The Next Stage of Stablecoins: From Assets to Services

In the rapidly evolving landscape of digital assets and blockchain finance, stablecoins have gradually transformed from being "just a medium of exchange" to the "base currency" of the DeFi and Web3 ecosystems. Numerous projects and users rely on this stable unit of value for decentralized trading, lending, on-chain payments, and cross-chain bridging. However, traditional stablecoins often depend on fiat reserves, banking systems, and centralized custody, which brings geographical limitations, regulatory bottlenecks, and centralization risks. Thus, the new model of "Stablecoin as a Service" has emerged—providing services such as issuance, management, synthesis, and combined use of stablecoins through open platforms, protocols, or ecosystems, empowering developers or project parties to quickly access stable value assets.

The macro drivers behind this shift are clear: the global demand for digital finance continues to expand, with trends emerging in cross-border payments, decentralized finance, on-chain asset utilization, and the creation of a "non-banking" user base. A blockchain-native stable asset that does not require a bank account and can circulate freely across multiple chains and protocols is becoming crucial. The bottlenecks of traditional stablecoin models are increasingly evident, with fiat reserves, custody trust, regulatory compliance, and bank connections becoming obstacles, especially in certain jurisdictions where banks may be unwilling to support stablecoin operations. Additionally, the DeFi ecosystem's desire for composable and scalable assets is driving change; stablecoins are no longer just "1:1 pegged to the dollar," but must also efficiently function in lending, trading, derivatives, and yield aggregation, making the service-oriented, protocol-based, and autonomous issuance logical. In this context, service platforms that can provide "stablecoin issuance + management + ecosystem access" are becoming significant opportunities in the blockchain finance sector.

Three Major Challenges Facing Stablecoin Serviceization

First is the game of the "trust-custody-compliance" triangle. Traditional stablecoins largely rely on fiat reserves, bank accounts, and centralized custodial institutions. For the service model to break through these dependencies, it must challenge the existing trust chain and reconstruct a compliant model. The reality is that banks are often unwilling to support non-traditional issuing institutions, and regulatory frameworks like MiCAR are constantly evolving. This puts service-oriented stablecoins in a dilemma: either collaborate with regulated financial institutions, which means compromise, or build a fully autonomous, highly trusted on-chain mechanism, which faces dual challenges of technology and trust.

Second is the "capital efficiency-stability-decentralization" trilemma. While stablecoins aim for a 1:1 peg to the dollar, there is a fundamental tension between capital input, collateralization rates, leverage, yield mechanisms, and risk hedging. Over-collateralization can reduce capital efficiency, while under-collateralization may lead to de-pegging risks, and reliance on centralized assets or institutions can undermine decentralization. It is challenging to achieve high decentralization, high capital efficiency, and strong stability simultaneously; typically, only two of the three can be prioritized.

Finally, there is a lack of mature examples for "ecosystem composition + yield models." Serviceization means that stablecoins cannot just be passively issued; they must also be widely used in scenarios such as lending, trading, yield, synthetic assets, and cross-chain applications. This requires issuing protocols to have sufficient liquidity, broad access capabilities, continuous yield, and robust mechanisms. However, in DeFi's history, many "algorithmic stablecoins" have suffered from trust issues due to design flaws or extreme market conditions, with the failure of UST being a typical example. The market remains cautiously observant towards stablecoin serviceization, as no one wants to be the next to step on a landmine.

Practical Examples of Stablecoin Serviceization

In the exploration of stablecoin serviceization, the issuer of USDe is providing a noteworthy answer. Its white-label stablecoin service (Stablecoin-as-a-Service) model essentially modularizes and protocols the capabilities of stablecoin issuance, management, and yield distribution, allowing any chain, application, or wallet to quickly deploy its own stablecoin.

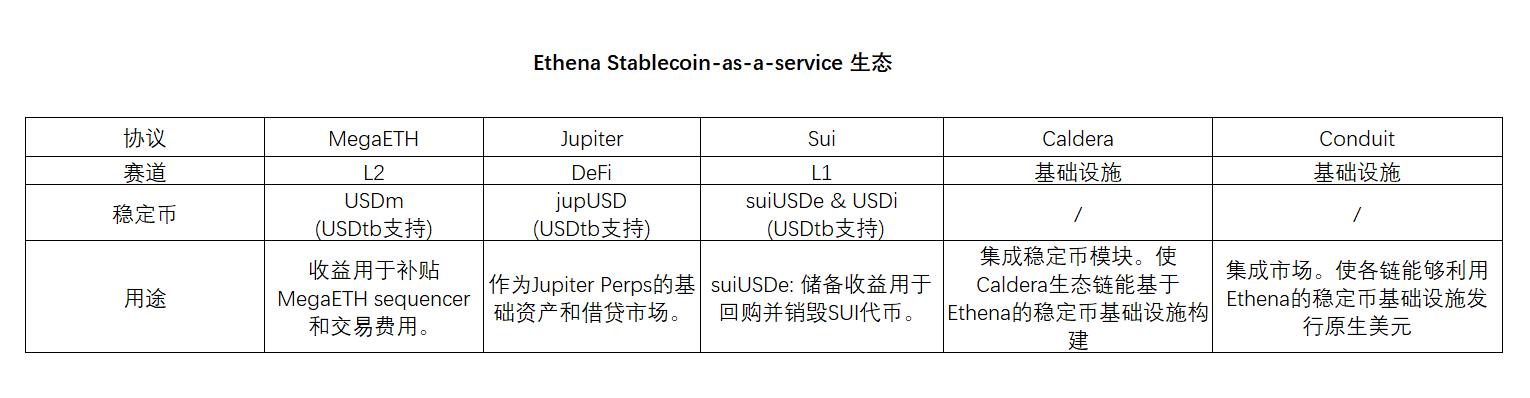

The core logic of this model is not complex: partners mint their branded stablecoins through Ethena's infrastructure, gaining most of the yield generated from the underlying collateral, while Ethena only charges a small protocol fee. Throughout the process, reserve management, auditing contracts, on-chain pipelines, custody and liquidity infrastructure, and compliance frameworks are all provided by Ethena. Partners only need to choose the backing mix (the ratio of USDtb or USDe) to achieve issuance from 0 to 1. For example, Jupiter's jupUSD was initially 100% backed by USDtb (government bond-supported) and can later be adjusted to USDe (delta-neutral mechanism) as needed to enhance APY. MegaETH's USDm uses USDtb reserves to maintain the stability and predictability of sequencer fees. Sui Network has launched suiUSDe and USDi to drive $SUI buybacks and DeFi growth in non-EVM ecosystems.

Returning to the three dilemmas mentioned earlier, the design thinking of USDe's issuer provides some solutions. In terms of "trust-custody-compliance," it collaborates with regulated institutions like Securitize and BlackRock BUIDL Fund to incorporate USDtb, a fiat-backed stablecoin, into the system, providing compliant reserve backing options while managing on-chain assets through institutional custodians like Copper to ensure transparency and security. This "partial compliance + on-chain transparency" hybrid approach alleviates the challenges of bank integration and regulatory pressure to some extent. In the "capital efficiency-stability-decentralization" trilemma, Ethena adopts a flexible strategy: USDtb follows the traditional fiat reserve route, offering strong stability but lower capital efficiency; USDe achieves synthetic dollars through a delta-neutral hedging mechanism (spot plus short futures), maintaining the peg while releasing capital efficiency and generating on-chain yield. Partners can dynamically adjust the ratio of the two based on their risk preferences, finding a balance rather than making extreme choices. In terms of "ecosystem composition + yield models," Ethena's strategy is to build a shared liquidity network. Each new white-label stablecoin is not an island but connects to the same infrastructure and liquidity pool. USDe has been integrated by centralized exchanges like Binance, Bybit, and Gate, and is widely used in perpetual contract DEXs like Ethereal, yield protocols like Pendle, and lending platforms like Euler and Morpho. This "network effect" means that each new partner's addition increases liquidity, users, and application scenarios for the entire ecosystem, thereby reducing the cold start costs for individual stablecoins.

Stablecoins are Becoming a Programmable Financial Layer

From a broader perspective, stablecoin serviceization represents a shift in infrastructure thinking. Traditional stablecoins are "products"; you either use USDC or USDT. Service-oriented stablecoins are "protocols," providing a set of standardized interfaces and modular capabilities that allow anyone to build their own stable value unit on top of it. This is somewhat similar to the evolution path of cloud computing—early on, enterprises either built their own servers or rented machines from specific vendors, but the emergence of AWS and Azure made "computing" itself a callable service that anyone could use on demand. Stablecoin serviceization is doing something similar; it transforms "stable value issuance" into a callable, composable, and customizable infrastructure capability. Ethena, through the integration of institutional custodians like Copper, is also bridging on-chain and off-chain. USDtb connects to BlackRock's BUIDL Fund, while USDe accesses the derivatives market through a delta-neutral mechanism, allowing stablecoins to no longer be confined to a single ecological island but to become an intermediary layer connecting CeFi, DeFi, and RWA.

If the past decade was the "pegging era" for stablecoins, the next decade will be their "service era." From jupUSD to suiUSDe, from MegaETH to UR Global, what we are witnessing is not the birth of a new stablecoin but the formation of a complete stablecoin infrastructure. Each ecosystem can have its own native dollar, each application can customize its yield strategy, and each user can obtain stable value and on-chain yield within a transparent, auditable framework. As demonstrated by USDe, stability does not mean stagnation; rather, it is an art of sustainable balance. Serviceization makes this art of balance replicable, scalable, and shareable. Stablecoins will no longer just be containers of value but will become engines of financial innovation—this may be the true future of stablecoins: not the victory of a particular currency but the establishment of a new paradigm of financial infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。