Written by: Ding Dong (@XiaMiPP)

On October 30, the China-U.S. talks concluded smoothly, but the performance of the crypto market was less than ideal.

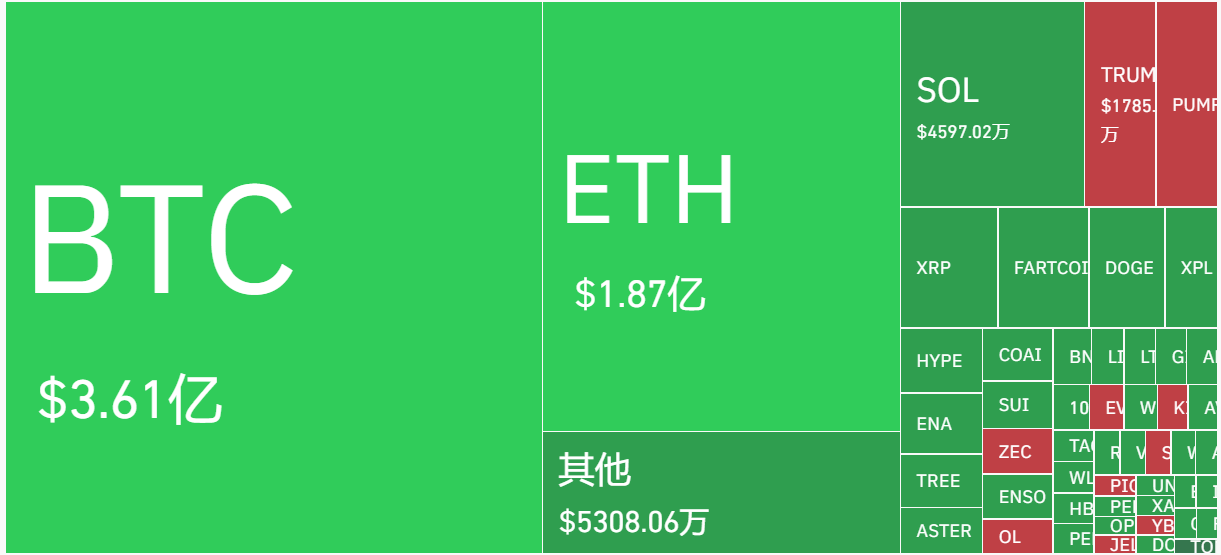

The price of BTC briefly fell below $108,000, currently reported at $111,424, with a 24-hour decline of 1.68%; ETH is currently reported at $3,941, with a 24-hour decline of 1.9%; SOL is currently reported at $195.9, and BNB is currently reported at $1,117, both of which have rebounded to recover their losses.

From the trend perspective, SOL and BNB are still oscillating within a relatively strong range. Among them, Grayscale's Solana Trust ETF officially listed on the NYSE on October 29, becoming the second Solana spot ETF listed in the U.S. after Bitwise. According to SoSoValue data, the total net asset value of the Solana spot ETF is $432 million, with a Solana net asset ratio (the market value relative to Solana's total market value) reaching 0.40%, and a historical cumulative net inflow of $117 million.

In terms of derivatives, the total liquidation amount in the market over the past 24 hours was $813 million, with long positions liquidating at $613 million and short positions liquidating at $200 million. The largest single liquidation occurred on Bybit - BTCUSD, valued at $11 million. Recently, the market has been characterized by high volatility and oscillation, referred to by the community as a "monkey market," which has caused significant capital erosion.

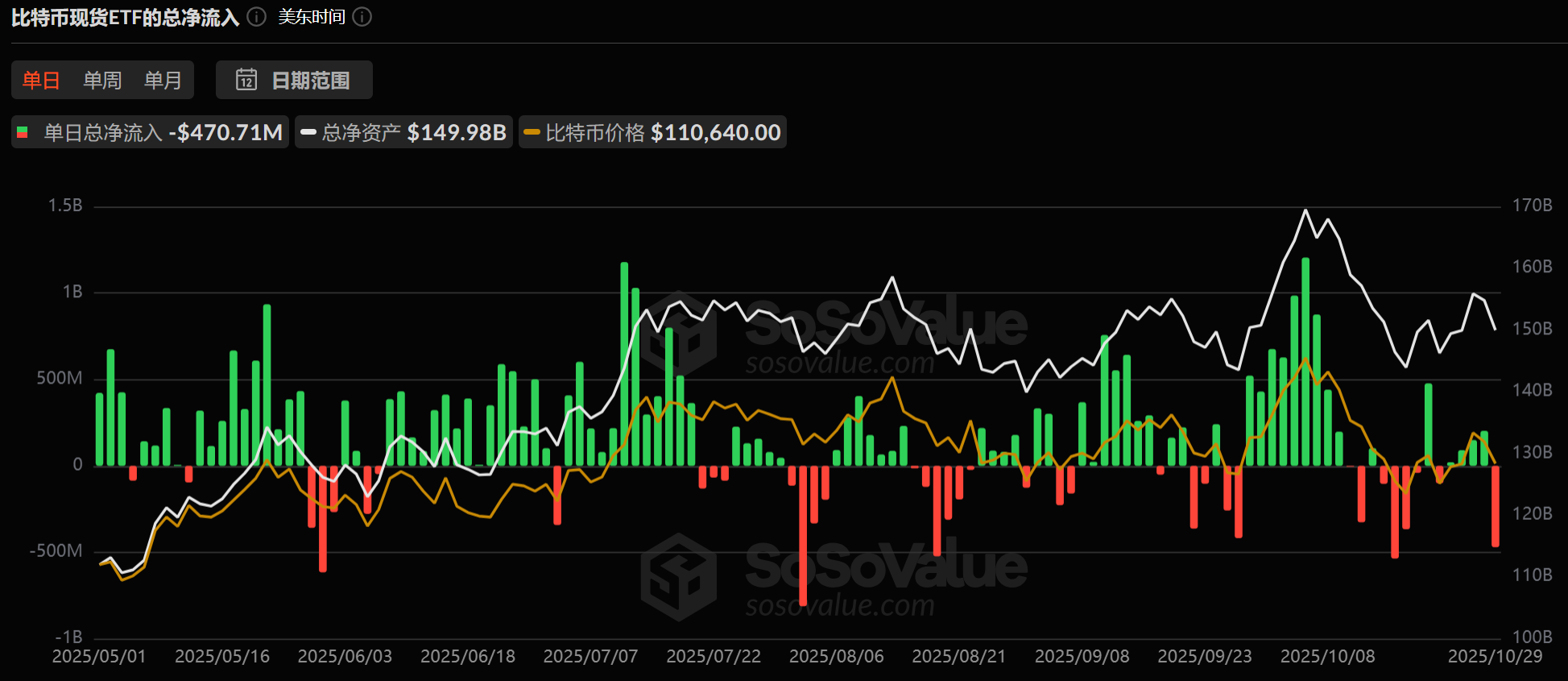

In terms of capital inflow, the BTC spot ETF ended four consecutive days of net inflow, with a significant net outflow of $470 million yesterday; the ETH spot ETF has been relatively weak recently, and although it also experienced a net outflow yesterday, the extent was relatively limited.

On the macro level, two major events were settled today.

First, the Federal Reserve lowered interest rates by 25 basis points as expected. The Fed has reduced the benchmark interest rate to 3.75%-4.00%, marking the second consecutive meeting of rate cuts. At the same time, it announced that it would end the balance sheet reduction starting December 1, with principal payments on agency debt and MBS fully reinvested in short-term Treasury bonds to maintain sufficient reserves and avoid a liquidity crisis.

Second, the China-U.S. talks progressed smoothly. According to CCTV reports, the two met in Busan, with the Chinese side emphasizing that "China's development and revitalization are not contradictory to President Trump's goal of 'making America great again.' The two countries can completely achieve mutual success and common prosperity. China and the U.S. should be partners and friends, which is a lesson from history and a necessity of reality. We are willing to continue working with President Trump to lay a solid foundation for China-U.S. relations and create a good environment for the development of both countries."

From this point, the market's focus shifts to whether there will be another rate cut in December. Fed Chairman Powell stated at a press conference that the government shutdown will temporarily drag down economic activity, and data before the shutdown indicated that the economy might be moving toward a more stable trajectory. A rate cut in December is "not a done deal." This aligns perfectly with Powell's current stance—he cannot commit to anything in advance, especially given that the government shutdown has lasted a month and severely affected the release of economic data.

However, according to market news, the U.S. government has been shut down for nearly a month, and the situation seems to finally be changing. Senate Majority Leader John Thune and his Senate allies, House Speaker Mike Johnson, and other House Republican leaders seem increasingly confident that more centrist Democrats are ready to compromise on a temporary funding bill to mitigate the impact of the shutdown, possibly as early as next week.

Inflation Insights analyst Omair Sharif believes that if there is still a lack of official economic data for October and November during the December meeting, the Fed may choose to "pause" due to a data vacuum, delaying the plan for a third consecutive rate cut. This is highly consistent with the internal divisions reflected in the September dot plot—the debate among officials regarding the pace of policy is heating up.

Nomura Securities previously predicted that the Fed would cut rates again by 25 basis points in December. From the current situation, the federal funds futures market's expectation of another rate cut before the end of the year has dropped from 91% to about 72%.

On-chain battles: Whales "vote with their feet"

In the context of the Fed's expected 25 basis point rate cut and Powell's uncertainty about a December cut, whales on Hyperliquid are also "voting with their feet."

HyperInsight monitoring data shows:

- "Abraxas Capital" has two addresses (0x5b5, 0xb83) that began to increase their short positions in BTC, SOL, and ETH simultaneously from 0:00 today, with the total nominal value of the two addresses' holdings increasing from $690 million to $738 million;

- A new whale address "100% Win Rate Counterparty" (0x218) has continued to increase its short position in ETH since yesterday, now achieving a floating return rate of 60%, with an average holding price of $4,128 and a nominal holding value of about $28 million;

- "Calm Order King" (0x926) has turned from loss to profit overall, with a floating return rate of 40% on BTC short positions, an average holding price of $112,200, and a total nominal holding value of $78.6 million;

- A whale (0x5D2) that has opened short positions in BTC four times, previously the top BTC short holder, has now turned its $136 million short position from loss to profit, with an average holding price of $114,000, and has not made any moves this morning as the market warmed up.

The long camp is also not to be outdone:

- An insider whale with "100% Win Rate" (0xc2a) opened a long position in BTC during the market downturn at 0:00 yesterday and increased its position against the trend, with an average holding price of $111,000, now holding a nominal value of $113 million; additionally, at 4:00 today, it opened a long position in ETH and rolled over its position, with an average holding price of $3,889, now holding a nominal value of $5.274 million, bringing the total nominal value of this address's holdings to $277 million;

- A whale suspected of insider trading for HYPE (0x082) rolled over its position in XPL and Hyperliquid ecosystem meme coin PURR during the market downturn at 0:00 today, with a total nominal holding value of $59.48 million.

Overall, the position structure of on-chain whales remains bearish, with short positions slightly prevailing.

Market Voices

In this high-volatility environment, Bitcoin believer Michael Saylor expressed an optimistic prediction in an interview with CNBC, stating that Bitcoin's price could reach $150,000 by the end of the year, with a target of $1 million in the next 4 to 8 years.

Matrixport believes that Bitcoin's dominance has now risen to 59.5%, showing a gradual upward trend. The latest round of "small altcoin season" has cooled down, with market preference returning to Bitcoin. In this round of market activity, BTC's dominance has increased; this phenomenon may be related to the increased participation of institutions and the concentration of funds in high liquidity and clearer compliance assets.

10x Research stated in its latest report that Bitcoin is currently at a critical price range, and the next market movement will mainly depend on institutional capital inflows, especially the movement of Bitcoin ETF funds. The report pointed out that Bitcoin's sideways movement over the past five months is not due to market weakness, but rather a large-scale redistribution of holdings: early cycle "OG" investors continue to sell, while newly entering institutional funds are steadily absorbing the selling pressure. This "hand-over phase" has kept prices in a range of fluctuations rather than stagnating.

In terms of price, 10x Research views $110,000 as the "line of life and death": if Bitcoin holds steady in the $110,000–$112,000 range, the upward trend can continue; if it falls below $110,000, risk management should be prioritized, and the market may experience a rapid adjustment, with target ranges possibly dropping to around $85,000.

Allen Ding, director of the New Fire Technology Research Institute, told Odaily that the crypto market's current "good news realization leads to a drop" is primarily due to expectation gaps and guidance: a 25bps rate cut meets expectations and is unlikely to bring new pricing, while Powell emphasized after the meeting that "a rate cut in December is not a done deal," raising uncertainty about real interest rates and the dollar path, triggering short-term pullbacks in risk assets; the market will enter a transitional period of "oscillation digestion + structural differentiation," with key observation points being whether the Fed's announced pause in balance sheet reduction (QT) and transition to reinvestment on December 1 is smoothly implemented, and whether new narratives such as stablecoin increments, RWA, and AI integration with crypto can resonate with liquidity improvements, thus building momentum for the next upward movement.

The key points to focus on before the end of 2025 are mainly four:

- The implementation of the pause in balance sheet reduction (QT) and reinvestment arrangements on December 1, and its marginal impact on global dollar liquidity;

- The last FOMC meeting and press conference of the year on December 10, along with its policy path and forward guidance;

- The synchronous changes in crypto ETF fund flows and DAT after U.S. stock market hours;

- New narratives in the native crypto industry, including (but not limited to) more ETF approvals, the integration of AI + Crypto applications, and the advancement of RWA, and their impact on incremental funds and valuations.

These factors will collectively determine the risk appetite and capital direction from the end of the year to the beginning of next year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。