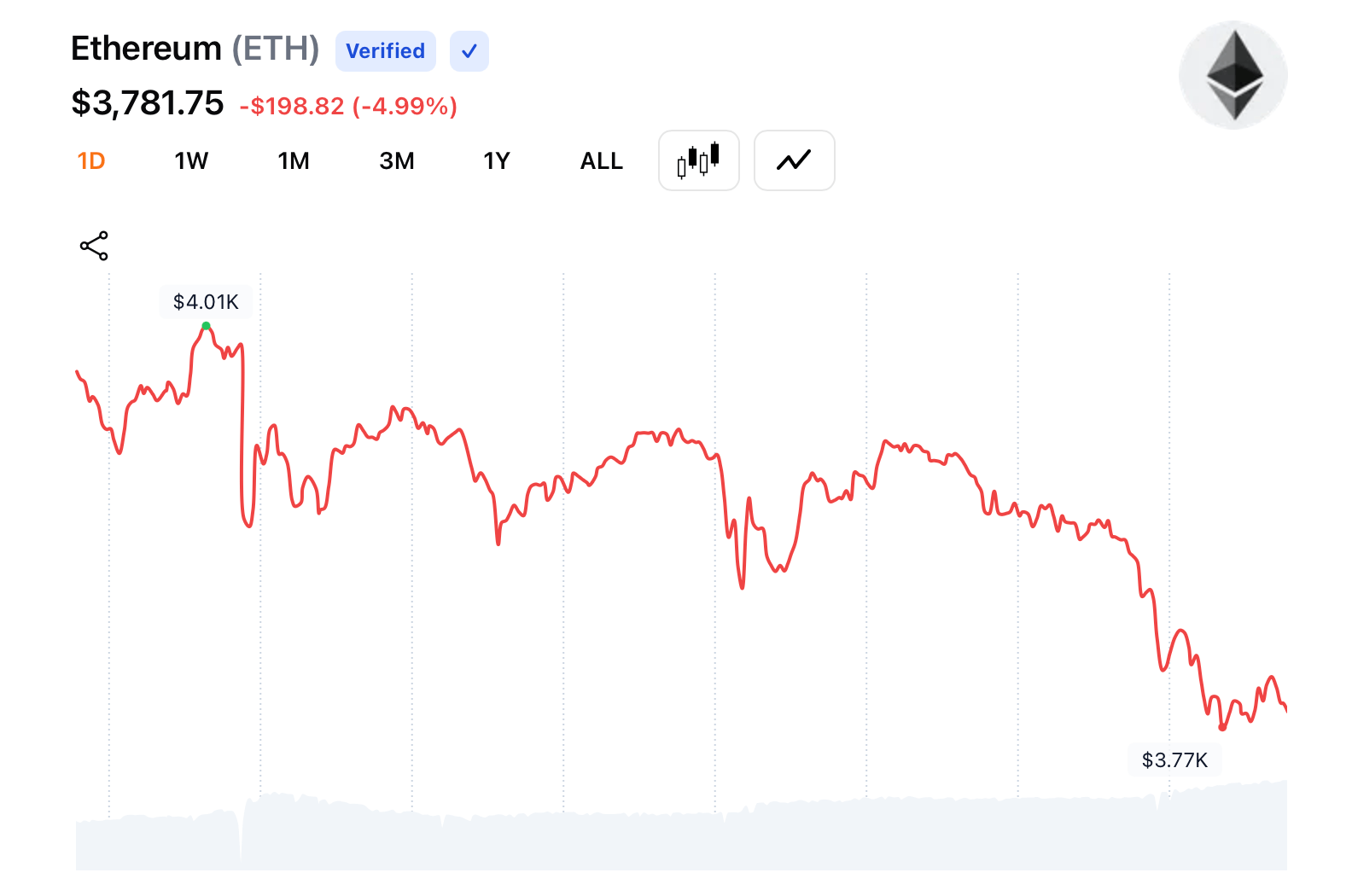

As of Thursday, ethereum (ETH) trades around $3,781, down 4.99% on the day and 2.63% for the week as of 11:15 a.m. Eastern time, as futures open interest swells to around $47.49 billion, per coinglass.com stats. The setup looks like a trick-or-treat bag stuffed with risk.

The futures arena is brimming with restless spirits. Total open interest (OI) across exchanges sits around 12.49 million ETH, showing that traders haven’t lost their nerve — they’ve just shifted their hiding places. CME still wears the institutional crown with $10.05 billion in ETH futures OI, commanding 21.15% of the market.

Current ETH spot price at 11:15 a.m. Eastern time on Oct. 30, 2025.

Yet it’s looking a bit pale, down 6.3% over 24 hours, as fund managers quietly reduce exposure. Binance follows close behind at $8.79 billion, posting mild gains over the last four hours, suggesting retail traders are still brave enough to dance in the dark. Meanwhile, Bybit, OKX, and Gate are seeing a lively resurrection in open interest, each gaining between 1% and 2.7% in the last few hours.

Gate’s $4.54 billion in OI rose 8.6%, while MEXC spiked 11.3%, the kind of move that screams “degen energy.” Kucoin, however, is the skeleton in the closet — its ETH futures OI plunged 20%, showing that not every exchange survived the volatility unscathed. The migration of leverage from CME to alternative venues suggests the night shift of traders is taking over just in time for expiry.

On the options front, the ghosts of optimism are very much alive. Ethereum’s total options open interest hovers around $15.17 billion, with calls haunting 63.5% of the market compared with 36.5% in puts. Traders are still dreaming of a resurrection above $4,000, but the last 24 hours show a shift in tone — put volume (53.9%) has overtaken calls (46.1%), hinting at hedging ahead of the Friday fright fest.

The most heavily loaded contracts on Deribit are calls at the $5,000, $6,000, and $7,000 strikes for Dec. 26, 2025, where more than 200,000 ETH in OI rests in wait, like bats hanging upside down for the next moonlight rally. This shows as far as the year’s end is concerned, there are still bullish sections of the market.

ETH’s max pain levels — that grim number where most traders lose money — sit right in ethereum’s current price neighborhood. Across Deribit, Binance, OKX, and Bybit, the pain line circles between $3,900 and $4,200, forming a cursed corridor of liquidity that could magnetize the price into expiry. With ETH hovering just below the graveyard gate, the setup looks perfect for a little Halloween mischief — perhaps a wicked short squeeze or a ghostly drop to reset the books.

As October draws to a close, ethereum’s derivatives market kinda feels like a haunted house filled with open contracts, anxious traders, and flickering candles of liquidity. Whether the next move brings tricks or treats, one thing’s for sure — no one’s leaving this party without a scare.

- How much ethereum futures open interest is on the market?

Roughly $47.5 billion in open interest spans across 12.49 million ETH contracts. - Which exchange dominates ethereum derivatives?

CME leads with $10 billion in open interest, followed by Binance and OKX. - What’s the current mood in ethereum options?

Calls dominate, but puts have overtaken in daily trading volume ahead of expiry. - Where is ethereum’s max pain price for Oct. 31 expiry?

Between $3,900 and $4,200 — right where things get spooky for traders.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。