The old rule, let's first talk about the current market situation. As always: just sharing thoughts, not making trading suggestions.

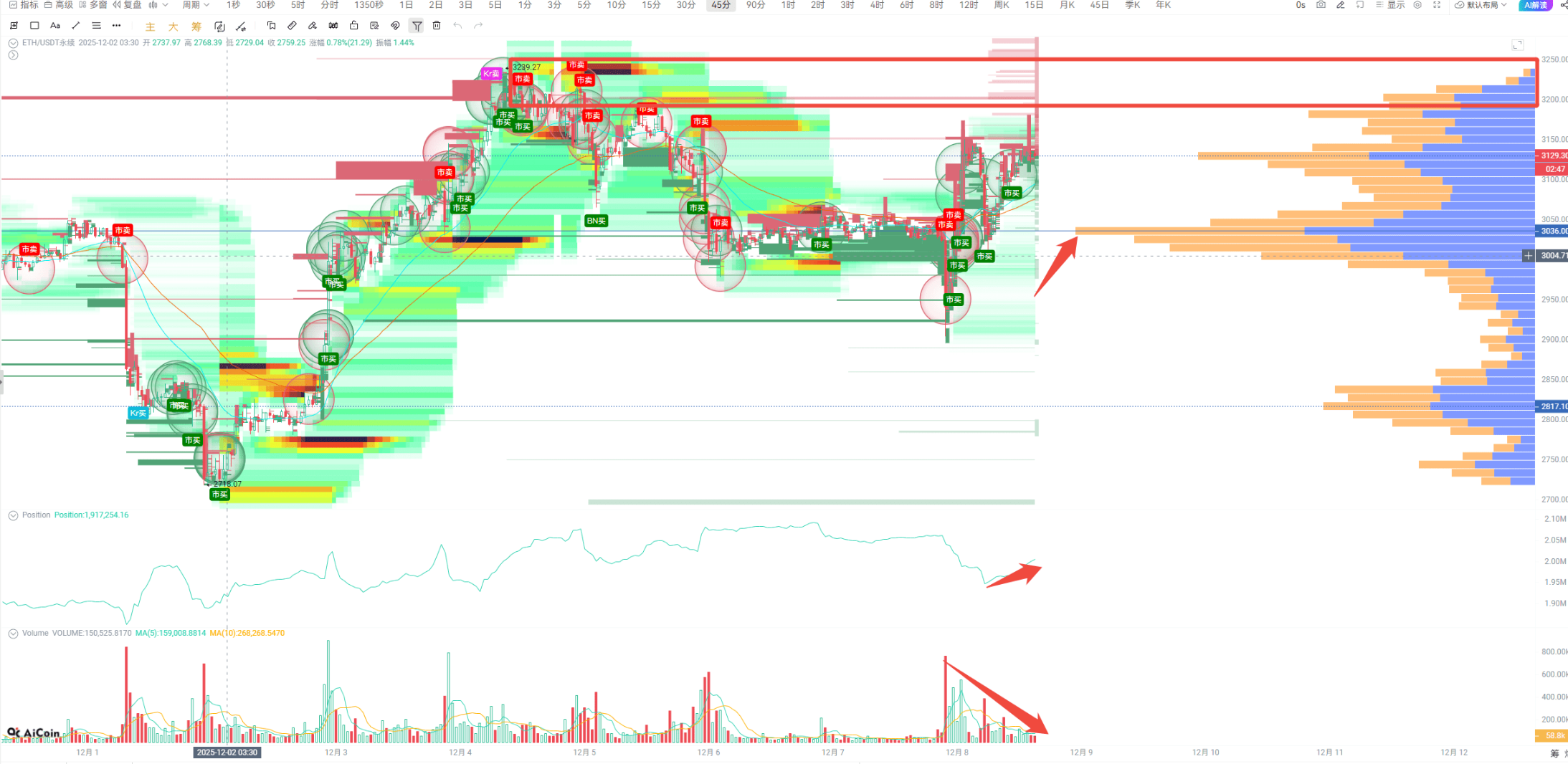

In the 45-minute cycle for BTC, although the open interest is rising, it's doing so sluggishly, and the trading volume is moving against the price trend (divergence).

If it wants to push up in the short term, we need to pay attention to the 93000~93050 area — this is where the most chips are piled up, and it's also a pressure zone where the main force has placed a lot of sell orders, and these are all spot orders.

Short-term support can be closely monitored at 89295, which is where the chip peak is concentrated.

Now looking at ETH, the situation is almost like "brothers in difficulty" with BTC.

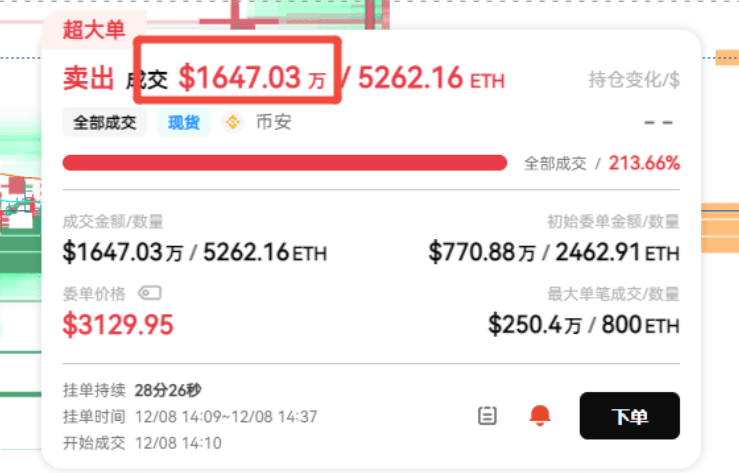

The main force just placed a limit sell order of 16.47 million dollars here.

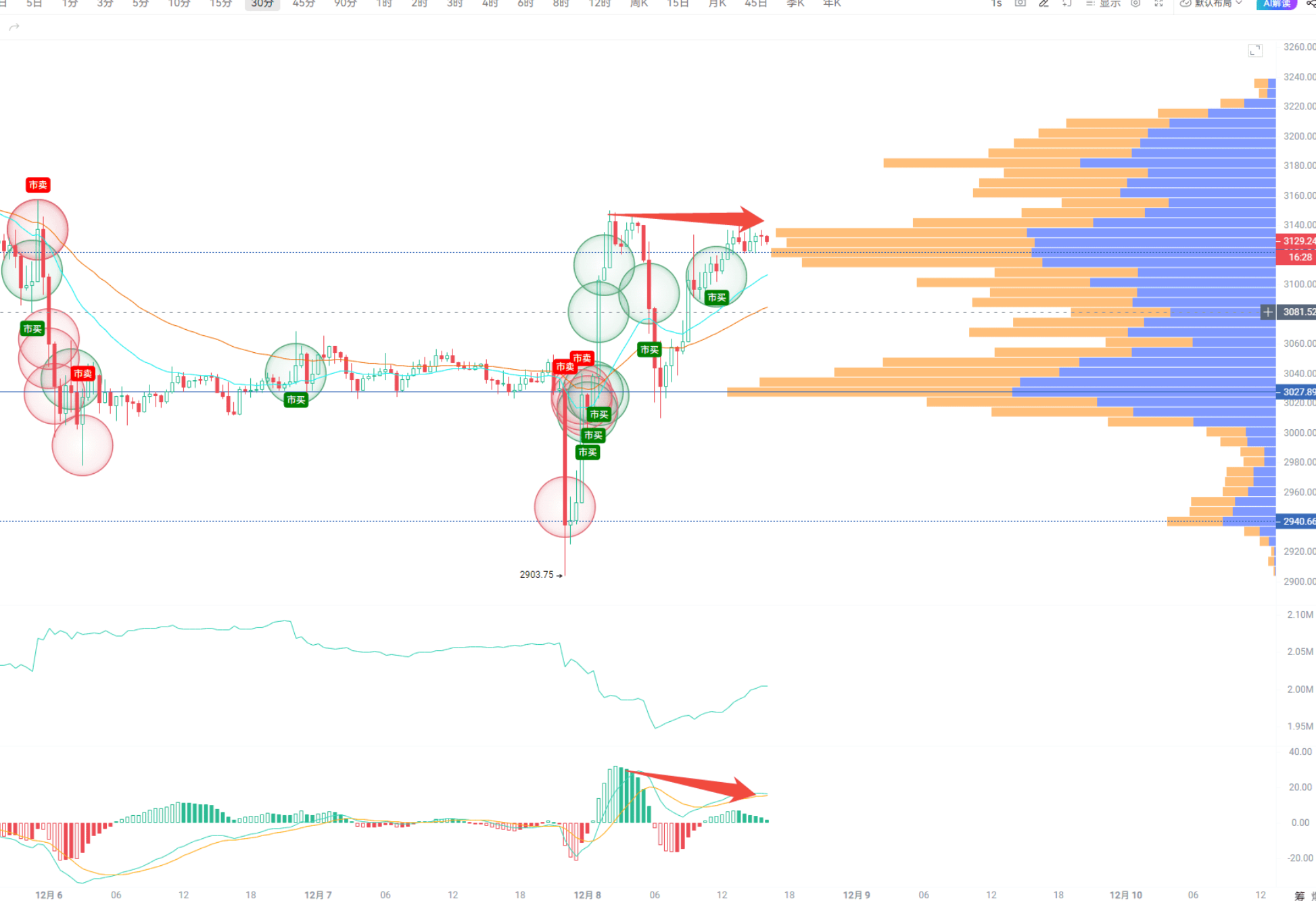

Everyone can also take a look at the 30-minute cycle; there might be signals of insufficient momentum.

Its short-term pressure is at 3200~3240 (recent high + sell orders from the main force), while support is at 3035 — this is where the most concentrated chip peak has occurred in the past week.

By the way, the red and green bars in the chart are tracking the main force's large orders, the blue and orange blocks represent chip distribution, and the light green is the liquidation heatmap — I will share the source code for these indicators later. Of course, the above is just a current technical analysis and absolutely does not constitute investment advice!

Having looked at the market, let's talk about something real next — where is the main force hiding and making moves? This is the core of today's live broadcast!

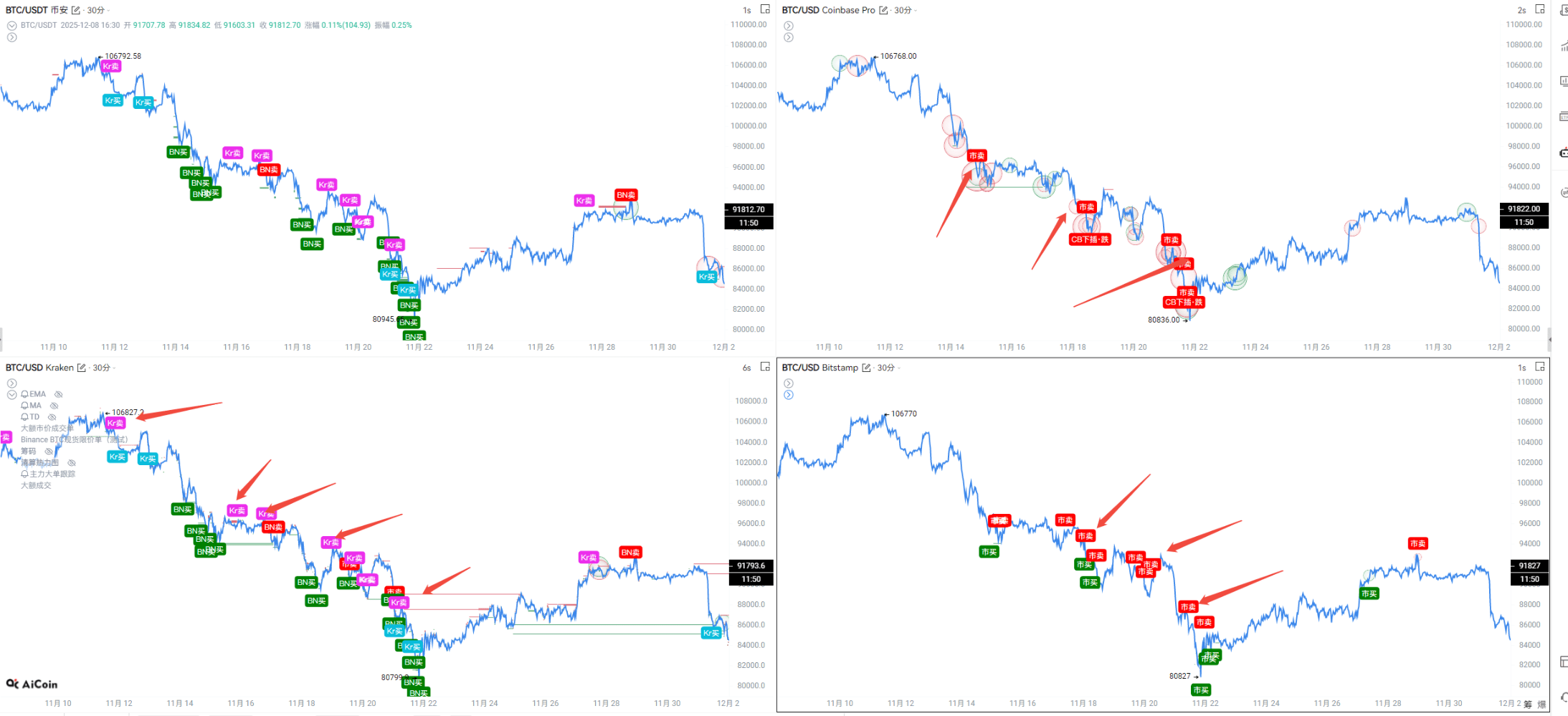

Friends who have used our PRO membership probably noticed an interesting thing: for example, during a decline, many buy orders appeared on Binance for BTC, but the price just couldn't stop falling.

Even three large orders had less impact than a single large order on Coinbase — for instance, that 19.31 million market order on Coinbase directly caused a price fluctuation of over 3%. This difference is related to the main force's strongholds.

Let's talk about Binance first — it is the leader in global trading volume, a position that no one can shake. This is mainly due to its large user base and operational model, making it the "heart" of liquidity: a massive number of market makers and quantitative teams are clustered here, and the proportion of retail investors is also high. However, these market makers and quant traders are not betting on direction; they are more focused on earning some price differences and arbitrage.

Retail investors, on the other hand, love to use limit orders (after all, the fees are low), so the limit orders on Binance are densely packed — you can see the BN buy signals in this chart, all of which are limit orders over 10 million dollars from Binance.

But Coinbase, Kraken, and Bitstamp are not on the same path as Binance — this is the main stage for institutional funds.

Coinbase needs no introduction; it is a top-tier exchange under U.S. regulation, and the funds for U.S. ETFs flow in and out through it, serving as a "dedicated trading entry" for U.S. institutions.

Kraken, while global, focuses on Europe and the U.S., and has a major weapon: it has one of the largest and most secretive cryptocurrency OTC trading desks in the world. Many of the funds from previous incidents like Mount Gox and FTX payouts have been transferred to Kraken — the users here are mostly old-money institutions from Europe, who prefer stability over short-term trading.

Bitstamp is positioned in the middle, serving as the main stage for European banks and fiat currency entry, primarily dealing with euro funds.

Currently, the market situation in the crypto space is mainly driven by European and American funds, so to observe the main force's movements, we need to focus on these three platforms. Moreover, all three have proper licenses and must comply with AML/KYC/FATF regulations, so institutions here are cautious about placing too many limit orders — one, for fear of being targeted by the market, and two, due to strict compliance checks, which can easily be seen as false orders. Binance is relatively more flexible.

Let me show you an example: during a previous decline, the main force on Binance was buying frantically (trying to support the price), but the main forces on these European and American platforms were still selling, especially on Coinbase. This is not an isolated case.

To summarize: during a decline, if you see large protective buy orders on Binance, you need to first confirm whether the main forces on Coinbase, Kraken, and Bitstamp have stopped selling; if BTC on Binance suddenly surges or plummets, you should also check whether the main forces on these platforms are moving along — without news or trading volume to support it, actions solely from Binance do not count.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

This article only represents the author's personal views and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。