21Shares HYPE ETF and Grayscale Updates Signal Altcoin ETFs Expansion

Is this the start of a new era for altcoin ETFs?

On 29th October, Swiss-based investment firm 21Shares took another big step into crypto by filing for the 21Shares HYPE ETF with the U.S. Securities and Exchange Commission (SEC).

This new fund aims to track the price of Hyperliquid (HYPE), the token behind a fast-growing decentralized exchange.

If approved, it will become the second exchange traded fund focused on HYPE, following Bitwise’s proposal in September.

The fund will rely on Coinbase and BitGo to safely store its assets, showing 21Shares’ effort to keep things secure and compliant.

The move also comes as the SEC looks at nearly 90 new crypto exchange traded funds filings, including products tied to Solana, XRP, Cardano, and Dogecoin.

What Makes the 21Shares HYPE ETF Different

The fund lets investors gain exposure to HYPE without needing to buy or hold the token themselves. It will mirror the performance of the token with financial products like swaps and options.

This structure allows users to access DeFi in a regulated way, without ever touching wallets or private keys.

For institutions wanting to invest in cryptocurrency but are averse to technicalities, this could be an accessible solution. It also shows how 21Shares tries to bring decentralized finance (DeFi) and traditional markets together.

Hyperliquid's Highly Growing Ecosystem

Hyperliquid is a decentralized exchange based on blockchain. It deals exclusively in trading perpetual futures, which is a type of cryptocurrency trading preferred by professional traders. The platform has seen more than $3 trillion in total trading volume so far and is known for having deep liquidity with zero gas fees.

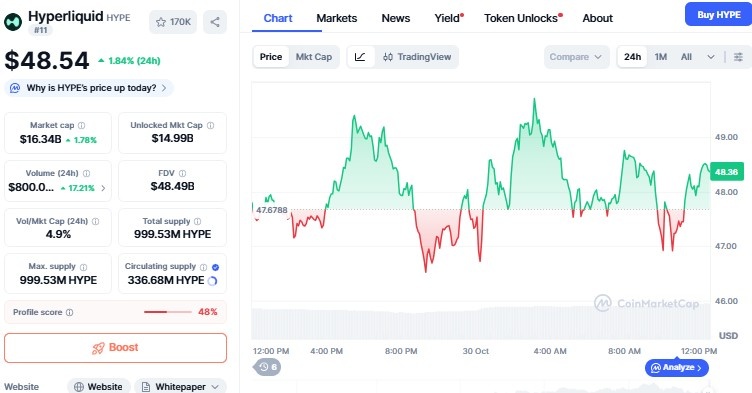

Its native token, HYPE, is among the top 20 tokens by market capitalization at $12.7 billion.

Source: CoinMarketCap

The HYPE price is currently trading near $48.36, increasing 1.84% in the last 24 hours.

Bitwise Solana ETF’s Strong Market Debut

While 21Shares moves toward the DeFi space, Bitwise’s Solana ETF (BSOL) is already making headlines. It brought in $69.5 million in inflows on its first day, far more than any other Solana investment fund. BSOL directly holds and stakes Solana tokens, giving investors an annual yield of about 7%.

Bitwise even waived its 0.20% management fee for the first three months to attract investors. Experts like Kyle Samani from Multicoin Capital called this launch “a watershed moment” for institutional access to $SOL.

Grayscale and Fidelity Push the Altcoin ETFs Trend

Big names like Grayscale and Fidelity are also entering the game. Grayscale Solana ETF gets approved by the SEC to trade on NYSE , adding a staking feature that can earn rewards for investors. But it will only stake under limited circumstances to comply with rules. Fidelity has also submitted an S-1 amendment for its Solana Exchange Traded Fund, showcasing how big institutions are gradually accepting the risk of such altcoins.

Such moves, in addition to the 21Shares filing, point to the direction that altcoin ETFs will soon co-exist just like Bitcoin and Ethereum funds.

Regulatory Changes Fuel ETF Expansion

Recent SEC policy changes have simplified the release of crypto ETFs. The 240-day review period has been reduced to 75 days, and the Trump administration has been more welcoming to digital assets.

This more open atmosphere for Altcoin ETFs is allowing new money such as the 21Shares HYPE ETF and Bitwise's Solana ETF to come to market quicker. Collectively, they could pave the way for a next-generation of crypto investment products that bridge mainstream finance and blockchain technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。