserve's news was realized, and these experiences can be referenced later.

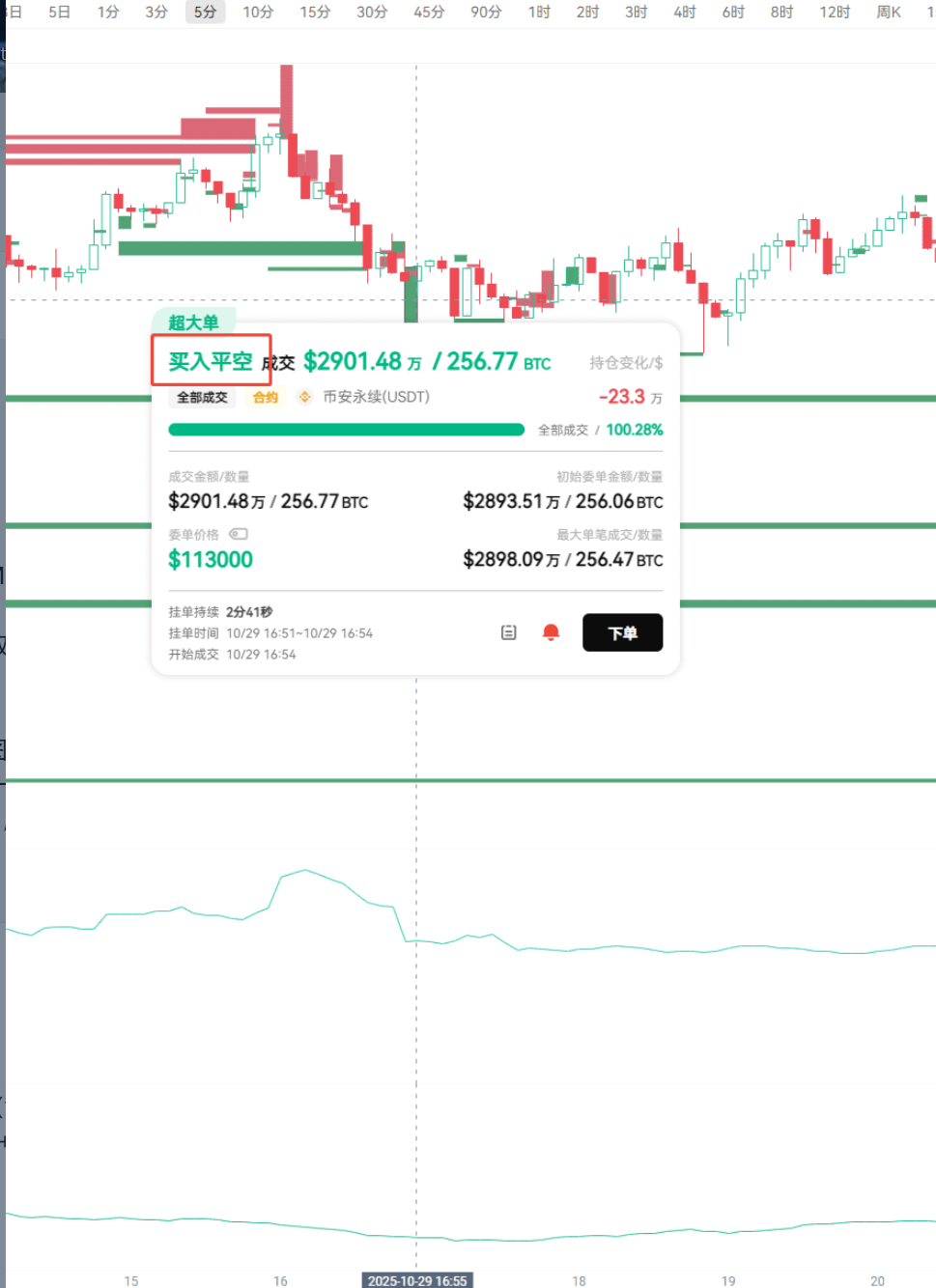

First, let's look at the chart; you can see the main players' movements from yesterday afternoon.

Next, let's look at the situation of open interest + LSUR. From the chart, it is clear that the main players had already opened short positions in advance.

Interestingly, when the main players started placing short orders, LSUR was still rising — this means that most retail investors were still clustering to short at that time.

By 15:00 to 16:00, the actions of the main players became clearer: they sold on the spot after a price surge, while closing long positions and adding short positions.

When retail investors lagged behind and chased shorts, some shorts had already begun to take profits from the first wave.

But even at this point, LSUR was still above 1.5, indicating that the number of retail investors going long was still dominant.

Here, I want to point out a key point: whether the main players are going long or short, as long as they enter the market, open interest is likely to increase. Now, looking back at this chart, we can see that after the U.S. stock market opened last night, Bitcoin began to decline, and the main players' operational path was very clear: first short → take profits on shorts → then a divergence between long and short.

Let's look at this chart again; the changes in open interest corresponded completely with the actions of the main players — rise → decline → rapid surge → significant drop. Let's focus on the period of "main player divergence":

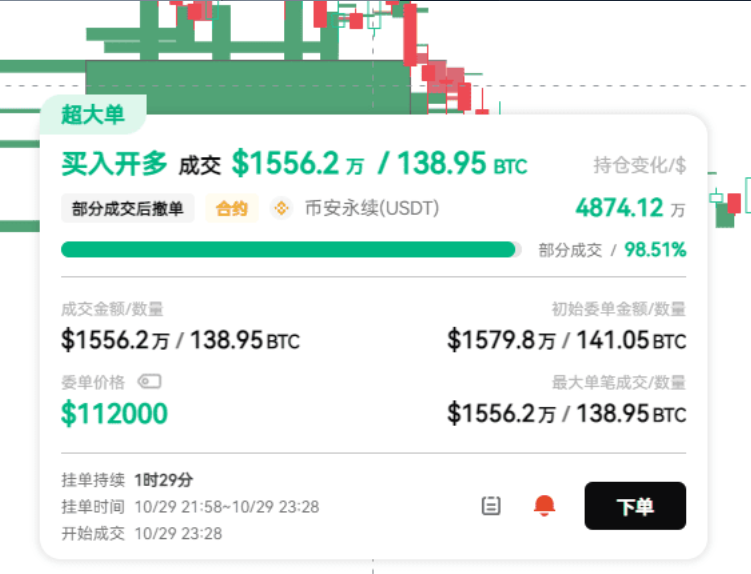

From the orders, it is indeed evident that some main players were going long.

However, combining the open interest differential and large transaction data shows that some main players were also shorting using market orders at that time. On one side, there were limit orders trying to go long, while on the other side, market orders were decisively shorting, with both sides' amounts being comparable. Therefore, the increase in open interest was particularly noticeable, and the trend became steep, indicating that main player funds were concentrated in the market.

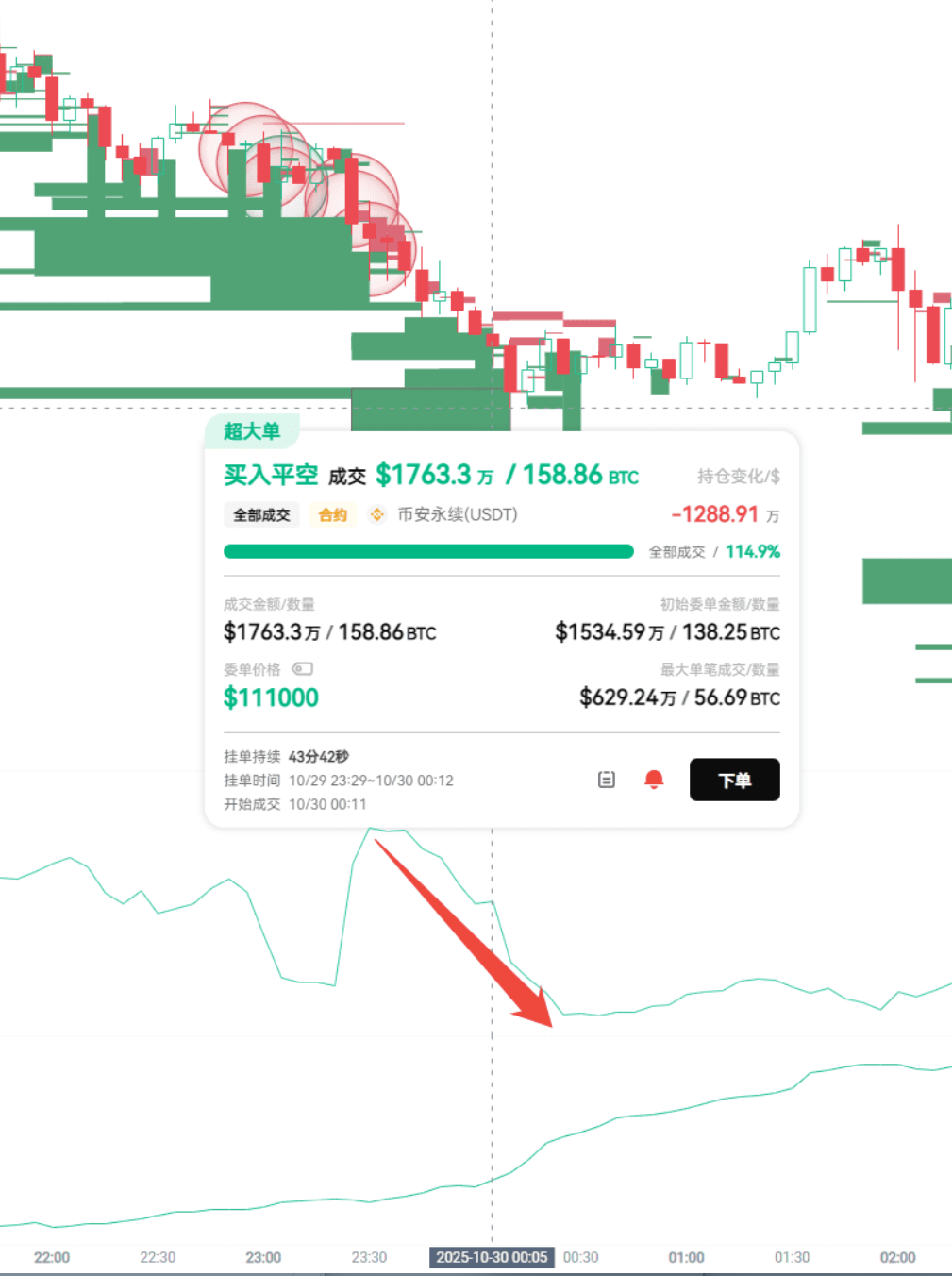

However, this wave of newly entered funds withdrew quickly; not long after, open interest returned to the level before the surge, and the main players who had shorted began to take profits.

Yet retail investors were still aggressively entering the market to go long, and the long-short position ratio continued to rise.

Until just before the Federal Reserve's decision was announced, and even at the time of the announcement, the main players had little significant action, and the overall open interest remained relatively stable. Occasionally, a few main players went long, but compared to the tens of millions of funds before midnight, the volume was much smaller.

Overall, the complete script of the main players in this wave was: ambush in advance → sell on the surge → rebound and add shorts → wash out and then exert force after the news. On platforms like Coinbase, market orders even experienced slippage of over $300. It’s worth mentioning that if it were just simple turnover, open interest would not show significant changes; everyone should pay attention to this detail.

Finally, let's clarify the core logic:

Using large orders from the main players can help anticipate their layout, as it tracks the limit order behavior of the main players, which cannot be hidden.

Using open interest to confirm the entry of funds; if open interest increases significantly, it indicates that a large amount of capital is moving — after all, some large accounts may split their orders, and looking solely at large orders from the main players may not provide a complete picture.

Using LSUR to observe retail behavior; retail actions usually lag behind those of the main players. For example, in situations where "price falls + volume falls + LSUR rises," it generally indicates that retail investors are going long, but there is little main player capital entering the market, so one should be cautious during such times.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

This article only represents the author's personal views and does not represent the platform's stance or views. This article is for information sharing only and does not constitute any investment advice to anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。