Written by: Thejaswini M A

Translated by: Shan Ouba, Golden Finance

In behavioral economics, there is a principle regarding mental accounting: people treat money differently based on where it is stored. A $100 in a checking account feels readily available for spending, while the same $100 in a retirement account feels untouchable. Although the funds are essentially interchangeable, the context of storage alters people's perception of them.

Sam Kazemian, founder of Frax, refers to this as the net worth theory: people prefer to keep their spending money in places where most of their wealth is already concentrated. If your net worth is primarily in stocks and bonds in a Charles Schwab account, you are likely to keep cash in a related bank account—because transferring between the two is frictionless; if your net worth is mainly on-chain (like in an Ethereum wallet and DeFi positions), you would want your dollars to easily integrate into that on-chain world.

Today, a significant number of people are storing most of their wealth on-chain. They have grown tired of the hassle of frequently transferring back to traditional banks just to buy a cup of coffee.

New cryptocurrency banks are addressing this issue through one-stop integrated infrastructure. On these platforms, you can save with interest-bearing stablecoins and spend directly with a Visa card, all without needing to interact with traditional bank accounts.

The rapid growth of these platforms is essentially a response to the market's recognition of a fact: the cryptocurrency space finally has enough real users and sufficient real funds on-chain, making the establishment of new crypto banks practically valuable.

For over a decade, cryptocurrency has promised to eliminate intermediaries, reduce fees, and give users more control, but it has always faced a core issue: merchants do not accept cryptocurrency payments, and expecting all merchants to accept them simultaneously is unrealistic.

You cannot pay rent with USDC, employers will not pay salaries in ETH, and grocery stores do not accept stablecoins. Even if you convert all your wealth into cryptocurrency, daily life still relies on traditional bank accounts. Each conversion between cryptocurrency and fiat currency incurs fees, settlement delays, and various frictions.

This is also the reason why most crypto payment projects have failed: BitPay attempted to enable merchants to accept Bitcoin directly, and the Lightning Network built peer-to-peer payment infrastructure but struggled with liquidity management and routing stability issues. Neither achieved widespread adoption, primarily due to high conversion costs—merchants need to confirm that users will use this payment method, and users need to confirm that merchants will accept it, with no one willing to take the first step.

New crypto banks make the coordination problem invisible. When you spend stablecoins from a self-custody wallet, the new bank automatically converts it to dollars and settles with merchants via Visa or Mastercard; the coffee shop still receives dollars from a bank account, completely unaware of the existence of cryptocurrency.

You do not need to convince all merchants to accept cryptocurrency; you just need to hide the conversion layer—allowing users to spend cryptocurrency at any merchant that accepts regular debit cards (which are almost ubiquitous).

After years of failed attempts, three foundational infrastructures have now matured simultaneously, finally making this all possible:

First, stablecoins have gained legitimacy. The GENIUS Act, passed in July 2025, provides a clear legal framework for stablecoin issuance. The U.S. Treasury Secretary predicts that by 2030, the transaction volume of payment stablecoins will reach $3 trillion. This signifies that the U.S. Treasury officially recognizes stablecoins as part of the financial system.

Second, the card infrastructure has been commoditized. Companies like Bridge provide white-label APIs, allowing teams to launch complete new banking products in just a few weeks (Stripe has acquired Bridge for $1.1 billion). Now, teams do not need to negotiate directly with card organizations or build banking partnerships from scratch.

Third, people are genuinely storing wealth on-chain. Early crypto payment projects failed because users did not place significant net worth in cryptocurrency—most savings remained in traditional brokerage accounts and 401(k) retirement accounts, with cryptocurrency seen merely as a speculative tool rather than a place to store lifelong savings.

The situation is now entirely different. Young users and crypto-native groups are storing substantial wealth in Ethereum wallets, staking positions, and DeFi protocols, completely reversing the mental accounting: keeping money on-chain and spending directly from it is easier than transferring back to bank deposits.

Products and Services of New Crypto Banks

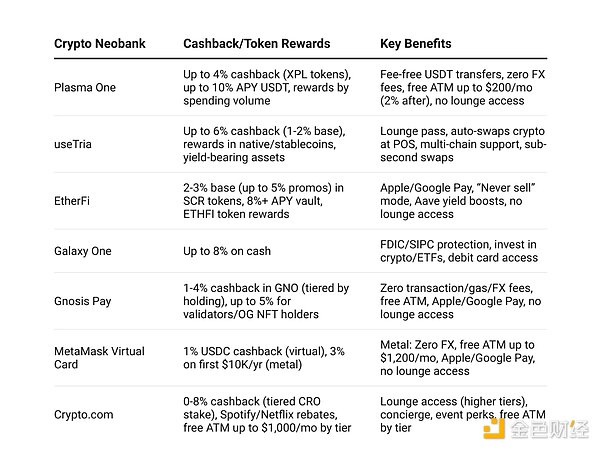

The differences among various new crypto banks mainly lie in yield rates, cashback percentages, and regional focuses, but they all address the same core issue: enabling people to spend cryptocurrency without giving up self-custody or frequently transferring back to bank deposits.

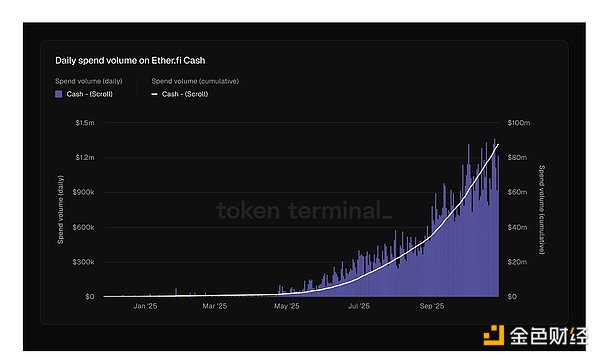

EtherFi's daily card spending has exceeded $1 million, and transaction volume has doubled in the past two months; similarly, Monerium's EURe stablecoin (Euro stablecoin) has seen significant growth in both issuance and destruction.

This growth is noteworthy because it demonstrates that these platforms are driving real economic activity rather than mere speculation among cryptocurrencies—funds are flowing out of the crypto ecosystem into the broader real economy.

This is precisely the bridge that has long been missing in the crypto space.

Over the past year, the competitive landscape of new crypto banks has rapidly expanded: Plasma One, as the first stablecoin-native new bank, focuses on emerging markets with limited access to dollars; Tria, built on Arbitrum, offers self-custody wallets and gas-free transactions; EtherFi has transformed from a liquid staking protocol into a complete new bank, with a total locked value (TVL) of $11 billion; and UR under Mantle positions itself with Swiss regulation and compliance as a priority, targeting the Asian market.

Each platform has a different path but is solving the same problem: how to allow people to spend cryptocurrency without frequently reverting to traditional banks?

Although new crypto banks are small in scale, they can compete for another reason: their users are inherently more valuable. The average balance in a checking account for ordinary Americans is about $8,000, while funds transferred by crypto-native users between protocols, chains, and platforms often reach six or seven figures. The transaction volume generated by a single crypto user requires hundreds of traditional bank customers to match—this fundamentally changes the unit economics.

New crypto banks do not need millions of users to be profitable; they only need thousands of high-value users. Traditional banks pursue scale because the revenue generated by a single customer is limited; however, new crypto banks can build sustainable businesses even with a small user base—because the value of a single customer in terms of transaction fees, interchange revenue (card organization sharing), and asset management scale is 10 to 100 times that of traditional customers. When your average user is not depositing a $2,000 paycheck twice a month, the profit logic is naturally entirely different.

All new crypto banks have coincidentally adopted the same architecture: separating spending balances from savings balances. Payment stablecoins like Frax's FRAUSD focus on universal acceptance—backed by low-risk treasury reserves, making it easier for merchants to integrate; while interest-bearing stablecoins like Ethena's sUSDe focus on high yields—achieving annualized returns of 4%-12% through complex arbitrage trading and DeFi strategies, but this complexity is something merchants are reluctant to evaluate.

A few years ago, DeFi attempted to merge the two types of stablecoins, defaulting to making all products interest-bearing, only to find that the friction caused by overlapping functionalities outweighed the problems they aimed to solve. Traditional banks separate checking and savings accounts to meet regulatory requirements; in the crypto space, this necessity for separation has been rediscovered from a foundational logic—there needs to be a payment layer that maximizes acceptance and a savings layer that maximizes yield; trying to optimize both simultaneously will only compromise both.

New crypto banks can offer yields that traditional banks cannot match. They also access the treasury yields that support stablecoins, but with an additional compliance step; traditional banks, constrained by higher cost structures (physical branches, outdated systems, compliance expenses), cannot compete on interest rates. New crypto banks eliminate all redundant costs and pass the benefits on to users.

Why have there been multiple attempts to build payment systems in the crypto space, and why is this time different?

This time is different because three necessary conditions have finally been met simultaneously: a sufficiently clear regulatory framework, banks willing to participate; mature infrastructure that allows teams to quickly launch products; and most importantly, a sufficient number of users placing enough wealth on-chain to make this market viable.

The mental accounting has shifted: in the past, people stored wealth in traditional accounts and speculated with cryptocurrency; now, people store wealth in cryptocurrency and only convert to fiat when they need to spend. The infrastructure built by new crypto banks simply matches the behavioral shift that users have already undergone.

Currency is essentially a self-narrative of our value. For centuries, telling this narrative has relied on the validation of intermediaries—banks are responsible for safeguarding accounts, governments provide credit backing for currency, and card organizations handle transaction clearing and circulation. Cryptocurrency once promised to rewrite this narrative by completely removing intermediaries, but in the end, we find that a bridge is still needed to connect the old and new narratives of value. Perhaps new crypto banks are that communicator.

Interestingly, in building the bridge between the two monetary systems, these new crypto banks have not created entirely new models. They have merely re-implemented an operational paradigm that has existed for a century because these paradigms reveal the core essence of human interaction with currency. Technology continues to iterate, but our understanding of the essence of currency and its ownership narrative remains remarkably consistent. Perhaps this is the true revelation: we thought we were disrupting the financial system, but in reality, we are merely directing wealth to places that align with the current narrative of value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。