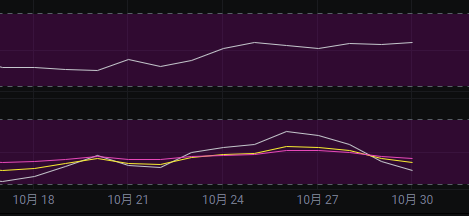

Yesterday we mentioned that the market was in a wide range, but it has met the conditions for a trend change. Today, the market has transitioned from a wide range to a narrow range, which aligns with our judgment of the market. We believe that the narrow range will last for several days to over ten days before the market chooses a direction.

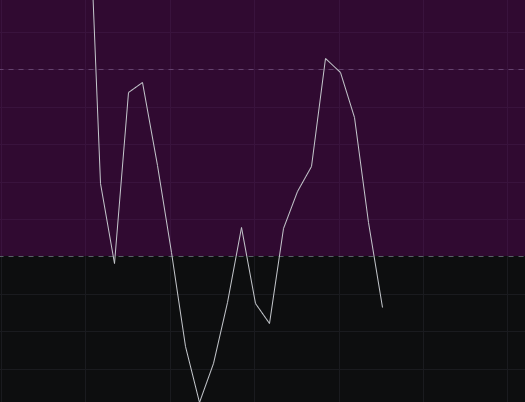

From the MACD perspective, the current energy bars are declining, and the fast line has also turned downward, favoring the bears, which is consistent with our recent market predictions.

From the CCI perspective, the current CCI has dropped below -100. Since it failed to stay above the zero line on the 27th, the bulls' momentum has basically ended, leading to the recent decline. The CCI has returned below -100, making it very difficult to rise above the zero line in the short term.

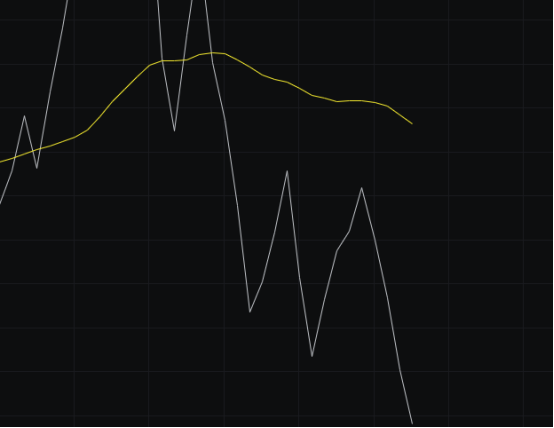

From the OBV perspective, with the recent days of decline, the OBV is accelerating its outflow, and the slow line continues to press downward, so we maintain a bearish outlook.

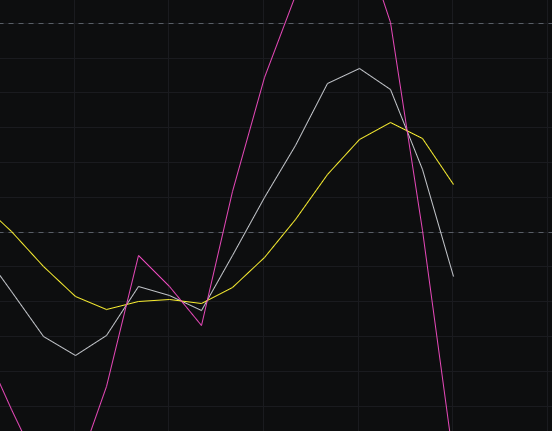

From the KDJ perspective, the KDJ did not rise above 80 but turned down around 70, indicating that this is just a rebound. Currently, the KDJ has formed a death cross, so the probability of an upward move in the coming days is very low.

From the MFI and RSI perspectives, the MFI tends to flatten out, while the RSI is developing downward. For the MFI to start moving down, the market needs to weaken in the coming days.

From the moving averages perspective, the previously entangled 30 and 120 have diverged, with the 30 starting to move downward. The likelihood of continued decline is greater, so the bears are expected to dominate for a while.

From the Bollinger Bands perspective, the market has followed our prediction from yesterday, transitioning from a wide range to a narrow range. This narrow range is expected to last for several days to over ten days, so there will likely be no significant market activity this week. If there is any activity, it will likely be seen next week at the earliest.

In summary: The market trend generally aligns with our predictions. Since the market has entered a narrow range, it is expected to last for several days to over ten days, so there will likely be no significant market activity this week. Of course, short-term trading is possible, and the target for this week is to close below 108,500, which would signify a victory for the bears. Today's resistance is seen at 110,000-112,000, with support at 107,500-106,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。