Source: Decrypt

Authors: Ryan S. Gladwin, Guillermo Jimenez

Original Title: Crypto Perps Are Easier to Access Than Ever Before—Is That A Good Thing?

Translation and Compilation: BitpushNews

Perpetual contracts are sweeping the cryptocurrency trading scene, becoming the hottest investment strategy at the moment. A large number of traders are flooding into this field at an unprecedented scale, making higher-risk bets on high-risk assets.

However, just as these investment products become easily accessible—now anyone with a crypto wallet or a Telegram account can easily participate—analysts are sounding the alarm: this seemingly sharp "double-edged sword" is bringing new risks to the entire crypto market.

As a type of derivative contract, perpetual contracts allow investors to borrow funds and use leverage to bet on the future price movements of assets like Bitcoin. If the judgment is correct, the investor's profits will multiply with the leverage factor;

If the bet is wrong, your position may be forcibly liquidated—just like the chain liquidation that occurred on October 10, which led to a record $19 billion in funds evaporating within hours.

For years, these high-risk, high-reward trades offering leverage from 10x to 1001x were typically only available at offshore centralized exchanges outside the United States.

But now the situation has changed, thanks not only to the relaxed regulatory environment faced by the crypto industry under President Trump but also due to the rise of decentralized trading solutions like Hyperliquid, which allow any user with a crypto wallet to participate globally.

The popular crypto wallets MetaMask and Phantom have now integrated perpetual contract trading directly into their mobile and browser applications through Hyperliquid. Hyperliquid is a decentralized exchange focused on perpetual contracts with its own blockchain. This means millions of new users can access this previously highly restricted trading product without needing to open accounts at centralized exchanges or provide personal identification information.

According to DefiLlama data, perpetual contract trading has accounted for 16% of Phantom's annual total revenue of $195 million and 6% of MetaMask's revenue of $81 million—despite both wallets only launching this feature in July and October of this year, respectively.

The Telegram mini-app Blum has also begun offering perpetual contracts with leverage of up to 100x, with the company predicting that such trading will account for 80% of its total trading volume by early 2026. MetaMask is equally enthusiastic about this opportunity.

"We have seen excellent early growth momentum," MetaMask's Senior Product Director Mike Lwin told Decrypt, "Perpetual contracts are a key focus for us, and more broadly, trading is at the core of MetaMask's future development."

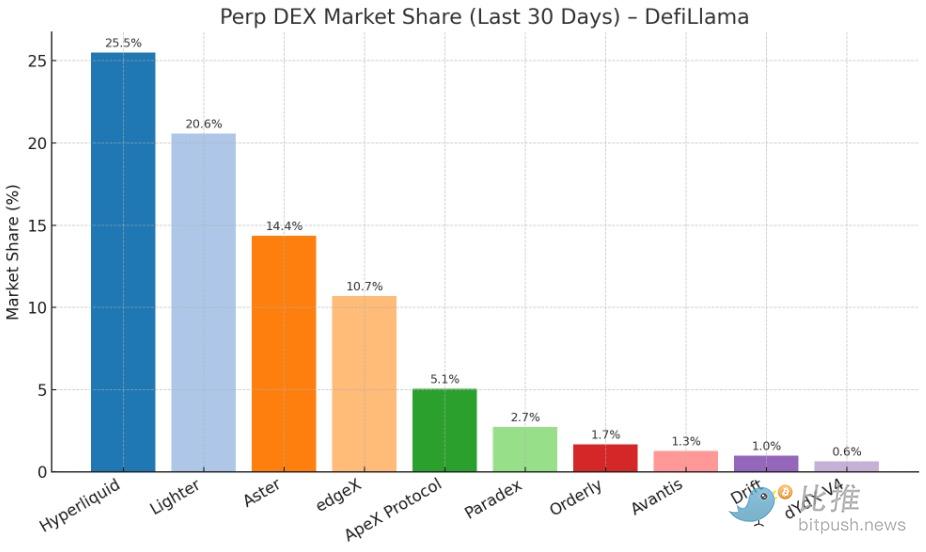

According to DefiLlama statistics, perpetual contracts have become an important business in the crypto industry this year, generating over $12.7 trillion in trading volume in the past 30 days. Decentralized exchanges focused on perpetual contracts (like Hyperliquid and Aster) have been particularly successful as they lower the barriers to entry.

However, the lower barriers also bring a broader, less experienced user base that may not understand how these products work and the associated risks.

Blum co-founder Gleb Kostarev revealed to Decrypt that many of its followers on X and Telegram are not clear about the definition, operation, or risk exposure of the automatic liquidation mechanism—this is a fundamental risk control mechanism for perpetual contract exchanges to reduce exchange risk.

"This example actually shows that many users do not have a deep understanding of the details of these products," Kostarev explained, "It is crucial to help them understand this, and we need to strengthen user education. Users should have a clear understanding of market dynamics, potential changes, and risks."

Blum is trying to educate users through social media channels. However, unlike centralized exchanges, Blum and similar applications do not require users to pass a risk assessment test or prove their understanding of the basics of perpetual contracts and leverage before trading.

Phantom introduces contract trading, leverage, and liquidation mechanisms through a concise guided process in the wallet when users open the perpetual contract product. MetaMask also provides a multi-step tutorial when users first use this feature.

Market analysts had previously warned Decrypt that the proliferation of perpetual contracts and competition for leverage services may be breeding systemic risks within the crypto market. Earlier this month, a historical record of $19 billion in leveraged positions was liquidated in a single day.

Messari research analyst Matthew Nay told Decrypt that the addition of perpetual contract features to wallets and communication apps has only a "marginal" impact on systemic risk, as the main risks come from whales holding millions or even billions in leveraged positions.

Blum's Kostarev pointed out that offering high leverage is aimed at attracting retail users rather than whales. As a Telegram mini-app, Blum's target users are industry newcomers and groups from developing countries, which is also why its interface is simplified for new traders.

MetaMask's Lwin believes that lowering the barriers to entry for perpetual contracts can "unlock a much larger user base" for crypto, thereby "deepening liquidity, narrowing spreads," and "accelerating" the migration of users from centralized products to decentralized products.

But Messari's Nay calls this low barrier a "double-edged sword": on one hand, it allows retail traders to access "innovative tools that can only be realized through crypto," but if insufficient education leads to new users suffering losses, it may also "deter some traders."

Gregoire Magadini, Director of Derivatives at Amberdata, bluntly stated in an interview with Decrypt that products like perpetual contracts cater perfectly to those traders who are used to "one-click ordering and hands-off management," while high-leverage positions are precisely the most taboo for this operational mode.

He sharply pointed out that passive investors who recklessly use perpetual contracts are likely making a "fatal mistake"—because such high-leverage strategies require continuous monitoring and active risk management, rather than passive holding.

"Leverage trading must set clear profit targets and stop-loss lines, requiring real-time data monitoring and risk warning systems to effectively control risk," Magadini reminded, "While lowering trading barriers does indeed drive innovation (like Robinhood's success in options trading), my advice for newcomers is clear: do your homework before entering the market."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。