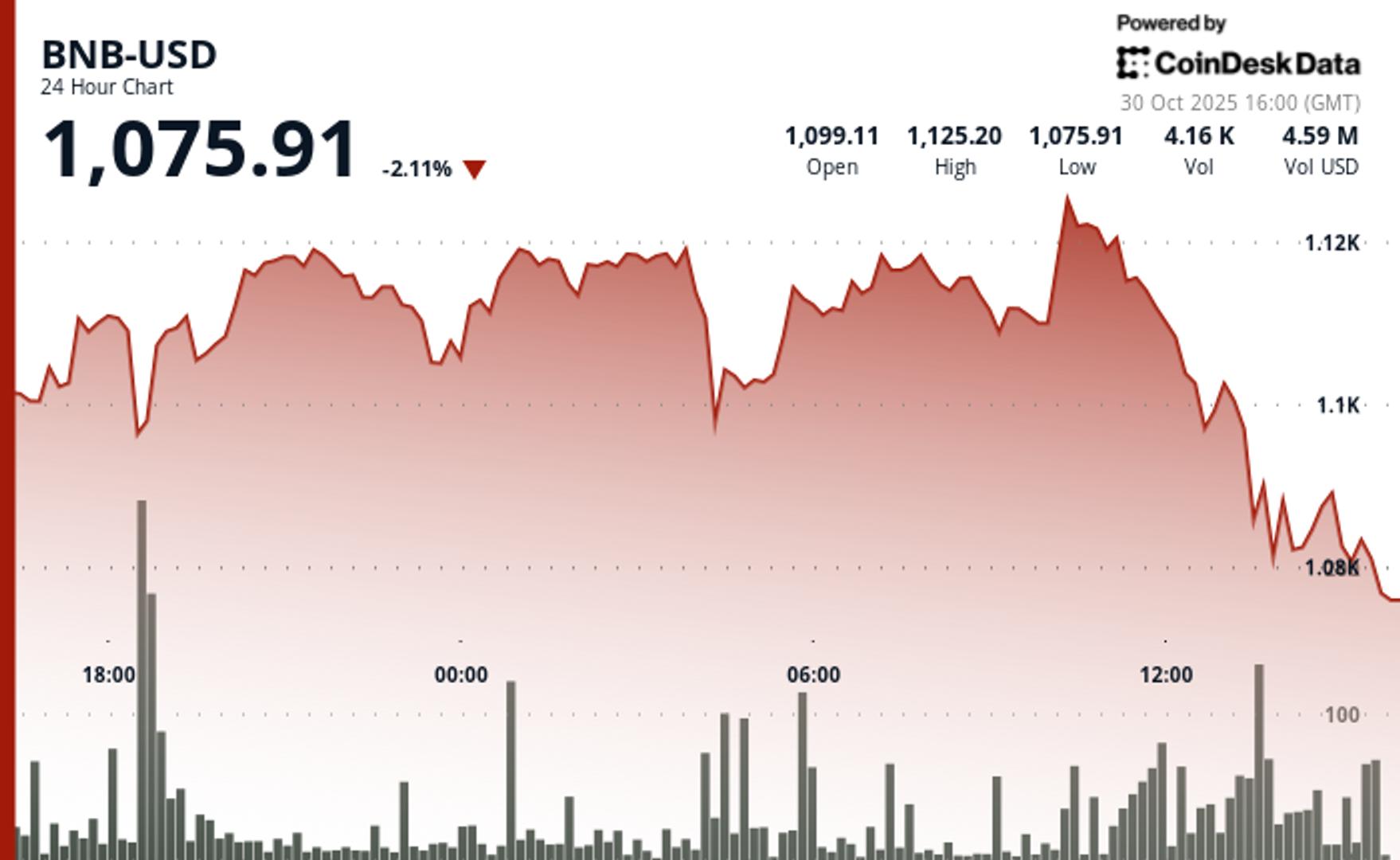

BNB is down more than 2% over the past 24 hours, falling to $1,073 after failing to hold key technical support around $1,095 according to CoinDesk Research's technical analysis data model.

The drop comes as the broader crypto market reels from a wave of selling tied to shifting signals from the U.S. Federal Reserve, with the broader market slipping 4.7% based on the CoinDesk 20 (CD20) index.

The Fed cut interest rates by 25 basis points, as widely expected. But Chair Jerome Powell’s remarks that further cuts in December aren’t guaranteed shook risk assets, including crypto.

As a result, 24-hour liquidation have ballooned to over $1.1 billion according to CoinGlass data, with most of those being long positions.

For BNB, the selloff accelerated after repeated failures to break resistance near $1,115. After prices fell below $1,095, selling pressure intensified with the token falling to an intraday low near $1,081 before settling around $1,073. Price action showed a series of lower highs, a signal of fading momentum.

The drop appears driven more by market structure than any token-specific news. BNB’s technical breakdown mirrors patterns across other major tokens as traders digest central bank policy and position for Friday’s $13 billion options expiry.

BNB now faces short-term resistance around $1,087. A recovery above $1,095 could help neutralize the downtrend, but if sellers stay active, a retest of the $1,081 level is in play.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。